5 Key Dos And Don'ts To Secure A Private Credit Role

Table of Contents

Do: Tailor Your Resume and Cover Letter to Each Private Credit Role Application

Your resume and cover letter are your first impression. Generic applications rarely succeed in the competitive private credit industry. To stand out, you must demonstrate a deep understanding of the specific role and the firm's investment strategy.

Highlight Relevant Skills and Experience:

- Use keywords found in job descriptions: Scan the job description carefully and incorporate relevant keywords such as "underwriting," "due diligence," "portfolio management," "asset-based lending," "structured finance," "private debt," "credit analysis," and "risk management." This helps Applicant Tracking Systems (ATS) identify your application as a strong match.

- Quantify your achievements: Instead of simply stating your responsibilities, quantify your accomplishments. For example, "Managed a portfolio of $50 million in commercial real estate loans" is far more impactful than "Managed a portfolio of commercial real estate loans." Use metrics to showcase your success in areas like portfolio growth, risk reduction, and deal closing.

- Showcase your experience in relevant sectors: Highlight experience in sectors where private credit is commonly invested, such as real estate, energy, healthcare, technology, or infrastructure. Demonstrate your understanding of the specific challenges and opportunities within these sectors.

Demonstrate Understanding of Private Credit Markets:

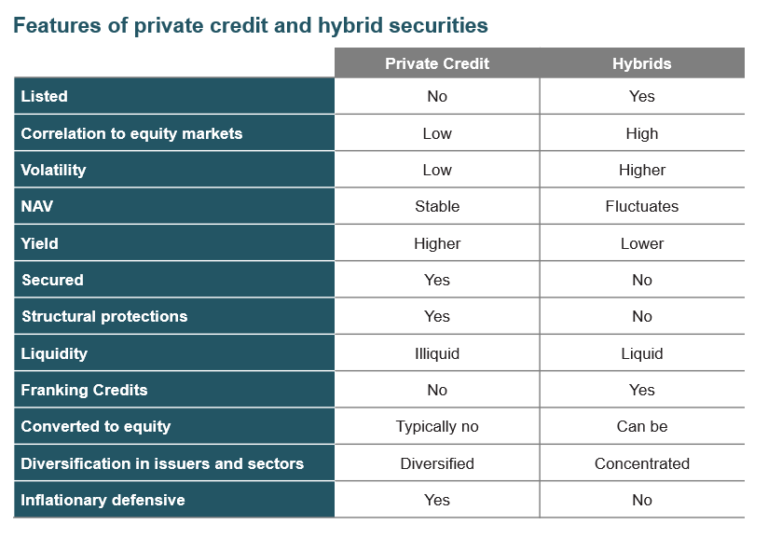

- Briefly explain your knowledge of different private credit strategies: Show your familiarity with direct lending, mezzanine financing, distressed debt, senior secured loans, and other strategies. Explain which strategies you prefer and why.

- Show familiarity with current market trends and economic factors: Mention current interest rate environments, macroeconomic factors affecting credit markets, and any regulatory changes impacting private credit investments.

- Tailor your language to match the specific fund or institution's investment strategy: Research the target investment areas, deal size, and investment philosophy of the firm. Align your resume and cover letter to reflect their specific focus.

Don't: Neglect Networking in the Private Credit Industry

Networking is crucial in the private credit world. Building relationships with professionals in the field can significantly enhance your job search prospects.

Leverage LinkedIn and Professional Events:

- Actively engage on LinkedIn: Connect with professionals in private credit, join relevant groups, and participate in industry discussions. Share insightful articles and contribute to conversations.

- Attend industry conferences and networking events: These events offer excellent opportunities to meet potential employers and learn about new opportunities. Prepare a concise and compelling introduction highlighting your skills and career aspirations.

- Follow relevant private credit news and publications: Staying informed about industry trends shows your commitment and helps you engage in meaningful conversations with potential employers. Publications like Private Equity International, Alternatives, and industry-specific blogs are valuable resources.

Underestimate the Power of Informational Interviews:

- Reach out to professionals for informational interviews: Request a brief conversation to learn about their experiences and gain insights into the industry. Focus on learning, not directly asking for a job.

- Prepare insightful questions beforehand: Show genuine interest by asking thoughtful questions about their career path, the firm's culture, and current market trends. Avoid generic questions that could be easily found online.

- Follow up with thank-you notes after each conversation: Express your gratitude and reiterate your interest in the field. This demonstrates professionalism and strengthens your network.

Do: Prepare Thoroughly for Private Credit Interviews

Private credit interviews are rigorous and assess both technical skills and cultural fit. Thorough preparation is essential.

Practice Behavioral Questions:

- Use the STAR method: Structure your answers using the STAR method (Situation, Task, Action, Result) to clearly and concisely communicate your experiences and achievements.

- Prepare examples showcasing your problem-solving skills, teamwork abilities, and resilience: Private credit roles require collaboration and the ability to handle pressure. Prepare examples demonstrating these qualities.

- Practice answering common interview questions related to private credit investment strategies: Be prepared to discuss your understanding of different investment approaches, risk assessment, and deal structuring.

Demonstrate Financial Modeling Proficiency:

- Be prepared to discuss your experience with financial modeling software: Demonstrate proficiency in Excel, Argus, or other relevant software. Be ready to walk through model construction and interpretation.

- Practice building and interpreting financial models for various investment scenarios: Prepare for case studies involving financial modeling and valuation techniques.

- Show understanding of key financial ratios and metrics used in private credit: Be familiar with metrics like leverage ratios, interest coverage, and debt service coverage.

Don't: Underestimate the Importance of Due Diligence on Potential Employers

Just as firms conduct due diligence on potential investments, you should conduct due diligence on potential employers.

Research the Firm's Investment Strategy and Culture:

- Thoroughly research the firm's investment focus, recent deals, and overall performance: Understand their investment thesis, target sectors, and deal flow. Analyze their track record and identify their strengths and weaknesses.

- Understand the firm’s culture and values to ensure alignment with your career goals: Research the firm’s culture through online resources, employee reviews on platforms like Glassdoor, and networking contacts.

- Look for employee reviews and insights on platforms like Glassdoor: Gain insights into the work environment, management style, and employee satisfaction levels.

Ask Informed Questions During the Interview Process:

- Prepare insightful questions to show your genuine interest and understanding of the firm: Ask questions that demonstrate your research and critical thinking abilities.

- Ask about the team dynamics, career development opportunities, and the firm’s future plans: Show your long-term interest and commitment.

- Avoid asking questions easily answered through basic online research: This shows a lack of preparation and initiative.

Do: Follow Up After the Private Credit Interview

A professional follow-up strengthens your candidacy and leaves a lasting positive impression.

Send a Thank-You Note:

- Send a personalized thank-you note within 24 hours of your interview: Express your gratitude for the opportunity and reiterate your interest in the role.

- Reiterate your interest in the role and highlight key aspects of your conversation: Mention specific points discussed and reaffirm your qualifications.

- Express your enthusiasm and reiterate your qualifications: Reinforce your suitability for the role and your enthusiasm for the opportunity.

Maintain Consistent Communication:

- If you haven't heard back within the expected timeframe, politely follow up with a brief email: Maintain a professional and respectful tone.

- Maintain a professional and respectful tone in all communications: Your communication reflects your professionalism and suitability for the role.

- Be patient and persistent throughout the application process: The private credit hiring process can be lengthy. Maintain your enthusiasm and professionalism throughout.

Conclusion

Securing a private credit role demands careful preparation and a strategic approach. By following these dos and don'ts—tailoring your application materials, networking effectively, preparing for interviews, conducting due diligence on potential employers, and following up professionally—you significantly increase your chances of success. Remember, landing your dream private credit role is a process, and perseverance is key. Start applying these strategies today and take the next step towards your ideal private credit career. Don't delay, start your search for the perfect private credit role now!

Featured Posts

-

Nyt Strands Wednesday March 12 2024 Complete Solution Guide Game 374

May 09, 2025

Nyt Strands Wednesday March 12 2024 Complete Solution Guide Game 374

May 09, 2025 -

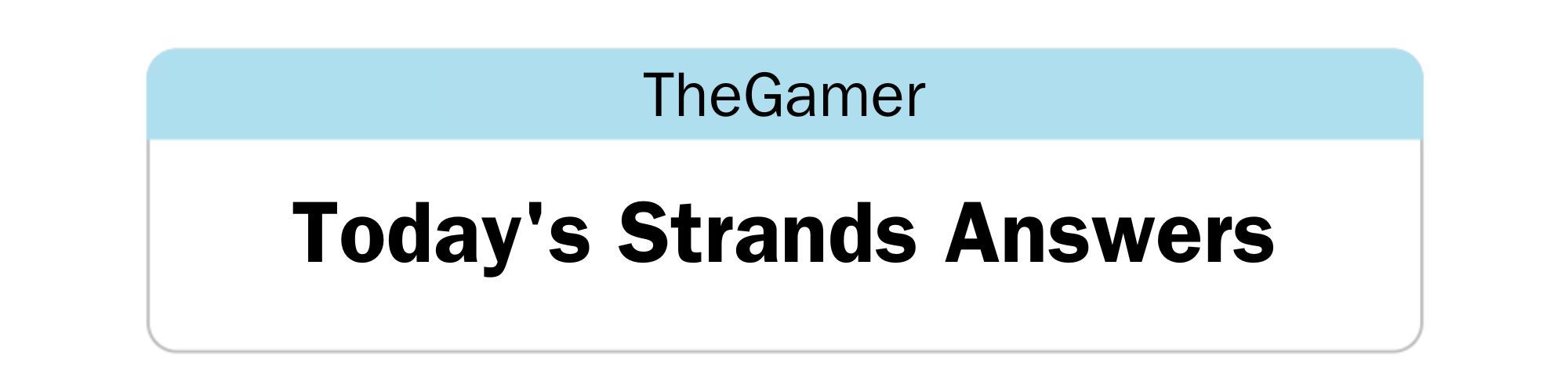

Credit Suisse Whistleblowers To Share 150 Million

May 09, 2025

Credit Suisse Whistleblowers To Share 150 Million

May 09, 2025 -

Weight Loss Drug Boom And Weight Watchers Financial Troubles

May 09, 2025

Weight Loss Drug Boom And Weight Watchers Financial Troubles

May 09, 2025 -

From Wolves Discard To Europes Elite A Footballing Success Story

May 09, 2025

From Wolves Discard To Europes Elite A Footballing Success Story

May 09, 2025 -

The Hollywood Strike A Joint Effort By Actors And Writers

May 09, 2025

The Hollywood Strike A Joint Effort By Actors And Writers

May 09, 2025