ABN Amro Under Investigation For Potential Bonus Violations

Table of Contents

Details of the Alleged ABN Amro Bonus Violations

The specifics of the alleged ABN Amro bonus violations are still emerging, but initial reports suggest irregularities in the bank's bonus scheme. The investigation focuses on potential breaches of regulatory guidelines regarding executive compensation and the fair distribution of bonuses. While the full extent of the alleged misconduct remains unclear, several key areas are under scrutiny:

- Misreporting of bonus payments: Reports suggest that ABN Amro may have misrepresented the true value of bonus payments to regulatory bodies, potentially avoiding taxes or circumventing internal controls.

- Exceeding regulatory limits: The investigation may involve allegations that ABN Amro exceeded permissible limits on executive compensation, violating established regulations designed to prevent excessive risk-taking and maintain financial stability.

- Unfair distribution of bonuses: Concerns have been raised about potential disparities in bonus allocation, with allegations that certain individuals or departments may have received disproportionately high bonuses compared to their performance or contributions.

The investigation also names specific departments and individuals potentially involved (although names haven't been publicly released at this time). This highlights the importance of robust internal controls and transparent bonus structures within financial institutions. Keywords related to this section include bonus scheme, executive compensation, regulatory compliance, financial misconduct, and internal controls.

The Regulatory Response and Ongoing Investigation

The regulatory body overseeing the investigation into the ABN Amro bonus violations is currently [Insert Name of Regulatory Body, e.g., the Dutch Central Bank (De Nederlandsche Bank or DNB)]. The scope of the investigation is broad, encompassing a thorough review of ABN Amro's bonus practices over a specific period. The investigation will likely involve:

- Document review: Scrutiny of internal documents, emails, and financial records to identify evidence of wrongdoing.

- Interviews: Questioning of current and former ABN Amro employees involved in the bonus scheme.

- Data analysis: Statistical analysis of bonus payments to detect patterns of irregularity or potential misconduct.

The potential penalties ABN Amro could face are substantial, including hefty fines, sanctions from regulatory bodies, and significant reputational damage. The timeline of the investigation is uncertain, but it's expected to be a lengthy and complex process. Relevant keywords include regulatory scrutiny, financial penalties, enforcement action, and investigation timeline.

Impact on ABN Amro's Stock Price and Reputation

The allegations of ABN Amro bonus violations have had a noticeable impact on the bank's stock price. [Insert data or chart showing stock price fluctuations since the allegations surfaced]. The negative publicity surrounding the investigation has eroded investor confidence, leading to market uncertainty and potential capital flight.

Beyond the financial implications, the scandal has severely damaged ABN Amro's reputation. The allegations undermine public trust in the bank's ethical conduct and commitment to regulatory compliance. This reputational damage could have long-term consequences, affecting customer relationships, future business prospects, and the bank's ability to attract and retain top talent. Key terms for this section include stock market reaction, reputational risk, investor confidence, and brand damage.

Potential Long-Term Consequences for ABN Amro and the Banking Sector

The ABN Amro bonus scandal has far-reaching implications, not only for the bank itself but also for the wider banking sector. The investigation highlights the need for stricter regulatory oversight of executive compensation and improved corporate governance within financial institutions.

- Increased regulatory scrutiny: Expect increased regulatory scrutiny of bonus structures across the banking industry, potentially leading to more stringent rules and stricter enforcement.

- Changes in bonus schemes: Banks may revise their bonus schemes to ensure greater transparency, fairness, and alignment with long-term performance goals.

- Enhanced ethical training: Greater emphasis on ethical conduct and compliance training for employees at all levels.

This scandal underscores the importance of ethical banking practices and the vital role of robust internal controls in maintaining public trust and financial stability. Keywords for this section include corporate governance, ethical banking, industry best practices, and future regulations.

Conclusion: The ABN Amro Bonus Scandal and the Path Forward

The allegations of ABN Amro bonus violations represent a serious blow to the bank's reputation and highlight systemic issues within the financial industry. The ongoing investigation will determine the full extent of the alleged misconduct and the consequences for ABN Amro. The outcome will undoubtedly influence future regulatory practices and corporate governance within the banking sector. To stay informed about developments in this case and similar instances of ABN Amro bonus violations or other financial misconduct, follow updates from [mention specific news sources and regulatory bodies]. Understanding these issues is crucial for anyone invested in or affected by the financial industry. Staying informed about developments in the ABN Amro bonus scandal is crucial for understanding the future landscape of ethical banking and regulatory compliance.

Featured Posts

-

Us China Trade Soars Ahead Of Trade Truce

May 22, 2025

Us China Trade Soars Ahead Of Trade Truce

May 22, 2025 -

Succession Planning Among The Super Wealthy A Rising Trend

May 22, 2025

Succession Planning Among The Super Wealthy A Rising Trend

May 22, 2025 -

Peppa Pigs Real Name A Surprise For Longtime Fans

May 22, 2025

Peppa Pigs Real Name A Surprise For Longtime Fans

May 22, 2025 -

Hellfest A Mulhouse Concert Au Noumatrouff

May 22, 2025

Hellfest A Mulhouse Concert Au Noumatrouff

May 22, 2025 -

La Multiplication Des Tours A Nantes Quelles Consequences Pour Les Cordistes

May 22, 2025

La Multiplication Des Tours A Nantes Quelles Consequences Pour Les Cordistes

May 22, 2025

Latest Posts

-

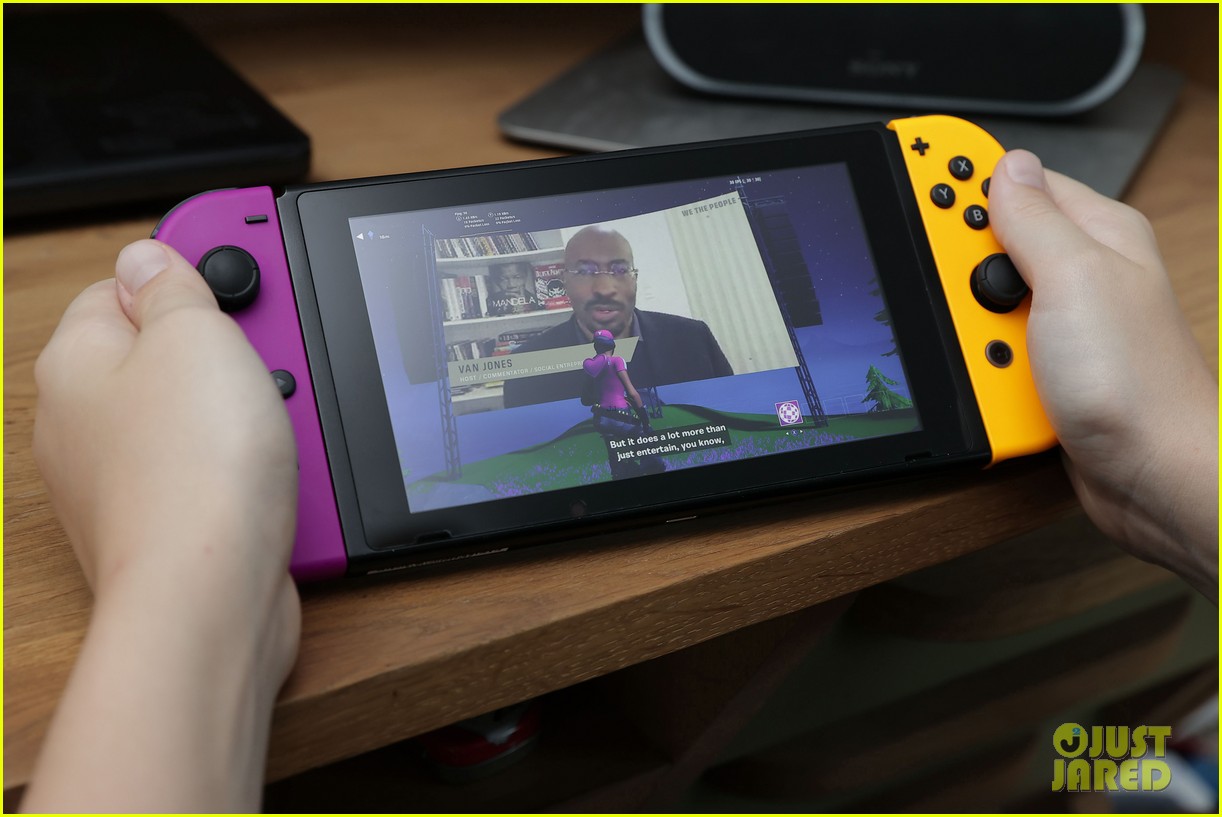

Fortnites Return To Us I Phones What You Need To Know

May 22, 2025

Fortnites Return To Us I Phones What You Need To Know

May 22, 2025 -

Fortnite Reappears On Us App Store

May 22, 2025

Fortnite Reappears On Us App Store

May 22, 2025 -

The Greatest Hot Weather Drink You Ve Never Tried

May 22, 2025

The Greatest Hot Weather Drink You Ve Never Tried

May 22, 2025 -

600 Year Old Structure In China Partially Collapses Tourist Impact Assessed

May 22, 2025

600 Year Old Structure In China Partially Collapses Tourist Impact Assessed

May 22, 2025 -

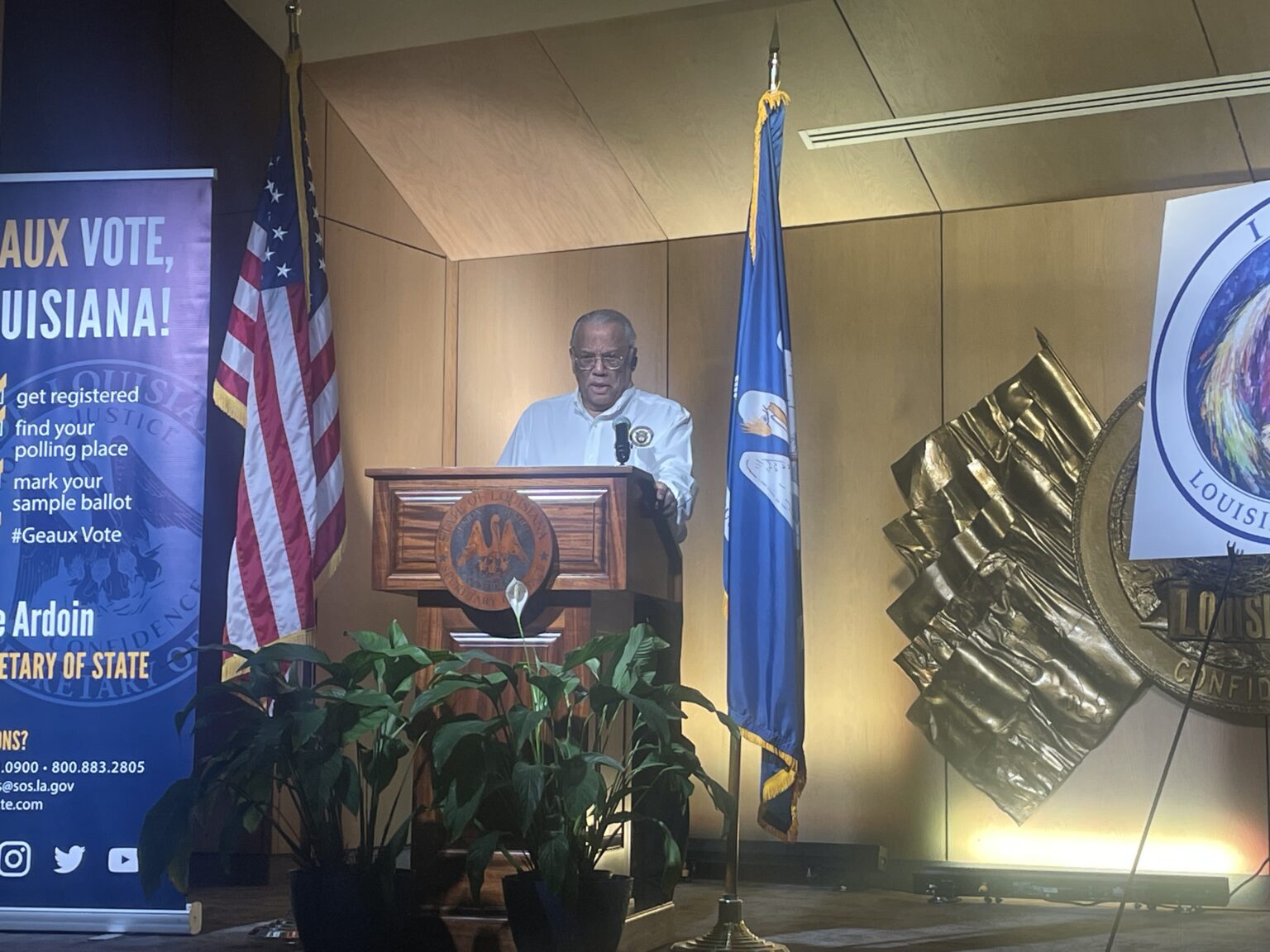

New Orleans Sheriff Withdraws From Reelection Race Amidst Ongoing Jail Escape Investigation

May 22, 2025

New Orleans Sheriff Withdraws From Reelection Race Amidst Ongoing Jail Escape Investigation

May 22, 2025