XRP: Ripple's Digital Asset - A Detailed Overview

Table of Contents

Understanding XRP and its Functionality

XRP's Role in RippleNet

XRP plays a crucial role in RippleNet, Ripple's global payment network. It acts as a bridge currency, facilitating faster and cheaper international transactions between different fiat currencies. This innovative approach significantly reduces reliance on traditional intermediary banks, leading to several key advantages:

- Lower transaction fees: Compared to traditional SWIFT transfers, XRP transactions offer significantly reduced fees, making them more cost-effective, especially for large-scale remittances.

- Faster settlement times: XRP transactions are processed considerably faster than traditional banking systems, often settling within seconds.

- Enhanced liquidity: XRP's use within RippleNet improves liquidity by providing a readily available intermediary currency for efficient conversions.

- Global reach: RippleNet, leveraging XRP, offers a vast global reach, connecting financial institutions across borders.

The mechanism involves converting source currency to XRP, transferring the XRP across borders, and then converting it back to the destination currency. This streamlined process minimizes delays and costs associated with traditional correspondent banking relationships.

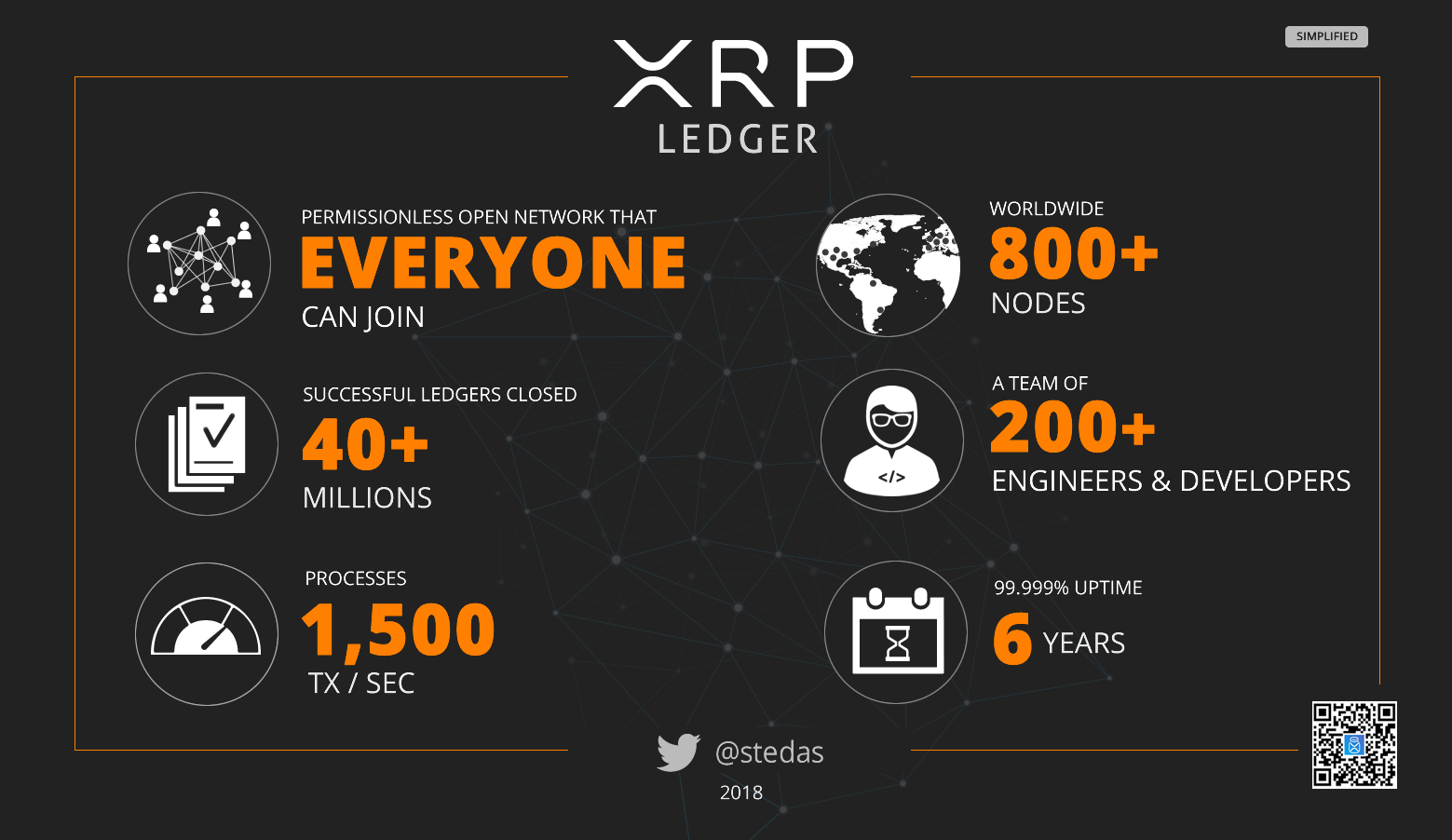

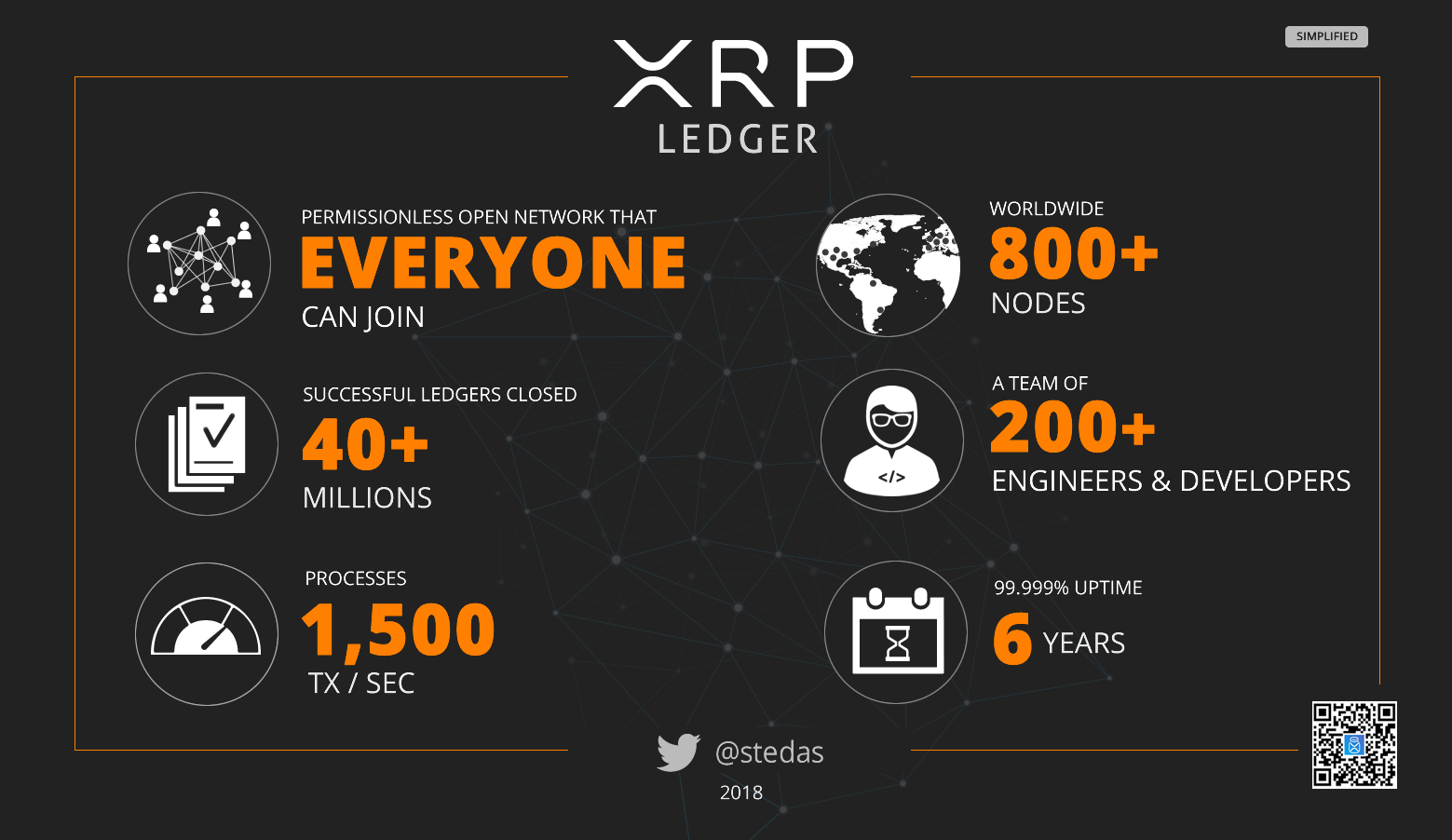

Technical Specifications of XRP

XRP boasts several key technical features that distinguish it from other cryptocurrencies:

- Consensus Mechanism (RPCA): XRP utilizes a unique consensus mechanism called the Ripple Protocol Consensus Algorithm (RPCA), designed for speed and efficiency. Unlike Proof-of-Work (PoW) cryptocurrencies like Bitcoin, RPCA consumes significantly less energy.

- Transaction Speed: XRP transactions are incredibly fast, capable of processing thousands of transactions per second, far surpassing many other blockchain networks.

- Scalability: The network's architecture is designed for scalability, handling a high volume of transactions without significant performance degradation.

- Energy Efficiency: RPCA's energy consumption is drastically lower than PoW systems, making XRP a more environmentally friendly option.

Importantly, XRP has a pre-mined supply of 100 billion coins, unlike many cryptocurrencies that are mined over time. This fixed supply contributes to its price stability, although it's also a point of contention for some critics.

Ripple and its Relationship with XRP

Ripple's Business Model and XRP

Ripple's business model is intrinsically linked to XRP. The company generates revenue through various avenues, including:

- XRP sales: Ripple sells XRP to financial institutions and other clients to be used within RippleNet.

- Use in RippleNet: The widespread adoption of RippleNet by financial institutions directly contributes to XRP's usage and demand.

- Partnerships: Strategic partnerships with banks and payment providers further enhance XRP's adoption and expand RippleNet's reach.

- Impact on Ripple's Profitability: The success of RippleNet and the demand for XRP are directly correlated with Ripple's overall profitability.

It's crucial to understand the distinction between Ripple (the company) and XRP (the cryptocurrency). While Ripple actively promotes and utilizes XRP, the cryptocurrency operates independently on its blockchain. Concerns regarding centralization often arise due to Ripple's significant holding of XRP, which is a point frequently debated within the cryptocurrency community.

Ripple's Legal Battles and their Impact on XRP

Ripple faces significant legal challenges, most notably the ongoing SEC lawsuit alleging that XRP is an unregistered security. This legal uncertainty has had a considerable impact on XRP:

- SEC Lawsuit: The lawsuit's outcome will have a profound impact on the future of XRP and its regulatory status.

- Implications for XRP Holders: The uncertainty has created volatility in XRP's price and introduced risk for investors.

- Regulatory Uncertainty: The lack of regulatory clarity surrounding XRP makes it challenging for businesses to confidently adopt it.

- Market Volatility: The ongoing legal battles have significantly contributed to the fluctuating price of XRP.

The outcome of these legal proceedings remains uncertain, but it will undoubtedly shape the future trajectory of XRP's adoption and market position.

XRP's Use Cases and Potential

Beyond Remittances: Other Applications of XRP

While cross-border payments are XRP's primary application, its potential extends beyond remittances:

- Micropayments: XRP's low transaction fees make it suitable for facilitating microtransactions, enabling new business models and applications.

- Decentralized Exchanges (DEXs): XRP can be integrated into DEXs, offering a faster and more efficient method of exchanging cryptocurrencies.

- Other Financial Applications: The possibilities include using XRP for various financial applications, such as trading, lending, and borrowing.

However, widespread adoption in these areas depends on further development and regulatory clarity.

The Future of XRP

The long-term prospects of XRP depend on several factors:

- Growing Adoption: Increased adoption by financial institutions and businesses will be crucial for its future growth.

- Regulatory Clarity: A clear regulatory framework will significantly boost investor confidence and facilitate wider adoption.

- Technological Advancements: Further improvements to the XRP Ledger and RippleNet will strengthen its capabilities.

- Market Capitalization Predictions: While predicting market capitalization is inherently speculative, positive developments could significantly impact XRP's value.

The future of XRP is complex and subject to many variables. It could experience significant growth if the legal challenges are resolved favorably and adoption increases. However, negative outcomes in the legal battles or a lack of broader adoption could significantly limit its potential.

Conclusion

XRP, Ripple's digital asset, is a unique cryptocurrency designed for fast and low-cost cross-border payments. Its integration with RippleNet has made it a significant player in the fintech landscape, although legal battles and regulatory uncertainty remain significant hurdles. Understanding XRP's functionality, its relationship with Ripple, its diverse use cases, and the ongoing legal challenges is crucial for navigating the complexities of the cryptocurrency market. While XRP holds significant potential, it's vital to conduct thorough research and understand the inherent risks before making any investment decisions. Learn more about XRP and its potential by researching reputable sources and staying informed about the latest developments. Invest responsibly and remember to perform your own due diligence before considering any investment in XRP.

Featured Posts

-

Toppins 21 Points Power Colorado Into Texas Tech Matchup

May 01, 2025

Toppins 21 Points Power Colorado Into Texas Tech Matchup

May 01, 2025 -

Saltillo El Boxeo Como Catalizador De La Transformacion Social En La Jornada Nacional

May 01, 2025

Saltillo El Boxeo Como Catalizador De La Transformacion Social En La Jornada Nacional

May 01, 2025 -

Klingbeil Stands Firm No Return To Russian Gas For Germany

May 01, 2025

Klingbeil Stands Firm No Return To Russian Gas For Germany

May 01, 2025 -

Ryan Coogler Et Le Reboot De X Files Ce Que Nous Savons

May 01, 2025

Ryan Coogler Et Le Reboot De X Files Ce Que Nous Savons

May 01, 2025 -

Eurovision 2025 Semi Final Running Order The Complete List

May 01, 2025

Eurovision 2025 Semi Final Running Order The Complete List

May 01, 2025