XRP Whale's Massive 20M Token Purchase: A Big Bet On Ripple?

Table of Contents

The Significance of the 20M XRP Purchase

The sheer scale of this XRP purchase is undeniably noteworthy. 20 million XRP represents a significant portion of the daily trading volume, and such a large transaction inevitably influences market sentiment and price action.

Identifying the Whale: An Enigma in the Crypto World

Identifying the entity behind this massive XRP purchase presents a significant challenge. The inherent anonymity afforded by the decentralized nature of the cryptocurrency market makes tracking large transactions difficult, even with sophisticated blockchain analytics tools.

- Techniques for Tracking Large Transactions: Blockchain analysts utilize various techniques, including analyzing transaction patterns, tracing addresses linked to known exchanges, and identifying clusters of related transactions. However, these methods are not foolproof.

- Limitations of Public Blockchain Data: Public blockchain data only reveals transaction details; it doesn't reveal the identity of the individuals or entities involved. Sophisticated mixing techniques further obscure the origins of funds.

- Potential for Multiple Entities: The transaction might involve multiple entities acting in coordination, making identification even more challenging.

The impact of whale activity on market volatility is substantial. Large purchases can trigger price increases as other investors interpret the move as a bullish signal, leading to a cascade effect. Conversely, large sell-offs can cause significant price drops. The potential for price manipulation, while always a concern in crypto markets, is amplified by actions of this magnitude.

Market Reaction to the Purchase: Ripple Effects in the XRP Market

The immediate market reaction to the 20 million XRP purchase was a noticeable surge in trading volume, followed by a temporary price increase. However, it's crucial to analyze the context: Did this purchase cause the price increase, or did it simply coincide with other positive market trends or news events?

- Price Charts: Analyzing price charts showing the XRP/USD or XRP/BTC pair before, during, and after the purchase provides valuable insights into the immediate impact. (Ideally, this section would include actual charts and data).

- Correlated News Events: Examining any concurrent news events—positive developments regarding Ripple's technology, partnerships, or the Ripple lawsuit itself—is essential to accurately assess the purchase's isolated effect.

Determining whether the purchase was a catalyst for the price increase or merely a coincidental event requires careful analysis of market dynamics and relevant news.

Interpreting the Whale's Actions: Bullish or Strategic?

Deciphering the whale's motivations requires careful consideration of several possibilities. Was this a bullish bet on Ripple's long-term prospects, a calculated strategic move, or something else entirely?

Belief in Ripple's Technology and Future: A Long-Term Vision?

One compelling interpretation is that the whale holds a strong belief in Ripple's technology and its potential for widespread adoption in the global financial system.

- Ripple's Ongoing Developments: RippleNet, Ripple's blockchain-based payment network, continues to expand its global reach, facilitating cross-border payments for major financial institutions.

- Partnerships and Market Adoption: Strategic partnerships and increasing adoption by financial institutions signal a growing acceptance of Ripple's technology and potentially the long-term value of XRP.

- Long-Term Value Proposition: XRP's role within the Ripple ecosystem is central to its value proposition, as it facilitates efficient and cost-effective transactions.

Speculation on the Ripple Lawsuit Outcome: A Calculated Risk?

The ongoing SEC lawsuit against Ripple undeniably casts a shadow over the XRP market. The whale's decision to make such a substantial purchase suggests either a very high risk tolerance or a strong conviction that Ripple will prevail in the legal battle.

- Potential Scenarios: Several outcomes are possible: a complete victory for Ripple, a partial settlement, or a loss. Each scenario would dramatically affect the XRP price.

- Recent Developments in the Case: Staying updated on the ongoing legal proceedings is crucial for understanding the risk involved in investing in XRP.

- Risk Tolerance and Long-Term Strategy: The whale's action suggests either an extremely bullish outlook or a strategic long-term investment plan that accounts for the potential risks of the lawsuit.

Alternative Explanations: Beyond the Bullish Narrative

While a bullish outlook on Ripple's future is a plausible explanation, other possibilities warrant consideration.

- Arbitrage Opportunities: Large-scale arbitrage opportunities across different exchanges could motivate such a large purchase.

- Market Manipulation (Less Likely): While possible, manipulating the XRP market to this extent would be extraordinarily difficult and risky. The scale of the purchase makes this explanation less probable.

- Strategic Trading Strategies: The purchase could be part of a broader, complex trading strategy designed to capitalize on market movements.

Dismissing alternative explanations prematurely would be a mistake; a thorough analysis of all possibilities is necessary.

Conclusion: Navigating the XRP Landscape

The massive 20M XRP purchase is a significant event that highlights the volatility and investment opportunities within the XRP and broader cryptocurrency market. Whether driven by a bullish bet on Ripple's future, a calculated strategic investment, or other factors, this event underscores the importance of staying informed. The ongoing uncertainty surrounding the Ripple lawsuit adds another layer of complexity.

Call to Action: The XRP market remains dynamic and unpredictable. To make informed decisions about your XRP investments or your broader cryptocurrency portfolio, stay informed on the latest XRP news and developments, including XRP price predictions and updates on the Ripple lawsuit. Thoroughly research the risks and potential rewards before making any investment decisions regarding XRP.

Featured Posts

-

Post Wildfire Reopening Rihanna Dines Alone At Giorgio Baldi

May 07, 2025

Post Wildfire Reopening Rihanna Dines Alone At Giorgio Baldi

May 07, 2025 -

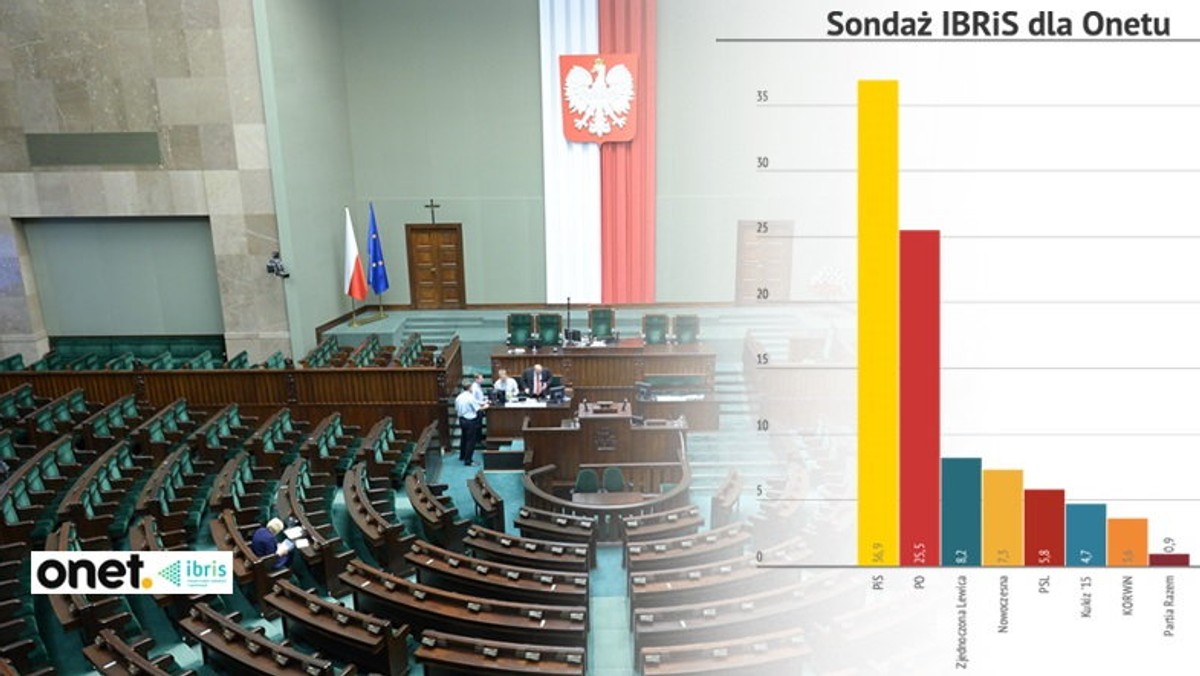

Badanie Ib Ri S Dla Onetu Kto Cieszy Sie Najwiekszym Zaufaniem Polakow

May 07, 2025

Badanie Ib Ri S Dla Onetu Kto Cieszy Sie Najwiekszym Zaufaniem Polakow

May 07, 2025 -

Best Cavaliers Vs Pacers Series Bets Eastern Conference Semifinals Predictions

May 07, 2025

Best Cavaliers Vs Pacers Series Bets Eastern Conference Semifinals Predictions

May 07, 2025 -

Nfl Trade Rumors Several Teams Pursuing Pittsburgh Steelers Wideout

May 07, 2025

Nfl Trade Rumors Several Teams Pursuing Pittsburgh Steelers Wideout

May 07, 2025 -

Latest On Anthony Edwards Injury Lakers Timberwolves Game

May 07, 2025

Latest On Anthony Edwards Injury Lakers Timberwolves Game

May 07, 2025

Latest Posts

-

Unseen Fillion A Pivotal Wwii Performance Before His Rookie Fame

May 08, 2025

Unseen Fillion A Pivotal Wwii Performance Before His Rookie Fame

May 08, 2025 -

Before The Rookie Nathan Fillions Iconic Wwii Role

May 08, 2025

Before The Rookie Nathan Fillions Iconic Wwii Role

May 08, 2025 -

Stream The Most Intense War Films Available On Amazon Prime

May 08, 2025

Stream The Most Intense War Films Available On Amazon Prime

May 08, 2025 -

Superior To Saving Private Ryan Military Historians Rate The Best Realistic Wwii Movies

May 08, 2025

Superior To Saving Private Ryan Military Historians Rate The Best Realistic Wwii Movies

May 08, 2025 -

Nathan Fillion From Wwii Movie To The Rookie His Early Career Highlight

May 08, 2025

Nathan Fillion From Wwii Movie To The Rookie His Early Career Highlight

May 08, 2025