XRP (Ripple) Below $3: A Prudent Investment Strategy

Table of Contents

Understanding XRP's Current Market Position

Analyzing Recent Price Volatility

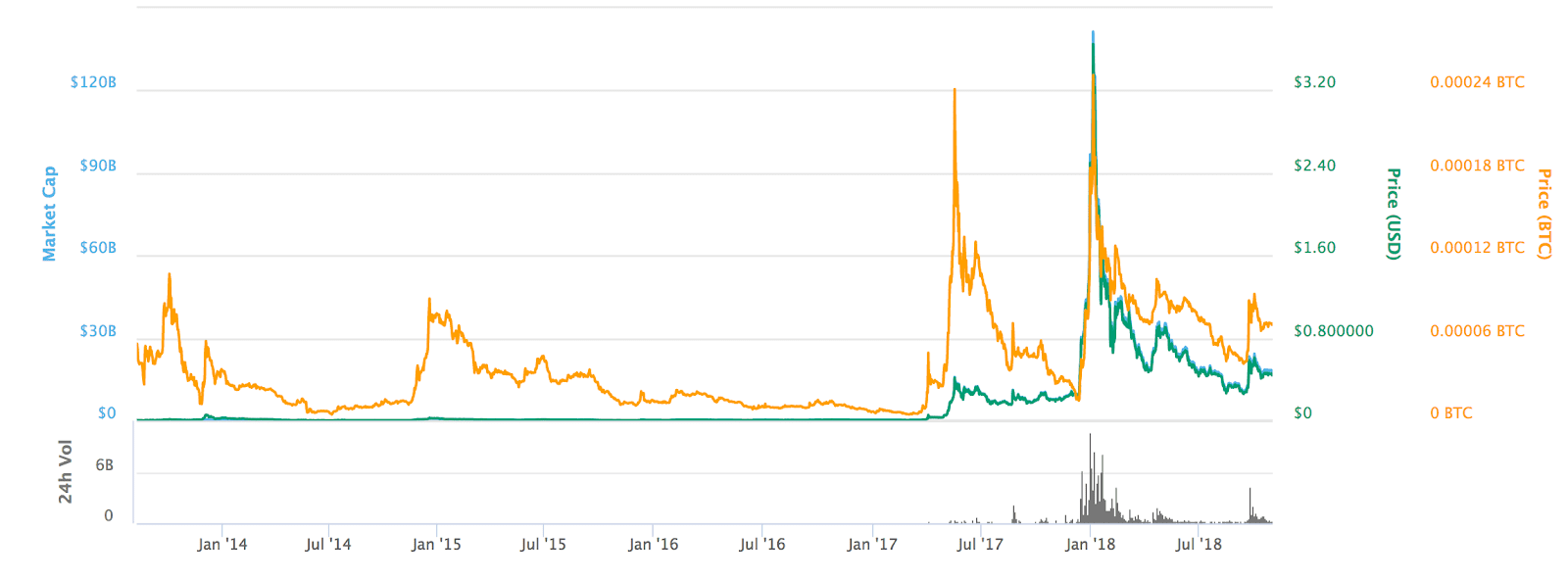

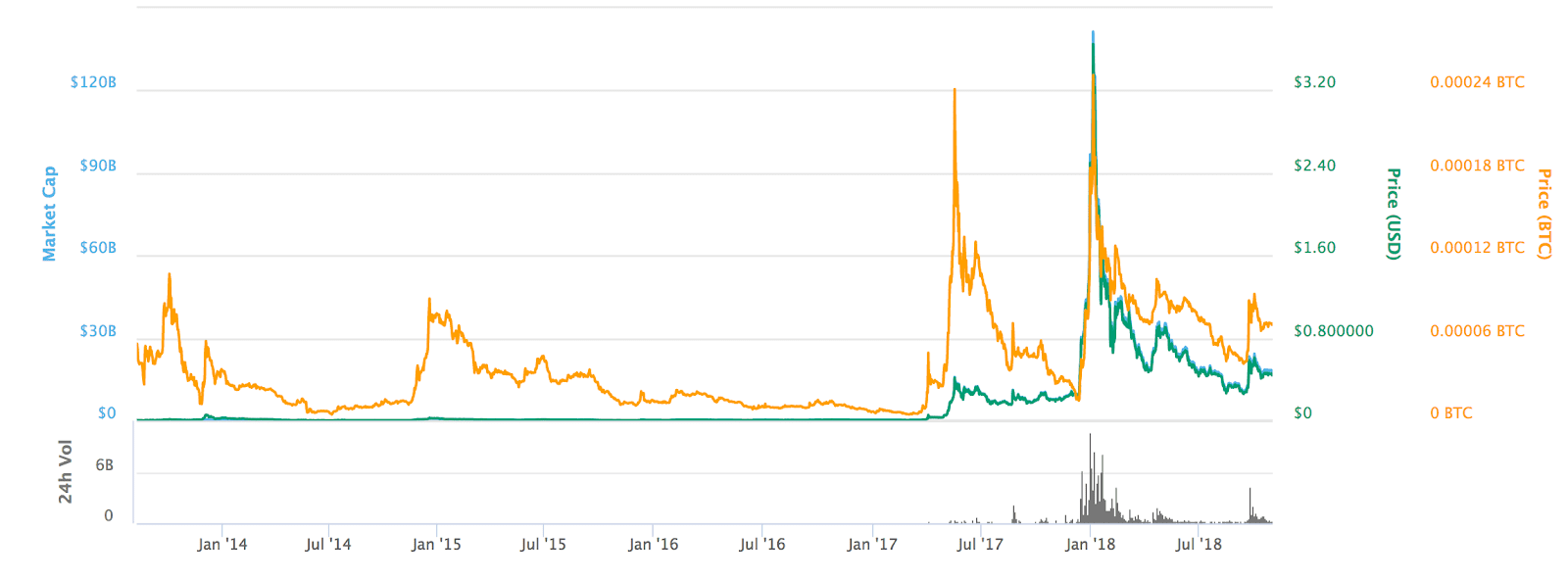

XRP's price has seen considerable volatility in recent months. Several factors have contributed to these fluctuations:

- The SEC Lawsuit: The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) remains a major influence on XRP's price. Positive developments in the case can lead to price surges, while negative news can cause significant drops.

- Regulatory Developments: Changes in cryptocurrency regulations globally impact XRP's value. Positive regulatory shifts in key markets could boost its price, while stricter regulations could depress it.

- Market Sentiment: Overall market sentiment towards cryptocurrencies significantly affects XRP's price. Periods of bullish sentiment can lead to price increases, while bearish markets often result in price declines.

[Insert chart or graph illustrating XRP's price trends over the past few months]

Assessing the Fundamentals of XRP

Despite the price volatility, XRP boasts several fundamental strengths:

- Fast Transaction Speeds: XRP offers significantly faster transaction speeds compared to many other cryptocurrencies, making it attractive for payments and remittances.

- Low Transaction Fees: The low cost of transactions makes XRP a cost-effective solution for cross-border payments.

- Scalability: XRP's network is designed for high scalability, capable of handling a large volume of transactions.

- Partnerships and Collaborations: Ripple has established numerous partnerships with financial institutions globally, expanding XRP's potential for adoption in the financial sector.

Evaluating the Risks of Investing in XRP Below $3

Regulatory Uncertainty

The SEC lawsuit presents a significant risk for XRP investors. The outcome of the case remains uncertain, and an unfavorable ruling could severely impact XRP's price.

- Potential Scenarios: A favorable ruling could significantly boost XRP's price, while an unfavorable ruling could lead to delisting from major exchanges and a substantial price drop.

- Regulatory Risk in Crypto: The cryptocurrency market is still largely unregulated, making it susceptible to sudden changes in regulatory landscape that could negatively affect investments.

Market Volatility and Price Fluctuations

The cryptocurrency market is inherently volatile, and XRP is no exception. Significant price swings are common, and investors should be prepared for substantial losses.

- Risk Management: Employing risk management strategies, such as setting stop-loss orders and diversifying your portfolio, is crucial to mitigate potential losses.

- Diversification: Don't put all your eggs in one basket. Diversifying your investment portfolio across different asset classes reduces your overall risk exposure.

Developing a Prudent Investment Strategy for XRP

Defining Your Investment Goals and Risk Tolerance

Before investing in XRP, it's crucial to define your investment goals and assess your risk tolerance.

- Investment Strategies: Are you a long-term holder looking for potential long-term growth, or a short-term trader aiming for quick profits? Your strategy should align with your goals and risk tolerance.

- Due Diligence: Thorough research is essential. Understand XRP's technology, its market position, and the risks involved before investing.

Diversification and Portfolio Management

Diversification is crucial for mitigating risk. Don't invest more than you can afford to lose.

- Asset Allocation: Spread your investments across different asset classes, including stocks, bonds, and other cryptocurrencies, to reduce overall portfolio risk.

- Dollar-Cost Averaging: Consider using dollar-cost averaging to mitigate the impact of price volatility. This involves investing a fixed amount of money at regular intervals, regardless of the price.

Setting Realistic Expectations and Managing Your Investment

Investing in cryptocurrencies requires patience and realistic expectations. Avoid emotional decision-making.

- Avoid Emotional Trading: Don't panic sell during market downturns. Stick to your investment plan and avoid making impulsive decisions based on short-term price fluctuations.

- Regular Review: Regularly review your investment strategy and make adjustments as needed based on market conditions and your financial goals.

Is XRP (Ripple) Below $3 a Smart Investment for You?

Investing in XRP below $3, or any cryptocurrency, presents both potential rewards and significant risks. The ongoing SEC lawsuit creates substantial uncertainty, and the market's inherent volatility necessitates careful risk management. We've outlined the importance of understanding XRP's fundamentals, defining your investment goals, and diversifying your portfolio. While XRP (Ripple) below $3 might present an opportunity, remember to conduct your own thorough research and develop a prudent investment strategy before making any decisions. Don't gamble with your finances; invest wisely in XRP and other cryptocurrencies.

Featured Posts

-

Pichais Warning Google Search At Risk From Doj Antitrust Lawsuit

May 02, 2025

Pichais Warning Google Search At Risk From Doj Antitrust Lawsuit

May 02, 2025 -

Plan Your Next Foodie Adventure A Windstar Cruise Experience

May 02, 2025

Plan Your Next Foodie Adventure A Windstar Cruise Experience

May 02, 2025 -

The 2024 Midterms Examining Voter Turnout In Florida And Wisconsin

May 02, 2025

The 2024 Midterms Examining Voter Turnout In Florida And Wisconsin

May 02, 2025 -

Rust Movie Review Examining The Film Amidst Controversy

May 02, 2025

Rust Movie Review Examining The Film Amidst Controversy

May 02, 2025 -

Melissa Gorga Reveals Exclusive Beach House Guest

May 02, 2025

Melissa Gorga Reveals Exclusive Beach House Guest

May 02, 2025