5 Essential Do's And Don'ts: Securing A Private Credit Role

Table of Contents

Do's for Securing a Private Credit Role

Network Strategically

Networking is paramount in the private credit industry. Building strong relationships can open doors to unadvertised private credit jobs and provide invaluable insights.

- Attend Industry Events: Private equity conferences, credit funds networking events, and industry-specific meetups are goldmines for connections. Actively participate, engage in conversations, and exchange business cards. Remember, private credit networking is all about building relationships.

- Leverage LinkedIn Effectively: Your LinkedIn profile should be a professional showcase. Optimize it with keywords like "private credit," "private debt," "credit analysis," and "financial modeling." Connect with professionals in private credit, join relevant groups, and participate in discussions. This boosts your visibility and positions you as an industry insider.

- Informational Interviews: Reach out to individuals working in private credit roles that interest you. These conversations provide firsthand insights into the industry and the specific firm's culture. They're an excellent way to learn more about private equity connections and navigate your career path.

Craft a Compelling Resume/CV

Your resume is your first impression. It must showcase your skills and achievements persuasively to land an interview for your desired private credit jobs.

- Highlight Relevant Skills: Emphasize skills crucial to private credit, such as financial modeling, credit analysis, valuation, due diligence, and understanding of leveraged finance.

- Quantify Achievements: Instead of simply stating your responsibilities, quantify your impact using numbers and data. For example, "Increased portfolio returns by 15% through improved credit risk management" is far more impactful than "Managed portfolio assets."

- Tailor Your Resume: Don't use a generic resume. Customize each application to match the specific requirements and keywords mentioned in the job description. This demonstrates your genuine interest and attention to detail. Include keywords like "private debt experience," "credit underwriting," and "financial statement analysis."

Master the Interview Process

The interview is your opportunity to shine. Preparation is key to demonstrating your knowledge and enthusiasm for private credit analyst positions or other private credit roles.

- Prepare for Behavioral Questions: Use the STAR method (Situation, Task, Action, Result) to structure your answers and showcase your problem-solving abilities.

- Practice Technical Questions: Expect questions on financial statements, credit metrics (like leverage ratios and interest coverage), industry trends, and your understanding of private credit strategies.

- Research the Firm Thoroughly: Demonstrate your knowledge of the firm's investment strategy, portfolio companies, and recent transactions. Showing genuine interest sets you apart.

- Ask Insightful Questions: Prepare thoughtful questions to show your engagement and curiosity about the role and the firm's culture. This indicates your proactive nature. This shows you're serious about private credit jobs and the firm's values.

Don'ts for Securing a Private Credit Role

Avoid Generic Applications

Sending the same resume and cover letter to every firm is a major mistake. It shows a lack of effort and interest.

- Tailor Each Application: Customize your resume and cover letter to each specific firm and role, highlighting relevant experiences and skills.

- Don't Neglect the Cover Letter: Use your cover letter to explain your interest in the specific firm and the role, demonstrating your understanding of their investment strategy and culture.

Neglect Professional Development

The private credit industry is dynamic. Continuous learning is essential to remain competitive.

- Stay Updated: Keep abreast of market trends, regulatory changes, and new technologies relevant to private credit.

- Consider Certifications: Pursuing relevant certifications such as the CFA (Chartered Financial Analyst) or CAIA (Chartered Alternative Investment Analyst) can significantly enhance your credentials.

Underestimate the Importance of Soft Skills

While technical skills are vital, soft skills are equally crucial in private credit.

- Highlight Soft Skills: Emphasize your communication, teamwork, problem-solving, and interpersonal skills in your resume and interviews.

- Demonstrate Work Ethic: Showcase your strong work ethic, proactive attitude, and ability to work effectively under pressure – all essential for success in a demanding environment like private credit.

Conclusion: Securing Your Dream Private Credit Role

Securing a private credit role requires a strategic, multifaceted approach. By following these do's and don'ts – networking effectively, crafting a compelling resume and cover letter, and mastering the interview process – you significantly increase your chances of landing your dream private credit job. Remember, the private credit industry is competitive, but with dedication and a well-defined strategy, you can stand out from the crowd. Start networking today, refine your application materials, and prepare for those crucial interviews. By following these essential do's and don'ts, you'll significantly improve your chances of securing your dream private credit role!

Featured Posts

-

Pfc Blocks Gensols Eo W Transfer Due To Fraudulent Documentation

Apr 27, 2025

Pfc Blocks Gensols Eo W Transfer Due To Fraudulent Documentation

Apr 27, 2025 -

Brazil Bound Justin Herbert And The Chargers 2025 Season Opener

Apr 27, 2025

Brazil Bound Justin Herbert And The Chargers 2025 Season Opener

Apr 27, 2025 -

20

Apr 27, 2025

20

Apr 27, 2025 -

Justin Herbert Chargers 2025 Season Opener In Brazil

Apr 27, 2025

Justin Herbert Chargers 2025 Season Opener In Brazil

Apr 27, 2025 -

Deloittes Forecast A Significant Slowdown In Us Economic Growth

Apr 27, 2025

Deloittes Forecast A Significant Slowdown In Us Economic Growth

Apr 27, 2025

Latest Posts

-

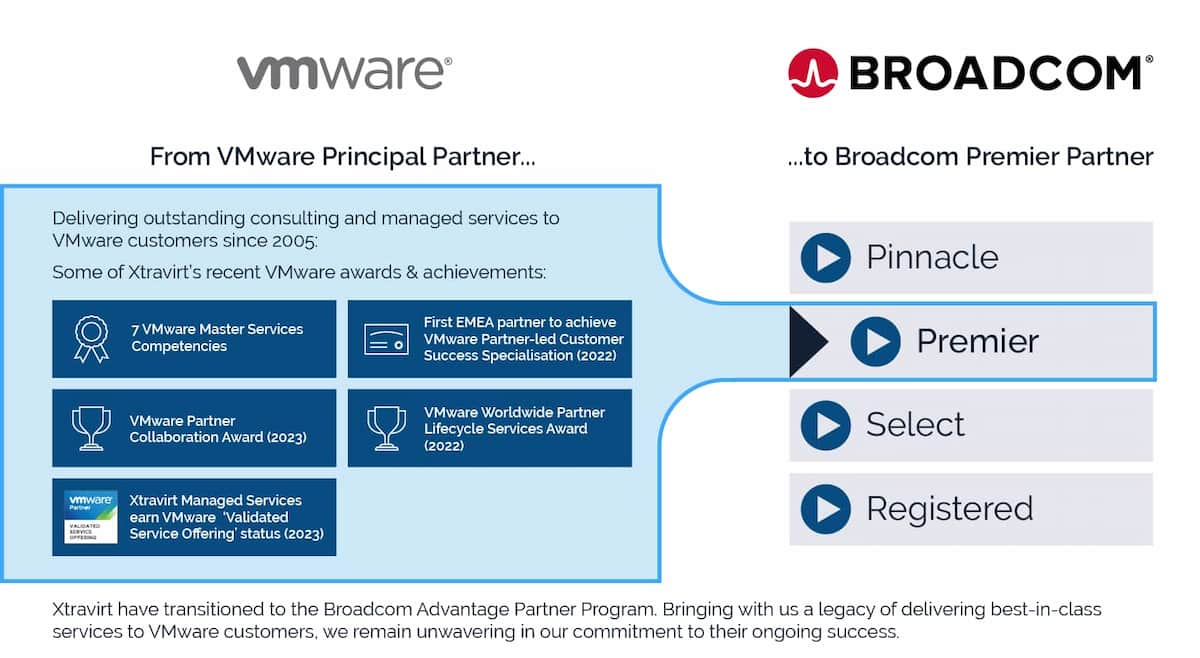

The Broadcom V Mware Deal An Extreme Price Hike Of 1 050 For At And T

Apr 28, 2025

The Broadcom V Mware Deal An Extreme Price Hike Of 1 050 For At And T

Apr 28, 2025 -

At And T Raises Alarm Over Extreme V Mware Price Hike After Broadcom Deal

Apr 28, 2025

At And T Raises Alarm Over Extreme V Mware Price Hike After Broadcom Deal

Apr 28, 2025 -

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increase Concerns

Apr 28, 2025

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increase Concerns

Apr 28, 2025 -

1 050 Price Hike At And T Challenges Broadcoms V Mware Acquisition Proposal

Apr 28, 2025

1 050 Price Hike At And T Challenges Broadcoms V Mware Acquisition Proposal

Apr 28, 2025 -

Assessing The Us Economy The Immediate Effects Of A Canadian Travel Boycott

Apr 28, 2025

Assessing The Us Economy The Immediate Effects Of A Canadian Travel Boycott

Apr 28, 2025