XRP Price Surge: Ripple SEC Case Progress And US ETF Implications

Table of Contents

The Ripple SEC Lawsuit: A Turning Point for XRP?

The Ripple SEC lawsuit, filed in December 2020, has cast a long shadow over XRP's price and market sentiment. The SEC alleges that Ripple sold XRP as an unregistered security, violating federal securities laws. The core arguments center around whether XRP's distribution and marketing constituted an investment contract, a key element in determining security status. This protracted legal battle has created significant regulatory uncertainty, impacting XRP's price considerably.

Recent Developments and Their Market Impact

Several significant developments in the Ripple SEC case have directly impacted XRP's price volatility.

- July 2023 Ruling: Judge Analisa Torres' partial summary judgment favored Ripple, declaring that programmatic sales of XRP did not constitute unregistered securities offerings. This positive development triggered a substantial XRP price surge.

- Expert Testimony: Expert witnesses from both sides have presented arguments influencing market sentiment. Their analyses on XRP's functionality and market dynamics have influenced price predictions and investor confidence.

- Ongoing Legal Proceedings: The case continues to unfold, with ongoing discovery and potential appeals impacting market reaction. Any new filings or court rulings can cause significant XRP price volatility.

[Insert chart or graph showing correlation between key legal developments and XRP price fluctuations]

The market reaction to these developments has been dramatic, showcasing the significant connection between legal progress and XRP's price. Positive news generally leads to price increases, while negative developments cause dips. Understanding this correlation is vital for informed decision-making.

Potential Outcomes and Their Implications for XRP's Future

Three primary scenarios could unfold:

- Ripple Wins: A complete victory for Ripple would likely lead to a significant, sustained XRP price surge, driven by reduced regulatory uncertainty and increased investor confidence.

- Ripple Loses: An unfavorable ruling could severely impact XRP's price, potentially leading to a prolonged downturn and further regulatory challenges.

- Settlement: A settlement between Ripple and the SEC would likely produce a mixed market reaction, depending on the terms of the agreement.

The long-term outlook for XRP hinges heavily on the outcome of this lawsuit. The regulatory uncertainty remains a significant factor influencing market sentiment and price prediction.

The Growing Interest in US XRP ETFs

The emergence of Exchange Traded Funds (ETFs) presents a significant opportunity for increased liquidity and accessibility in the cryptocurrency market. ETFs offer a convenient way for investors to gain exposure to crypto assets without directly holding them.

The Potential for XRP ETF Approval in the US

The US regulatory landscape for crypto ETFs is still evolving. The SEC has shown a cautious approach to approving crypto ETFs, particularly those tied to assets like XRP facing regulatory challenges. Factors influencing the SEC's decision include:

- Regulatory Clarity: The SEC needs clearer regulatory frameworks for cryptocurrencies before approving ETFs broadly.

- Market Manipulation Concerns: The SEC needs to mitigate concerns about market manipulation in the cryptocurrency markets.

- Custody Solutions: Secure custody solutions for the underlying assets are crucial for ETF approval.

Successful XRP ETF listing could drastically alter the landscape, boosting liquidity, attracting institutional investment, and significantly increasing XRP's market capitalization, leading to a substantial XRP price surge.

Comparing XRP ETF Potential to Other Crypto ETFs

While Bitcoin and Ethereum ETFs are further along in the approval process, the potential for an XRP ETF is substantial, especially considering the positive impact of a Ripple victory in court. XRP's unique focus on cross-border payments could be a compelling factor in its favor, making it an attractive asset for institutional investors seeking diversification.

Analyzing XRP Price Prediction Factors Beyond the Lawsuit

While the Ripple SEC case is a dominant factor, other elements contribute to XRP price prediction.

Technical Analysis of XRP Price

Technical analysis using indicators like moving averages and RSI can help identify potential price trends. Chart patterns and trading volume offer further insights. For example, a sustained uptrend with increasing trading volume could signal a bullish outlook.

Fundamental Analysis of XRP and Ripple

XRP's utility within the RippleNet network for cross-border payments is a key fundamental factor. The growth and adoption of RippleNet directly impact XRP's long-term value and potential price appreciation driven by increased demand for blockchain technology solutions.

Market Sentiment and Investor Confidence

Overall market sentiment, including Fear, Uncertainty, and Doubt (FUD), significantly impacts XRP's price. Positive news and increased investor confidence usually fuel price increases, while negative sentiment can lead to sharp declines. Market sentiment analysis plays a crucial role in accurate price prediction.

Conclusion: Understanding the XRP Price Surge and Future Outlook

The XRP price surge is intricately linked to the progress of the Ripple SEC lawsuit and the potential for US XRP ETF approval. Positive developments in the legal case, combined with increased investor confidence and a potential ETF listing, can significantly impact XRP's price. However, it's crucial to consider the interplay between legal developments, technical indicators, fundamental analysis, and market sentiment when assessing XRP's future trajectory. Understanding these interwoven factors is key for any investor looking to navigate the XRP market. To stay informed about the XRP price surge and its future prospects, continue researching Ripple's progress in the SEC lawsuit and the developments in the broader cryptocurrency regulatory landscape. Stay updated on XRP price prediction analyses and consider diversifying your investment portfolio accordingly.

Featured Posts

-

Sdr Azad Kshmyr Awr Brtanwy Parlymnt Ka Mshtrkh Mwqf Kshmyr Ka Msylh

May 02, 2025

Sdr Azad Kshmyr Awr Brtanwy Parlymnt Ka Mshtrkh Mwqf Kshmyr Ka Msylh

May 02, 2025 -

Juridische Strijd Kampen Dagvaardt Enexis Wegens Weigering Stroomnetaansluiting

May 02, 2025

Juridische Strijd Kampen Dagvaardt Enexis Wegens Weigering Stroomnetaansluiting

May 02, 2025 -

Mwqe Bkra 30 Shkhsyt Krwyt Mkrwht Mn Aljmahyr

May 02, 2025

Mwqe Bkra 30 Shkhsyt Krwyt Mkrwht Mn Aljmahyr

May 02, 2025 -

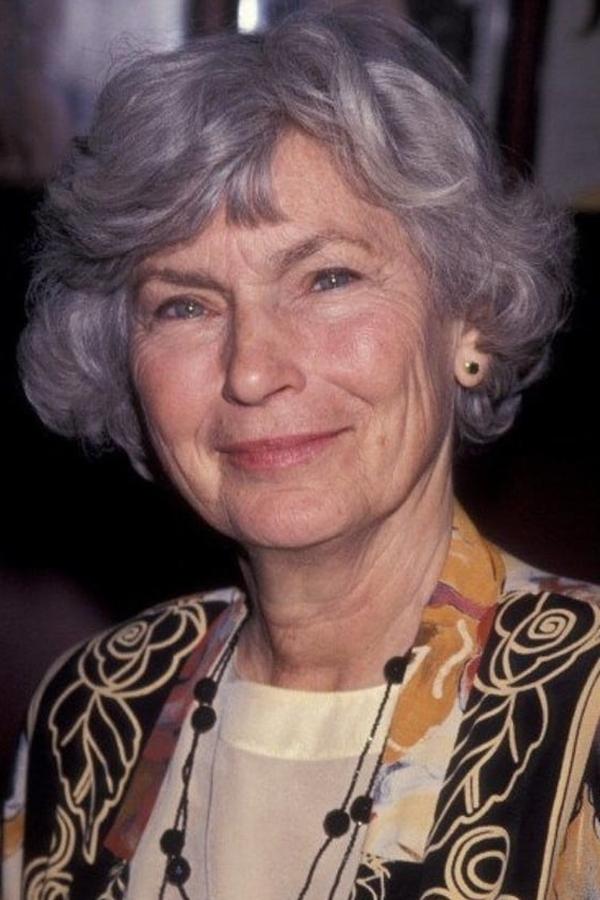

Carrie Actress Priscilla Pointer Passes Away At Age 100

May 02, 2025

Carrie Actress Priscilla Pointer Passes Away At Age 100

May 02, 2025 -

Sag Aftra Joins Wga Complete Hollywood Production Shutdown

May 02, 2025

Sag Aftra Joins Wga Complete Hollywood Production Shutdown

May 02, 2025