ABN Amro: Dutch Central Bank Investigates Bonus Payments

Table of Contents

The Nature of the Investigation

The DNB's investigation into ABN Amro's bonus payments is a significant development in the Dutch financial landscape. The scope of the investigation remains somewhat unclear, but initial reports suggest it encompasses a broad range of compensation practices, not just specific bonus schemes. The DNB's concerns are multi-faceted. They likely stem from suspicions that the bonus structure may have incentivized excessive risk-taking, potentially jeopardizing the bank's financial health and breaching regulatory guidelines. There are also concerns about potential breaches in financial regulations related to transparency and proper disclosure of compensation information.

- Scope: The investigation likely covers multiple years of bonus payments, potentially stretching back several years to allow for a thorough examination of historical trends and their impact. The exact timeframe hasn't been officially disclosed.

- Concerns: Key concerns revolve around potential failures in risk management associated with the bonus structure. Did the incentives encourage actions that put the bank at undue risk? The DNB is also likely scrutinizing the bank's compliance with regulatory guidelines on executive compensation and transparency.

- Potential Penalties: If the investigation finds ABN Amro to be non-compliant, the penalties could be substantial. These could range from substantial fines to restrictions on future operations and even reputational damage that could affect the bank's standing in the market. In extreme cases, senior management could face personal consequences.

ABN Amro's Response to the Investigation

ABN Amro has issued an official statement acknowledging the DNB's investigation. The bank has publicly expressed its full cooperation with the authorities, highlighting its commitment to transparency and regulatory compliance. While the exact details of their internal response remain confidential, they have indicated they are conducting their own internal investigation to fully understand the issues raised by the DNB. This internal review is likely to include a reassessment of their existing bonus structures and compensation policies.

- Official Statement: ABN Amro's public statement emphasizes its commitment to upholding the highest ethical and regulatory standards. They have pledged to provide the DNB with all necessary information and cooperation throughout the investigation.

- Internal Investigations: The bank's internal investigation will likely involve a thorough review of documents, interviews with relevant personnel, and an assessment of their compliance protocols. The findings could lead to significant changes in compensation policies.

- Executive Statements: Public statements from ABN Amro's CEO and other senior executives are crucial in managing the bank's reputation during this period. Their messages emphasize cooperation and a commitment to improving internal processes.

Wider Implications for the Dutch Banking Sector

The DNB's investigation into ABN Amro's bonus payments has broader ramifications for the entire Dutch banking sector. It sends a strong signal that regulators are actively monitoring compensation practices and are prepared to take action against institutions that fail to meet regulatory standards. This could trigger a domino effect, prompting other Dutch banks to review their bonus structures and ensure full compliance with all relevant regulations.

- Impact on Other Banks: Other Dutch banks are likely to increase their scrutiny of their own bonus schemes and compensation practices to ensure they align with regulatory expectations and mitigate potential risks.

- Regulatory Changes: The findings of the investigation could lead to further regulatory changes in the Netherlands, potentially involving stricter rules on executive compensation, increased transparency requirements, and enhanced supervisory oversight.

- Investor Confidence: The investigation could impact investor confidence in the Dutch banking sector, leading to increased market volatility and potentially affecting the cost of capital for affected institutions. Transparency and responsible practices are vital to regaining trust.

Comparison with International Banking Practices

Comparing ABN Amro's practices to international standards reveals variations in regulatory approaches towards executive compensation. While many international banks operate under the broad umbrella of Basel accords, the specifics of bonus structures differ significantly depending on national regulations and cultural norms. Some countries have implemented stricter rules on bonus caps and deferred compensation to mitigate excessive risk-taking. This international comparison underscores the need for a globally harmonized approach to executive compensation within the banking sector to prevent regulatory arbitrage and ensure a level playing field.

- International Benchmarking: A detailed comparison with bonus structures at similar-sized international banks can provide valuable insights into best practices and highlight areas where ABN Amro might fall short.

- Basel Accords and Beyond: The investigation will undoubtedly highlight the role of international regulatory frameworks, such as the Basel accords, in shaping and limiting bonus structures within banks globally.

- Cross-Country Variations: The comparison will reveal differences in regulatory approaches to executive compensation, some stricter than others, showcasing the need for a more globally consistent approach.

Conclusion

The Dutch Central Bank's investigation into ABN Amro's bonus payments highlights ongoing concerns about executive compensation and its impact on risk management within the banking sector. The investigation's outcome will have significant implications for ABN Amro, the Dutch banking landscape, and potentially the broader international discussion on responsible banking practices. The scrutiny over ABN Amro bonus payments serves as a crucial reminder of the importance of ethical and transparent compensation policies in the financial industry.

Call to Action: Stay updated on the latest developments in this ongoing investigation of ABN Amro bonus payments. Follow us for further analysis and insights into the impact on the Dutch banking sector and financial regulations. Keep checking back for updates on the ABN Amro bonus payment scandal.

Featured Posts

-

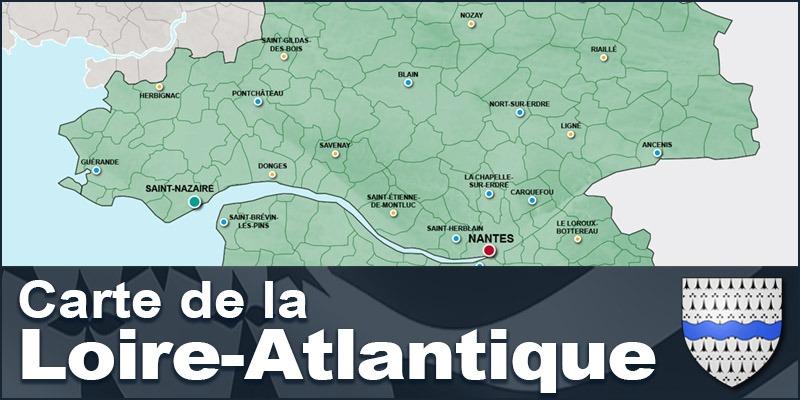

Itineraires Cyclistes En Loire Atlantique Nantes Le Vignoble Et L Estuaire

May 21, 2025

Itineraires Cyclistes En Loire Atlantique Nantes Le Vignoble Et L Estuaire

May 21, 2025 -

L Evolution De L Agriculture A Moncoutant Sur Sevre Et Clisson Diversification Et Progres

May 21, 2025

L Evolution De L Agriculture A Moncoutant Sur Sevre Et Clisson Diversification Et Progres

May 21, 2025 -

Ea Fc 24 Fut Birthday A Comprehensive Player Tier List

May 21, 2025

Ea Fc 24 Fut Birthday A Comprehensive Player Tier List

May 21, 2025 -

Discover Unique Ingredients At The Manhattan Forgotten Foods Festival

May 21, 2025

Discover Unique Ingredients At The Manhattan Forgotten Foods Festival

May 21, 2025 -

Exploration De L Architecture Toscane En Petite Italie De L Ouest

May 21, 2025

Exploration De L Architecture Toscane En Petite Italie De L Ouest

May 21, 2025

Latest Posts

-

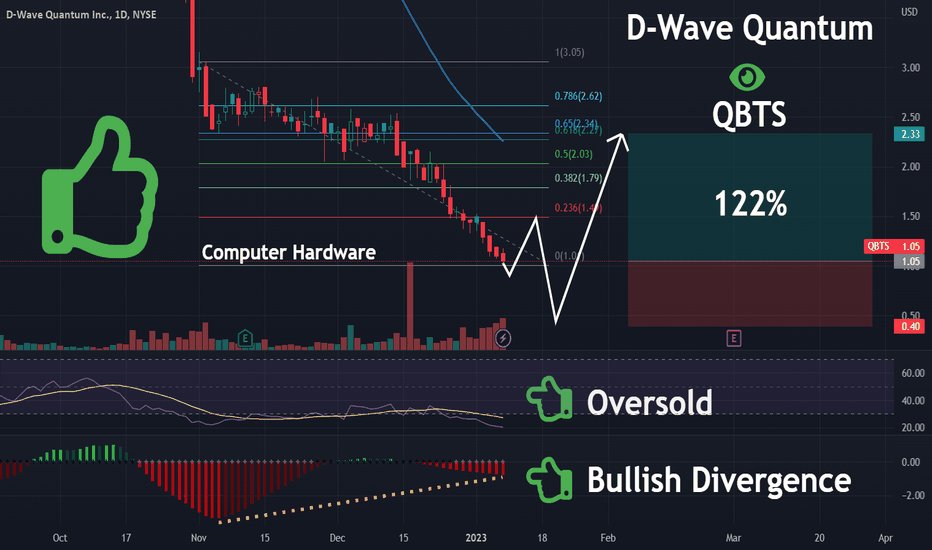

2025 Market Analysis Deconstructing The D Wave Quantum Qbts Stock Fall

May 21, 2025

2025 Market Analysis Deconstructing The D Wave Quantum Qbts Stock Fall

May 21, 2025 -

Factors Contributing To The D Wave Quantum Inc Qbts Stock Slump Of 2025

May 21, 2025

Factors Contributing To The D Wave Quantum Inc Qbts Stock Slump Of 2025

May 21, 2025 -

Understanding D Wave Quantums Qbts Stock Performance On Monday

May 21, 2025

Understanding D Wave Quantums Qbts Stock Performance On Monday

May 21, 2025 -

D Wave Quantum Qbts Stock Market Performance In 2025 A Deep Dive

May 21, 2025

D Wave Quantum Qbts Stock Market Performance In 2025 A Deep Dive

May 21, 2025 -

D Wave Quantum Qbts Stock Decline Monday Reasons And Analysis

May 21, 2025

D Wave Quantum Qbts Stock Decline Monday Reasons And Analysis

May 21, 2025