Nippon-U.S. Steel Deal: A Deep Dive Into Trump's Decision And Its Significance

Table of Contents

The Context: Rising Trade Tensions and Steel Tariffs

The Nippon-U.S. Steel deal wasn't made in a vacuum. It emerged from a period of escalating trade tensions between the US and several countries, particularly concerning the steel sector. President Trump, citing unfair trade practices and the need to protect American jobs, initiated a series of protectionist measures.

- Rising US steel imports and their impact on domestic producers: A surge in imported steel, particularly from countries like China and Japan, depressed prices and threatened the viability of American steel mills. This led to job losses and plant closures in the US steel industry.

- Trump administration's rationale behind imposing steel tariffs: The Trump administration argued that these imports were “dumped” – sold below market value – and subsidized by foreign governments, giving them an unfair competitive advantage. Steel tariffs were seen as a necessary tool to level the playing field.

- Specific concerns about unfair trade practices from Japan: While not as severe as concerns regarding China, the US government expressed concerns about certain Japanese steel practices, arguing they negatively impacted American producers.

- Reactions from Japanese steelmakers and the government: Japanese steelmakers and the government reacted with a mixture of concern and opposition. They argued that the tariffs were protectionist and would disrupt established trade relationships. Negotiations commenced to find a mutually acceptable solution.

The Nippon-U.S. Steel Deal: Key Provisions and Negotiations

The resulting Nippon-U.S. Steel deal aimed to address US concerns while mitigating the negative consequences for Japanese steel exporters. The specifics of the agreement remain somewhat opaque, but key features include:

- Quotas or tariffs imposed on Japanese steel exports to the US: The exact details varied depending on the type of steel, but the agreement involved either quotas limiting the volume of steel Japan could export to the US or tariffs increasing the cost of imported steel.

- Concessions made by both sides during the negotiations: Both sides made concessions. Japan likely agreed to limit its steel exports to the US, while the US may have offered some assurances regarding future trade relations.

- Timeline of the negotiations and key players involved: The negotiations unfolded over several months, involving representatives from both governments, along with lobbying groups representing steel manufacturers on both sides of the Pacific.

- The role of lobbying groups in influencing the deal: Powerful lobbying groups from both the US and Japanese steel industries heavily influenced the negotiations, advocating for their respective interests.

Impact on the US Steel Industry

The Nippon-U.S. Steel deal had a mixed impact on the US steel industry:

- Short-term and long-term impacts on US steel production: In the short term, the deal provided some relief to domestic producers by limiting competition from Japan. However, the long-term effects are more complex and debated.

- Changes in employment levels within the US steel industry: While some jobs were potentially saved or created in the short term, the long-term impact on employment is uncertain, given the evolving global steel market.

- Price fluctuations in the US steel market: The deal likely led to some price increases in the US steel market, benefiting domestic producers but potentially harming downstream industries.

- Impact on related industries (e.g., automotive, construction): The increased steel prices resulting from the deal could have cascading effects on industries that rely heavily on steel, such as the automotive and construction sectors.

Impact on the Japanese Steel Industry

The consequences for the Japanese steel industry were also significant:

- Changes in Japanese steel exports to the US and other markets: Japanese steelmakers had to adjust their export strategies, potentially diverting exports to other markets.

- Adjustments in Japanese steel production and capacity: The reduced access to the US market may have led to adjustments in Japanese steel production and capacity.

- Impact on Japanese steel company profits and competitiveness: Japanese steel companies experienced a decline in profits from reduced US exports, affecting their overall competitiveness.

- Governmental response and support measures for the Japanese steel industry: The Japanese government likely implemented measures to support its steel industry, potentially through subsidies or other forms of assistance.

Long-Term Implications and Geopolitical Significance

The Nippon-U.S. Steel deal holds broader implications:

- The deal's impact on the broader US-Japan trade relationship: The deal strained the broader US-Japan trade relationship, highlighting the complexities of navigating trade disputes between major economic powers.

- Effects on global steel prices and market dynamics: The deal impacted global steel prices and market dynamics, affecting producers and consumers worldwide.

- Lessons learned about trade negotiations and protectionist policies: The deal provided lessons regarding the effectiveness and consequences of protectionist policies in international trade negotiations.

- Comparison to other similar trade agreements and disputes: The deal can be compared to other similar trade disputes and agreements, offering valuable insights into the dynamics of international trade policy.

Conclusion

The Nippon-U.S. Steel deal, a product of President Trump's protectionist trade policies, significantly impacted both the US and Japanese steel industries. While offering short-term relief to some US producers, the long-term consequences remain a subject of ongoing debate. Understanding the nuances of the Nippon-U.S. Steel Deal is crucial for comprehending the complexities of international trade and the impact of protectionist policies. Further research into this and other similar Nippon-U.S. Steel trade agreements can offer valuable insights into the future of global commerce.

Featured Posts

-

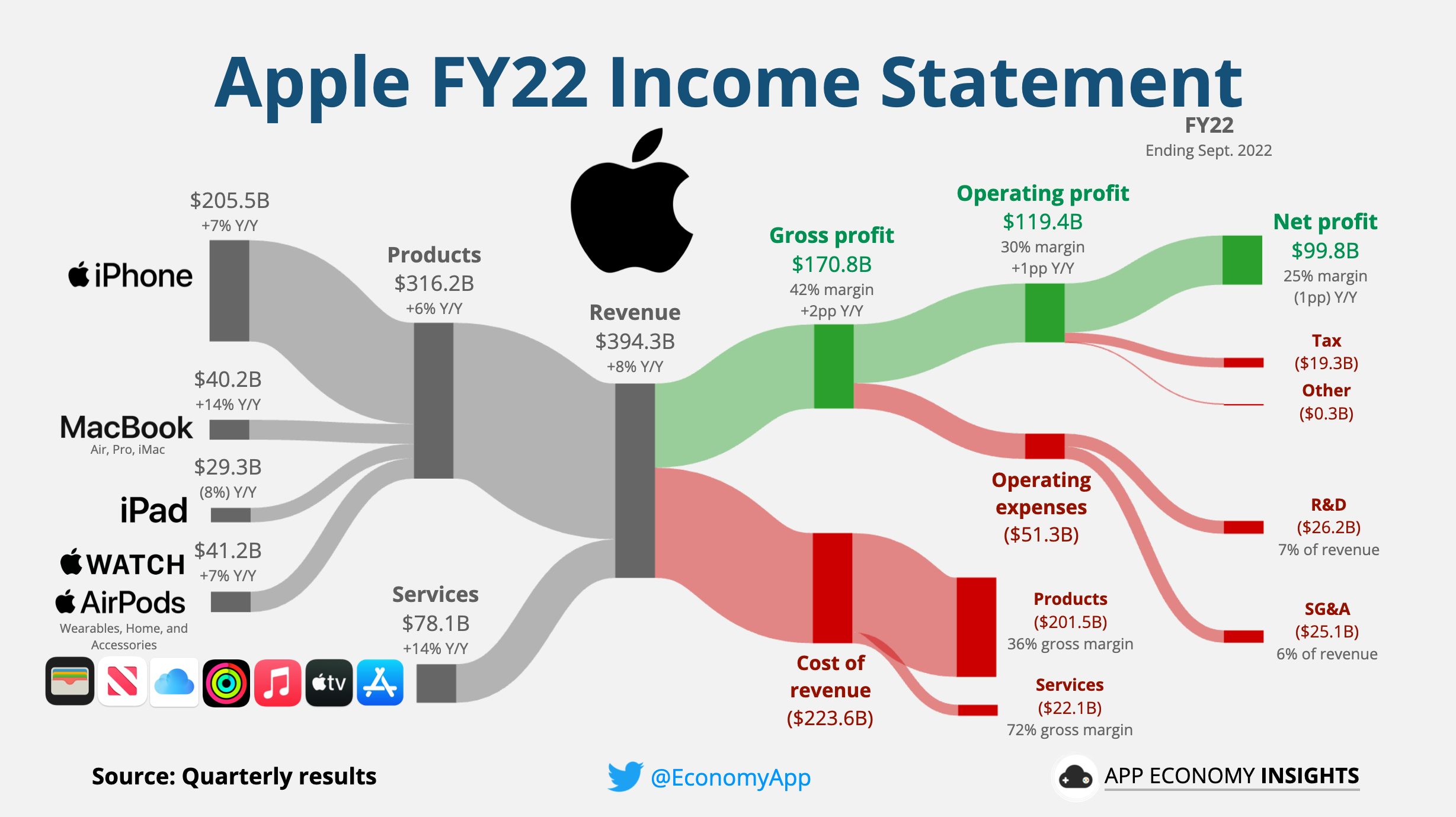

Analyzing Apple Stock Before The Q2 Earnings Release

May 25, 2025

Analyzing Apple Stock Before The Q2 Earnings Release

May 25, 2025 -

Skolko Let Personazham Filma O Bednom Gusare Zamolvite Slovo Podrobniy Analiz

May 25, 2025

Skolko Let Personazham Filma O Bednom Gusare Zamolvite Slovo Podrobniy Analiz

May 25, 2025 -

Apple Stock Analysis Of Q2 Results And Future Outlook

May 25, 2025

Apple Stock Analysis Of Q2 Results And Future Outlook

May 25, 2025 -

M6 Drivers Face Significant Delays Following Van Crash

May 25, 2025

M6 Drivers Face Significant Delays Following Van Crash

May 25, 2025 -

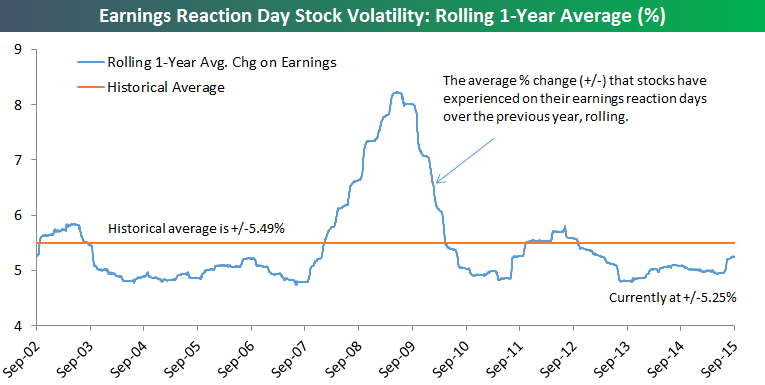

Apples Q2 Earnings Impact On Stock Price

May 25, 2025

Apples Q2 Earnings Impact On Stock Price

May 25, 2025

Latest Posts

-

Fanatik Gazetesi Atletico Madrid Barcelona Macini Canli Izleyin

May 25, 2025

Fanatik Gazetesi Atletico Madrid Barcelona Macini Canli Izleyin

May 25, 2025 -

Atletico Madrid Barcelona Maci Canli Yayin Son Dakika Futbol Haberleri

May 25, 2025

Atletico Madrid Barcelona Maci Canli Yayin Son Dakika Futbol Haberleri

May 25, 2025 -

Canli Izle Atletico Madrid Barcelona Macinin Heyecani Fanatik Te

May 25, 2025

Canli Izle Atletico Madrid Barcelona Macinin Heyecani Fanatik Te

May 25, 2025 -

Atletico Madrid Barcelona Maci Canli Izle Fanatik Gazetesi Nden Anlik Guencellemeler

May 25, 2025

Atletico Madrid Barcelona Maci Canli Izle Fanatik Gazetesi Nden Anlik Guencellemeler

May 25, 2025 -

Atletico Madrid In Zaferi 3 Maclik Durgunluk Asildi

May 25, 2025

Atletico Madrid In Zaferi 3 Maclik Durgunluk Asildi

May 25, 2025