30% Drop For Palantir: Time To Invest?

Table of Contents

Understanding the 30% Palantir Stock Price Drop

Recent Market Trends and Their Impact on Palantir

The recent 30% drop in Palantir stock isn't happening in a vacuum. Broader market conditions have significantly impacted the tech sector, including Palantir. Rising interest rates, a general tech sector downturn, and concerns about inflation have created a challenging environment for growth stocks like Palantir.

- Correlation with Tech Stocks: Palantir's performance is heavily correlated with other tech stocks. When the overall tech market experiences a downturn, as it has recently, Palantir tends to suffer alongside its peers. This is largely due to investor sentiment and broader market risk aversion.

- Contributing News and Events: Specific news events, such as disappointing earnings reports from other tech giants or shifts in regulatory landscapes affecting the data analytics industry, can also influence Palantir's stock price.

- Comparative Performance: Compared to other big data analytics companies, Palantir's recent performance might be stronger or weaker depending on the specific company and market conditions. A thorough comparison against similar companies is essential for a comprehensive Palantir stock analysis.

Palantir's Financial Performance and Future Projections

Analyzing Palantir's recent financial reports reveals mixed signals. While the company shows consistent revenue growth, profitability remains a challenge. Future guidance offered by the company may also influence investor confidence and consequently, the Palantir stock price.

- Key Financial Metrics: Examining revenue growth, earnings per share (EPS), operating margin, and free cash flow provides a picture of Palantir's financial health. These metrics need to be assessed in relation to the company's growth trajectory and future projections.

- Analyst Predictions: Analyst predictions and ratings for Palantir's future performance provide another important perspective. However, it is crucial to remember that these predictions are not guarantees.

- Long-Term Sustainability Concerns: Questions about Palantir's long-term sustainability, such as its reliance on government contracts or its ability to compete with larger tech companies, can significantly affect investor sentiment and the Palantir stock price.

Analyzing Investor Sentiment and Market Volatility

Understanding investor sentiment and market volatility is crucial for interpreting the recent Palantir price drop. Changes in analyst ratings, increased short-selling activity, and market speculation all play significant roles.

- Analyst Ratings: Shifts in analyst ratings from "buy" to "hold" or "sell" can significantly impact investor confidence and the Palantir stock price.

- Short-Selling and Speculation: A high level of short-selling indicates negative sentiment. Market speculation, fueled by rumors or news, can also contribute to price fluctuations.

- Trading Volume and Market Indicators: Analyzing trading volume and other market indicators such as the VIX (volatility index) can provide insight into the level of uncertainty and risk in the market.

Assessing the Risks and Rewards of Investing in Palantir After the Drop

Potential Risks of Investing in Palantir

Investing in Palantir, like any growth stock, carries inherent risks. The volatility of the stock price is a major concern, as seen in the recent 30% drop.

- Stock Price Volatility: Palantir's stock price is known for its volatility. This makes it a high-risk, high-reward investment.

- Competition: Palantir faces competition from established players in the big data and analytics market. This competition could put pressure on margins and hinder growth.

- Regulatory and Legal Risks: Data privacy regulations and potential legal challenges related to data security and usage pose ongoing risks.

Potential Rewards of Investing in Palantir

Despite the risks, investing in Palantir at its discounted price could offer substantial rewards. The long-term growth potential of the big data and AI market is significant.

- Big Data and AI Market Growth: The big data and AI market is expected to continue growing rapidly, presenting significant opportunities for Palantir.

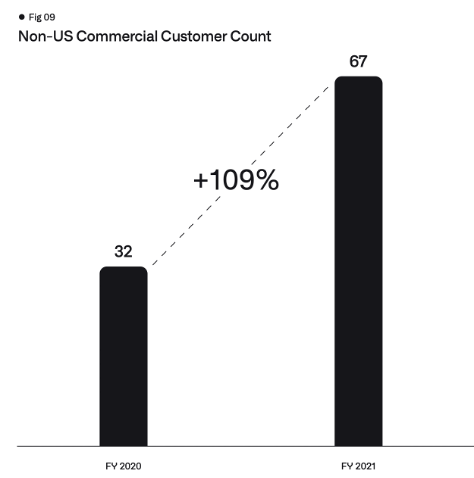

- Government Contracts and Commercial Expansion: Palantir's strong government contracts provide a stable revenue stream, while its expansion into the commercial sector offers potential for significant growth.

- Technological Advancements and Market Share: Future technological advancements and increases in market share could lead to substantial returns for investors.

Developing an Investment Strategy for Palantir

Diversification and Risk Management

Diversification is key to mitigating risk. Don't put all your eggs in one basket.

- Appropriate Allocation: Allocate a percentage of your investment portfolio to Palantir based on your risk tolerance. Avoid overexposure to a single stock.

- Limiting Investment: Limit your investment in Palantir to avoid significant losses in case of further price drops.

Dollar-Cost Averaging (DCA) and Long-Term Investment

Dollar-cost averaging (DCA) can help reduce the impact of volatility.

- DCA Benefits: Investing a fixed amount regularly, regardless of the stock price, mitigates the risk of buying high and selling low.

- Long-Term Horizon: Palantir is a long-term investment. Short-term fluctuations should be viewed within the context of its long-term growth potential.

Seeking Professional Financial Advice

This article is for informational purposes only and not financial advice.

- Personalized Planning: Consult a qualified financial advisor for personalized investment advice tailored to your circumstances and risk tolerance.

Conclusion

Palantir's recent 30% stock price drop is a complex issue influenced by market conditions, financial performance, and investor sentiment. While the volatility presents significant risks, the long-term potential of Palantir within the expanding big data and AI markets remains compelling. Thoroughly research Palantir and its position within the market, understand your own risk tolerance, and consider consulting a financial advisor before making any investment decisions regarding Palantir stock. Remember, this analysis is for informational purposes only and not financial advice. Conduct thorough due diligence before investing in Palantir stock or any other security.

Featured Posts

-

Arrestan A Universitaria Transgenero Por Usar Bano Femenino El Caso Que Genera Debate

May 10, 2025

Arrestan A Universitaria Transgenero Por Usar Bano Femenino El Caso Que Genera Debate

May 10, 2025 -

Wynne Evans I Promise I Have Done Nothing Wrong Supporters Rally

May 10, 2025

Wynne Evans I Promise I Have Done Nothing Wrong Supporters Rally

May 10, 2025 -

White House Cocaine Secret Service Investigation Concludes

May 10, 2025

White House Cocaine Secret Service Investigation Concludes

May 10, 2025 -

Is Palantir Stock A Good Buy Before Its May 5th Earnings

May 10, 2025

Is Palantir Stock A Good Buy Before Its May 5th Earnings

May 10, 2025 -

Melanie Eiffel De Dijon Une Figure Cle Dans La Reussite De Gustave

May 10, 2025

Melanie Eiffel De Dijon Une Figure Cle Dans La Reussite De Gustave

May 10, 2025