1,050% Price Hike: AT&T's Concerns Over Broadcom's VMware Acquisition

Table of Contents

AT&T's Specific Concerns and the 1050% Price Increase Claim

AT&T's public statement regarding the Broadcom-VMware merger isn't just a mild concern; it's a fire alarm. The telecommunications giant claims it received a quote reflecting a 1,050% increase in the price of specific VMware services following the proposed acquisition. This isn't a small, negligible change; it's a potentially crippling blow to businesses already grappling with rising operational costs.

- Specific VMware Services Affected: While the exact services haven't been publicly disclosed in full detail by AT&T, it's understood to involve crucial elements of VMware's enterprise software portfolio, likely impacting their core virtualization and cloud infrastructure offerings. More information is expected as the regulatory process unfolds.

- Quantifying the Price Increase: A 1,050% increase translates to an eleven-fold jump in cost. If a service previously cost $10,000 annually, the new price could be $110,000. This dramatic increase represents a significant financial burden for businesses of all sizes.

- AT&T's Statements: While precise quotes haven't been fully released publicly, AT&T's statements highlight their deep concerns about the potential for Broadcom to leverage its market dominance post-merger to drastically inflate prices for essential technology services. This is a critical point in the antitrust debate.

- Supporting Documentation: AT&T likely possesses internal documentation supporting its claims, though the specifics remain confidential for now. The details will probably emerge during regulatory investigations.

Antitrust Concerns and Regulatory Scrutiny

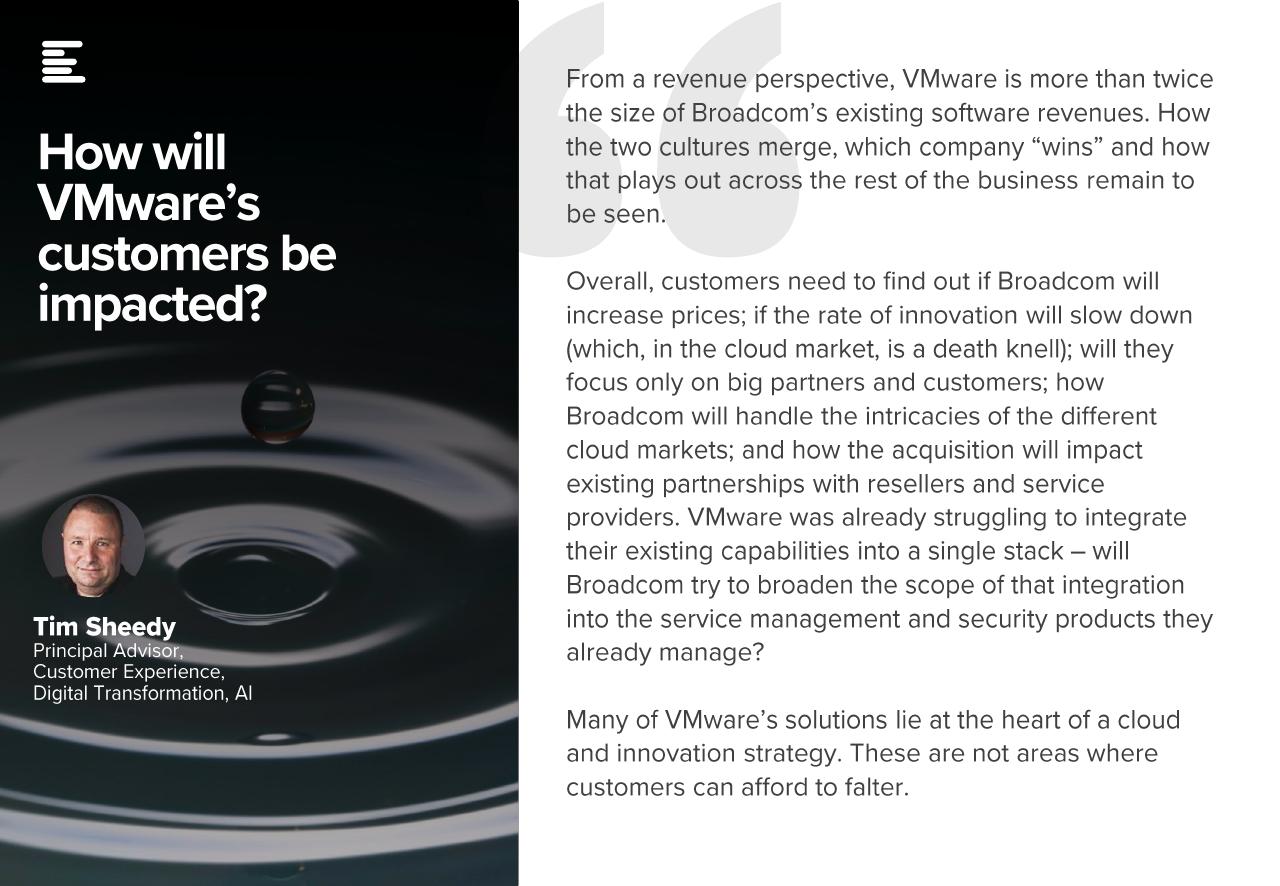

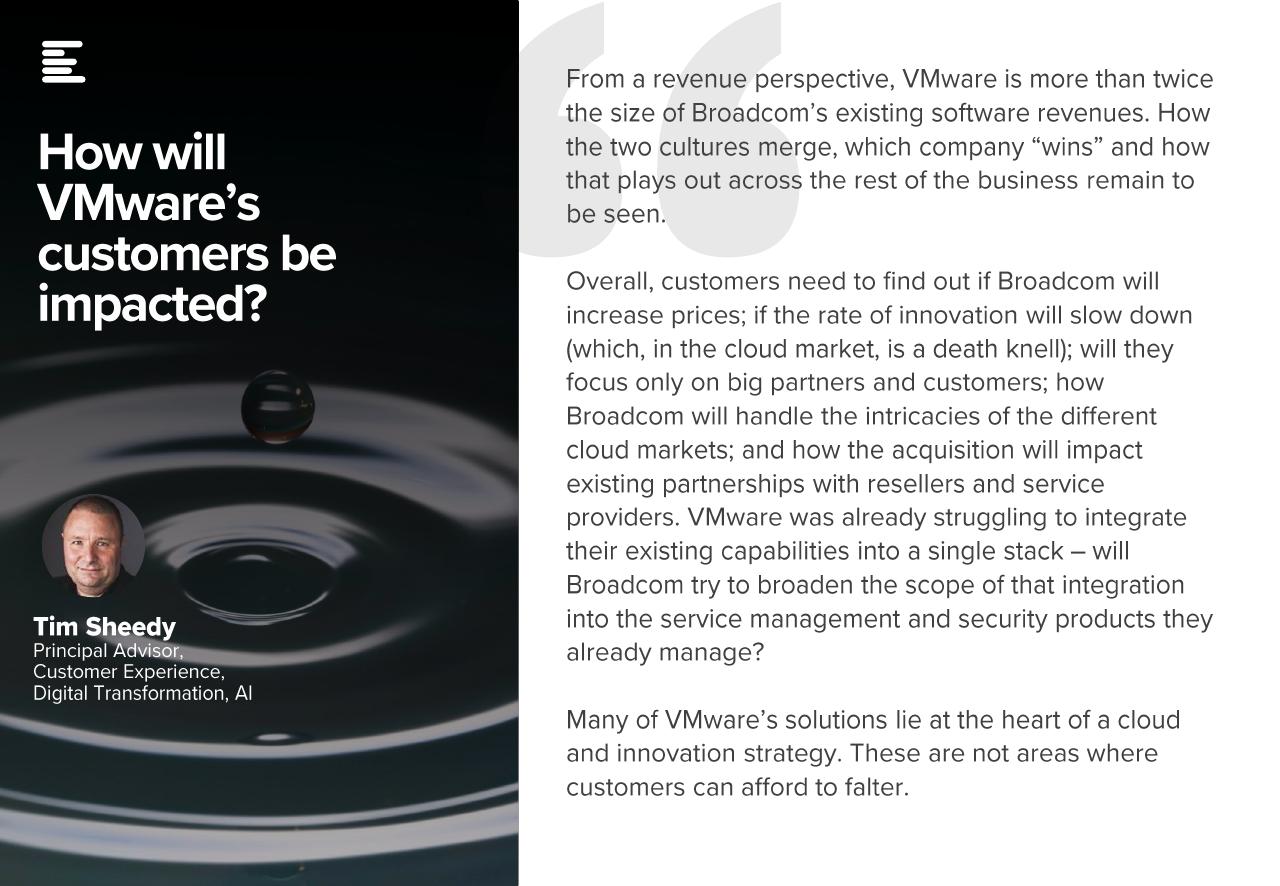

The potential for Broadcom to establish a monopoly in key technology sectors after acquiring VMware is a major concern fueling the antitrust investigation. This merger could significantly stifle competition, leading to higher prices, reduced innovation, and limited choices for consumers and businesses.

- Regulatory Bodies Involved: The Federal Trade Commission (FTC) in the US and equivalent regulatory bodies in the European Union and other jurisdictions are currently scrutinizing the Broadcom-VMware deal, meticulously examining its potential impact on competition.

- Arguments Against the Merger: Critics argue that Broadcom's acquisition of VMware would create an entity with excessive market power, enabling them to dictate prices and limit choices for their customers. The elimination of a significant competitor like VMware is the core issue.

- Broadcom's Market Power: Broadcom is already a major player in the semiconductor and networking industries. Acquiring VMware would add significant cloud infrastructure and virtualization capabilities, granting them unparalleled control over a vast portion of the market.

- Consequences of Unconditional Approval: If the merger proceeds without significant conditions or remedies, it could lead to higher prices for businesses, reduced innovation, and a less competitive technology landscape. This could stifle smaller companies unable to absorb these price increases.

Impact on Consumers and Businesses

The Broadcom VMware acquisition's impact extends beyond large corporations like AT&T. The ripple effect will undoubtedly be felt by businesses and consumers alike.

- Price Increases for VMware Products: Businesses relying on VMware's products and services can expect significant price hikes if Broadcom's acquisition is approved without stringent conditions. This will translate to higher IT costs for many organizations.

- Impact on Innovation: A less competitive market could stifle innovation. Without the pressure of competition, Broadcom might have less incentive to improve its products and services.

- Smaller Businesses at Risk: Smaller businesses with less negotiating power will be particularly vulnerable to these price increases, potentially forcing them to adopt less efficient or more costly alternatives.

- Alternatives for Businesses: Affected businesses might seek alternative virtualization and cloud solutions, potentially leading to a shift in the market landscape and increased complexity.

Broadcom's Response and Defense

Broadcom has responded to the concerns raised, primarily by arguing that the acquisition will lead to increased innovation and efficiencies.

- Broadcom's Official Statements: Broadcom's public statements emphasize the benefits of the merger, including the integration of their technologies to create a more comprehensive and innovative offering. They downplay the antitrust concerns.

- Arguments Against Antitrust Concerns: Broadcom will likely argue that there are still other significant players in the market, thereby preventing the formation of a monopoly. They might also highlight potential benefits for consumers and businesses.

- Proposed Solutions or Commitments: Broadcom might offer concessions, such as divesting certain assets or making commitments to maintain pricing stability, to address regulatory concerns.

The Future of the VMware Acquisition and Potential Outcomes

The future of the Broadcom-VMware acquisition remains uncertain. The regulatory scrutiny it faces could significantly impact its outcome.

- Possible Outcomes: The acquisition could be approved unconditionally, rejected outright, or approved subject to significant conditions aimed at mitigating antitrust concerns.

- Potential Timelines: The regulatory review process could take several months, even years, depending on the complexity of the issues involved.

- Ongoing Legal Battles: We might see legal challenges from competing companies or consumer advocacy groups, further complicating the process.

Conclusion:

AT&T's alarming claim of a 1,050% price increase highlights the serious antitrust concerns surrounding Broadcom's proposed acquisition of VMware. This merger has the potential to significantly impact businesses and consumers through price hikes, reduced innovation, and less competition. The regulatory review process will be critical in determining the ultimate outcome. Stay tuned for updates on the Broadcom VMware acquisition and the progress of the antitrust investigation. Follow the progress of the antitrust investigation into the Broadcom VMware merger and understand the implications of the Broadcom VMware acquisition for your business. Learn more about the potential impact of the Broadcom VMware deal on your business.

Featured Posts

-

Zombie Buildings In Chicago Understanding The Office Real Estate Collapse

Apr 29, 2025

Zombie Buildings In Chicago Understanding The Office Real Estate Collapse

Apr 29, 2025 -

High Profile Office365 Hack Millions Stolen Investigation Underway

Apr 29, 2025

High Profile Office365 Hack Millions Stolen Investigation Underway

Apr 29, 2025 -

Is Kevin Bacon Returning For Tremor 2 On Netflix Exploring The Rumors

Apr 29, 2025

Is Kevin Bacon Returning For Tremor 2 On Netflix Exploring The Rumors

Apr 29, 2025 -

New Documentary Showcases Willie Nelsons Respect For His Roadie

Apr 29, 2025

New Documentary Showcases Willie Nelsons Respect For His Roadie

Apr 29, 2025 -

Reliances Stellar Earnings A Catalyst For Indian Large Cap Growth

Apr 29, 2025

Reliances Stellar Earnings A Catalyst For Indian Large Cap Growth

Apr 29, 2025

Latest Posts

-

Eligibility Of Convicted Cardinal To Participate In Papal Conclave

Apr 29, 2025

Eligibility Of Convicted Cardinal To Participate In Papal Conclave

Apr 29, 2025 -

Debate Erupts Over Convicted Cardinals Vote In Next Papal Conclave

Apr 29, 2025

Debate Erupts Over Convicted Cardinals Vote In Next Papal Conclave

Apr 29, 2025 -

Convicted Cardinal Challenges Eligibility For Papal Election

Apr 29, 2025

Convicted Cardinal Challenges Eligibility For Papal Election

Apr 29, 2025 -

Papal Conclave Convicted Cardinals Unexpected Demand

Apr 29, 2025

Papal Conclave Convicted Cardinals Unexpected Demand

Apr 29, 2025 -

Cardinals Conclave Voting Rights A Legal Battle

Apr 29, 2025

Cardinals Conclave Voting Rights A Legal Battle

Apr 29, 2025