XRP Price Surge: 400% In 3 Months – Is It Time To Buy?

Table of Contents

Factors Contributing to the XRP Price Surge

Several key factors have contributed to the significant increase in XRP's price. Understanding these factors is crucial for assessing the potential for future growth and the associated risks.

Ripple's Legal Victory

The positive impact of the Ripple Labs court case outcome on XRP's price cannot be overstated. The long-running "Ripple lawsuit" against the SEC (Securities and Exchange Commission) significantly impacted investor sentiment.

- Implications of the court decision: The court ruling largely favored Ripple, reducing the legal uncertainty surrounding XRP's classification as a security.

- Reduction in uncertainty: This clarity significantly boosted investor confidence, leading to increased demand for XRP.

- Effect on investor sentiment: The positive outcome improved the overall perception of XRP, attracting both existing and new investors. The removal of "legal uncertainty" was a major catalyst for the price surge.

The court ruling directly affected XRP's trading volume and market capitalization. Following the decision, trading volume spiked dramatically, indicating a significant influx of new buyers and a renewed interest in the cryptocurrency. Market capitalization also saw a considerable increase, reflecting the growth in XRP's overall value.

Increasing Institutional Adoption

The growing interest from institutional investors in XRP is another significant factor driving its price. Large financial institutions are increasingly recognizing the potential of XRP's underlying blockchain technology and its applications.

- Partnerships and collaborations: Several financial institutions are forming partnerships to utilize XRP for cross-border payments and other financial services.

- Integrations within financial institutions: The integration of XRP into existing financial systems simplifies the process of using cryptocurrencies for payments.

- Blockchain technology adoption: XRP's unique blockchain technology, designed for speed and efficiency, is attracting attention from institutions seeking advanced payment solutions.

Examples of institutions exploring or utilizing XRP for cross-border payments include [insert examples of companies here if available]. These integrations demonstrate the increasing mainstream acceptance of XRP within the financial sector.

Growing Demand for Cross-Border Payments

XRP's utility in facilitating faster and cheaper international transactions is a key driver of its price increase. Traditional methods of cross-border payments are often slow, expensive, and complex.

- Transaction speed: XRP transactions are significantly faster than traditional bank transfers, making it an attractive option for businesses needing rapid international payments.

- Transaction fees: XRP boasts considerably lower transaction fees compared to other cryptocurrencies and traditional payment methods, making it cost-effective for high-volume transactions.

- Global payments solutions: XRP offers a streamlined and efficient solution for global payments, addressing the limitations of existing systems.

Compared to traditional methods like SWIFT, XRP offers substantially faster transaction speeds (seconds vs. days) and lower fees, making it a compelling alternative for businesses and individuals involved in international remittances.

Analyzing the Risks of Investing in XRP

While the recent price surge is encouraging, investors must carefully consider the inherent risks associated with investing in XRP.

Market Volatility

The cryptocurrency market is notoriously volatile, and XRP is no exception. Price fluctuations can be dramatic and unpredictable.

- Cryptocurrency risk: Investing in cryptocurrencies inherently carries a high degree of risk.

- Price fluctuations: XRP's price can experience significant swings in short periods.

- Market correction: The market is susceptible to sudden corrections, potentially resulting in significant losses.

Historical data clearly demonstrates XRP's price volatility. Analyzing past price charts reveals periods of rapid growth followed by equally sharp declines, highlighting the inherent risk of investing in this asset.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies remains uncertain globally. Changes in regulations can significantly impact XRP's price and future prospects.

- Crypto regulation: Governments worldwide are still developing regulatory frameworks for cryptocurrencies.

- Government regulations: Future regulations could significantly impact XRP's usage and price.

- Legal compliance: Ensuring compliance with evolving regulations is crucial for investors.

Regulatory environments vary significantly across different countries and jurisdictions. This inconsistency creates uncertainty for investors and poses a potential risk to XRP's future.

Competition from other cryptocurrencies

XRP faces competition from other cryptocurrencies offering similar functionalities. The competitive landscape is constantly evolving.

- Cryptocurrency competition: The cryptocurrency market is highly competitive, with many altcoins vying for market share.

- Market share: XRP's market share is subject to competition from other payment-focused cryptocurrencies.

- Blockchain technology comparison: The technological advancements of competing platforms can impact XRP's position.

Analyzing the overall market landscape and comparing XRP's features and functionality against its competitors is essential before making any investment decisions.

Should You Buy XRP Now? A Balanced Perspective

The decision of whether or not to buy XRP requires careful consideration of both the potential upside and the significant risks involved. The recent price surge is undeniably significant, yet the inherent volatility and regulatory uncertainty cannot be ignored.

Weighing the pros and cons based on the information presented above is crucial. Consider your risk tolerance, and remember that past performance is not indicative of future results. Conduct thorough due diligence, focusing on XRP's current price and market trends. Before investing any significant amount of money, it is highly recommended to consult with a qualified financial advisor to ensure your investment strategy aligns with your financial goals and risk appetite.

Conclusion

The recent XRP price surge is fueled by Ripple's legal victory, increasing institutional adoption, and the growing demand for efficient cross-border payments. However, the market remains volatile, and regulatory uncertainty persists. Before investing in XRP, thoroughly assess the risks and potential rewards. Conduct your own research, consider your risk tolerance, and consult a financial advisor to make an informed investment decision. Remember to carefully analyze the current XRP price and market trends before committing your capital. Understanding the factors driving the XRP price surge allows for a more informed approach to investing in this cryptocurrency.

Featured Posts

-

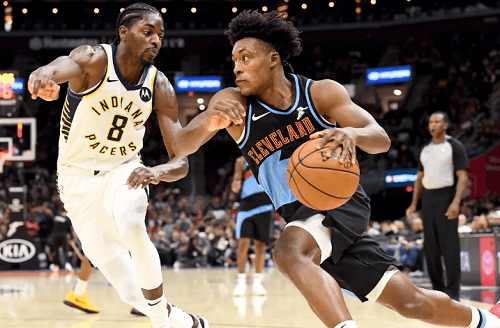

Indiana Pacers Vs Cleveland Cavaliers Complete Game Guide

May 01, 2025

Indiana Pacers Vs Cleveland Cavaliers Complete Game Guide

May 01, 2025 -

State Of Emergency Louisville Faces Tornado Damage And Widespread Flooding

May 01, 2025

State Of Emergency Louisville Faces Tornado Damage And Widespread Flooding

May 01, 2025 -

On Set Footage Ben Affleck And Gillian Anderson In A Shootout Scene

May 01, 2025

On Set Footage Ben Affleck And Gillian Anderson In A Shootout Scene

May 01, 2025 -

Target Investasi Pekanbaru Bkpm Optimistis Capai Rp 3 6 Triliun Tahun Ini

May 01, 2025

Target Investasi Pekanbaru Bkpm Optimistis Capai Rp 3 6 Triliun Tahun Ini

May 01, 2025 -

Energiezekerheid Voor Bio Based Basisscholen De Rol Van De Generator

May 01, 2025

Energiezekerheid Voor Bio Based Basisscholen De Rol Van De Generator

May 01, 2025