ABN AMRO: US Import Tariffs Slash Dutch Food Exports

Table of Contents

The ABN AMRO Report: Key Findings and Methodology

The ABN AMRO report, released [Insert Date], meticulously analyzed the impact of US import tariffs on Dutch food exports. Its methodology involved a comprehensive review of export data from [Insert Data Sources, e.g., Dutch Customs, industry associations] covering the period from [Insert Start Date] to [Insert End Date]. The report utilizes statistical modeling to isolate the effect of tariffs from other market factors, providing a robust assessment of their impact.

Key findings reveal a significant decrease in Dutch food exports to the US since the imposition of tariffs. The report highlights:

- A [Insert Percentage]% decrease in total Dutch food exports to the US since [Insert Date of Tariff Imposition].

- Significant impacts on key export categories, including cheese, dairy products, agricultural goods like fruits and vegetables, and processed foods. Specific examples cited include a sharp decline in exports of Gouda cheese and a substantial reduction in sales of Dutch tulips.

- Disproportionate impact on specific regions within the Netherlands, with [Insert Regions] experiencing the most severe consequences due to their higher concentration of food production and export businesses.

- Limited effectiveness of initial countermeasures employed by Dutch exporters, underscoring the severity of the tariff-related challenges.

Impact on Specific Dutch Food Sectors

The ABN AMRO report provides a sector-by-sector breakdown of the damage inflicted by US import tariffs.

-

Dairy Industry: The dairy industry has been particularly hard hit, with a significant drop in cheese exports. The report estimates a [Insert Percentage]% loss in market share for Dutch cheese in the US market, impacting both large-scale producers and smaller, artisanal cheesemakers. The decline in sales of other dairy products, like butter and yogurt, further exacerbates the situation.

-

Agricultural Sector: The agricultural sector faces similar challenges, with decreased exports of fruits, vegetables, and other agricultural goods. The report specifically mentions the impact on Dutch flower exports, noting a [Insert Percentage]% decline in US sales of tulips and other flowers. This reflects the heightened sensitivity of perishable goods to tariff-related trade disruptions.

-

Processed Food Industry: The processed food industry, encompassing packaged foods and prepared meals, has also experienced considerable difficulties. The added cost of tariffs makes Dutch products less competitive compared to domestically produced alternatives in the US, affecting market share and profitability.

Economic Consequences for the Netherlands

The consequences extend far beyond individual businesses. The ABN AMRO report estimates that the decline in Dutch food exports to the US has resulted in:

- [Insert Number] job losses in the food export sector and related industries.

- A negative impact on related industries, including logistics, packaging, and transportation, highlighting the ripple effects throughout the Dutch economy.

- Reduced GDP growth as a result of decreased export revenue and economic activity. The report estimates a potential GDP reduction of [Insert Percentage] due to reduced food exports to the US.

- Limited government response to date, with calls for more effective aid packages to support affected businesses and workers.

Future Outlook and Potential Solutions

The outlook for Dutch food exports to the US remains uncertain. However, the report suggests several potential strategies for mitigating the negative impacts of US import tariffs:

- Diversification of export markets: Reducing dependence on the US market by actively exploring opportunities in other countries with a strong demand for Dutch food products.

- Improving competitiveness: Focusing on cost reduction through process optimization and technological advancements, as well as product innovation to meet evolving consumer preferences in target markets.

- Advocacy efforts: Strengthening collaboration between Dutch food producers, industry associations, and the government to lobby for trade agreements that alleviate the impact of US tariffs.

- Projections for export recovery remain uncertain, contingent on the evolution of trade relations between the Netherlands and the US, as well as the effectiveness of the aforementioned strategies.

Conclusion

The ABN AMRO report unequivocally demonstrates the significant negative impact of US import tariffs on Dutch food exports. Across various sectors, from dairy to agriculture to processed foods, the consequences are profound, leading to job losses, reduced GDP growth, and considerable uncertainty for the future. The Dutch food industry faces a critical challenge, requiring proactive strategies for market diversification, enhanced competitiveness, and effective advocacy to mitigate the damage caused by these US import tariffs on Dutch food exports. Stay informed about the evolving situation regarding US import tariffs and their impact on Dutch food exports by regularly checking for updates from ABN AMRO and other reliable sources. Understanding these dynamics is crucial for businesses operating within this sector and for policymakers aiming to mitigate the damage.

Featured Posts

-

Abn Amro Rapport De Kwetsbaarheid Van De Voedingsindustrie Door Goedkope Arbeidsmigranten

May 21, 2025

Abn Amro Rapport De Kwetsbaarheid Van De Voedingsindustrie Door Goedkope Arbeidsmigranten

May 21, 2025 -

Abn Amro Zijn Nederlandse Huizen Wel Betaalbaar Reactie Geen Stijl

May 21, 2025

Abn Amro Zijn Nederlandse Huizen Wel Betaalbaar Reactie Geen Stijl

May 21, 2025 -

Fastest Australian Crossing Man Completes Epic Foot Race

May 21, 2025

Fastest Australian Crossing Man Completes Epic Foot Race

May 21, 2025 -

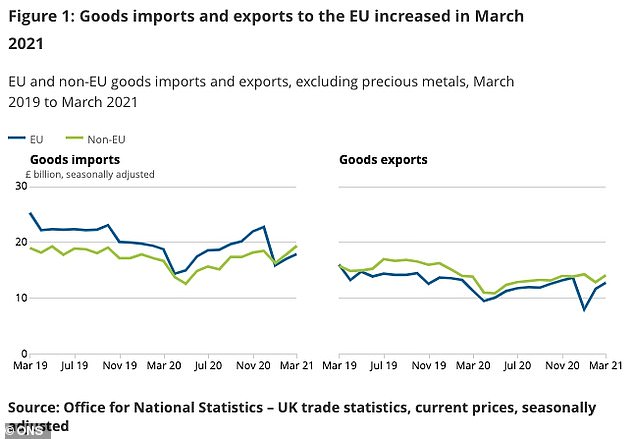

Brexit Slows Uk Luxury Exports To The Eu

May 21, 2025

Brexit Slows Uk Luxury Exports To The Eu

May 21, 2025 -

Arne Slot Liverpools Lucky Psg Win And The Worlds Best Goalkeeper

May 21, 2025

Arne Slot Liverpools Lucky Psg Win And The Worlds Best Goalkeeper

May 21, 2025

Latest Posts

-

Paley Center To Honor Gmas 50th Anniversary

May 21, 2025

Paley Center To Honor Gmas 50th Anniversary

May 21, 2025 -

Good Morning America Robin Roberts Announces Family Addition

May 21, 2025

Good Morning America Robin Roberts Announces Family Addition

May 21, 2025 -

Robin Roberts Shares Joyful Family News On Good Morning America

May 21, 2025

Robin Roberts Shares Joyful Family News On Good Morning America

May 21, 2025 -

Scorpion Sting Surprise Ramon Rodriguezs Will Trent Sleep Story

May 21, 2025

Scorpion Sting Surprise Ramon Rodriguezs Will Trent Sleep Story

May 21, 2025 -

Michael Strahans Departure From Good Morning America The Real Reason

May 21, 2025

Michael Strahans Departure From Good Morning America The Real Reason

May 21, 2025