A Cryptocurrency's Unexpected Strength During The Trade War

Table of Contents

Safe Haven Asset During Geopolitical Uncertainty

Cryptocurrencies, particularly Bitcoin, are increasingly recognized as potential safe haven assets during periods of geopolitical uncertainty like trade wars. This stems from several key factors:

- Decentralization: Unlike traditional financial systems vulnerable to government intervention and manipulation, Bitcoin's decentralized nature protects it from direct control by any single entity. This is crucial during trade wars, where government policies can significantly impact markets.

- Limited Supply: Bitcoin's fixed supply of 21 million coins acts as a hedge against inflation. Trade disputes often lead to inflationary pressures, making Bitcoin an attractive alternative for investors seeking to preserve their purchasing power.

- Increased Demand: During times of uncertainty, the demand for Bitcoin often increases as investors seek refuge in assets perceived as less volatile than traditional markets. This increased demand fuels price appreciation.

- Historical Performance: Examining Bitcoin's performance during previous geopolitical events reveals a pattern of increased demand and price appreciation during times of heightened global uncertainty. This reinforces its potential as a safe haven asset.

Increased Demand from Investors Seeking Alternatives

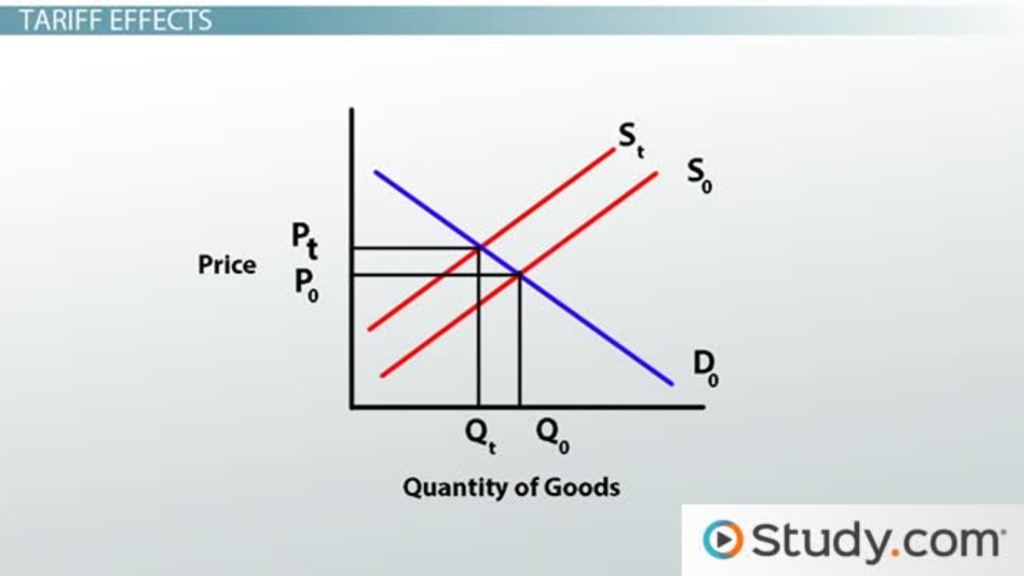

Trade wars disrupt traditional markets, causing uncertainty in stock and bond markets and raising concerns about currency devaluation. This often pushes investors to diversify their portfolios and seek alternative investments, including cryptocurrencies:

- Stock and Bond Market Uncertainty: Trade wars create uncertainty in traditional markets, leading to volatility and potential losses. Investors seek assets perceived as less correlated to these traditional markets.

- Currency Devaluation Concerns: Trade conflicts can weaken national currencies, making investors search for assets that are not subject to the same risks.

- Diversification Strategies: Increasingly, sophisticated investors are incorporating cryptocurrencies into their portfolios as a means of diversification to mitigate risk.

- Institutional Cryptocurrency Investment: The growing institutional investment in Bitcoin and other cryptocurrencies further validates their position as an alternative asset class.

Technological Advantages and Decentralization as a Buffer

The inherent characteristics of cryptocurrencies, such as decentralization and blockchain technology, contribute to their resilience during economic stress caused by trade wars:

- Transparency and Immutability: Blockchain transactions are transparent and immutable, making them resistant to manipulation or censorship, unlike some traditional financial systems.

- Resistance to Censorship: Cryptocurrency transactions are not subject to the same level of regulatory oversight or censorship as traditional financial transactions, offering a degree of freedom during periods of geopolitical tension.

- Global Accessibility: Cryptocurrencies are accessible globally, regardless of geographical location or political boundaries, making them an attractive option during trade wars that might disrupt traditional cross-border transactions.

- Comparison with Traditional Systems: The vulnerabilities of traditional financial systems to geopolitical events, such as sanctions and capital controls, are starkly contrasted by the relative resilience of decentralized cryptocurrencies.

Specific Examples of Cryptocurrency Performance During Recent Trade Wars

Analyzing Bitcoin's price movements during periods of heightened trade tensions reveals a correlation between trade war escalation and increased demand for Bitcoin. (Include charts and graphs here illustrating price movements and trading volume spikes during periods of trade war uncertainty. Cite reputable data sources for accuracy.) This analysis demonstrates that Bitcoin often sees increased trading volume and price appreciation during periods of market instability.

Conclusion: Understanding a Cryptocurrency's Unexpected Strength During the Trade War

This article has explored the unexpected strength of cryptocurrencies, like Bitcoin, during trade wars. We've demonstrated that they function as safe haven assets due to their decentralized nature and limited supply, benefit from investors seeking alternatives to volatile traditional markets, and leverage technological advantages inherent in blockchain technology. Understanding this resilience is crucial for navigating increasingly complex geopolitical landscapes. Learn more about how to navigate the complexities of cryptocurrency investment during trade wars and discover the potential of using cryptocurrencies as a hedge against future trade disputes. Developing effective cryptocurrency investment strategies during trade wars is crucial for mitigating risk in today's volatile global environment.

Featured Posts

-

Live Stream Inter Vs Barcelona Uefa Champions League Match

May 08, 2025

Live Stream Inter Vs Barcelona Uefa Champions League Match

May 08, 2025 -

Daily Lotto Results Thursday 17th April 2025

May 08, 2025

Daily Lotto Results Thursday 17th April 2025

May 08, 2025 -

Bitcoin Price Surge Trade Tensions Boost Crypto Market

May 08, 2025

Bitcoin Price Surge Trade Tensions Boost Crypto Market

May 08, 2025 -

Chinas Economic Strategy Lower Rates And Increased Lending In Response To Tariffs

May 08, 2025

Chinas Economic Strategy Lower Rates And Increased Lending In Response To Tariffs

May 08, 2025 -

Pnjab 8 Ays Pyz Awr 21 Dy Ays Pyz Ke Tqrr W Tbadlwn Ky Tfsylat

May 08, 2025

Pnjab 8 Ays Pyz Awr 21 Dy Ays Pyz Ke Tqrr W Tbadlwn Ky Tfsylat

May 08, 2025