Reliance's Stellar Earnings: A Catalyst For Indian Large-Cap Growth?

Table of Contents

Reliance Industries' Q[Quarter] Earnings: A Deep Dive

H3: Record Revenue and Profitability:

Reliance Industries' Q[Quarter] earnings showcased impressive growth across its key sectors. [Insert Quarter and Year]. The company reported record revenue figures of [Insert Revenue Figure], representing a YoY growth of [Insert YoY Growth Percentage]. Profitability also soared, with net profits reaching [Insert Net Profit Figure], reflecting a [Insert Percentage] increase compared to the same period last year. This exceptional performance was driven primarily by robust growth in its Jio telecom, retail, and energy segments.

- Specific revenue figures: [Insert detailed breakdown of revenue by segment - Jio, Retail, Energy etc.]

- Profit margins: [Insert data on profit margins and their improvement]

- YoY growth percentages: [Insert detailed YoY growth percentages for key metrics]

- Key drivers of growth: Jio's expanding subscriber base, strong performance of Reliance Retail despite inflationary pressures, and progress in the renewable energy sector fueled this impressive growth.

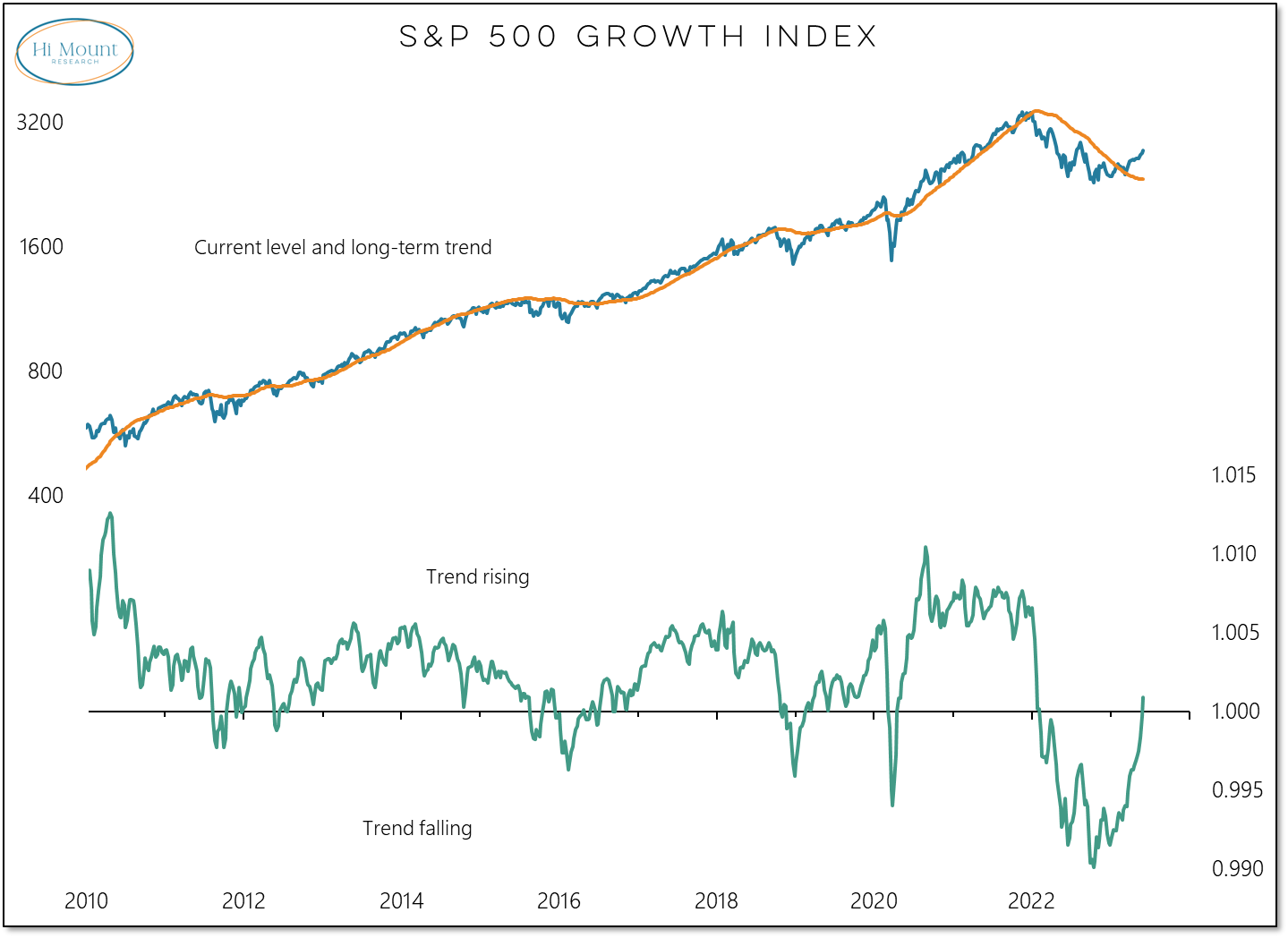

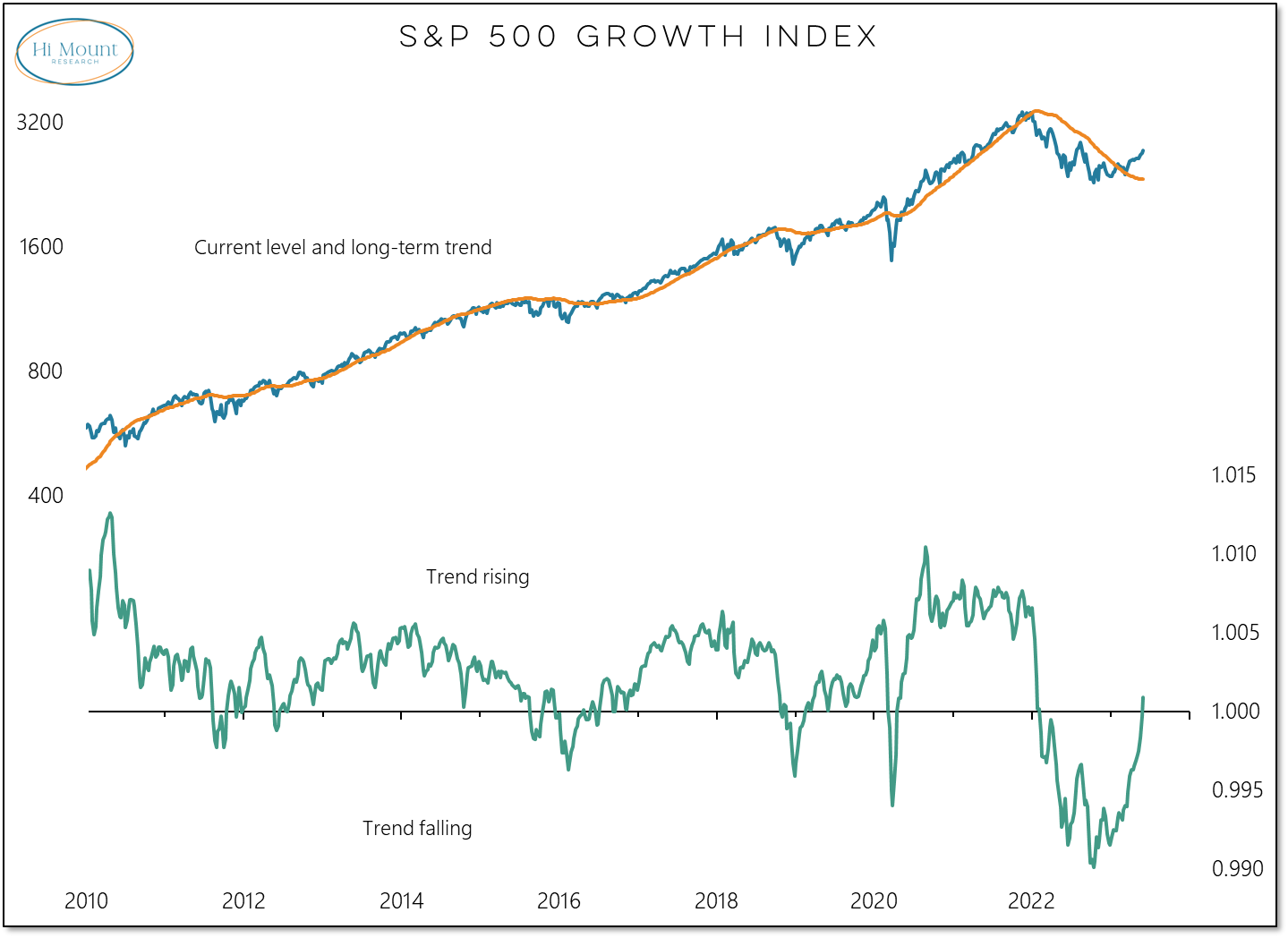

[Insert a visually appealing chart or graph illustrating revenue and profit growth over the past few quarters.]

H3: Sector-Specific Performance Analysis:

Reliance's success wasn't monolithic; each sector contributed significantly.

- Jio (Telecom): Jio continued its impressive growth trajectory, adding [Insert Number] subscribers in Q[Quarter], further consolidating its position as a market leader. This was driven by its aggressive 5G rollout and attractive data plans.

- Reliance Retail: Despite inflationary pressures, Reliance Retail demonstrated strong revenue growth, benefiting from its vast network of stores and a diverse product portfolio. Its focus on omnichannel strategies also proved to be highly effective.

- Energy: Reliance's investments in renewable energy sources are beginning to bear fruit, with significant progress in [mention specific projects]. This reflects a strategic shift towards a more sustainable future and aligns with global trends.

Reliance's competitive positioning within each sector remains strong, showcasing its ability to adapt and innovate.

H3: Impact on Investor Sentiment and Stock Price:

The market reacted positively to the earnings announcement. Reliance stock price experienced a [Insert Percentage] increase following the release, indicating strong investor confidence. Analyst ratings have been largely positive, with many upgrading their forecasts for future performance. This positive sentiment reflects a bullish outlook on Reliance's future prospects and its ability to navigate the challenges facing the Indian economy.

- Stock price movement post-earnings: [Detailed analysis of stock price fluctuations post-earnings announcement.]

- Investor confidence levels: [Reference any available data or surveys regarding investor sentiment.]

- Analyst ratings and forecasts: [Summarize key analyst predictions and ratings.]

- Implications for investors: The strong earnings signal potential for substantial returns for existing and prospective investors interested in Reliance stock and the Indian stock market.

The Ripple Effect: Implications for the Broader Indian Market

H3: Large-Cap Growth Potential:

Reliance's strong performance could act as a catalyst for broader Indian large-cap growth. The positive sentiment surrounding Reliance may spill over into other large-cap companies, leading to increased investor confidence in the Indian market as a whole. This could attract more foreign investment, further fueling market expansion.

- Positive sentiment spillover effect: Increased confidence in India's economic resilience.

- Increased investor confidence in the Indian market: Attracting both domestic and foreign investments.

- Potential for increased foreign investment: Boosting overall market capitalization.

- Interconnectedness: Reliance's partnerships and supply chains extend to numerous other large-cap companies, creating a ripple effect across sectors.

H3: Macroeconomic Factors at Play:

While Reliance's performance is impressive, the broader macroeconomic context is crucial. India's overall economic growth rate, inflation levels, government policies, and global economic conditions all play a role. A strong macroeconomic environment will amplify the positive impact of Reliance's success.

- Overall economic growth in India: [Reference official growth figures and forecasts.]

- Inflation rates: [Discuss the impact of inflation on consumer spending and business activity.]

- Government policies: [Analyze the role of government initiatives in influencing market dynamics.]

- Global economic conditions: [Consider the impact of global factors such as geopolitical instability or recessionary fears.]

H3: Risks and Uncertainties:

Despite the positive outlook, risks remain. Geopolitical uncertainties, regulatory changes, intensifying competition, and potential economic slowdowns could impact Reliance's future performance and its influence on the Indian large-cap market. A balanced perspective acknowledges both potential upsides and downsides.

- Geopolitical risks: [Discuss potential geopolitical risks and their impact on the Indian economy.]

- Regulatory changes: [Highlight potential regulatory changes that could affect Reliance or the broader market.]

- Competition: [Analyze competitive pressures within Reliance's various sectors.]

- Potential economic slowdowns: [Discuss the impact of potential economic downturns on Reliance's performance.]

Conclusion:

Reliance Industries' stellar Q[Quarter] earnings demonstrate remarkable financial strength and strategic execution. While these results are undeniably positive and have boosted investor sentiment, their impact on the broader Indian large-cap growth remains contingent on several factors, including the overall macroeconomic environment and ongoing geopolitical uncertainties. The interconnectedness of Reliance with other large-cap companies means its performance does have a ripple effect, but a holistic view incorporating macroeconomic indicators is crucial for accurate assessment. To fully understand the implications, continued monitoring of Reliance Industries earnings and related macroeconomic indicators is essential.

Call to Action: Stay informed on the latest developments in Reliance Industries earnings and their impact on Indian large-cap growth. Learn more about investing in Indian large-cap stocks by researching the latest Reliance Industries' performance data and macroeconomic forecasts.

Featured Posts

-

European Central Bank Highlights Fiscal Supports Role In Inflation

Apr 29, 2025

European Central Bank Highlights Fiscal Supports Role In Inflation

Apr 29, 2025 -

Is The Venture Capital Secondary Market Overheated A Current Analysis

Apr 29, 2025

Is The Venture Capital Secondary Market Overheated A Current Analysis

Apr 29, 2025 -

The Troubling Trend Of Betting On The Los Angeles Wildfires

Apr 29, 2025

The Troubling Trend Of Betting On The Los Angeles Wildfires

Apr 29, 2025 -

Adidas Anthony Edwards 2 A First Look At The New Signature Shoe

Apr 29, 2025

Adidas Anthony Edwards 2 A First Look At The New Signature Shoe

Apr 29, 2025 -

Post Roe America How Otc Birth Control Reshapes Reproductive Healthcare

Apr 29, 2025

Post Roe America How Otc Birth Control Reshapes Reproductive Healthcare

Apr 29, 2025

Latest Posts

-

D C Blackhawk Passenger Jet Crash A New Report Reveals Horrific Details

Apr 29, 2025

D C Blackhawk Passenger Jet Crash A New Report Reveals Horrific Details

Apr 29, 2025 -

D C Helicopter Crash Pilots Disregard For Instructor Led To Tragedy

Apr 29, 2025

D C Helicopter Crash Pilots Disregard For Instructor Led To Tragedy

Apr 29, 2025 -

Black Hawk Pilots Actions Before Fatal D C Crash A Detailed Analysis

Apr 29, 2025

Black Hawk Pilots Actions Before Fatal D C Crash A Detailed Analysis

Apr 29, 2025 -

Pilot Negligence Uncovered Details In Reagan Airport Helicopter Incident

Apr 29, 2025

Pilot Negligence Uncovered Details In Reagan Airport Helicopter Incident

Apr 29, 2025 -

Liverpools Unexpected Title Contention Under Arne Slot

Apr 29, 2025

Liverpools Unexpected Title Contention Under Arne Slot

Apr 29, 2025