A Billionaire's Path: Examining The Canadian Successor To Warren Buffett

Table of Contents

Identifying Potential Candidates: Who Could Be the Next Canadian Warren Buffett?

Finding a true "Warren Buffett successor" requires identifying individuals who embody his key characteristics: a commitment to long-term value investing, a mastery of fundamental analysis, exceptional business acumen, and a strong ethical compass. While no one can perfectly replicate Buffett's legendary career, several prominent Canadian investors and business leaders exhibit some of these qualities. We’ll focus on identifying those who exemplify the principles of successful long-term value investing within the Canadian stock market. To be considered, candidates must demonstrate a proven track record in portfolio management, achieving consistent growth through careful stock picking and a nuanced understanding of fundamental analysis.

Several factors are critical in evaluating potential candidates. These include:

- Long-term investment horizon: A consistent focus on long-term value creation rather than short-term gains.

- Fundamental analysis expertise: A deep understanding of a company's financials, competitive landscape, and management team.

- Disciplined investment approach: Sticking to a well-defined investment philosophy, avoiding emotional decision-making.

- Risk mitigation strategies: Implementing strategies to protect capital and minimize potential losses.

Let's consider three potential candidates:

-

Candidate 1: (Insert Name & Company): Known for their focus on undervalued Canadian companies in the resource sector, this investor employs a classic value investing strategy, seeking companies with strong fundamentals but trading below their intrinsic value. Their investment style is characterized by thorough due diligence and a long-term perspective. Key investments include (mention specific investments and their success).

-

Candidate 2: (Insert Name & Company): This individual heads a diversified investment firm with a strong track record in both public and private markets. Their approach integrates value investing principles with a focus on identifying growth opportunities within emerging sectors of the Canadian economy. Notable successes include (mention specific investments and their success).

-

Candidate 3: (Insert Name & Company): This Canadian billionaire built their empire through a combination of shrewd real estate investments and strategic acquisitions. Their investment style is characterized by patient capital allocation and a focus on long-term appreciation. Their portfolio often includes diverse assets including equities and real estate.

Investment Strategies: A Comparison to Warren Buffett's Approach

The investment strategies of our potential candidates share some similarities with Warren Buffett's approach, although each has unique characteristics. Like Buffett, these investors emphasize fundamental analysis, seeking companies with strong balance sheets, sustainable competitive advantages ("moats"), and competent management teams. They share a preference for long-term investments, avoiding speculative trading and focusing on the intrinsic value of assets.

-

Comparison of investment philosophies: While all three share a commitment to value investing, their specific approaches vary. Candidate 1 focuses on specific sectors, while Candidate 2 emphasizes diversification.

-

Analysis of their portfolio compositions: Each candidate's portfolio reflects their individual investment philosophy and risk tolerance. Some might hold concentrated positions in a few select companies, while others prefer a more diversified approach.

-

Assessment of their risk tolerance and management techniques: All three demonstrate a calculated approach to risk, often employing strategies like diversification and thorough due diligence to mitigate potential losses. However, their risk tolerance might differ based on their age, experience, and investment goals.

Building a Business Empire: Lessons from Their Success Stories

The success stories of our potential Canadian Warren Buffetts are rich in lessons for aspiring entrepreneurs and investors. Their journeys demonstrate the importance of:

-

Innovation: Identifying and capitalizing on emerging opportunities within the Canadian market.

-

Adaptability: Adjusting strategies to changing market conditions and economic trends.

-

Leadership: Building strong teams and fostering a culture of excellence.

-

Strategic Partnerships: Leveraging relationships to gain access to resources and opportunities.

-

Key milestones in their career paths: Understanding the critical decisions and pivotal moments that shaped their trajectories.

-

Strategies for overcoming challenges and setbacks: Learning from their mistakes and adapting their approaches.

-

Lessons learned from their business experiences: Extracting valuable insights that can be applied to other business ventures.

Philanthropy and Social Responsibility: The Canadian Perspective

While financial success is significant, the social responsibility and philanthropic contributions of these potential candidates also merit examination. Similar to Warren Buffett's well-known charitable giving, many successful Canadian business leaders actively engage in philanthropy and corporate social responsibility initiatives. This commitment reflects their values and contributes to the broader Canadian community.

- Examples of their charitable work: Identifying and highlighting their contributions to various causes.

- Their views on corporate social responsibility: Understanding their perspectives on the role of businesses in contributing to social good.

- Impact of their philanthropic efforts: Assessing the positive impact of their contributions on society.

Conclusion

Identifying a true "Canadian Successor to Warren Buffett" requires considering more than just financial success; it necessitates examining long-term investment strategies, ethical business practices, and significant contributions to society. While no single individual perfectly mirrors Buffett's unique journey, the candidates explored in this article demonstrate many of the qualities that define a truly great investor. By studying their investment strategies, business acumen, and philanthropic endeavors, aspiring investors can learn valuable lessons and potentially chart their own path to financial success. By following in the footsteps of these Canadian investment success stories, and by mastering Canadian investment strategies, you too can pursue the path to building wealth and making a lasting impact. Continue researching these individuals and discover your own path to success inspired by the best examples of a "Canadian Successor to Warren Buffett."

Featured Posts

-

Summer Walkers Near Fatal Childbirth Experience

May 09, 2025

Summer Walkers Near Fatal Childbirth Experience

May 09, 2025 -

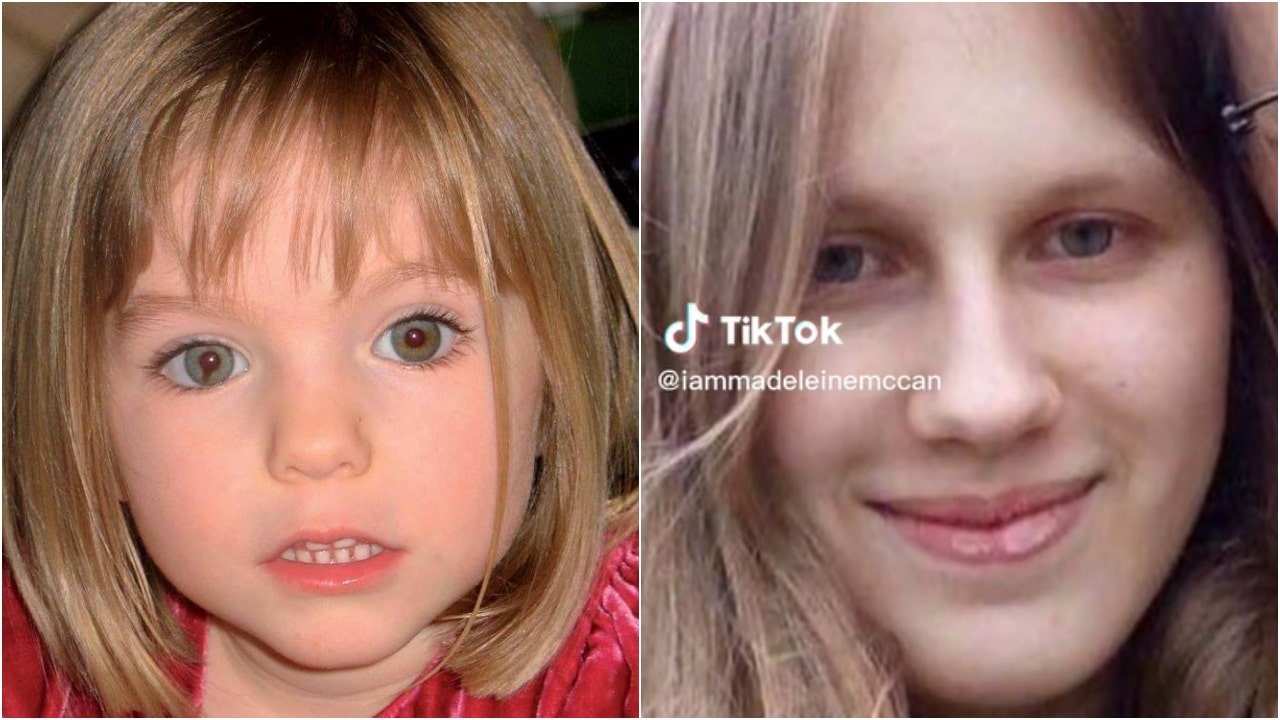

Madeleine Mc Cann Case Polish Woman Charged With Stalking Following Bristol Airport Incident

May 09, 2025

Madeleine Mc Cann Case Polish Woman Charged With Stalking Following Bristol Airport Incident

May 09, 2025 -

Leon Draisaitl Injury Oilers Star Out Against Winnipeg

May 09, 2025

Leon Draisaitl Injury Oilers Star Out Against Winnipeg

May 09, 2025 -

Palantir Stock Is It Worth Investing In Right Now Market Analysis And Predictions

May 09, 2025

Palantir Stock Is It Worth Investing In Right Now Market Analysis And Predictions

May 09, 2025 -

Pam Bondis Reaction To James Comers Epstein Files Comments

May 09, 2025

Pam Bondis Reaction To James Comers Epstein Files Comments

May 09, 2025