XRP (Ripple): Assessing The Risks And Rewards Of A Long-Term Investment

Table of Contents

Understanding XRP and its Technology

XRP is the native cryptocurrency of Ripple, a company focused on providing a faster, cheaper, and more efficient system for global financial transactions. Unlike cryptocurrencies like Bitcoin that rely on blockchain technology for consensus, Ripple uses a unique, proprietary consensus mechanism called the Ripple Protocol Consensus Algorithm (RPCA). This allows for significantly faster transaction speeds and lower fees compared to many other cryptocurrencies.

Ripple's primary focus is its RippleNet, a global network that connects financial institutions enabling seamless cross-border payments. This is a key differentiator for XRP, setting it apart from cryptocurrencies primarily used for speculation.

- RippleNet: This network streamlines international payments by using XRP as a bridge currency, reducing transaction times and costs drastically. Banks and other financial institutions use RippleNet to send and receive money across borders quickly and efficiently.

- Speed and Low Transaction Costs: XRP transactions are processed within seconds, a significant advantage over traditional banking systems that can take days or even weeks. Transaction fees are also remarkably low, making it a cost-effective solution for high-volume transactions.

- Scalability: The XRP Ledger is designed for scalability, meaning it can handle a large volume of transactions without compromising speed or efficiency. This is crucial for its adoption in the financial industry, which requires high throughput.

- Potential for Wider Adoption: The increasing adoption of RippleNet by major financial institutions signals a strong potential for wider acceptance and usage of XRP in the future.

The Potential Rewards of Investing in XRP

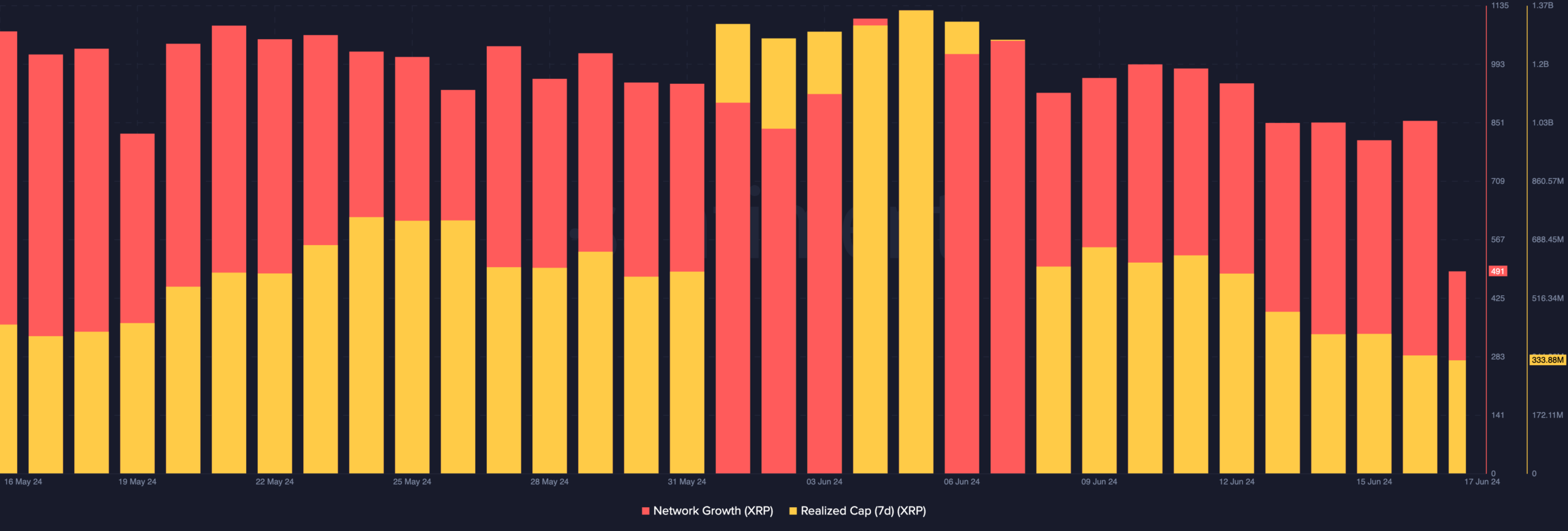

The potential rewards of a long-term XRP investment are significant, driven by its unique position in the fintech space and potential for increased adoption. While past performance is not indicative of future results, analyzing historical price trends can provide insights.

- Price Appreciation Potential: Market sentiment and increased adoption by financial institutions could significantly impact XRP's price. Positive news and growth within the Ripple ecosystem can lead to price increases.

- Long-Term Growth in Fintech: XRP's integration into RippleNet positions it for growth within the rapidly expanding fintech industry. As more institutions adopt the system, demand for XRP could increase, driving up its value.

- Passive Income Potential (Limited): While not as extensive as with some other cryptocurrencies, certain platforms offer opportunities for earning passive income through staking or lending XRP. However, this should be carefully researched, and risks should be carefully considered.

The Risks Associated with XRP Investment

Investing in XRP, like any cryptocurrency, carries substantial risk. It's crucial to understand these risks before committing any capital.

- Volatility: The cryptocurrency market is known for its volatility. XRP's price can fluctuate dramatically in short periods, leading to significant gains or losses.

- Regulatory Uncertainty: The ongoing SEC lawsuit against Ripple creates regulatory uncertainty, potentially impacting XRP's price and future prospects. The outcome of this lawsuit is a significant factor to consider.

- New and Less Established Asset: Compared to more established cryptocurrencies, XRP is relatively new and carries higher risk. Its future success is not guaranteed.

- Other Risks:

- SEC Lawsuit: The ongoing legal battle poses a significant threat to XRP's price and future.

- Market Manipulation: The cryptocurrency market is susceptible to manipulation, which could negatively impact XRP's price.

- Total Loss of Investment: There's a risk of losing your entire investment in XRP.

- Diversification: It's crucial to diversify your investment portfolio and not put all your eggs in one basket, especially in a high-risk asset like XRP.

Analyzing the XRP Investment Landscape

The cryptocurrency market is highly competitive. XRP's success depends on its ability to maintain its position amidst other cryptocurrencies offering similar functionalities.

- Competitive Landscape: XRP faces competition from other cryptocurrencies and payment solutions. Its success will depend on its ability to differentiate itself and gain wider adoption.

- Market Trends and Predictions: Analyzing market trends, expert opinions, and technological advancements is vital for assessing XRP's future potential.

- Technological Advancements: Technological developments within blockchain and fintech could significantly impact XRP's value.

- Macroeconomic Factors: Global economic conditions can influence the cryptocurrency market as a whole, impacting XRP's price.

Conclusion: Making Informed Decisions About Your XRP Investment

Investing in XRP involves significant potential rewards but also substantial risks. The ongoing SEC lawsuit, market volatility, and the competitive landscape all need careful consideration. Remember, this article is not financial advice. Thorough research, understanding your risk tolerance, and diversification are crucial before investing in XRP or any cryptocurrency. Weigh the risks and rewards carefully before making any decisions regarding your XRP (Ripple) investment. Further research and careful consideration are key to success in this volatile market.

Featured Posts

-

Analisis Ballena De Xrp Compra 20 Millones De Tokens Que Significa Esto Spanish Translation

May 07, 2025

Analisis Ballena De Xrp Compra 20 Millones De Tokens Que Significa Esto Spanish Translation

May 07, 2025 -

Latest News On Anthony Edwards Injury Timberwolves Vs Lakers

May 07, 2025

Latest News On Anthony Edwards Injury Timberwolves Vs Lakers

May 07, 2025 -

Nfl Draft 2024 Steelers Keep Top Wide Receiver On Roster

May 07, 2025

Nfl Draft 2024 Steelers Keep Top Wide Receiver On Roster

May 07, 2025 -

Anthony Edwards Faces 50 K Nba Fine After Vulgar Exchange With Fan

May 07, 2025

Anthony Edwards Faces 50 K Nba Fine After Vulgar Exchange With Fan

May 07, 2025 -

Progress On Ldc Graduation Key Initiatives By The Government

May 07, 2025

Progress On Ldc Graduation Key Initiatives By The Government

May 07, 2025

Latest Posts

-

Supermans Struggle Sneak Peek Highlights Kryptos Aggression

May 08, 2025

Supermans Struggle Sneak Peek Highlights Kryptos Aggression

May 08, 2025 -

Kryptos Betrayal Superman Sneak Peek Offers A Glimpse

May 08, 2025

Kryptos Betrayal Superman Sneak Peek Offers A Glimpse

May 08, 2025 -

A Wounded Superman Sneak Peek Features Kryptos Violence

May 08, 2025

A Wounded Superman Sneak Peek Features Kryptos Violence

May 08, 2025 -

Revealed Superman Sneak Peek Shows Kryptos Brutal Attack

May 08, 2025

Revealed Superman Sneak Peek Shows Kryptos Brutal Attack

May 08, 2025 -

Superman Sneak Peek Krypto Turns Against The Man Of Steel

May 08, 2025

Superman Sneak Peek Krypto Turns Against The Man Of Steel

May 08, 2025