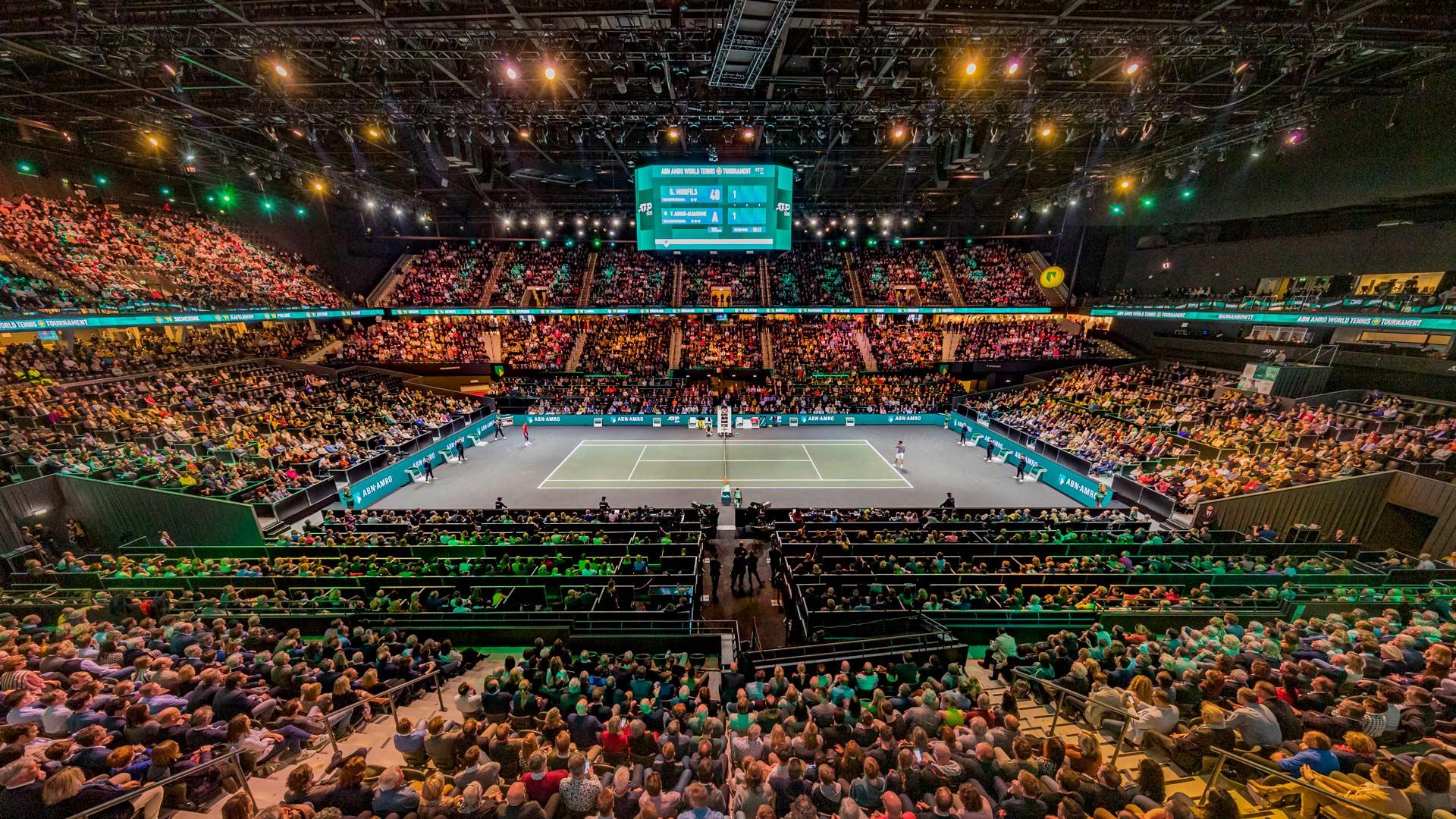

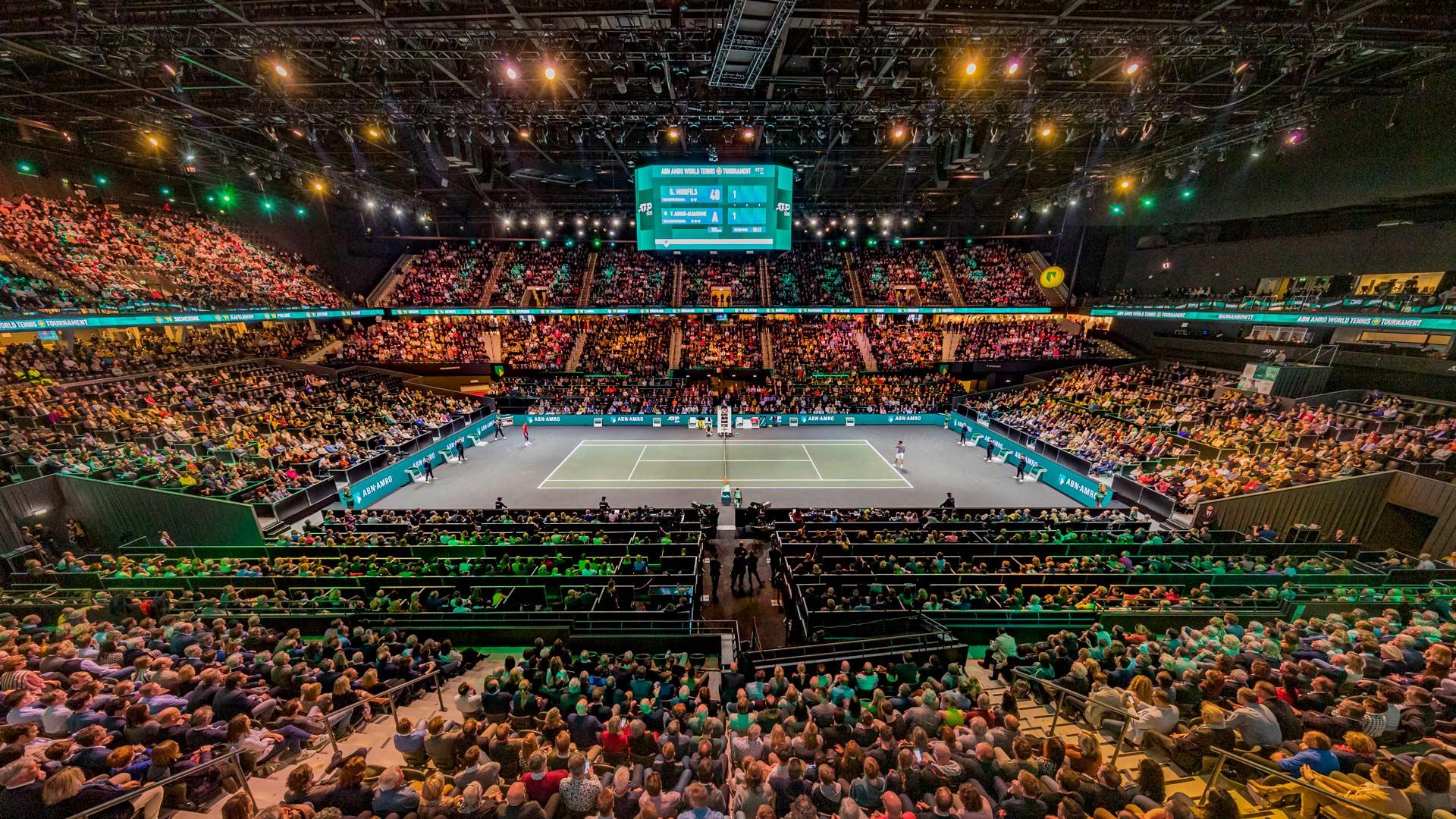

ABN Amro Bonus Scheme Under Scrutiny: Dutch Regulator Eyes Potential Penalties

Table of Contents

Allegations of Misconduct in the ABN Amro Bonus Scheme

Allegations swirling around the ABN Amro bonus scheme center on concerns that bonuses were potentially linked to excessively risky behavior, potentially violating Dutch banking regulations. The DNB investigation is examining whether the bank adequately assessed and mitigated these risks. The core issue appears to be a disconnect between the reward structure and responsible risk management practices.

- Specific examples of alleged misconduct: While specific details remain largely confidential due to the ongoing investigation, press reports suggest that certain bonuses were awarded despite significant losses incurred in high-risk investment strategies.

- Details about the types of bonuses awarded: The scheme reportedly included both performance-based bonuses and long-term incentive plans, with payouts often tied to short-term profitability targets. This incentivized short-term gains potentially at the expense of long-term stability and responsible risk management.

- The number of employees potentially affected by the investigation: The exact number of employees affected is unclear, but it’s understood the investigation encompasses a significant portion of staff involved in relevant areas.

Related Keywords: ABN Amro bonus scandal, DNB investigation, Dutch banking regulation, risk management failure, financial misconduct.

De Nederlandsche Bank's Investigation and Potential Penalties

De Nederlandsche Bank (DNB), the Dutch central bank and financial regulator, has launched a thorough investigation into the ABN Amro bonus scheme. The DNB's investigation process involves a detailed review of internal documents, interviews with employees, and analysis of the bank's risk management systems.

- Timeline of the investigation: The investigation commenced in [Insert Start Date if available], and its duration remains uncertain.

- Potential penalties facing ABN Amro: Potential penalties for ABN Amro could range from substantial fines to restrictions on its operations, impacting its future business activities. Further, reputational damage could lead to difficulties in attracting and retaining talent.

- The DNB's statement on the matter: While the DNB typically avoids public comment during ongoing investigations, it has confirmed the investigation's existence and expressed its commitment to ensuring regulatory compliance within the Dutch banking sector.

Related Keywords: DNB sanctions, ABN Amro fines, financial penalties, regulatory compliance, Dutch central bank, banking supervision.

Impact on ABN Amro's Reputation and Share Price

The investigation into the ABN Amro bonus scheme has already had a noticeable impact on the bank's reputation and share price. Negative press coverage and uncertainty surrounding the potential penalties have eroded investor confidence.

- Changes in investor confidence: The investigation has undoubtedly shaken investor confidence, potentially impacting future investments and lending opportunities.

- Fluctuations in ABN Amro's share price: The bank's share price has experienced volatility since news of the investigation emerged, reflecting market concerns about the potential financial and reputational ramifications.

- Potential damage to the bank's brand image: The scandal could tarnish the bank's reputation, damaging its ability to attract and retain customers and employees.

Related Keywords: ABN Amro share price, reputational damage, investor confidence, financial markets, brand crisis management.

The Broader Implications for Dutch Banking Practices

The ABN Amro bonus scheme investigation has significant implications for the broader Dutch banking sector. It serves as a stark reminder of the need for robust risk management and ethical compensation practices.

- Potential changes in bonus structures across Dutch banks: The investigation is likely to prompt a review of bonus structures across other Dutch banks, potentially leading to more conservative and carefully scrutinized compensation packages.

- Increased regulatory scrutiny of bonus schemes: The DNB's actions signal a heightened focus on regulatory oversight of bonus schemes within the Dutch banking sector. Expect more frequent and rigorous audits of compensation practices.

- The potential for stricter enforcement of banking regulations: The investigation underscores the DNB's commitment to enforcing banking regulations, setting a precedent for stricter penalties for non-compliance.

Related Keywords: Dutch banking reform, banking regulation, financial sector reform, bonus culture, responsible banking.

Conclusion

The ABN Amro bonus scheme investigation highlights the critical importance of regulatory compliance and responsible risk management within the financial sector. The potential penalties facing ABN Amro serve as a stark warning to other financial institutions. The ongoing scrutiny underscores the need for transparency and responsible compensation practices to maintain investor confidence and public trust. To stay informed about the latest developments in this evolving situation and other crucial aspects of the ABN Amro bonus scheme, continue following reputable financial news sources. Stay updated on the implications of this case for the future of ABN Amro bonus scheme structures and the wider financial landscape. Understanding the implications of the ABN Amro bonus scheme investigation is crucial for all stakeholders.

Featured Posts

-

Sta Se Krije Iza Promene Imena Vanje Mijatovic

May 21, 2025

Sta Se Krije Iza Promene Imena Vanje Mijatovic

May 21, 2025 -

Abn Amro Under Scrutiny For Bonus Practices Potential Fine Looms

May 21, 2025

Abn Amro Under Scrutiny For Bonus Practices Potential Fine Looms

May 21, 2025 -

Chennai Wtt Star Contender A Record 19 Paddlers From India

May 21, 2025

Chennai Wtt Star Contender A Record 19 Paddlers From India

May 21, 2025 -

Is Beenie Mans New York Concert The Future Of It Streaming

May 21, 2025

Is Beenie Mans New York Concert The Future Of It Streaming

May 21, 2025 -

Arne Slot Liverpools Lucky Psg Win And The Worlds Best Goalkeeper

May 21, 2025

Arne Slot Liverpools Lucky Psg Win And The Worlds Best Goalkeeper

May 21, 2025

Latest Posts

-

Auto Dealers Double Down On Opposition To Ev Sales Requirements

May 21, 2025

Auto Dealers Double Down On Opposition To Ev Sales Requirements

May 21, 2025 -

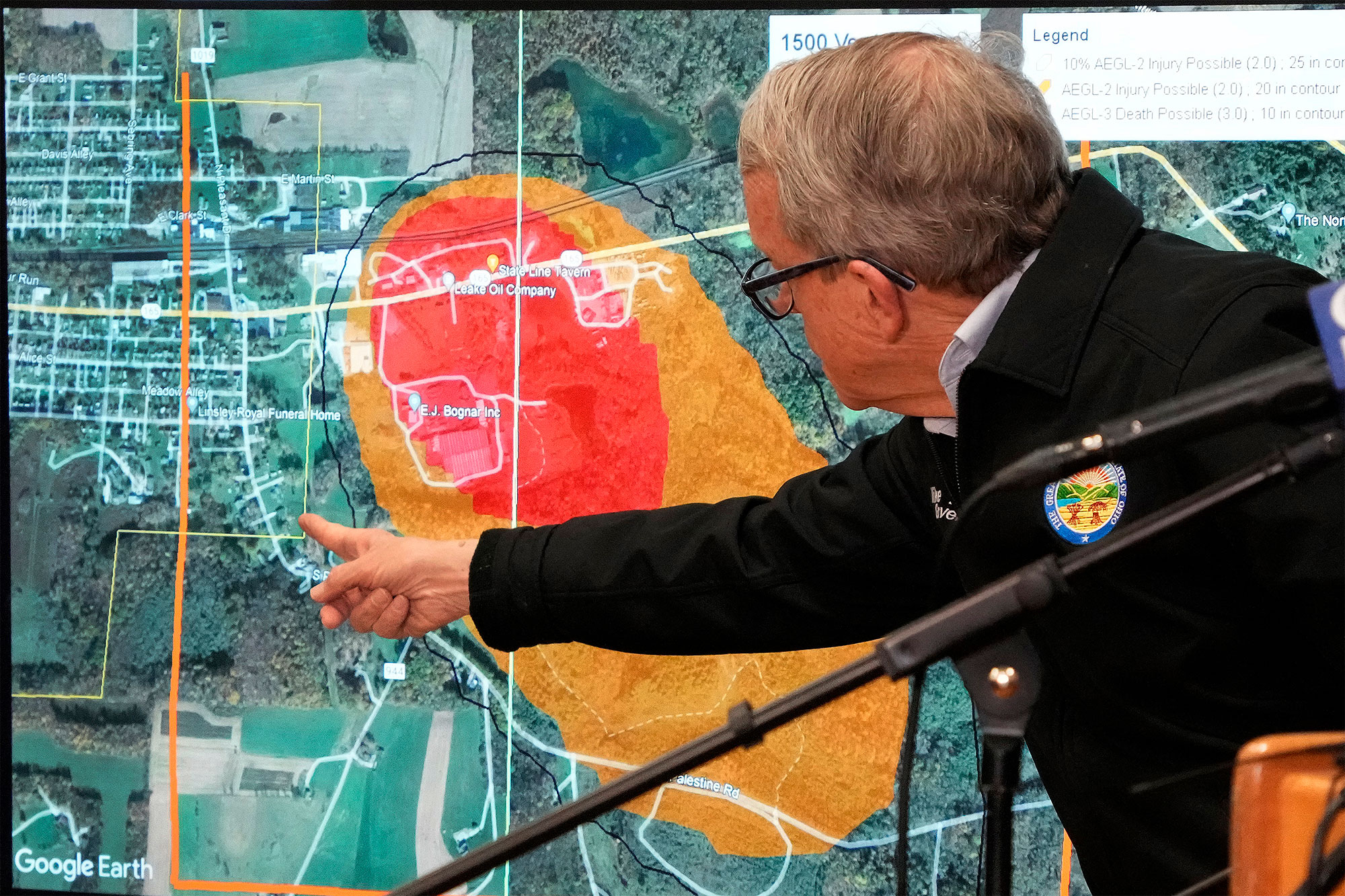

Long Term Effects Of Toxic Chemicals From Ohio Train Derailment On Buildings

May 21, 2025

Long Term Effects Of Toxic Chemicals From Ohio Train Derailment On Buildings

May 21, 2025 -

Ohio Train Derailment Aftermath Investigation Into Lingering Toxic Chemicals

May 21, 2025

Ohio Train Derailment Aftermath Investigation Into Lingering Toxic Chemicals

May 21, 2025 -

T Mobile Hit With 16 Million Fine Over Three Years Of Data Breaches

May 21, 2025

T Mobile Hit With 16 Million Fine Over Three Years Of Data Breaches

May 21, 2025 -

Building Voice Assistants Made Easy Open Ais Latest Tools And Technologies

May 21, 2025

Building Voice Assistants Made Easy Open Ais Latest Tools And Technologies

May 21, 2025