A Place In The Sun: Essential Considerations Before Buying Overseas Property

Table of Contents

Financial Planning for Overseas Property Purchase

Purchasing overseas property requires meticulous financial planning. Failing to account for all associated costs can lead to significant financial strain and potentially jeopardize your investment.

Budgeting and Financing

Before you even start browsing properties, create a comprehensive budget. Consider these vital costs:

- Purchase Price: The initial cost of the property itself.

- Legal Fees: Costs associated with solicitors, conveyancers, and legal representation.

- Taxes: Stamp duty, property transfer taxes, and other relevant taxes in the country of purchase.

- Transfer Fees: Fees associated with transferring ownership of the property.

- Agency Commissions: Fees paid to real estate agents facilitating the purchase.

- Renovation Costs: If planning renovations, budget accordingly. Unexpected repairs are also common.

- Ongoing Expenses: Factor in yearly property taxes, insurance premiums, maintenance costs, and potential rental management fees if you plan to rent out the property.

Explore financing options early on:

- International Mortgages: Research mortgage providers offering international loans. Interest rates and terms vary significantly.

- Foreign Currency Exchange: Understand exchange rate fluctuations and their impact on your loan repayments.

- Tax Implications of Financing: Consult a tax advisor to understand the tax implications of financing your overseas property purchase. Interest deductions may be available.

- Pre-Approval: Secure pre-approval for a mortgage before you begin your property search to avoid disappointment.

Currency Fluctuations

Currency exchange rates are volatile. A seemingly affordable property can become significantly more expensive due to unfavorable exchange rate movements.

- Risk Mitigation: Use currency hedging strategies to minimize the risk of losses due to currency fluctuations.

- Financial Advisor: Consult a financial advisor specializing in international transactions for expert guidance.

- Transaction Costs: Be aware of the fees associated with currency conversions. These can add up over the course of the transaction.

Legal and Regulatory Considerations for Overseas Property

Navigating the legal aspects of buying overseas property is paramount. Mistakes can be costly and time-consuming to rectify.

Due Diligence

Thorough due diligence is essential to protect your investment.

- Title and Ownership: Verify the property's title and ensure clear legal ownership.

- Local Solicitor: Engage a reputable local solicitor or lawyer experienced in international property transactions.

- Documentation Verification: Examine all documentation, including planning permissions and compliance with building regulations.

- Outstanding Debts: Check for any outstanding debts, liens, or encumbrances on the property.

Taxation and Residency Implications

Understand the tax implications in both your home country and the country where you're buying property.

- Tax Research: Research capital gains tax, property taxes, inheritance taxes, and other relevant taxes in both jurisdictions.

- Residency Status: Determine the impact of property ownership on your residency status. This can have significant tax implications.

- Tax Professional: Seek professional advice from a tax specialist experienced in international taxation.

Lifestyle and Practical Aspects of Overseas Property Ownership

Beyond the financial and legal considerations, think carefully about the practicalities of owning a property overseas.

Location, Location, Location

Choosing the right location is critical. Consider:

- Community Research: Thoroughly research the local community, its infrastructure, amenities, and the prevailing climate.

- Essential Services: Assess proximity to transportation links, healthcare facilities, and essential services.

- Lifestyle Alignment: Ensure the location aligns with your lifestyle preferences and needs.

- Multiple Visits: Visit the location multiple times before making a final decision. Experience it in different seasons.

Property Maintenance and Management

Owning property remotely presents challenges.

- Maintenance Challenges: Consider potential maintenance and management difficulties.

- Property Management: Explore options for hiring a property management company or local contractors.

- Travel Costs: Factor in travel costs and time commitment for managing your property.

- Long-Term Upkeep: Assess long-term upkeep and repair costs. Unexpected repairs can be expensive.

Conclusion

Buying overseas property presents a unique opportunity for investment and lifestyle change. However, careful planning and preparation are paramount. By thoroughly researching financial implications, legal considerations, and practical aspects, you can significantly increase your chances of a successful and rewarding experience. Remember to conduct thorough due diligence, secure appropriate financing, and understand the tax and legal implications before making an offer on your dream overseas property. Don't let the allure of a "place in the sun" blind you to the crucial steps involved in this exciting venture. Start planning your overseas property purchase today!

Featured Posts

-

Justice Department Action School Desegregation Order And Future Litigation

May 03, 2025

Justice Department Action School Desegregation Order And Future Litigation

May 03, 2025 -

Kivinin Kabugu Yenir Mi Faydalari Riskleri Ve Tueketim Oenerileri

May 03, 2025

Kivinin Kabugu Yenir Mi Faydalari Riskleri Ve Tueketim Oenerileri

May 03, 2025 -

Rupert Lowe Mp Police Inquiry Underway

May 03, 2025

Rupert Lowe Mp Police Inquiry Underway

May 03, 2025 -

Canadian Dollar Rises After Trumps Comments On Carney Deal

May 03, 2025

Canadian Dollar Rises After Trumps Comments On Carney Deal

May 03, 2025 -

Lion Storages 1 4 G Wh Bess Project In The Netherlands Financial Close Achieved

May 03, 2025

Lion Storages 1 4 G Wh Bess Project In The Netherlands Financial Close Achieved

May 03, 2025

Latest Posts

-

1 4 26

May 04, 2025

1 4 26

May 04, 2025 -

Chefsache Esc 2025 Sonderedition Gestartet

May 04, 2025

Chefsache Esc 2025 Sonderedition Gestartet

May 04, 2025 -

Warren Buffett Denies Trump Tariff Support All Reports False

May 04, 2025

Warren Buffett Denies Trump Tariff Support All Reports False

May 04, 2025 -

1 4

May 04, 2025

1 4

May 04, 2025 -

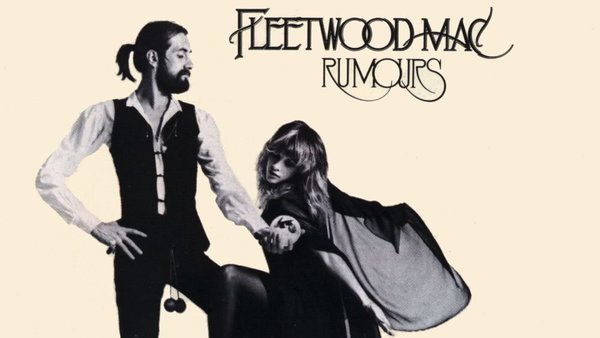

The Enduring Influence Of Fleetwood Mac A Supergroups Impact

May 04, 2025

The Enduring Influence Of Fleetwood Mac A Supergroups Impact

May 04, 2025