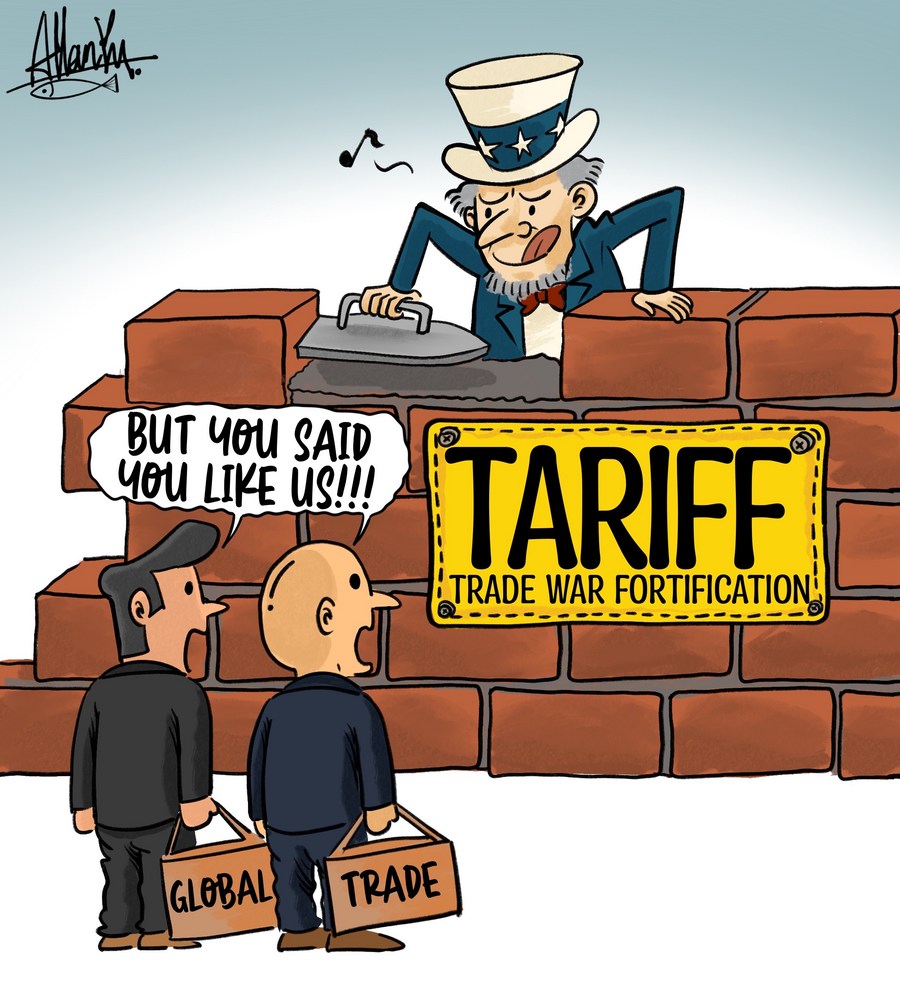

2% Fall On Amsterdam Stock Exchange: Impact Of Trump's Tariffs

Table of Contents

Direct Exposure of Dutch Companies to US Tariffs

Several Dutch sectors faced direct exposure to the impact of Trump's tariffs, experiencing a tangible blow to their bottom lines. The agricultural sector, a cornerstone of the Dutch economy, was particularly vulnerable, with exports of dairy products and agricultural machinery facing increased tariffs in the US market. Manufacturing was also significantly affected, as Dutch companies exporting goods like machinery, chemicals, and electronics to the US saw their competitiveness eroded.

- Specific Examples: While precise figures are difficult to obtain immediately following market fluctuations, anecdotal evidence suggests significant drops in stock prices for companies heavily reliant on US exports. For example, [Insert example of a Dutch company and its percentage stock drop, if available. If not, replace with a general statement, e.g., "Several agricultural exporters reported reduced orders and lowered profit margins."]

- Goods Affected: Tariffs targeted a wide range of goods, including:

- Dairy products (cheese, milk powder)

- Agricultural machinery

- Chemicals

- Machinery and equipment

- Electronics components

- Retaliatory Measures: The EU, in response to Trump's tariffs, implemented its own retaliatory measures, further complicating trade relations and potentially exacerbating the negative impact on Dutch businesses. These measures, while intended to protect European interests, could have contributed to the overall uncertainty and market decline. Keywords: Dutch economy, export-oriented businesses, tariff impact on specific sectors, EU trade relations.

Indirect Impact on the Amsterdam Stock Exchange through Global Market Sentiment

Beyond the direct impact on specific Dutch companies, Trump's tariffs created a climate of global uncertainty that significantly affected investor sentiment. The threat of a protracted trade war fueled risk aversion, leading investors to divest from riskier assets, including stocks listed on the AEX. This indirect effect amplified the initial shockwaves caused by direct tariff impacts.

- Global Market Volatility: The AEX's performance showed a clear correlation with other major global indices like the Dow Jones and FTSE. As these indices declined amidst trade war anxieties, the AEX followed suit, reflecting the interconnected nature of global markets.

- Investor Psychology: Investor behavior was heavily influenced by:

- Fear of further escalation of the trade war

- Uncertainty about future trade policies

- Concerns about reduced global economic growth

- A general shift toward safer investments (e.g., bonds) Keywords: global market volatility, investor sentiment, international trade, market correlation, risk aversion.

Long-Term Implications for Dutch Businesses and the AEX

The long-term consequences of Trump's tariffs on the Dutch economy and the AEX remain uncertain, but several potential scenarios are worth considering. Affected sectors might experience economic restructuring, forcing companies to adapt to a new global trade landscape. This could involve shifting investment strategies toward less tariff-sensitive markets, increasing diversification, and focusing on innovation to maintain competitiveness.

- Potential Scenarios:

- Continued economic contraction in affected sectors.

- Accelerated investment in alternative markets and technologies.

- Increased focus on domestic consumption to mitigate export dependence.

- Potential for long-term economic resilience through adaptation and innovation. Keywords: long-term economic outlook, sustainable business strategies, economic resilience, investment diversification, future of the AEX.

Alternative Explanations for the AEX Decline (Beyond Trump's Tariffs)

It's crucial to acknowledge that the 2% drop in the AEX might not be solely attributable to Trump's tariffs. Other macroeconomic factors and internal market dynamics could have played a role. For instance, broader concerns about global economic slowdown, changes in interest rates, or internal political developments within the Netherlands could have independently contributed to the market decline.

- Other Potential Factors:

- Global economic slowdown

- Changes in interest rates

- Internal political instability

- Specific company-related news unrelated to tariffs Keywords: macroeconomic factors, internal market dynamics, economic analysis, holistic perspective.

Conclusion: Navigating the Impact of Trump's Tariffs on the Amsterdam Stock Exchange

The 2% fall on the Amsterdam Stock Exchange highlights the significant impact of Trump's tariffs, both directly on exposed Dutch sectors and indirectly through global market sentiment. Understanding the interconnectedness of global markets is crucial for navigating the complexities of international trade policies. While other factors undoubtedly contributed to the AEX decline, the influence of Trump's tariffs cannot be ignored. Staying informed about developments concerning Trump's tariffs and their potential ongoing effects on the Amsterdam Stock Exchange and the Dutch economy is paramount for investors and businesses alike. Keywords: AEX market analysis, Trump tariffs impact, Dutch economic forecast, global trade implications. Stay informed and proactively manage your investments in light of these evolving global trade dynamics.

Featured Posts

-

Dazi Stati Uniti Prezzi Moda E Tendenze 2024

May 24, 2025

Dazi Stati Uniti Prezzi Moda E Tendenze 2024

May 24, 2025 -

Royal Philips Announces 2025 Annual General Meeting Agenda

May 24, 2025

Royal Philips Announces 2025 Annual General Meeting Agenda

May 24, 2025 -

Massimo Vian Leaves Gucci Impact On The Luxury Brands Industrial Operations

May 24, 2025

Massimo Vian Leaves Gucci Impact On The Luxury Brands Industrial Operations

May 24, 2025 -

Decouvrez Les Personnes Derriere Le Brest Urban Trail

May 24, 2025

Decouvrez Les Personnes Derriere Le Brest Urban Trail

May 24, 2025 -

Dow Jones Index Cautious Optimism Following Strong Pmi Report

May 24, 2025

Dow Jones Index Cautious Optimism Following Strong Pmi Report

May 24, 2025

Latest Posts

-

Mia Farrow Calls For Trumps Imprisonment Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Imprisonment Over Venezuelan Deportations

May 24, 2025 -

17 Famous Faces Overnight Reputation Ruins

May 24, 2025

17 Famous Faces Overnight Reputation Ruins

May 24, 2025 -

The Downfall 17 Celebrities Whose Images Were Tarnished

May 24, 2025

The Downfall 17 Celebrities Whose Images Were Tarnished

May 24, 2025 -

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025 -

How 17 Celebrities Ruined Their Reputations

May 24, 2025

How 17 Celebrities Ruined Their Reputations

May 24, 2025