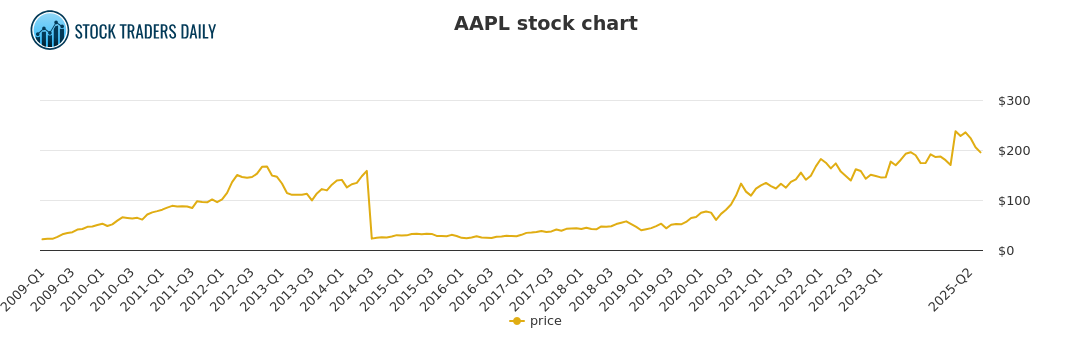

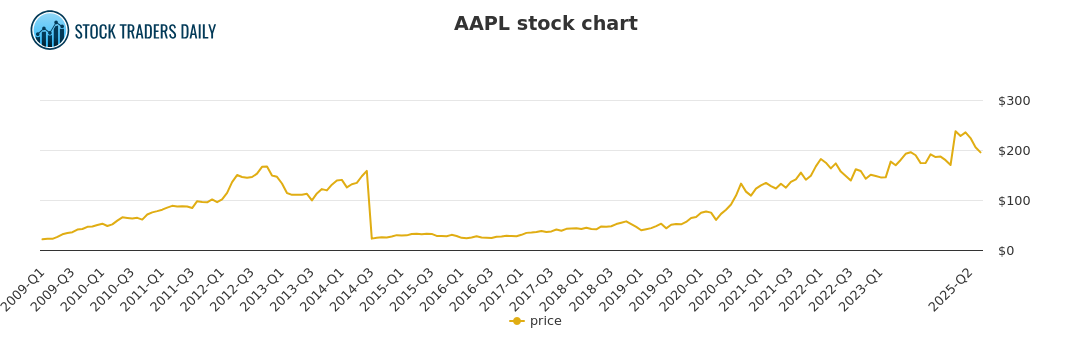

AAPL Stock Forecast: Important Price Levels And Trading Strategies

Table of Contents

Identifying Key Support and Resistance Levels for AAPL

Understanding support and resistance levels is crucial for any AAPL stock forecast. Support levels represent price points where buying pressure is strong enough to prevent further price declines, while resistance levels mark price points where selling pressure outweighs buying pressure, hindering further price increases. Technical analysis tools help identify these levels.

-

Moving Averages: Simple moving averages (SMA) and exponential moving averages (EMA) smooth out price fluctuations, revealing potential support and resistance zones. For example, the 50-day and 200-day moving averages are often used as significant indicators.

-

Fibonacci Retracements: This tool identifies potential support and resistance levels based on Fibonacci ratios, providing insights into potential price reversal points after a significant price move.

-

Historical Data: Examining AAPL's historical price charts can reveal past support and resistance levels, offering potential clues for future price movements. These levels often act as magnets, attracting buying or selling pressure.

Examples of Historical Support and Resistance (Illustrative – Always check current charts):

- $150: Historically acted as strong support.

- $175: A significant resistance level in the past.

(Insert Chart Here showing historical AAPL price with marked support and resistance levels)

- How to identify support levels using chart patterns: Look for "double bottoms" or "triple bottoms" indicating potential bounce points.

- How to identify resistance levels using chart patterns: Observe "double tops" or "triple tops" suggesting potential price reversals.

- Importance of volume confirmation in support/resistance levels: High volume at support/resistance levels confirms the strength of these levels.

- Potential breakouts from support/resistance – how to trade them: Breakouts can signal significant price movements; manage risk carefully.

Analyzing AAPL's Fundamental Performance and its Impact on Price

While technical analysis helps identify price levels, fundamental analysis assesses the intrinsic value of AAPL. Key indicators include:

- Earnings Per Share (EPS): Reflects AAPL's profitability on a per-share basis. Consistent EPS growth is a positive sign.

- Revenue Growth: Shows the rate at which AAPL's revenue is increasing. Strong revenue growth often translates to higher stock prices.

- Debt-to-Equity Ratio: Indicates the company's financial leverage. A lower ratio suggests better financial health.

Analyzing AAPL's 10-K and 10-Q filings provides a comprehensive picture of its financial health. News releases announcing new product launches, earnings reports, and guidance updates also significantly impact the stock price.

- Key financial ratios to watch for AAPL: Gross margin, operating margin, return on equity (ROE).

- Impact of new product launches on AAPL's stock price: New iPhones, Macs, and other products often boost investor sentiment and drive price increases.

- Effect of macroeconomic factors on AAPL’s performance: Global economic conditions, interest rates, and currency fluctuations can affect AAPL's performance.

- Analyzing analyst ratings and price targets: While not always accurate, analyst ratings and price targets can provide insights into market sentiment.

Effective Trading Strategies for AAPL Stock

Different trading strategies suit various risk tolerances:

-

Swing Trading: Holding AAPL for a few days to several weeks, aiming to profit from short-to-medium-term price swings. Requires identifying clear entry and exit points based on technical indicators and price action.

-

Day Trading: Holding AAPL for a few minutes to hours, aiming to capitalize on intraday price fluctuations. Requires quick decision-making and a deep understanding of technical analysis. High risk.

-

Long-Term Investing: Holding AAPL for years, based on the belief in the company's long-term growth potential. A lower-risk approach.

-

Swing trading AAPL: Identifying entry and exit points: Use moving averages, support/resistance, and relative strength index (RSI).

-

Day trading AAPL: Using technical indicators for short-term trades: Employ indicators like RSI, MACD, and stochastic oscillators.

-

Long-term investing in AAPL: A buy-and-hold strategy: Focus on the company’s fundamentals and long-term growth prospects.

-

Risk management strategies for AAPL trading: Use stop-loss orders to limit potential losses and diversify your portfolio.

Understanding Market Sentiment and its Influence on AAPL's Price

Market sentiment – the overall feeling of investors towards AAPL – heavily influences its price. Bullish sentiment drives prices up, while bearish sentiment pushes them down. Gauge sentiment through:

-

News Articles: Monitor financial news outlets for reports on AAPL and the overall market.

-

Social Media: Analyze social media sentiment towards AAPL using sentiment analysis tools.

-

Options Trading: High implied volatility in AAPL options suggests increased uncertainty and potentially heightened volatility.

-

Using sentiment analysis tools to gauge market sentiment: Several tools can analyze social media and news articles to quantify market sentiment.

-

Identifying potential market turning points based on sentiment shifts: Extreme bullish or bearish sentiment might signal potential reversals.

-

Interpreting options market data to understand market sentiment: High put/call ratios could suggest bearish sentiment.

Conclusion: Making Informed Decisions with Your AAPL Stock Forecast

Developing a robust AAPL stock forecast involves combining fundamental and technical analysis, understanding key support and resistance levels, and gauging market sentiment. Remember that no trading strategy guarantees profits, and risk management is crucial. Conduct thorough research, develop a trading plan that aligns with your risk tolerance, and use the insights from this article to refine your AAPL stock forecast and trading strategies. Explore additional resources, including financial news websites and educational materials, to enhance your understanding of AAPL stock and the broader market. Start building your informed AAPL stock forecast today!

Featured Posts

-

England Airpark And Alexandria International Airport Promoting Local And International Travel With Ae Xplore

May 25, 2025

England Airpark And Alexandria International Airport Promoting Local And International Travel With Ae Xplore

May 25, 2025 -

Krasivaya Data Svadeb 89 Par Sozdali Semi Na Kharkovschine

May 25, 2025

Krasivaya Data Svadeb 89 Par Sozdali Semi Na Kharkovschine

May 25, 2025 -

Nippon U S Steel Deal A Deep Dive Into Trumps Decision And Its Significance

May 25, 2025

Nippon U S Steel Deal A Deep Dive Into Trumps Decision And Its Significance

May 25, 2025 -

Brezhnev Ryazanov I Garazh Za Kulisami Satiry I Politicheskoy Intrigi

May 25, 2025

Brezhnev Ryazanov I Garazh Za Kulisami Satiry I Politicheskoy Intrigi

May 25, 2025 -

Georgia Man Charged With Murder 19 Years After Wifes Killing And Flight With Nanny

May 25, 2025

Georgia Man Charged With Murder 19 Years After Wifes Killing And Flight With Nanny

May 25, 2025

Latest Posts

-

From Scatological Documents To Engaging Podcasts An Ai Solution

May 25, 2025

From Scatological Documents To Engaging Podcasts An Ai Solution

May 25, 2025 -

Ai Powered Podcast Creation Analyzing And Transforming Scatological Data

May 25, 2025

Ai Powered Podcast Creation Analyzing And Transforming Scatological Data

May 25, 2025 -

Turning Poop Into Podcast Gold Ai Digest For Repetitive Documents

May 25, 2025

Turning Poop Into Podcast Gold Ai Digest For Repetitive Documents

May 25, 2025 -

Dogecoin Price Prediction Considering Elon Musks Role

May 25, 2025

Dogecoin Price Prediction Considering Elon Musks Role

May 25, 2025 -

The Impact Of Elon Musks Actions On The Dogecoin Price

May 25, 2025

The Impact Of Elon Musks Actions On The Dogecoin Price

May 25, 2025