Analysis: Dollar's Weakness And Asian Currency Fluctuations

Table of Contents

Factors Contributing to the Dollar's Weakness

Several interconnected factors contribute to the ongoing weakness of the US dollar. Analyzing these elements provides a clearer picture of the current situation and allows for better predictions of future currency movements.

Interest Rate Differentials

Interest rate differentials between the US and other major economies significantly influence the dollar's value. The Federal Reserve's monetary policy plays a central role. When the Fed lowers interest rates, the return on dollar-denominated assets decreases, making them less attractive to international investors. This leads to a decrease in demand for the dollar, causing its value to fall.

-

The impact of the Federal Reserve's monetary policy: The Fed's actions, such as quantitative easing or interest rate hikes, directly impact the attractiveness of the dollar. Aggressive rate cuts typically weaken the dollar.

-

Comparison of US interest rates with those in major Asian economies: Comparing US interest rates to those in Japan, China, South Korea, and other Asian nations reveals the relative attractiveness of investments in each region. Higher interest rates in Asia can draw investment away from the US, weakening the dollar.

-

The role of inflation in influencing interest rate decisions: Inflation significantly influences central bank decisions regarding interest rates. High inflation often leads to interest rate hikes, potentially strengthening the currency, while low inflation may result in lower rates, weakening the currency.

Geopolitical Uncertainty

Global political events and uncertainty surrounding the US significantly affect the dollar's status as a safe-haven currency. During times of global instability, investors often flock to the dollar, increasing its demand. Conversely, periods of US political instability or international conflict can weaken the dollar's appeal.

-

The impact of US political instability: Political turmoil within the US, such as periods of divided government or significant policy changes, can erode investor confidence, leading to a weaker dollar.

-

The effect of global conflicts and trade tensions: Global conflicts and escalating trade wars create uncertainty in the global economy, often causing investors to shift away from riskier assets, potentially impacting the dollar negatively.

-

The role of economic sanctions and international relations: US economic sanctions and strained relationships with other countries can impact investor sentiment towards the dollar and influence its value in the foreign exchange market.

US Economic Performance

The health of the US economy is intrinsically linked to the dollar's strength. Positive economic indicators typically support a stronger dollar, while weak economic data can lead to its decline.

-

The influence of GDP growth: Strong GDP growth indicates a healthy economy, attracting foreign investment and boosting the dollar's value. Conversely, slow or negative GDP growth can weaken the dollar.

-

The impact of trade deficits: Large and persistent trade deficits can signal underlying economic weakness, potentially putting downward pressure on the dollar.

-

The role of employment data and consumer confidence: Strong employment numbers and high consumer confidence generally indicate a robust economy and support a stronger dollar.

Impact on Asian Currencies

The weakening dollar has a ripple effect across Asian economies, influencing currency values, trade, investment, and inflation.

Currency Appreciation/Depreciation

A weaker dollar typically leads to appreciation in many Asian currencies. For example, the Japanese Yen, the Chinese Renminbi, and the South Korean Won often strengthen against the dollar during periods of dollar weakness.

-

Specific examples of currency movements against the dollar: Tracking the exchange rates of major Asian currencies against the dollar provides concrete examples of this relationship.

-

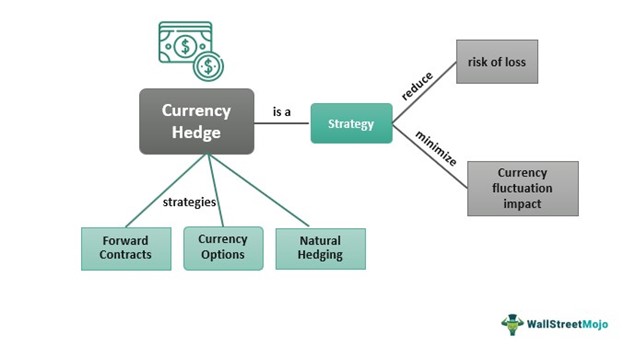

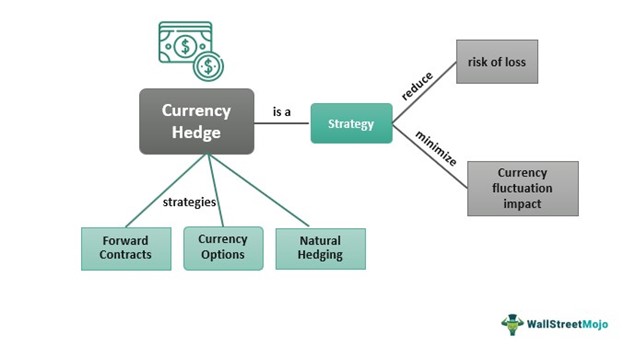

The impact on different Asian economies: The impact of currency fluctuations varies across Asian economies, depending on their trade balances, reliance on exports, and the composition of their foreign debt.

-

The relationship between currency fluctuations and trade balances: Currency appreciation can make exports more expensive and imports cheaper, potentially impacting a country's trade balance.

Implications for Trade and Investment

Currency fluctuations significantly impact trade and investment flows between the US and Asia.

-

Increased import costs for Asian countries if their currency appreciates: A stronger Asian currency makes imports from the US more expensive.

-

Increased export competitiveness for Asian countries: A stronger Asian currency relative to the dollar can boost their export competitiveness in global markets.

-

The attractiveness of Asian assets to foreign investors: A weaker dollar can make Asian assets more attractive to foreign investors seeking higher returns.

Impact on Inflation

Currency fluctuations directly affect inflation rates in Asian economies.

-

How import prices are affected: A stronger local currency can lower import prices, potentially reducing inflation.

-

The role of currency movements in impacting consumer prices: Currency fluctuations influence the price of imported goods and services, impacting consumer prices and inflation.

-

The implications for monetary policy in Asian countries: Central banks in Asian countries may need to adjust their monetary policies to manage inflation in response to currency fluctuations.

Conclusion: Navigating the Volatility of the Dollar and Asian Currencies

The weakness of the dollar and its impact on Asian currency fluctuations are complex phenomena driven by interconnected factors including interest rate differentials, geopolitical uncertainty, and the performance of the US economy. Understanding these dynamics is crucial for investors and businesses operating in the global marketplace. Staying informed about these factors is key to navigating the volatility of the foreign exchange market. To stay ahead, continue monitoring relevant economic news, exchange rate data, and analysis from reputable sources to make informed decisions regarding investments and international trade. Regularly review currency exchange rates and consider diversifying your portfolio to mitigate risks associated with dollar weakness and Asian currency fluctuations.

Featured Posts

-

Celtics Vs Knicks Live Stream Tv Channel And How To Watch

May 06, 2025

Celtics Vs Knicks Live Stream Tv Channel And How To Watch

May 06, 2025 -

2025 Gold Market Facing First Double Digit Weekly Losses

May 06, 2025

2025 Gold Market Facing First Double Digit Weekly Losses

May 06, 2025 -

How To Watch Knicks Vs Celtics 2025 Nba Playoffs A Complete Guide

May 06, 2025

How To Watch Knicks Vs Celtics 2025 Nba Playoffs A Complete Guide

May 06, 2025 -

Analysis Ddgs Take My Son And Its Connection To Halle Bailey

May 06, 2025

Analysis Ddgs Take My Son And Its Connection To Halle Bailey

May 06, 2025 -

The Dark Side Of Disaster Examining The Market For Los Angeles Wildfire Bets

May 06, 2025

The Dark Side Of Disaster Examining The Market For Los Angeles Wildfire Bets

May 06, 2025

Latest Posts

-

The Dont Take My Son Diss Track Ddg Fires Back At Halle Bailey

May 06, 2025

The Dont Take My Son Diss Track Ddg Fires Back At Halle Bailey

May 06, 2025 -

Celebrating Independence Day A Guide To Patriotic Festivities

May 06, 2025

Celebrating Independence Day A Guide To Patriotic Festivities

May 06, 2025 -

Who Is Jeff Goldblums Wife Emilie Livingston Her Age And Children

May 06, 2025

Who Is Jeff Goldblums Wife Emilie Livingston Her Age And Children

May 06, 2025 -

New Ddg Diss Track Dont Take My Son Aimed At Halle Bailey

May 06, 2025

New Ddg Diss Track Dont Take My Son Aimed At Halle Bailey

May 06, 2025 -

Emilie Livingston Age Family Life And Marriage To Jeff Goldblum

May 06, 2025

Emilie Livingston Age Family Life And Marriage To Jeff Goldblum

May 06, 2025