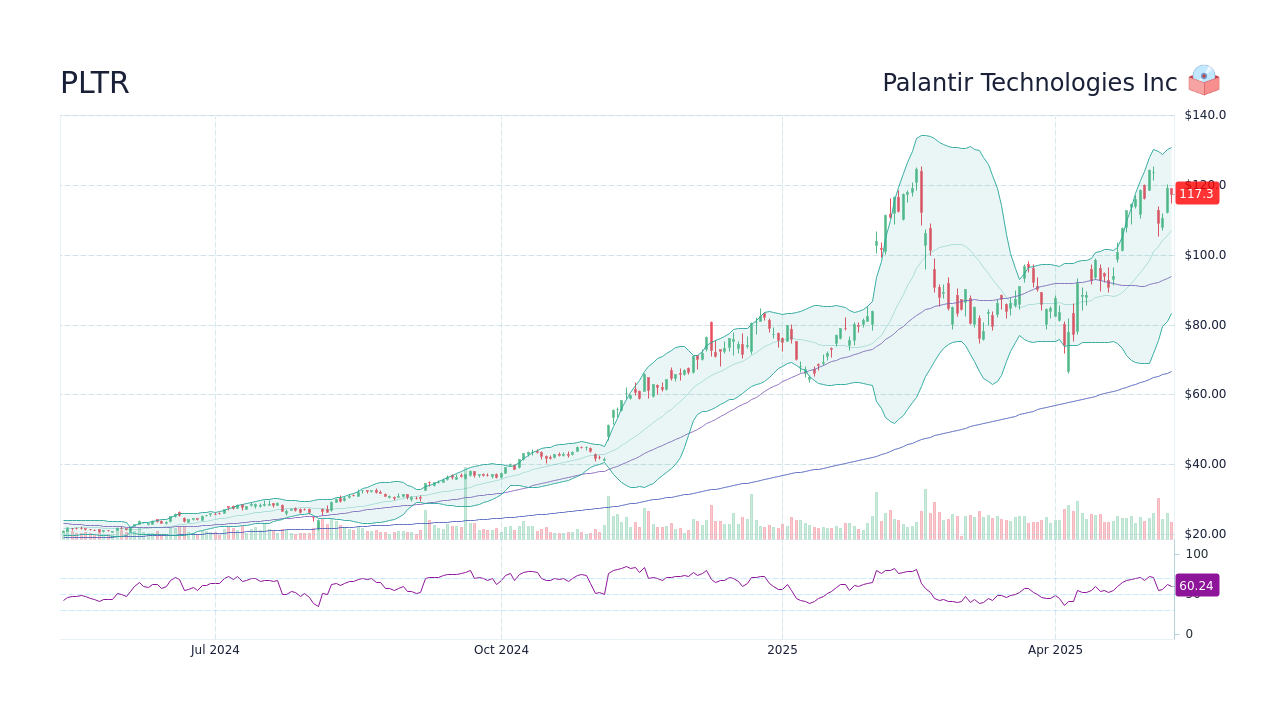

2025 Palantir Stock Prediction: Evaluating The 40% Growth Scenario

Table of Contents

Can Palantir Technologies truly achieve a 40% stock growth by 2025? This in-depth analysis explores the factors driving this ambitious 2025 Palantir stock prediction and investigates the feasibility of such a significant increase in Palantir's stock value. We will delve into Palantir's current financial performance, market position, and future growth prospects to determine the likelihood of this 40% growth scenario for 2025 Palantir stock. This article aims to provide a comprehensive overview to aid in understanding the potential of a Palantir stock investment.

Analyzing Palantir's Current Financial Performance and Market Position

Revenue Growth and Profitability

Palantir's recent financial reports reveal a mixed bag. While the company has demonstrated consistent revenue growth, profitability remains a key area of focus. Analyzing Palantir's financial performance requires a detailed look at key metrics.

- Year-over-year revenue growth: Examining the percentage increase in revenue year after year is crucial in assessing the trajectory of Palantir's financial health. Recent reports show fluctuations, requiring careful consideration of the underlying factors.

- Net income: A positive net income indicates profitability, a key driver of stock value. Palantir's net income needs to be analyzed in conjunction with revenue growth to fully understand its financial standing.

- Operating expenses: Understanding Palantir's operating expenses, including research and development, sales and marketing, and general and administrative costs, is critical in assessing its profitability and efficiency. Efficiency improvements can significantly impact the 2025 Palantir stock prediction.

Analyzing Palantir's financial performance shows a company with significant growth potential, but profitability needs continued improvement to support a 40% stock growth prediction. The "revenue growth trajectory" and "profitability analysis" are key aspects determining the feasibility of the prediction.

Market Share and Competitive Landscape

Palantir operates in the highly competitive big data and analytics market. Understanding Palantir's market share and competitive advantages is vital for a 2025 Palantir stock prediction.

- Key Competitors: Companies like AWS, Microsoft, and Google Cloud Platform offer competing solutions, creating a challenging landscape.

- Palantir's Unique Selling Propositions (USPs): Palantir's focus on complex data integration and its strong government relationships provide unique advantages.

- Market Share Estimations: While precise market share figures are difficult to obtain, Palantir's position within specific niche markets should be carefully evaluated.

Palantir's "market share" and its ability to maintain a "competitive advantage" in the "big data analytics competition" will directly influence its future growth and the accuracy of any 2025 Palantir stock prediction.

Government Contracts and Commercial Partnerships

Palantir's revenue stream significantly depends on government contracts and commercial partnerships. Evaluating the strength and potential of these relationships is crucial.

- Major Government Contracts: Analyzing the size, duration, and renewal prospects of existing contracts is crucial for predicting future revenue streams.

- Strategic Partnerships: Palantir's partnerships with other technology companies and corporations provide access to new markets and technological advancements, boosting growth potential.

- Future Contract Wins and Partnership Expansions: The potential for winning new government contracts and expanding existing commercial partnerships is a key factor in the 2025 Palantir stock prediction.

A robust pipeline of "Palantir government contracts" and successful "commercial partnerships," including future "contract wins," will significantly contribute to the company's future growth.

Evaluating Factors Contributing to (or Hindering) the 40% Growth Prediction

Technological Advancements and Innovation

Palantir's commitment to "Palantir innovation" through research and development is a critical driver of its future growth.

- Technological Advancements: New technologies, such as AI and machine learning integration into its platforms, are pivotal to maintaining a competitive edge.

- New Product Launches: Successful introductions of new products and services will be essential in expanding market reach and revenue streams.

- Market Impact of New Technologies: The successful adoption and integration of new technologies directly impact Palantir's ability to meet market demands and improve its "product development" capabilities.

The level of "technological advancements" and their successful integration will significantly influence the accuracy of the 40% 2025 Palantir stock prediction.

Macroeconomic Factors and Market Volatility

Broader economic conditions and market volatility can significantly influence Palantir's stock price.

- Potential Risks: A recession or increased inflation could negatively impact government spending and commercial investment, potentially reducing demand for Palantir's services.

- Opportunities: Increased government spending on data analytics in response to global challenges could create opportunities for growth.

- Economic Outlook: The overall economic outlook will directly influence investor sentiment and the "macroeconomic impact" on Palantir's stock price.

Understanding the "market volatility" and the overall "economic outlook" is critical for assessing the feasibility of the 40% growth prediction.

Investor Sentiment and Market Expectations

Investor sentiment and market expectations play a significant role in shaping Palantir's stock price.

- Analyst Ratings: Positive analyst ratings can boost investor confidence and increase demand for Palantir stock.

- Stock Price Predictions from Other Analysts: Comparing this 40% growth prediction with other market forecasts is crucial for a comprehensive assessment.

- Significant News Events: Major news events, both positive and negative, can significantly influence investor sentiment and market expectations.

Analyzing "investor sentiment" and "market expectations," including "analyst ratings" and other relevant forecasts, is essential for predicting Palantir's future stock performance.

Scenario Planning and Risk Assessment for the 2025 Palantir Stock Prediction

Best-Case, Worst-Case, and Base-Case Scenarios

To effectively assess the 40% growth prediction, various scenarios should be considered:

- Best-Case Scenario: This scenario assumes highly favorable conditions, such as strong revenue growth, successful new product launches, and positive investor sentiment. This could result in exceeding the 40% growth target.

- Worst-Case Scenario: This considers unfavorable conditions like a significant economic downturn, increased competition, and negative investor sentiment, potentially leading to a much lower growth rate or even a decline.

- Base-Case Scenario: This scenario presents a more realistic outlook, considering a moderate level of growth based on current market trends and company performance. This "scenario planning" approach helps determine the probability of achieving the 40% growth prediction.

Identifying Key Risks and Opportunities

Identifying "risk factors" and "growth opportunities" is crucial for a realistic "2025 Palantir stock forecast."

- Potential Risks: Increased competition, regulatory changes, cybersecurity threats, and dependence on government contracts represent potential risks.

- Growth Opportunities: Expansion into new markets, strategic acquisitions, technological breakthroughs, and improved profitability present significant growth opportunities.

- Potential Challenges: Overcoming "potential challenges" requires a proactive approach to risk mitigation and seizing emerging opportunities.

Conclusion: Investing in the Future: Your 2025 Palantir Stock Strategy

This analysis provides a nuanced perspective on the potential of a 40% growth scenario for Palantir stock by 2025. While Palantir possesses significant potential fueled by its innovative technology and strong government partnerships, achieving this ambitious target depends on various internal and external factors. The "risk assessment" reveals the need for a cautious approach, considering both the potential upside and downside risks. This thorough examination of Palantir's financial performance, market position, and future growth prospects offers a starting point for informed investment decisions. Remember to conduct your own thorough research and develop a sound investment strategy based on your personal risk tolerance before investing in Palantir stock. This 2025 Palantir stock prediction should be viewed as one factor amongst many in your overall investment strategy.

Featured Posts

-

Nhl Highlights Hertls Two Hat Tricks In One Month

May 10, 2025

Nhl Highlights Hertls Two Hat Tricks In One Month

May 10, 2025 -

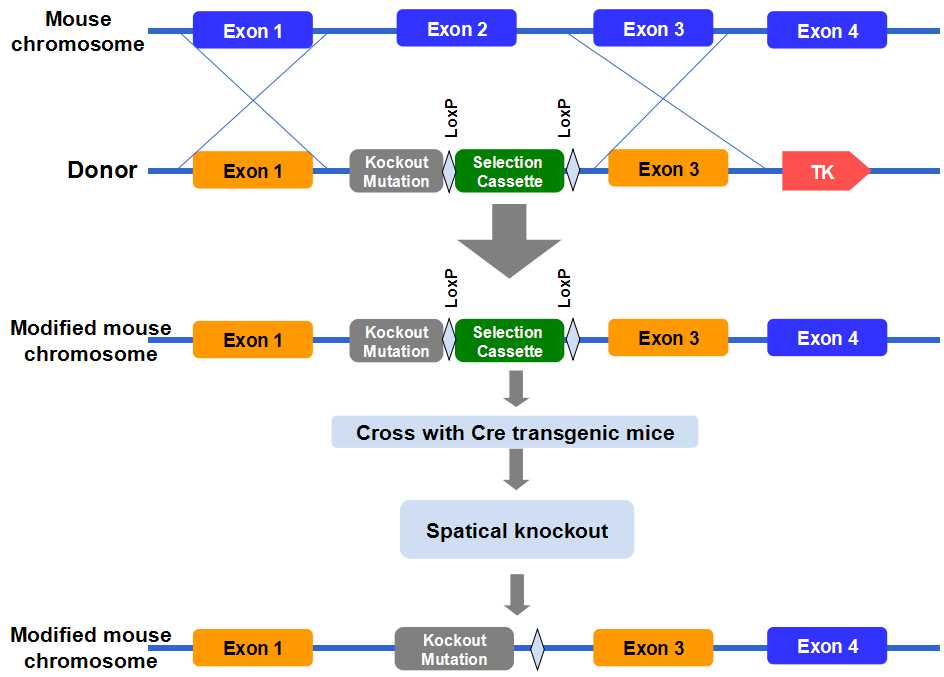

The Truth About Us Funding For Transgender Mouse Studies

May 10, 2025

The Truth About Us Funding For Transgender Mouse Studies

May 10, 2025 -

Pakistan Stock Market Crisis Operation Sindoor Triggers Sharp Decline

May 10, 2025

Pakistan Stock Market Crisis Operation Sindoor Triggers Sharp Decline

May 10, 2025 -

168 Million Whats App Spyware Judgment Impact On Meta And Future Of Messaging Security

May 10, 2025

168 Million Whats App Spyware Judgment Impact On Meta And Future Of Messaging Security

May 10, 2025 -

Pakistan Stock Exchange Portal Down Volatility And Geopolitical Tensions

May 10, 2025

Pakistan Stock Exchange Portal Down Volatility And Geopolitical Tensions

May 10, 2025