Your Guide To Finance Loans: Everything You Need To Know About Interest, EMIs, And Repayment

Table of Contents

Understanding Interest Rates in Finance Loans

Interest is the cost of borrowing money. It's the extra amount you pay back to the lender on top of the principal loan amount. Understanding how interest impacts the total cost of your finance loan is paramount. The total amount you repay significantly increases with higher interest rates, making it crucial to shop around for the best possible terms.

Different types of interest rates exist, each with its own implications:

-

Fixed Interest Rates: These offer predictability. Your monthly payments remain consistent throughout the loan term, making budgeting easier. However, you might miss out on lower rates if market interest rates fall.

-

Variable Interest Rates: These fluctuate with market conditions. You might enjoy lower initial payments, but your monthly repayments could increase significantly if interest rates rise. This can make budgeting more challenging.

Several factors influence the interest rate you'll receive on your finance loan:

-

Credit Score: A higher credit score generally qualifies you for lower interest rates, reflecting your creditworthiness. Improving your credit score before applying for a loan can save you money in the long run.

-

Loan Amount: Larger loan amounts often attract higher interest rates. Lenders perceive greater risk with larger sums.

-

Loan Term: Longer loan terms typically result in lower monthly payments, but you'll end up paying significantly more interest over the life of the loan. Shorter terms mean higher monthly payments but less interest paid overall.

Understanding the Annual Percentage Rate (APR) is vital when comparing loan offers. The APR represents the total annual cost of the loan, including interest and other fees. Always compare APRs from different lenders before making a decision.

Decoding EMIs (Equated Monthly Installments)

Your EMI is the fixed amount you pay each month towards your finance loan. It covers both the principal amount (the original loan amount) and the interest. The EMI calculation considers three key factors:

-

Loan Amount (P): The principal amount borrowed.

-

Interest Rate (r): The annual interest rate (expressed as a decimal).

-

Loan Tenure (n): The loan term in months.

While the precise formula is complex, the general principle is that a higher loan amount, a higher interest rate, or a longer loan tenure will all lead to a higher EMI.

Examples:

-

A larger loan amount (e.g., $50,000 vs. $25,000) will have a higher EMI.

-

A higher interest rate (e.g., 10% vs. 5%) will significantly increase the EMI.

-

A longer loan tenure (e.g., 60 months vs. 36 months) will result in a lower EMI but higher overall interest paid. Using an online EMI calculator can help you easily determine your monthly payment.

Mastering Finance Loan Repayment Strategies

Choosing the right repayment strategy is critical for managing your finance loan effectively and minimizing interest costs.

-

Standard Amortization: This involves consistent monthly payments over the loan term. Each payment includes a portion of the principal and interest.

-

Accelerated Repayment: This involves making extra payments beyond your regular EMI. This strategy reduces the loan term and the total interest paid, saving you money in the long run.

Timely Repayments are Crucial:

-

Making timely repayments maintains a good credit score, essential for future borrowing needs.

-

Defaulting on your loan can severely damage your credit score, making it harder to secure credit in the future and leading to penalties and late fees.

Prepayment Options: Many lenders allow you to prepay your loan, but some may charge prepayment penalties. Carefully review your loan agreement to understand any associated costs.

Creating a realistic repayment budget is essential to avoid missed payments and financial stress. Track your income and expenses, allocate funds for your EMI, and build an emergency fund to handle unforeseen circumstances.

Choosing the Right Finance Loan

Various finance loans cater to different needs:

-

Personal Loans: Versatile loans for various purposes, such as debt consolidation or home improvements.

-

Auto Loans: Specifically designed for purchasing vehicles.

-

Home Loans (Mortgages): Used to finance the purchase of a property.

Comparing Loan Offers: Always compare offers from multiple lenders to secure the best interest rate and terms.

Understanding the Loan Agreement: Thoroughly read and understand the loan agreement before signing to avoid hidden fees or unfavorable terms.

Assessing Financial Capabilities: Before applying for a loan, honestly assess your financial capacity to repay the loan without compromising your financial stability.

Conclusion

Successfully navigating the world of finance loans requires a comprehensive understanding of interest rates, EMIs, and repayment strategies. This guide has provided you with the essential knowledge to make informed decisions when securing a finance loan. Remember to compare offers, understand the terms and conditions, and choose a repayment plan that suits your financial capabilities. By carefully considering these factors, you can confidently manage your finance loans and achieve your financial goals. Start planning your next financial move today by exploring different finance loan options and securing the best deal for your needs. Don't hesitate to seek professional financial advice if needed to further understand finance loans and their implications.

Featured Posts

-

San Diego Padres Embark On A Long Road Trip Starting In Pittsburgh

May 28, 2025

San Diego Padres Embark On A Long Road Trip Starting In Pittsburgh

May 28, 2025 -

American Music Awards 2025 Jennifer Lopez Confirmed As Host

May 28, 2025

American Music Awards 2025 Jennifer Lopez Confirmed As Host

May 28, 2025 -

Mfajat Almwsm Ayndhwfn Ytwj Baldwry Alhwlndy

May 28, 2025

Mfajat Almwsm Ayndhwfn Ytwj Baldwry Alhwlndy

May 28, 2025 -

Report Bianca Censori Wants Divorce Amidst Kanye Wests Control

May 28, 2025

Report Bianca Censori Wants Divorce Amidst Kanye Wests Control

May 28, 2025 -

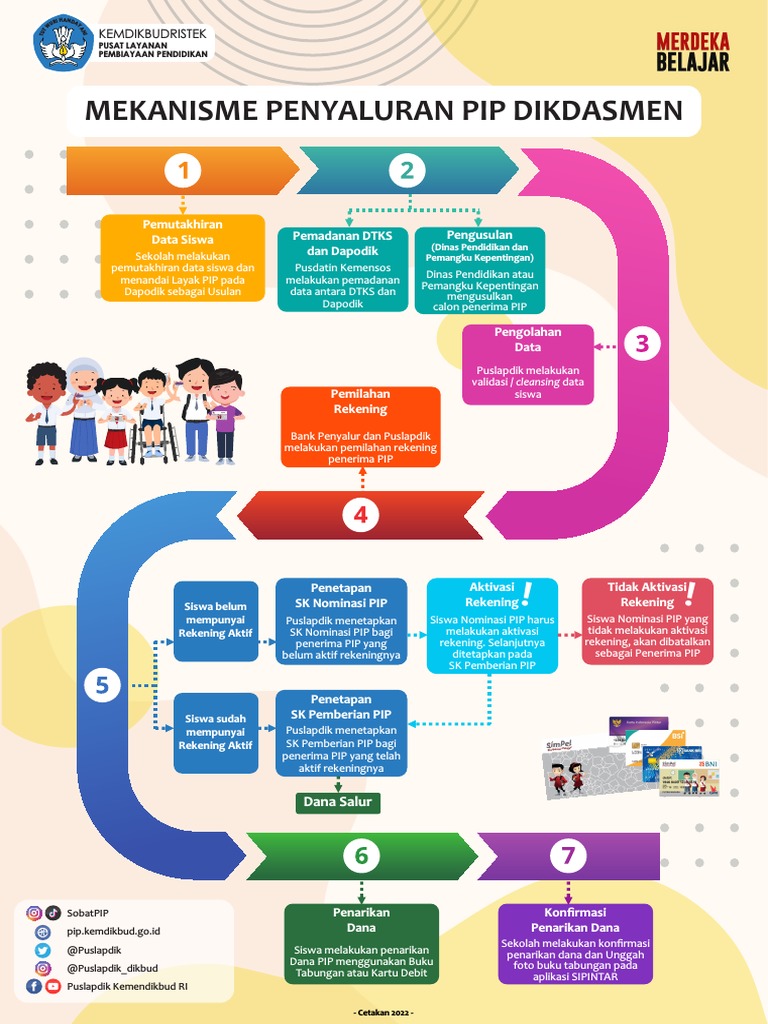

Mekanisme Penyaluran Bkk Gubernur Koster Fokus 6 Kabupaten Prioritaskan Program Strategis

May 28, 2025

Mekanisme Penyaluran Bkk Gubernur Koster Fokus 6 Kabupaten Prioritaskan Program Strategis

May 28, 2025

Latest Posts

-

De La Pista Al Campo La Sorprendente Nueva Carrera De Andre Agassi

May 30, 2025

De La Pista Al Campo La Sorprendente Nueva Carrera De Andre Agassi

May 30, 2025 -

Un Tenista Argentino Arremete Contra Rios Un Dios Del Tenis

May 30, 2025

Un Tenista Argentino Arremete Contra Rios Un Dios Del Tenis

May 30, 2025 -

El Regreso De Andre Agassi Mas Alla Del Tenis

May 30, 2025

El Regreso De Andre Agassi Mas Alla Del Tenis

May 30, 2025 -

Erfolg Im Pickleball Die Methoden Von Steffi Graf Und Andre Agassi

May 30, 2025

Erfolg Im Pickleball Die Methoden Von Steffi Graf Und Andre Agassi

May 30, 2025 -

El Chino Rios Revelaciones De Un Tenista Argentino Sobre Una Leyenda

May 30, 2025

El Chino Rios Revelaciones De Un Tenista Argentino Sobre Una Leyenda

May 30, 2025