8% Stock Market Jump On Euronext Amsterdam: Impact Of Trump's Tariff Decision

Table of Contents

Trump's Tariff Decision and its Immediate Impact on Euronext Amsterdam

Former President Trump's decision to significantly reduce tariffs on certain imported goods into the United States had an immediate and dramatic effect on the Euronext Amsterdam. This unexpected policy shift, after years of escalating trade tensions, unleashed a wave of optimism among investors.

-

Specific sectors affected by the tariff changes: The technology and manufacturing sectors, particularly those heavily reliant on US trade, saw the most significant gains. Companies exporting to the US experienced a boost in their projected profitability.

-

Initial market reaction: The market reacted almost instantaneously. Within minutes of the announcement, the Euronext Amsterdam index began its dramatic climb, ultimately reaching an 8% increase within the trading day. This swift and substantial rise was unprecedented in recent market history.

-

Mention of any press releases or official statements: Press releases from several major players on the Euronext Amsterdam highlighted the positive impact of the reduced tariffs, reinforcing the market's enthusiastic response. Official statements from the Dutch government expressed cautious optimism.

Analysis of the Contributing Factors Beyond the Tariff Decision

While Trump's tariff decision was the primary catalyst for the Euronext Amsterdam stock market jump, other factors likely contributed to the magnitude of the rise.

-

Global economic indicators: Positive global economic indicators, such as stronger-than-expected GDP growth in several key European economies and signs of easing inflation, contributed to a generally positive investor sentiment.

-

Investment strategies and large-scale buy orders: Large institutional investors likely capitalized on the opportunity, placing substantial buy orders, amplifying the upward momentum. This coordinated buying activity further fueled the rapid increase in market value.

-

Overall investor sentiment and market confidence: The tariff decision, coupled with positive global economic data, significantly boosted investor confidence, leading to a more risk-on approach and increased willingness to invest. This overall positive sentiment acted as a multiplier on the initial impact of the tariff news.

The Long-Term Implications for Euronext Amsterdam and the European Market

The long-term effects of both the tariff decision and the resulting Euronext Amsterdam stock market jump remain to be seen.

-

Sustained growth or potential correction: While the initial surge is impressive, the market may experience a period of consolidation or even a correction as investors assess the longer-term implications of the tariff changes and the broader economic landscape.

-

Impact on foreign direct investment (FDI): The increased confidence could attract significant foreign direct investment into the Netherlands, boosting economic activity and creating jobs. This positive impact could potentially outweigh any negative impacts from future market corrections.

-

Overall economic consequences for businesses: Businesses operating on the Euronext Amsterdam stand to benefit from increased demand and improved access to the US market. However, they must adapt to potential shifts in the global economic landscape and carefully manage their exposure to risks.

Comparison with other European Stock Markets

The impact of Trump's tariff decision wasn't limited to the Euronext Amsterdam. Other European stock markets also reacted, albeit with varying degrees of intensity.

-

Performance of the London Stock Exchange (LSE), Frankfurt Stock Exchange (FWB), and Paris Euronext: The LSE and FWB experienced more modest gains, reflecting a more nuanced response to the tariff news. The Paris Euronext showed a similar, though slightly smaller, positive reaction compared to Amsterdam.

-

Differences in market reactions: These differences in market response can be attributed to the varying sectoral compositions of each exchange and the unique exposure of companies listed on those exchanges to US markets.

-

Comparative analysis of the sectors most affected: Technology and manufacturing sectors across all European markets experienced a positive impact, but the magnitude of the effect varied depending on the specific companies and their degree of reliance on US trade.

Expert Opinions and Predictions

Financial experts offer a range of opinions on the future outlook for Euronext Amsterdam following this significant event.

-

Quotes from reputable sources: Many analysts predict sustained, albeit possibly moderated, growth, while others caution against potential short-term volatility. Several economic forecasts suggest a positive outlook for the Netherlands and the broader European economy in the coming year.

-

Summary of prevailing market sentiment: The prevailing market sentiment is cautiously optimistic, reflecting both the positive effects of the tariff reduction and concerns about potential future economic uncertainty.

-

Predictions regarding potential risks and opportunities: Potential risks include global economic slowdowns, geopolitical instability, and future changes in trade policy. Opportunities lie in increased investment, economic growth, and expanded access to global markets.

Conclusion

The 8% Euronext Amsterdam stock market jump, triggered by Trump's tariff decision, presents a complex scenario with both short-term and long-term implications for the Dutch and European economies. While the immediate impact was undeniably positive, understanding the contributing factors and considering expert opinions is crucial for navigating the future. To stay informed about further developments and the ongoing impact of this significant event on the Euronext Amsterdam stock market, continue following reputable financial news sources and conducting your own in-depth research on the Euronext Amsterdam stock market jump and related market analyses. Remember to consult with a financial advisor before making any investment decisions based on this or any other market event.

Featured Posts

-

Porsche Cayenne Gts Coupe Czy Spelnia Oczekiwania

May 24, 2025

Porsche Cayenne Gts Coupe Czy Spelnia Oczekiwania

May 24, 2025 -

Ferrari Boss Condemns Hamiltons Controversial Remarks

May 24, 2025

Ferrari Boss Condemns Hamiltons Controversial Remarks

May 24, 2025 -

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In Het Groen

May 24, 2025

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In Het Groen

May 24, 2025 -

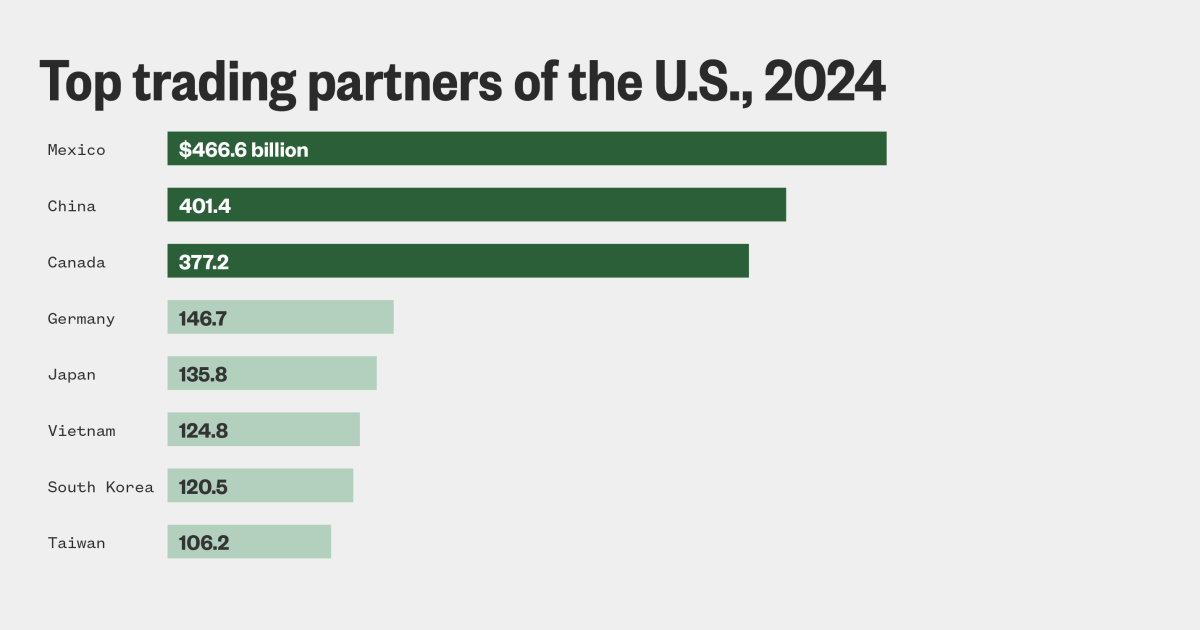

Lvmh Q1 Sales Miss Expectations Shares Fall 8 2

May 24, 2025

Lvmh Q1 Sales Miss Expectations Shares Fall 8 2

May 24, 2025 -

Escape To The Country Top Locations For A Country Lifestyle

May 24, 2025

Escape To The Country Top Locations For A Country Lifestyle

May 24, 2025

Latest Posts

-

Repetitive Documents An Ai Solution For Creating A Poop Podcast

May 24, 2025

Repetitive Documents An Ai Solution For Creating A Poop Podcast

May 24, 2025 -

Ai Digest Transforming Repetitive Documents Into Informative Poop Podcasts

May 24, 2025

Ai Digest Transforming Repetitive Documents Into Informative Poop Podcasts

May 24, 2025 -

Lab Owners Guilty Plea Faking Covid 19 Test Results During Pandemic

May 24, 2025

Lab Owners Guilty Plea Faking Covid 19 Test Results During Pandemic

May 24, 2025 -

Utilizing Orbital Space Crystals For Superior Drug Production

May 24, 2025

Utilizing Orbital Space Crystals For Superior Drug Production

May 24, 2025 -

Space Crystals And Pharmaceutical Advancement Exploring New Frontiers In Drug Research

May 24, 2025

Space Crystals And Pharmaceutical Advancement Exploring New Frontiers In Drug Research

May 24, 2025