XRP On The Brink Of A Record High: The Grayscale ETF Factor

Table of Contents

The Grayscale Bitcoin ETF's Ripple Effect on XRP

The potential approval of a Grayscale Bitcoin ETF could have far-reaching consequences, creating a significant ripple effect that impacts XRP and the entire cryptocurrency landscape. This stems from several key factors:

Regulatory Uncertainty and its Impact

The current regulatory landscape surrounding cryptocurrencies is undeniably complex. The SEC's stance on XRP, particularly following its lawsuit against Ripple, casts a long shadow. However, a positive ruling for the Grayscale Bitcoin ETF could establish a crucial precedent, potentially altering the SEC's approach to other cryptocurrencies, including XRP.

- Positive Precedent: A favorable decision could signal a shift in regulatory thinking, potentially paving the way for a more positive outlook on other cryptocurrencies like XRP.

- Investor Sentiment Boost: Increased regulatory clarity could significantly boost investor confidence, attracting new capital into the crypto market and driving demand for assets like XRP.

- Historical Correlation Analysis: While Bitcoin and XRP haven't always exhibited a direct, perfectly correlated price movement, positive momentum in Bitcoin often spills over to the broader crypto market, positively impacting altcoins like XRP.

Increased Institutional Interest and Investment

A successful Grayscale Bitcoin ETF application would likely attract substantial institutional investment into the cryptocurrency market. This influx of capital could lead to increased demand for XRP, driving its price upwards.

- Portfolio Diversification: Large financial institutions may seek to diversify their holdings by adding XRP, a relatively established and widely-used cryptocurrency, to their portfolios.

- Enhanced Liquidity: Increased institutional involvement would dramatically improve XRP's liquidity, making it easier for investors to buy and sell the asset without significantly impacting its price.

- Current Institutional Interest: Several institutional investors are already showing increasing interest in XRP, suggesting a growing recognition of its potential and utility.

XRP's Fundamental Strengths and Technological Advancements

Beyond the external factors influencing XRP's price, the cryptocurrency boasts intrinsic strengths that contribute to its potential for growth.

Technological Upgrades and Utility

The XRP Ledger continues to evolve, boasting improvements in speed, efficiency, and scalability. These advancements are attractive to developers and businesses seeking a robust and reliable platform for various applications.

- Strategic Partnerships: Partnerships and integrations with various companies expand XRP's utility and reach, solidifying its position in the market.

- Developer Ecosystem: The technological advancements attract developers to build upon and enhance the XRP ecosystem, further strengthening its functionalities.

- Energy Efficiency: The XRP Ledger's energy-efficient consensus mechanism is an environmentally friendly alternative to other blockchain technologies, further enhancing its appeal.

Growing Adoption and Use Cases

XRP's real-world applications, particularly in cross-border payments, illustrate its potential to disrupt the traditional financial system.

- Faster, Cheaper Transactions: Companies already leverage XRP for faster and cheaper cross-border transactions, reducing processing times and costs.

- DeFi Potential: XRP's integration into decentralized finance (DeFi) protocols is growing, offering further opportunities for its utility.

- Ongoing Adoption Initiatives: Various initiatives continue to promote XRP adoption, fostering its growth and expansion within various sectors.

Potential Risks and Challenges

Despite the bullish outlook, several potential risks and challenges could impact XRP's price trajectory.

Regulatory Scrutiny

The ongoing legal battles facing Ripple, the company behind XRP, are a significant factor. The outcome of these cases could significantly influence investor confidence and XRP's price.

- Legal Uncertainty: The uncertainty surrounding the legal proceedings creates volatility and could impact investor sentiment.

- Impact on Investor Confidence: Negative outcomes could shake investor confidence, potentially leading to a price decline.

- Historical Price Reactions: Analyzing past price reactions to significant news related to the Ripple lawsuit can provide insights into potential future scenarios.

Market Volatility and Speculation

The cryptocurrency market is inherently volatile, and XRP's price is subject to fluctuations driven by market sentiment and speculation.

- Market Sentiment: External factors such as broader market trends and macroeconomic conditions can impact XRP's price.

- Risk Management: Investors should implement sound risk management strategies to mitigate potential losses.

- Investment Strategies: A long-term investment strategy, based on fundamental analysis rather than short-term speculation, is often advised for cryptocurrencies like XRP.

Conclusion

The potential approval of a Grayscale Bitcoin ETF presents a significant catalyst for XRP, potentially driving it towards a record high. However, it's crucial to consider the regulatory landscape, XRP's technological advancements, its growing adoption, and the inherent volatility of the cryptocurrency market. XRP on the brink of a record high presents a compelling investment opportunity, but thorough due diligence and a cautious approach are paramount. While the potential for XRP to reach a record high is significant, it's crucial to conduct thorough research and understand the risks involved before investing. Stay informed about developments surrounding the Grayscale ETF and the XRP ecosystem to make informed decisions about your investment in XRP on the brink of a record high.

Featured Posts

-

Le Jeune Lane Hutson Sera T Il Un Defenseur De Premier Plan Dans La Lnh

May 07, 2025

Le Jeune Lane Hutson Sera T Il Un Defenseur De Premier Plan Dans La Lnh

May 07, 2025 -

Cavaliers Vs Pacers Playoffs Betting Your Guide To Eastern Conference Semifinals Wagers

May 07, 2025

Cavaliers Vs Pacers Playoffs Betting Your Guide To Eastern Conference Semifinals Wagers

May 07, 2025 -

Why Is My Ps 5 Game Stuttering Troubleshooting Common Problems

May 07, 2025

Why Is My Ps 5 Game Stuttering Troubleshooting Common Problems

May 07, 2025 -

The Last Piece Of The Puzzle Resolving George Pickenss Issues With The Steelers

May 07, 2025

The Last Piece Of The Puzzle Resolving George Pickenss Issues With The Steelers

May 07, 2025 -

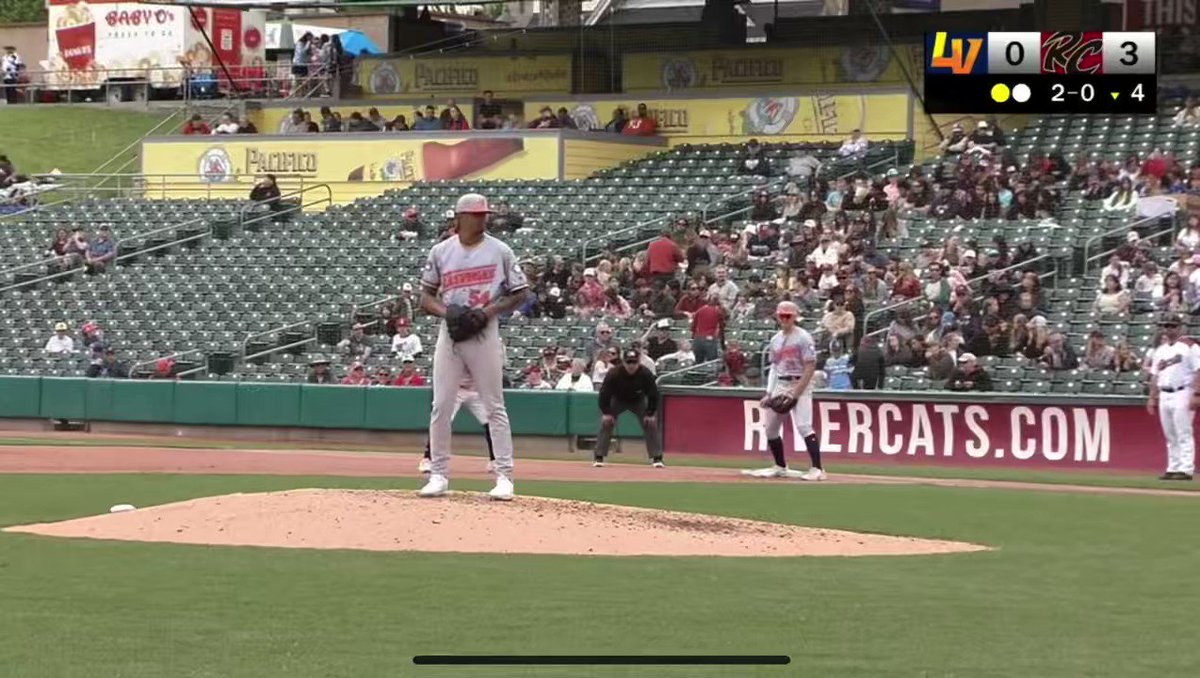

Sacramento River Cats Fall To Aviators In Series Defeat

May 07, 2025

Sacramento River Cats Fall To Aviators In Series Defeat

May 07, 2025

Latest Posts

-

Thunder Vs Pacers Injury Report March 29th Game Status

May 08, 2025

Thunder Vs Pacers Injury Report March 29th Game Status

May 08, 2025 -

Okc Thunder Vs Portland Trail Blazers How To Watch On March 7th

May 08, 2025

Okc Thunder Vs Portland Trail Blazers How To Watch On March 7th

May 08, 2025 -

Thunder Vs Trail Blazers Live Stream How To Watch On March 7th

May 08, 2025

Thunder Vs Trail Blazers Live Stream How To Watch On March 7th

May 08, 2025 -

Thunders Game 1 Triumph Alex Carusos Historic Playoff Debut

May 08, 2025

Thunders Game 1 Triumph Alex Carusos Historic Playoff Debut

May 08, 2025 -

Exploring The Exceptional Double Performances Of Former Okc Thunder Players

May 08, 2025

Exploring The Exceptional Double Performances Of Former Okc Thunder Players

May 08, 2025