X's Financial Reorganization: Debt Sale Data And Company Transformation

Table of Contents

Analyzing X's Debt Sale Data

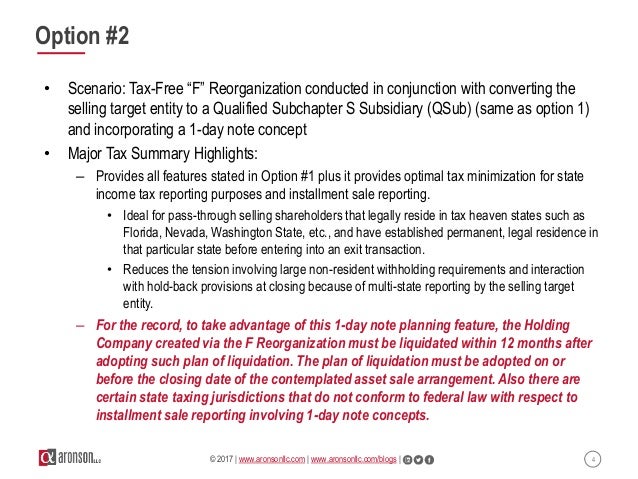

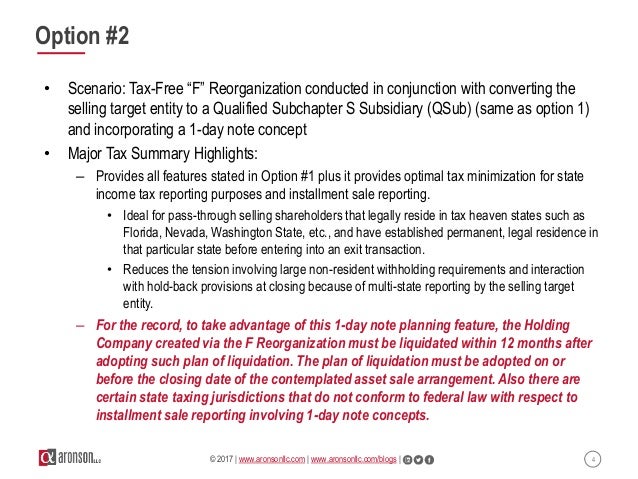

X's financial restructuring involved a strategic debt sale, a crucial step in its journey towards financial recovery. Understanding the specifics of this debt sale is vital to appreciating the scope of the company's transformation. This section analyzes the key data points, providing insights into the process and its impact. Keywords relevant to this section include: debt sale data, financial restructuring, distressed debt, asset sale, creditor negotiations, liquidity, and financial performance.

-

Detailed breakdown of debt types sold: The debt sale included a mix of senior secured debt and subordinated debt, reflecting the complex capital structure X had previously maintained. The proportion of each type of debt sold provides valuable insight into the company's approach to debt reduction. For example, prioritizing the sale of senior secured debt might signal a focus on reducing immediate liabilities and enhancing liquidity.

-

Analysis of the sale price compared to face value: The sale price achieved for the debt was significantly below its face value, a common characteristic of distressed debt sales. This discount reflects the inherent risks associated with investing in a company undergoing financial reorganization. Analyzing this discount relative to market conditions provides critical insight into the market's perception of X's recovery prospects.

-

Impact of the debt sale on X's liquidity position: The successful debt sale significantly improved X's liquidity position. By reducing its debt burden, the company freed up valuable resources to reinvest in operations, fund strategic initiatives, and meet its financial obligations. The increased liquidity is a cornerstone of X's subsequent company transformation efforts.

-

Evaluation of the buyer's profile and potential implications: The buyers involved in the debt sale represent a mix of hedge funds and private equity firms specialized in distressed debt investments. Their involvement signals confidence (or at least a calculated risk) in X's ability to restructure and recover. Their expertise in financial restructuring could also play a role in future strategic decisions.

-

Discussion of any associated legal or regulatory considerations: The debt sale process involved complex legal and regulatory considerations, including compliance with bankruptcy laws and creditor rights. Navigating this legal landscape successfully was a critical factor in the overall success of the reorganization.

Strategic Initiatives for Company Transformation

Beyond the debt sale, X implemented a series of strategic initiatives to facilitate its company transformation. These initiatives focused on operational restructuring, cost optimization, and the development of new revenue streams. Keywords relevant here include: company transformation, operational restructuring, cost-cutting measures, efficiency improvements, strategic partnerships, innovation, and business model changes.

-

Implementation of cost-cutting measures and efficiency improvements: X implemented a comprehensive cost-reduction program, targeting non-essential expenses and streamlining operational processes. This included reducing administrative overhead, renegotiating contracts with suppliers, and optimizing its supply chain.

-

Restructuring of operational processes to enhance productivity: Operational restructuring focused on improving efficiency and productivity across all departments. This involved the adoption of new technologies, automation of repetitive tasks, and improved employee training programs.

-

Development of new strategic partnerships to expand market reach: X actively sought strategic partnerships to expand its market reach and access new revenue streams. These partnerships leverage complementary resources and expertise, facilitating innovation and growth.

-

Implementation of innovative strategies to drive revenue growth: X has focused on innovation to drive revenue growth, including the development of new products and services tailored to evolving market demands.

-

Exploration of any changes to the business model: X assessed its existing business model and identified opportunities for improvement. This may have included a shift towards a more sustainable or digitally-focused model.

Impact on Key Performance Indicators (KPIs)

The debt sale and subsequent company transformation have significantly impacted X's key performance indicators (KPIs). Monitoring these KPIs is essential for assessing the effectiveness of the reorganization strategy. Keywords include: KPIs, financial performance, profitability, revenue growth, debt-to-equity ratio, cash flow, and market share.

-

Analysis of changes in profitability and revenue growth: Early indicators suggest improved profitability and revenue growth, reflecting the success of cost-cutting measures and revenue-generating initiatives.

-

Evaluation of improvements in the debt-to-equity ratio: The debt sale has significantly improved X's debt-to-equity ratio, reducing financial risk and enhancing the company's creditworthiness.

-

Assessment of changes in cash flow and liquidity: X's cash flow and liquidity have improved dramatically, providing the financial flexibility to invest in future growth opportunities.

-

Monitoring of market share and competitive position: X is actively monitoring its market share and competitive position to ensure the sustainability of its recovery and growth.

Long-Term Outlook and Sustainability

The success of X's financial reorganization depends on its ability to maintain long-term financial stability and sustainable growth. This section explores X's long-term prospects and its commitment to robust risk management and good corporate governance. Relevant keywords include: long-term sustainability, future growth, financial stability, risk management, strategic planning, and corporate governance.

-

Assessment of the effectiveness of the implemented restructuring strategies: Ongoing monitoring of the effectiveness of restructuring strategies is crucial for ensuring sustainable growth.

-

Discussion of ongoing risk management strategies: X has implemented comprehensive risk management strategies to mitigate future financial challenges.

-

Analysis of future growth potential and opportunities: X is exploring new growth opportunities and capitalizing on its improved financial position.

-

Evaluation of improvements in corporate governance and transparency: Enhanced corporate governance and transparency contribute to building trust with investors and stakeholders.

Conclusion

X's financial reorganization, encompassing a complex debt sale and a comprehensive company transformation, marks a significant turning point for the company. By strategically analyzing debt sale data and implementing targeted initiatives, X has made considerable strides towards financial recovery and long-term stability. The continued success of this transformation hinges upon the ongoing execution of these strategies and the adaptability to ever-changing market conditions. This case study of X provides a valuable example of effective debt reduction and company transformation.

Call to Action: Stay informed about the ongoing progress of X's financial reorganization and its continuous company transformation by following our future updates and analyses. Understanding X's successful navigation of financial challenges offers critical insights into effective debt management and company restructuring strategies.

Featured Posts

-

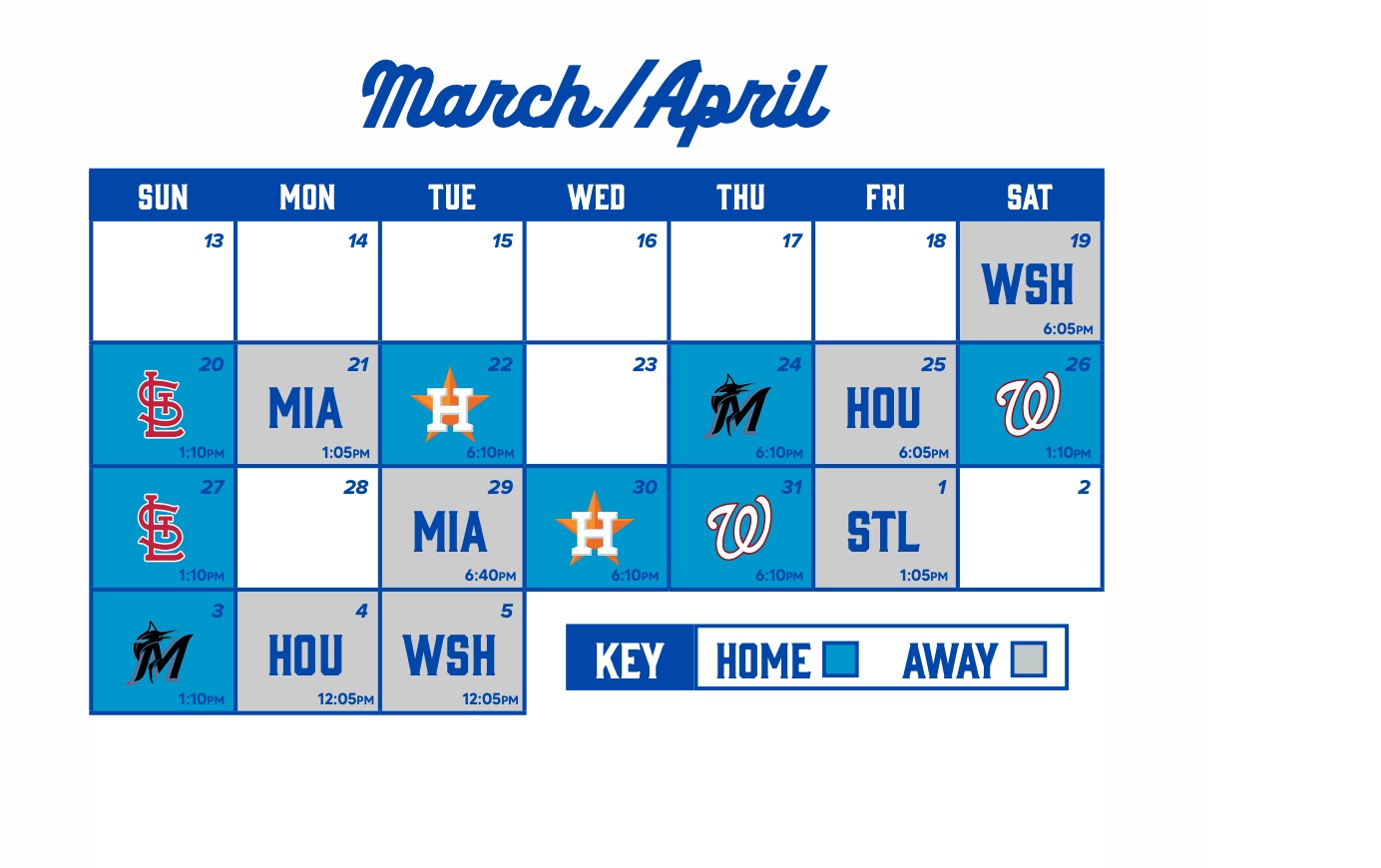

Mets Spring Training Pitchers Name S Road To The Rotation

Apr 28, 2025

Mets Spring Training Pitchers Name S Road To The Rotation

Apr 28, 2025 -

Talladega Superspeedway 2025 Nascar Jack Link 500 Prop Bets And Winning Strategies

Apr 28, 2025

Talladega Superspeedway 2025 Nascar Jack Link 500 Prop Bets And Winning Strategies

Apr 28, 2025 -

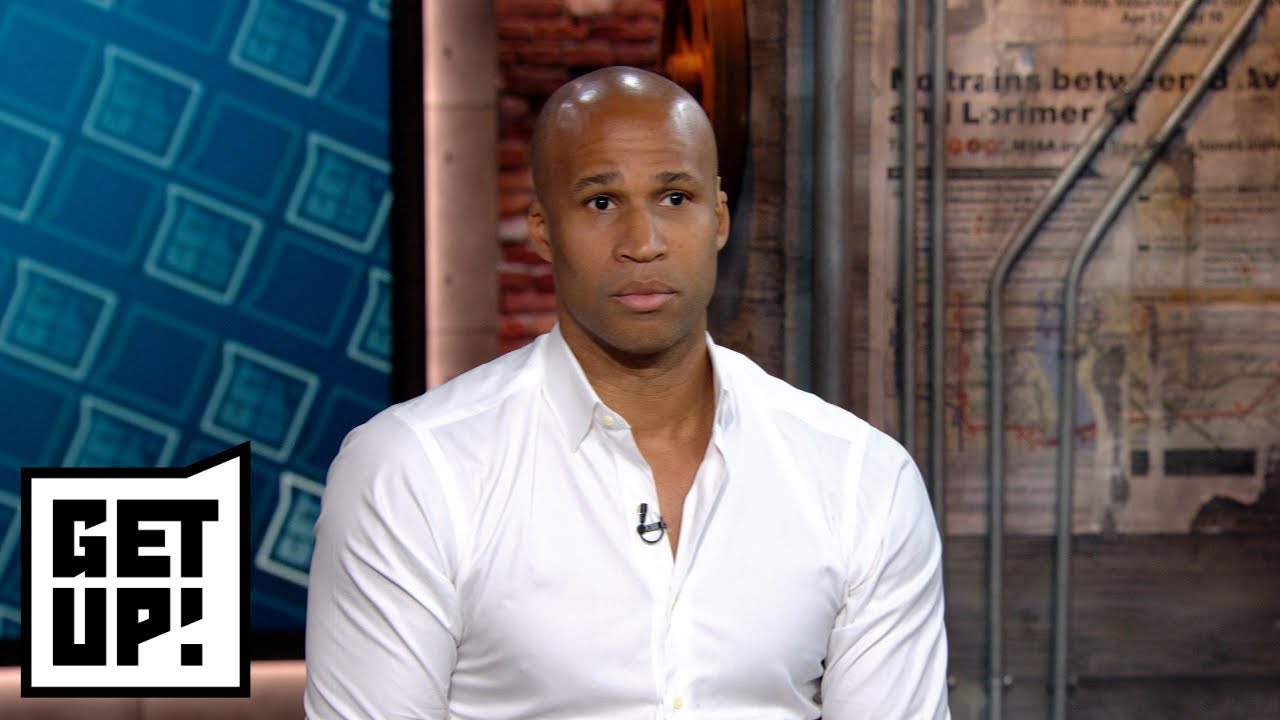

Nba Analyst Jj Redick Applauds Espns Richard Jefferson Decision

Apr 28, 2025

Nba Analyst Jj Redick Applauds Espns Richard Jefferson Decision

Apr 28, 2025 -

Le Bron James Reaction To Richard Jeffersons Espn News Segment

Apr 28, 2025

Le Bron James Reaction To Richard Jeffersons Espn News Segment

Apr 28, 2025 -

Richard Jeffersons New Espn Role Will He Be At The Nba Finals

Apr 28, 2025

Richard Jeffersons New Espn Role Will He Be At The Nba Finals

Apr 28, 2025