XRP's Future: Navigating The SEC's Commodity Classification

Table of Contents

The SEC Lawsuit and its Implications

The SEC's lawsuit against Ripple, filed in December 2020, alleges that Ripple sold XRP as an unregistered security, violating federal securities laws. This legal challenge hinges on the interpretation of the "Howey Test," a legal precedent used to determine whether an investment contract constitutes a security.

Understanding the SEC's Arguments

The SEC's core arguments center around the assertion that XRP sales constituted investment contracts, based on the following:

- Profit expectations: The SEC claims investors purchased XRP with the expectation of profit based on Ripple's efforts.

- Common enterprise: The SEC argues that Ripple's activities and the interconnectedness of XRP holders created a common enterprise.

- Investment of money: The SEC points to the purchase of XRP with fiat currency as an investment of money.

Ripple, however, counters these arguments, asserting that:

- XRP is a decentralized digital asset, not a security.

- XRP sales were not directed at US investors.

- The Howey Test does not apply to XRP's transactional use.

Potential Outcomes of the Lawsuit

Several outcomes are possible:

- Complete SEC Victory: A complete victory for the SEC could lead to significant penalties for Ripple and potentially cripple XRP's market position. The price could plummet, and exchanges might delist XRP.

- Partial Victory for Ripple: A partial victory could see some XRP sales deemed securities, while others are not, creating a complex and uncertain regulatory landscape.

- Settlement: A settlement between Ripple and the SEC could involve significant fines but might offer more clarity regarding XRP's future regulatory status.

The impact of each scenario on XRP's price and market capitalization is highly speculative, with expert opinions varying significantly. The outcome will also greatly influence future regulatory frameworks for cryptocurrencies in the US.

XRP's Technological Advantages and Use Cases

Despite the legal uncertainty, XRP possesses several technological advantages and practical use cases that contribute to its potential long-term viability.

RippleNet and its Global Reach

RippleNet, Ripple's payment network, facilitates fast and cost-effective cross-border transactions using XRP. Its adoption by numerous financial institutions highlights XRP's utility in the global financial system:

- Speed: XRP transactions are significantly faster than traditional banking methods.

- Cost-effectiveness: XRP transactions incur lower fees compared to traditional SWIFT transfers.

- Efficiency: The network's decentralized nature enhances efficiency and transparency.

Major partnerships with banks and payment processors demonstrate the growing acceptance of XRP within the financial industry. This widespread adoption could influence the SEC's perspective on XRP's classification.

XRP's Role in the Future of Finance

Beyond cross-border payments, XRP's potential extends to other areas:

- Decentralized Finance (DeFi): XRP's scalability and energy efficiency make it a potential candidate for various DeFi applications.

- Other Sectors: XRP's speed and low cost could find applications in various sectors, such as supply chain management and micropayments.

Continued innovation and development surrounding XRP could further expand its utility and enhance its long-term prospects.

Navigating the Regulatory Landscape

The regulatory landscape for cryptocurrencies is evolving rapidly, with significant variations across jurisdictions.

International Regulations and Adoption

Several countries outside the US have adopted more favorable regulatory environments for cryptocurrencies. This international adoption could mitigate the impact of a negative US regulatory outcome for XRP:

- Examples: [Insert examples of countries with favorable regulations for cryptocurrencies].

Global initiatives aimed at harmonizing cryptocurrency regulation could also play a crucial role in shaping XRP's future.

The Future of Crypto Regulation in the US

The future of crypto regulation in the US remains uncertain, with ongoing debates among lawmakers and regulatory bodies. Bipartisan efforts to create a comprehensive regulatory framework could significantly impact XRP and the broader cryptocurrency market:

- Lobbying efforts: Industry players and regulatory bodies are actively involved in shaping future regulations.

The ultimate outcome will likely shape the long-term trajectory of XRP within the US market.

Conclusion

The SEC lawsuit against Ripple has cast a shadow over XRP's future, but the cryptocurrency's technological advantages and global adoption present opportunities amidst the uncertainty. The outcome of the legal battle and the evolution of the regulatory landscape will significantly impact XRP's price, adoption, and overall trajectory. Understanding the nuances of the SEC's commodity classification and its implications for XRP is crucial for making informed decisions. Stay informed about the ongoing legal proceedings and regulatory developments to navigate this dynamic market effectively. Continue researching the future of XRP and its position within the cryptocurrency space to make sound investment decisions.

Featured Posts

-

Is This Xrps Big Moment Etf Hopes Sec Changes And Ripples Transformation

May 08, 2025

Is This Xrps Big Moment Etf Hopes Sec Changes And Ripples Transformation

May 08, 2025 -

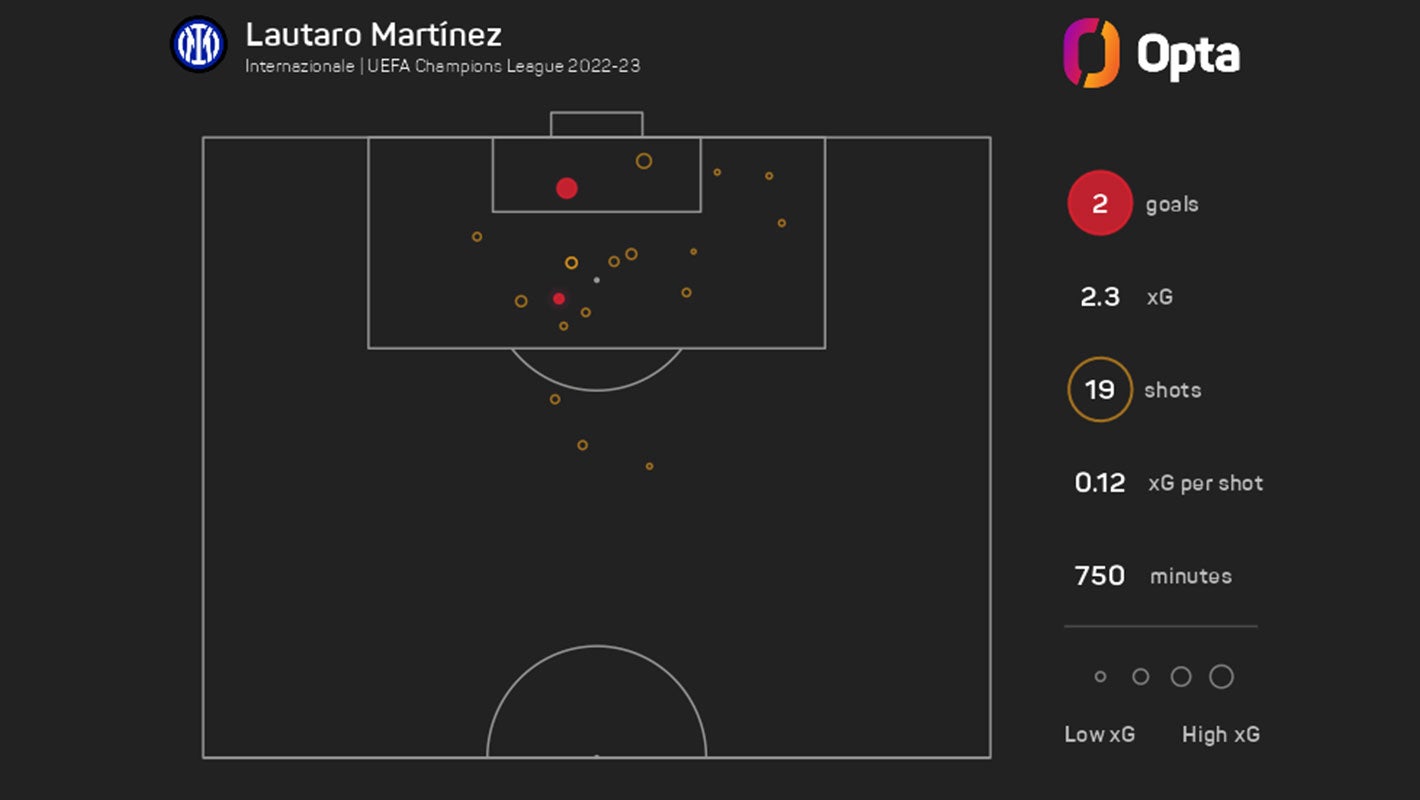

Barcelona And Inter Milan Deliver Champions League Classic 6 Goals Shared

May 08, 2025

Barcelona And Inter Milan Deliver Champions League Classic 6 Goals Shared

May 08, 2025 -

Unseen Fillion A Pivotal Wwii Performance Before His Rookie Fame

May 08, 2025

Unseen Fillion A Pivotal Wwii Performance Before His Rookie Fame

May 08, 2025 -

Inter Milan Eliminate Feyenoord Secure Place In Last Eight

May 08, 2025

Inter Milan Eliminate Feyenoord Secure Place In Last Eight

May 08, 2025 -

A Closer Look At Nathan Fillions Impactful Saving Private Ryan Scene

May 08, 2025

A Closer Look At Nathan Fillions Impactful Saving Private Ryan Scene

May 08, 2025