XRP On The Brink: Examining The ETF Push, SEC Case Resolution, And Ripple's Next Steps

Table of Contents

The SEC Lawsuit and its Potential Outcomes

The SEC's case against Ripple alleges that XRP is an unregistered security, violating federal securities laws. The SEC's key arguments center on the assertion that Ripple sold XRP to investors, promising future profits based on Ripple's efforts, thereby meeting the Howey Test definition of a security. This contrasts with Ripple's argument that XRP is a decentralized, utility token used for facilitating cross-border payments on the XRP Ledger.

Potential outcomes range from a complete victory for Ripple, resulting in a clear legal precedent for XRP and other cryptocurrencies, to a settlement that might include certain restrictions or concessions from Ripple, or ultimately, a loss for Ripple, potentially impacting the future of XRP and the broader cryptocurrency landscape.

-

Impact of a Ripple win on XRP price and regulatory clarity: A Ripple victory could send XRP's price soaring, reflecting increased investor confidence and providing much-needed regulatory clarity within the cryptocurrency space. This would significantly boost XRP's legitimacy and potential for mainstream adoption.

-

Implications of a settlement on XRP's future and investor confidence: A settlement might offer a compromise, but it could also leave lingering uncertainty regarding XRP's legal status and dampen investor confidence, potentially limiting its price appreciation.

-

Consequences of a loss for Ripple and the broader XRP ecosystem: A loss could severely damage Ripple's reputation and negatively impact the XRP ecosystem, potentially leading to delisting from exchanges and impacting investor sentiment negatively. This scenario poses significant risks to XRP's future.

-

Analysis of legal arguments and expert opinions: Legal experts offer diverse opinions on the likely outcome, highlighting the complexities of the case and the lack of established legal precedents for cryptocurrencies. The judge's interpretation of the Howey Test will be crucial in determining the final verdict.

The ongoing debate regarding XRP's classification as a security underscores the need for clearer regulatory frameworks in the crypto industry. This uncertainty continues to impact XRP price volatility and investor hesitancy.

The Growing Push for XRP ETFs

The approval of an XRP ETF would be a game-changer, significantly impacting XRP's price and mainstream adoption. An ETF listing would offer increased liquidity, attracting institutional investors and potentially driving a substantial price increase. This would increase accessibility for the average investor and boost market capitalization.

-

Advantages of ETF listing for increased liquidity and institutional investment: ETFs provide a regulated and accessible investment vehicle, attracting large institutional investors who are currently hesitant due to regulatory uncertainties and security concerns surrounding direct cryptocurrency purchases.

-

Comparison to other crypto ETFs already approved: While Bitcoin and Ethereum ETFs have gained approval in some jurisdictions, XRP's ETF approval remains pending, highlighting the unique challenges associated with the SEC lawsuit and its lingering implications.

-

Potential hurdles and regulatory scrutiny faced by ETF applicants: ETF applicants face rigorous scrutiny from regulatory bodies, needing to demonstrate the ETF's compliance with all relevant securities laws and regulations. The SEC's stance on XRP is a major hurdle to overcome.

-

Analysis of market demand and investor sentiment towards XRP ETFs: There is significant market demand for an XRP ETF, indicated by investor interest and the numerous applications filed. Positive sentiment around the potential benefits would likely drive further interest.

The potential impact of ETF approval on XRP's market capitalization is substantial. Increased trading volume and institutional investment could propel XRP into the ranks of the top cryptocurrencies by market cap.

Ripple's Strategic Next Steps and Future Roadmap

Ripple's strategic response to the SEC case and its long-term vision for XRP are critical for the token's future. Ripple's strategies involve a combination of technological advancements, strategic partnerships, and community engagement.

-

Ripple's ongoing development of its technology (e.g., enhancements to the XRP Ledger): Continuous development and improvements to the XRP Ledger are essential for maintaining its competitiveness and attracting further adoption. Scalability, speed, and security enhancements are key focus areas.

-

Key partnerships and collaborations with financial institutions: Ripple's partnerships with banks and financial institutions demonstrate its commitment to bridging the gap between traditional finance and cryptocurrencies. These collaborations are crucial for expanding XRP's utility.

-

Ripple's advocacy for clearer regulatory frameworks in the crypto space: Ripple's active engagement in advocating for clear regulations shows its commitment to fostering a stable and secure cryptocurrency ecosystem, benefiting XRP indirectly.

-

Impact of the SEC case outcome on Ripple's future plans: The SEC case outcome will significantly shape Ripple's future direction, influencing its investment strategy, technological development priorities, and overall business model.

Ripple's response to the SEC verdict, whether positive or negative, will likely involve adapting its strategy and communication to address the market's concerns and maintain investor confidence. Ripple's long-term vision for XRP involves positioning it as a critical component of the global financial system, enabling faster, cheaper, and more efficient cross-border payments.

Conclusion

This article examined the critical factors influencing XRP's future: the SEC lawsuit, the push for XRP ETFs, and Ripple's strategic response. The resolution of the SEC case will significantly impact XRP's price and regulatory standing. The approval of XRP ETFs could lead to increased mainstream adoption and institutional investment. Ripple's continued innovation and strategic partnerships will play a crucial role in shaping XRP's long-term trajectory.

Call to Action: Stay informed on the latest developments surrounding XRP. Follow reputable news sources and keep an eye on the SEC lawsuit, ETF applications, and Ripple's announcements to make informed decisions about your XRP investments. Understanding the intricacies of the XRP ecosystem, including ongoing legal battles and technological advancements, is key to navigating the volatile cryptocurrency market effectively. Keep researching and learning more about the potential of XRP.

Featured Posts

-

Arsenali Akuzohet Per Shkelje Te Rregullores Se Uefa S Ne Ndeshjen Me Psg

May 08, 2025

Arsenali Akuzohet Per Shkelje Te Rregullores Se Uefa S Ne Ndeshjen Me Psg

May 08, 2025 -

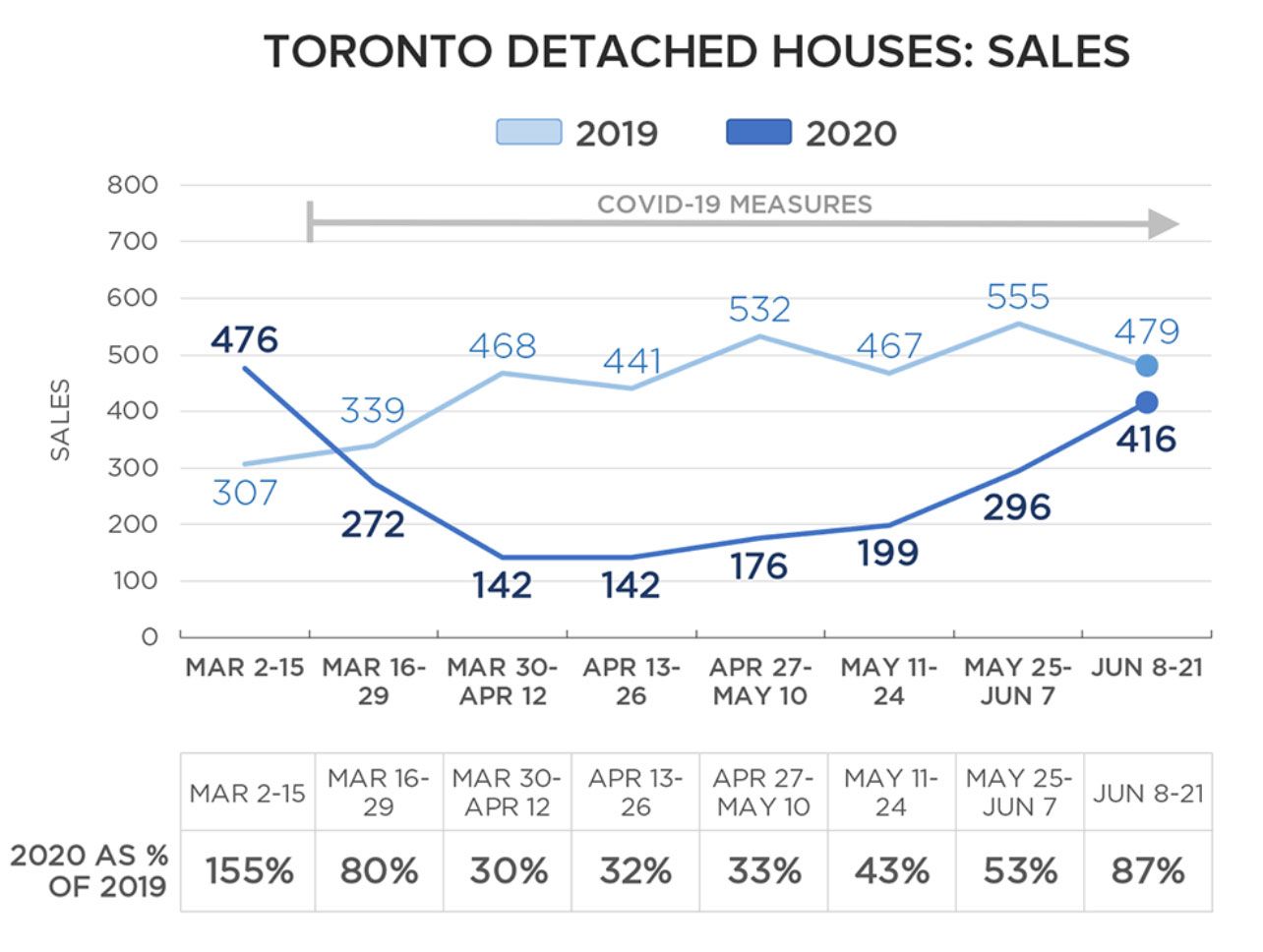

Sharp Decline In Toronto Home Sales 23 Year Over Year Drop 4 Price Reduction

May 08, 2025

Sharp Decline In Toronto Home Sales 23 Year Over Year Drop 4 Price Reduction

May 08, 2025 -

Trumps Crypto Advisors Unexpected Bitcoin Price Surge Prediction

May 08, 2025

Trumps Crypto Advisors Unexpected Bitcoin Price Surge Prediction

May 08, 2025 -

The Long Walk Trailer Reveals Stephen Kings Brutal Survival Story

May 08, 2025

The Long Walk Trailer Reveals Stephen Kings Brutal Survival Story

May 08, 2025 -

Claiming Back Universal Credit A Guide To Historical Refunds

May 08, 2025

Claiming Back Universal Credit A Guide To Historical Refunds

May 08, 2025