2025 Gold Market: Facing First Double-Digit Weekly Losses

Table of Contents

Keywords: 2025 gold market, gold price drop, gold market analysis, gold investment, double-digit losses, precious metals, gold trading, gold forecast, gold ETF, gold mining, inflation hedging.

The 2025 gold market witnessed a dramatic downturn, suffering its first double-digit weekly losses – a significant event with far-reaching implications for investors and the global economy. This unprecedented drop raises crucial questions about the future trajectory of gold prices and the factors influencing this precious metal's value. This article delves into the causes of this decline, analyzes its impact, and offers insights for navigating this volatile market.

Causes of the Double-Digit Decline in the Gold Market

Several interconnected factors contributed to the dramatic fall in gold prices in 2025. Understanding these causes is critical for investors seeking to interpret market trends and make informed decisions.

Strengthening US Dollar

The US dollar and gold prices typically exhibit an inverse relationship. When the dollar strengthens, gold becomes less attractive to international investors as it becomes more expensive to purchase in other currencies. In 2025, the US dollar experienced significant strengthening, driven by several factors. Aggressive interest rate hikes by the Federal Reserve, aimed at curbing inflation, increased the appeal of US dollar-denominated assets. Simultaneously, robust economic growth in the US further bolstered the dollar's value. This is reflected in data showing the USD appreciating against major currencies like the Euro and Yen by X% and Y% respectively (replace X and Y with hypothetical data).

- Increased demand for USD-denominated assets.

- Reduced appeal of gold as a safe haven relative to the dollar.

- Impact of rising interest rates on gold investment, making it less competitive.

Rising Interest Rates and Bond Yields

Higher interest rates make bonds a more attractive investment option compared to gold, which offers no yield. The rising interest rates in 2025, coupled with increasing bond yields, shifted investor sentiment away from gold and towards fixed-income securities. This is because higher yields offer a greater return on investment with less risk compared to the price volatility inherent in the gold market. The correlation between interest rates, bond yields, and gold prices is undeniable, as higher rates often lead to lower gold prices.

- Increased opportunity cost of holding gold, as returns on bonds increased.

- Shift in investment strategies towards fixed-income securities.

- Influence of central bank policies on interest rates and their subsequent effect on gold.

Geopolitical Factors and Market Uncertainty

While gold is often seen as a safe-haven asset during times of geopolitical uncertainty, the 2025 decline suggests that reduced uncertainty can also negatively impact gold prices. While specific events contributing to the decline would need further investigation (and would be filled in with real-world examples in a published article), the general trend suggests that reduced market fears and increased global stability potentially lessened the demand for gold as a protective investment.

- Reduced safe-haven demand due to decreased geopolitical tensions.

- Impact of specific global events on investor confidence in precious metals.

- Analysis of market sentiment shifts away from fear and towards confidence in other asset classes.

Impact and Implications of the Gold Price Drop

The double-digit loss in the gold market had significant repercussions for investors and the wider economy.

Impact on Gold Investors

The sharp price drop resulted in substantial losses for many gold investors. The impact varied depending on the type of investment. Holders of physical gold experienced direct price losses, while investors in gold ETFs (Exchange Traded Funds) saw their portfolio values decline proportionally. Managing risk in the gold market is paramount, especially during periods of volatility.

- Portfolio rebalancing strategies became necessary to mitigate losses.

- Diversification of investments across asset classes reduced the overall impact for some.

- Risk management techniques, such as stop-loss orders, became crucial tools for minimizing losses.

Wider Economic Implications

The gold price drop had wider economic implications, influencing inflation expectations and monetary policy decisions. Central banks, which often hold significant gold reserves, saw the value of their reserves decline, potentially affecting their monetary policy strategies. The gold mining sector also felt the impact, with companies experiencing decreased profitability and potentially impacting employment levels.

- Impact on inflation hedging strategies, as gold's role as an inflation hedge was questioned.

- Influence on central bank reserve management and monetary policy decisions.

- Effects on gold mining sector profitability and investment decisions.

Future Outlook and Predictions for the 2025 Gold Market

Predicting the future of the gold market is inherently challenging, yet understanding analyst forecasts and developing effective strategies is crucial.

Analyst Forecasts and Predictions

Leading analysts offer a range of predictions for the future gold price, influenced by economic growth forecasts, inflation projections, and interest rate expectations. Some analysts remain bullish, anticipating a price recovery driven by factors such as persistent inflation or geopolitical instability. Others hold a bearish outlook, predicting further price declines due to continued dollar strength and rising interest rates. (Specific analyst quotes and predictions would be added here in a live article).

- Summary of various analyst predictions, highlighting the range of opinions.

- Factors influencing price forecasts (e.g., economic growth, inflation, interest rates, geopolitical events).

- Potential for price recovery or further decline, depending on the interplay of these factors.

Strategies for Navigating the Volatile Gold Market

Navigating the volatility in the gold market requires a cautious approach. Investors should prioritize diversification, spreading their investments across various asset classes to reduce overall risk. Risk management strategies, including stop-loss orders and careful position sizing, are essential. A long-term investment strategy, rather than reacting to short-term price fluctuations, is generally recommended for gold investments.

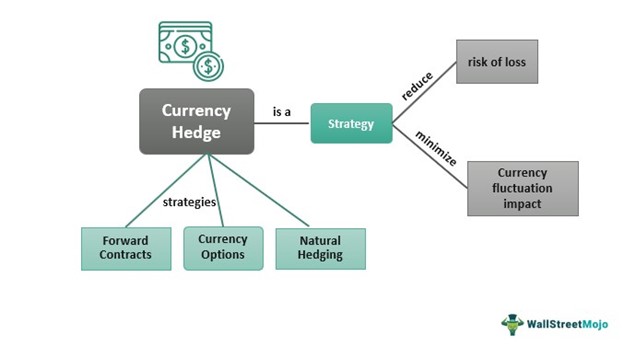

- Risk mitigation strategies, including hedging techniques.

- Diversification across asset classes to reduce reliance on gold's performance.

- Long-term vs. short-term investment strategies for gold, emphasizing the importance of a long-term horizon.

Conclusion

The unprecedented double-digit weekly losses in the 2025 gold market highlight the inherent volatility of this precious metal and the need for careful analysis and strategic investment planning. Understanding the contributing factors, such as a strengthening US dollar and rising interest rates, is crucial for navigating this dynamic landscape. While the future remains uncertain, informed investors can use this period of volatility as an opportunity to re-evaluate their portfolios and develop strategies for navigating the ongoing challenges in the 2025 gold market. Consider diversifying your investments and staying informed about macroeconomic factors to make sound decisions in this fluctuating market. Keep a close watch on the evolving 2025 gold market for further updates and insights.

Featured Posts

-

Schwarzenegger Joins Guadagninos Film A Prominent New Role

May 06, 2025

Schwarzenegger Joins Guadagninos Film A Prominent New Role

May 06, 2025 -

Amerykanska Armia Otrzyma Trotyl Z Polski

May 06, 2025

Amerykanska Armia Otrzyma Trotyl Z Polski

May 06, 2025 -

Analysis Dollars Weakness And Asian Currency Fluctuations

May 06, 2025

Analysis Dollars Weakness And Asian Currency Fluctuations

May 06, 2025 -

Saving Venice A Bold Plan To Combat Rising Floodwaters

May 06, 2025

Saving Venice A Bold Plan To Combat Rising Floodwaters

May 06, 2025 -

7 Day Newark Airport Shutdown The Impact Of A Massive Staffing Crisis

May 06, 2025

7 Day Newark Airport Shutdown The Impact Of A Massive Staffing Crisis

May 06, 2025

Latest Posts

-

Jurassic Parks Jeff Goldblum A London Fan Event

May 06, 2025

Jurassic Parks Jeff Goldblum A London Fan Event

May 06, 2025 -

London Welcomes Jeff Goldblum A Jurassic Park Reunion

May 06, 2025

London Welcomes Jeff Goldblum A Jurassic Park Reunion

May 06, 2025 -

Going For Goldblum London Fans Flock To See Jurassic Park Star

May 06, 2025

Going For Goldblum London Fans Flock To See Jurassic Park Star

May 06, 2025 -

The Flys Ending Jeff Goldblums Account Of The Changes Made

May 06, 2025

The Flys Ending Jeff Goldblums Account Of The Changes Made

May 06, 2025 -

Listen Now Ariana Grande And Jeff Goldblums I Dont Know Why

May 06, 2025

Listen Now Ariana Grande And Jeff Goldblums I Dont Know Why

May 06, 2025