65 Hudson's Bay Leases Generate Significant Investor Interest

Table of Contents

Prime Locations Drive Investor Demand for Hudson's Bay Leases

The strategic locations of these 65 Hudson's Bay leases are the cornerstone of their attractiveness. These properties occupy prime commercial real estate in major Canadian cities, boasting unparalleled access and visibility. Their status as highly sought-after locations significantly impacts their rental rates, occupancy rates, and overall property values.

Consider the following key location advantages:

- High Foot Traffic Areas: Many of these leases are situated in bustling downtown cores and shopping districts, guaranteeing consistent high foot traffic, crucial for retailers and businesses seeking maximum exposure.

- Proximity to Public Transportation: Convenient access to public transportation networks enhances accessibility for both employees and customers, making these locations highly desirable.

- Strong Demographics: The properties are strategically located within areas characterized by strong demographics, including high-income earners and a robust consumer base.

- Nearby Amenities: The presence of nearby amenities, such as restaurants, entertainment venues, and other businesses, creates a vibrant and attractive environment.

Data supports the desirability of these locations. For example, rental rates in these areas consistently outperform market averages, and occupancy rates remain exceptionally high, further solidifying the value proposition for investors. Property values in these prime locations also tend to appreciate at a faster rate than those in less desirable areas. This translates to strong capital appreciation potential for investors in Hudson's Bay leases.

Attractive Lease Terms and Conditions Attract Investors

Beyond location, the attractive lease terms and conditions offered further incentivize investors. These leases are structured to provide significant financial benefits, fostering long-term stability and strong returns.

Key features that make these leases so attractive include:

- Lease Duration: Long-term lease agreements provide investors with predictable income streams and reduce the risk of vacancy.

- Rental Rates: Competitive rental rates ensure a healthy return on investment (ROI), making these leases a financially sound proposition.

- Renewal Options: Built-in renewal options provide investors with greater certainty and predictability regarding their future cash flows.

- Tenant Quality: The tenant, Hudson's Bay Company, is a well-established and financially sound entity, providing strong tenant covenants and minimizing the risk of default.

The financial benefits for investors are clear:

- Competitive Rental Yields: These leases deliver competitive rental yields compared to other commercial real estate investments.

- Long-Term Lease Agreements: Long-term leases provide stability and reduce the uncertainties associated with shorter-term agreements.

- Built-in Rent Escalations: Built-in rent escalations protect against inflation and ensure that rental income keeps pace with rising costs.

- Solid Tenant Covenants: Strong tenant covenants safeguard investors' interests and provide confidence in the stability of the investment.

Diverse Investor Profiles Show Broad Interest in Hudson's Bay Leases

The interest in these leases isn't limited to a single investor type. A wide range of investors, each with their unique investment strategies, are vying for a piece of this lucrative market.

This diverse investor base includes:

- REITs (Real Estate Investment Trusts): REITs are seeking to diversify their portfolios with high-quality, income-generating assets like these Hudson's Bay leases.

- Private Equity Firms: Private equity firms see value-add opportunities in these properties, potentially through renovations or repositioning strategies.

- High-Net-Worth Individuals: High-net-worth individuals are attracted by the potential for stable income streams and long-term capital appreciation.

Industry experts echo this sentiment. One prominent commercial real estate analyst stated, "The combination of prime locations and attractive lease terms makes these Hudson's Bay properties highly sought after. We're seeing strong demand from a diverse range of investors, reflecting the confidence in the long-term potential of these assets."

Market Analysis: The Future of Hudson's Bay Leases and Investment Potential

Current market conditions are favorable for this type of investment. The strong demand for prime commercial real estate, coupled with the attractive characteristics of these leases, points to continued growth potential.

Looking ahead:

- Projected Rental Growth: Rental rates in these prime locations are expected to continue growing, driven by strong demand and limited supply.

- Potential for Property Value Appreciation: The properties are positioned for significant long-term value appreciation due to their strategic locations and the inherent strength of the underlying assets.

- Economic Factors: While economic factors can always impact returns, the stability of the Hudson's Bay tenant and the enduring demand for prime commercial real estate mitigate many risks.

- Risks Associated with the Investment: Like any investment, there are inherent risks, including potential changes in market conditions and the performance of the tenant. However, the long-term leases and the strong tenant provide a considerable degree of protection.

The market outlook for Hudson's Bay properties and their leasing potential remains positive, making them a compelling investment opportunity for those seeking exposure to prime Canadian commercial real estate.

Conclusion: Investing in the Future of Hudson's Bay Leases

The significant investor interest in the 65 Hudson's Bay leases stems from a confluence of factors: prime locations, attractive lease terms, and a robust market outlook. These leases offer a compelling combination of predictable income streams, strong rental growth potential, and potential for significant capital appreciation. Investing in these properties provides access to a stable, high-yield asset class within a thriving market. Contact us today to learn more about available Hudson's Bay lease investment opportunities and secure your stake in this thriving market. Explore the potential of Hudson's Bay commercial real estate investments and discover how you can secure your future in these prime locations.

Featured Posts

-

Bold And The Beautiful Spoilers Liams Health Scare Following A Fierce Confrontation With Bill

Apr 24, 2025

Bold And The Beautiful Spoilers Liams Health Scare Following A Fierce Confrontation With Bill

Apr 24, 2025 -

Nba

Apr 24, 2025

Nba

Apr 24, 2025 -

The Bold And The Beautiful Spoilers Finns Promise To Liam On April 23rd

Apr 24, 2025

The Bold And The Beautiful Spoilers Finns Promise To Liam On April 23rd

Apr 24, 2025 -

William Watson Scrutinizing The Liberal Platform Before You Vote

Apr 24, 2025

William Watson Scrutinizing The Liberal Platform Before You Vote

Apr 24, 2025 -

Trumps Comments On Powell Boost Us Stock Futures

Apr 24, 2025

Trumps Comments On Powell Boost Us Stock Futures

Apr 24, 2025

Latest Posts

-

Understanding Debbie Elliotts Contributions

May 12, 2025

Understanding Debbie Elliotts Contributions

May 12, 2025 -

Learn About Debbie Elliott Life Work And Impact

May 12, 2025

Learn About Debbie Elliott Life Work And Impact

May 12, 2025 -

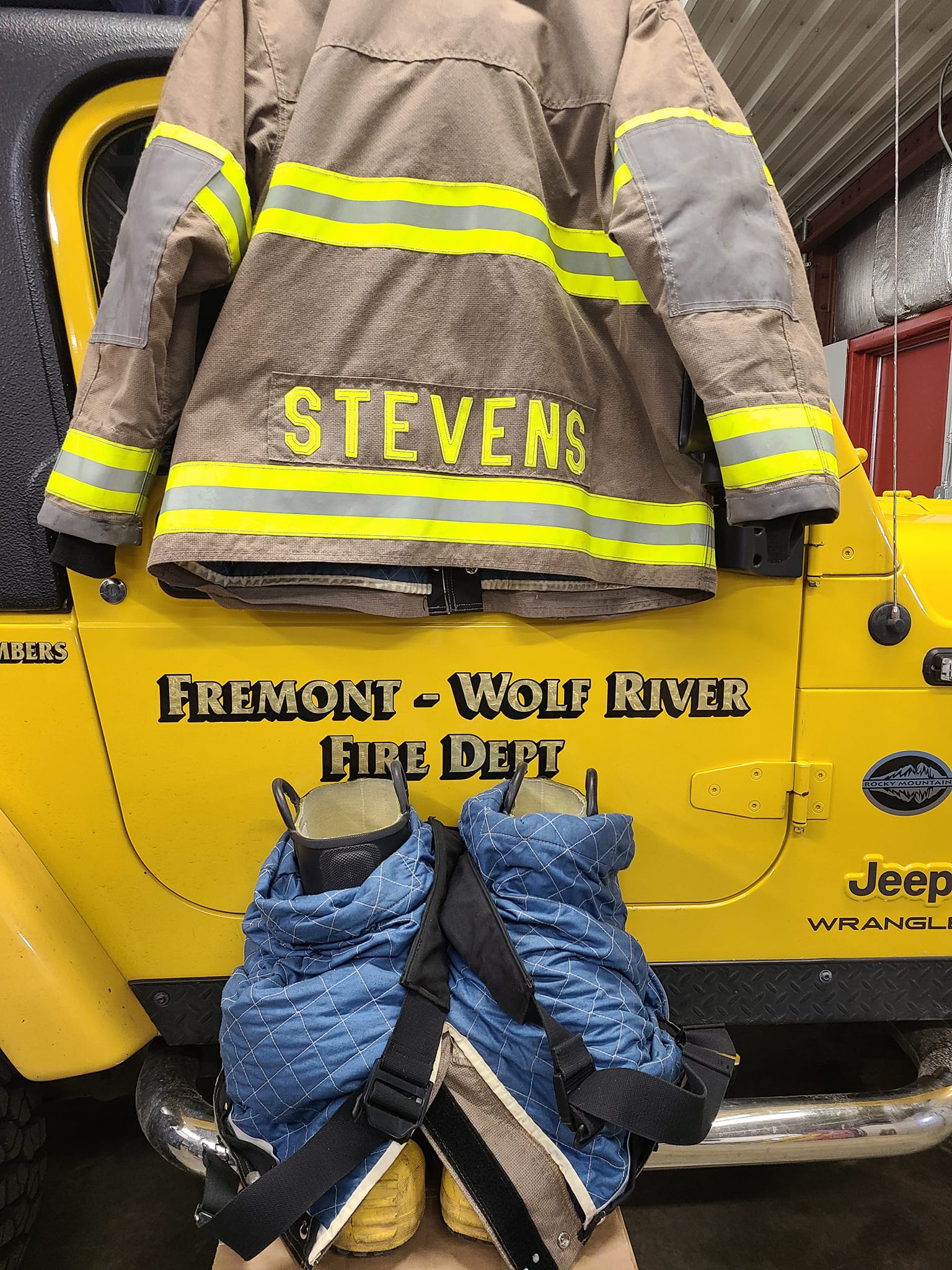

Remembering A Hero Fremont Wolf River Firefighter Honored At National Memorial

May 12, 2025

Remembering A Hero Fremont Wolf River Firefighter Honored At National Memorial

May 12, 2025 -

New Music Jessica Simpson Receives Support From Eric Johnson

May 12, 2025

New Music Jessica Simpson Receives Support From Eric Johnson

May 12, 2025 -

National Fallen Firefighters Memorial Honoring Fremonts Wolf River Firefighter

May 12, 2025

National Fallen Firefighters Memorial Honoring Fremonts Wolf River Firefighter

May 12, 2025