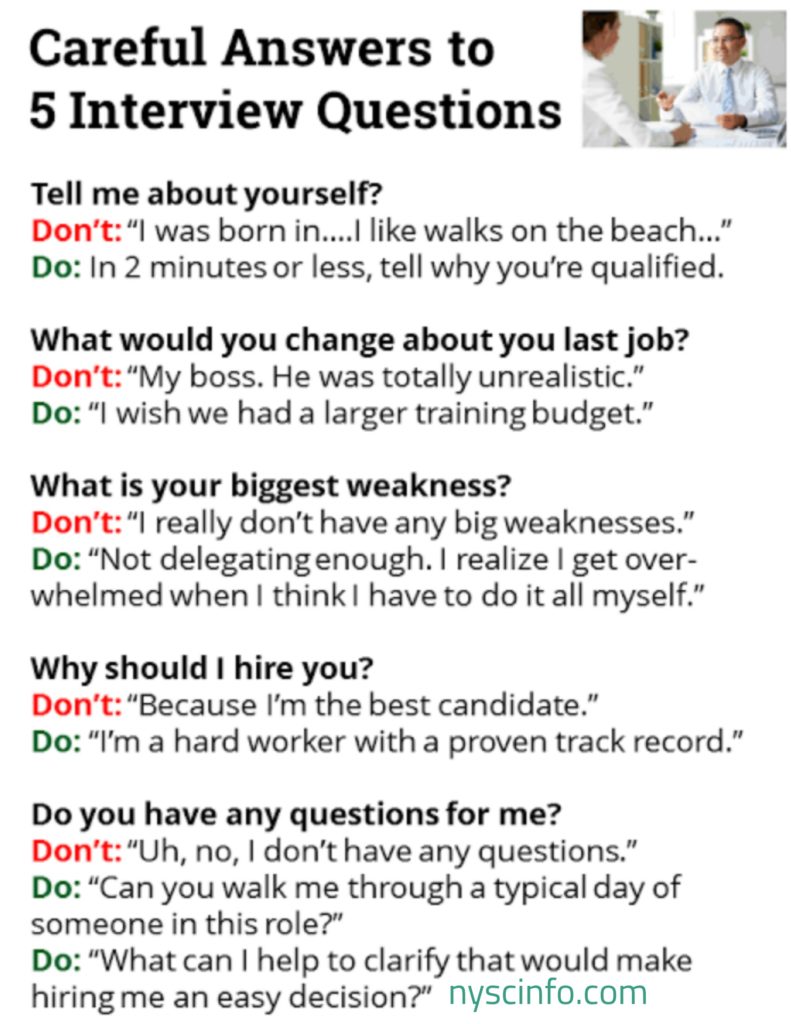

Ace Your Private Credit Job Interview: 5 Do's And Don'ts To Follow

Table of Contents

5 Do's to Ace Your Private Credit Job Interview

Do 1: Thoroughly Research the Firm and the Role

Before your private credit job interview, thorough preparation is paramount. This includes a deep dive into the firm and the specific role you're applying for.

- Understand the firm's investment strategy: What sectors do they focus on? What is their typical investment size and structure? What is their track record?

- Research recent deals: Familiarize yourself with their recent investments. This demonstrates your interest and allows you to ask insightful questions. Look at press releases and industry news.

- Identify key personnel: Understand the backgrounds and experience of the individuals you may be interviewing with. LinkedIn is a valuable resource.

- Analyze the role's responsibilities and required skills: Carefully review the job description and tailor your responses to highlight how your skills and experience directly align with their needs.

- Example: "I've followed your firm's investments in the renewable energy sector, particularly the recent acquisition of SolarBright, and I believe my expertise in distressed debt restructuring, coupled with my experience in renewable energy project finance, would be a valuable asset to your team."

Do 2: Showcase Your Financial Modeling and Analysis Skills

Private credit roles demand strong analytical skills. Be prepared to demonstrate your expertise in financial modeling and analysis.

- Master financial modeling software: Proficiency in Excel, Argus, and Bloomberg Terminal is essential. Be ready to discuss your experience with each.

- Highlight your proficiency in financial statement analysis: Demonstrate your understanding of key financial ratios, profitability analysis, and cash flow statements.

- Discuss valuation methodologies: Be prepared to explain your understanding of discounted cash flow (DCF) analysis, precedent transactions, and comparable company analysis.

- Showcase your credit risk assessment skills: Explain your approach to assessing credit risk, including qualitative and quantitative factors.

- Prepare examples of your work: Bring specific examples of your projects to showcase your analytical skills and problem-solving abilities. Be prepared to discuss the methodologies used and the outcomes achieved.

- Example: "In my previous role at Alpha Capital, I developed a complex DCF model to value a portfolio of middle-market businesses, accurately predicting their future cash flows and resulting in a successful investment recommendation."

Do 3: Demonstrate Your Understanding of Private Credit Markets

Demonstrate a solid grasp of the current landscape of the private credit industry.

- Display knowledge of various private credit strategies: Understand direct lending, mezzanine financing, distressed debt, and other strategies.

- Discuss current market trends: Stay updated on interest rate fluctuations, economic conditions, and regulatory changes.

- Show understanding of different types of credit instruments: Explain your understanding of senior debt, subordinated debt, and other credit instruments and their risk-return profiles.

- Analyze the competitive landscape: Understand the key players in the market and their competitive strategies.

- Example: "The current macroeconomic environment presents both challenges and opportunities in the private credit market, particularly in the real estate sector, which I believe requires a more selective and cautious approach to deal selection focusing on strong underlying fundamentals."

Do 4: Highlight Your Networking and Communication Skills

Private credit involves building relationships and communicating effectively.

- Prepare examples illustrating your ability to build relationships: Showcase your experience in working with borrowers, lenders, and other stakeholders.

- Practice your communication skills: Clearly explain complex financial concepts in a concise and easily understandable manner.

- Demonstrate your teamwork and collaboration abilities: Highlight your success in collaborative environments. Give examples of working effectively in teams.

- Example: "In my previous role, I successfully negotiated a complex amendment to a credit agreement with a challenging borrower by building a strong rapport and clearly communicating our concerns and expectations, resulting in a mutually beneficial outcome."

Do 5: Prepare Thoughtful Questions to Ask the Interviewer

Asking insightful questions demonstrates your engagement and initiative.

- Prepare questions related to the firm's culture: Ask about the firm's values, working environment, and team dynamics.

- Inquire about future plans and strategies: Show your interest in the firm's long-term vision.

- Ask specific questions about the role: Clarify aspects of the role that are unclear to you.

- Avoid questions readily available on the company website: Your questions should demonstrate your critical thinking and deeper understanding.

- Example: "What are the firm's plans for expanding its investment activities in the technology sector, and how does this role contribute to that strategy?"

5 Don'ts for Your Private Credit Job Interview

Don't 1: Underestimate the Importance of Preparation

Thorough preparation is crucial for success.

- Practice answering common interview questions: Prepare for behavioral questions, technical questions, and case studies.

- Conduct thorough research: Understand the firm's investment strategy, recent deals, and key personnel.

- Rehearse your responses: Practice your answers to ensure you deliver them confidently and professionally.

Don't 2: Lack Enthusiasm or Show Limited Interest

Demonstrate genuine interest in the role and the firm.

- Display passion for the private credit industry: Show your excitement about the opportunity.

- Maintain positive body language: Show your engagement and enthusiasm through your nonverbal communication.

- Actively engage with the interviewer: Ask clarifying questions and show genuine interest in the conversation.

Don't 3: Be Unprepared to Discuss Your Weaknesses

Be honest and self-aware.

- Identify your weaknesses honestly: Acknowledge your areas for improvement.

- Focus on how you're actively working to improve them: Demonstrate self-awareness and a commitment to continuous learning.

- Frame weaknesses as areas for growth: Present them in a positive light, focusing on your efforts to overcome them.

Don't 4: Overlook the Importance of Following Up

A thank-you note is essential.

- Send a thank-you note: Express your gratitude for the interview opportunity.

- Reiterate your interest in the position: Confirm your strong interest in the role.

- Highlight your key qualifications: Re-emphasize your most relevant skills and experience.

Don't 5: Neglect to Negotiate (When Applicable)

Know your worth and be prepared to negotiate.

- Research industry salary ranges: Understand the typical compensation for similar roles.

- Prepare to discuss your compensation expectations confidently: Know your desired salary range and be ready to justify it.

- Negotiate respectfully and strategically: Approach the negotiation process professionally and respectfully.

Conclusion

Successfully navigating a private credit job interview requires meticulous preparation and a strategic approach. By following these five do's and don'ts, you'll significantly increase your chances of making a positive impression and securing your dream role. Remember to thoroughly research the firm and position, showcase your expertise in financial modeling and analysis, demonstrate a comprehensive understanding of private credit markets, highlight your communication and networking skills, and prepare thoughtful questions. Avoid common pitfalls like inadequate preparation, lack of enthusiasm, and neglecting post-interview follow-up. By mastering these key elements, you can confidently ace your private credit job interview and launch your career in this exciting and dynamic industry. Start preparing today and increase your chances of landing your dream private credit job!

Featured Posts

-

Nebraska Voter Id Initiative Receives National Recognition

May 03, 2025

Nebraska Voter Id Initiative Receives National Recognition

May 03, 2025 -

Valorant Mobile Tencents Pubg Studio Reportedly Developing

May 03, 2025

Valorant Mobile Tencents Pubg Studio Reportedly Developing

May 03, 2025 -

Daily Lotto Winning Numbers For Friday 18th April 2025

May 03, 2025

Daily Lotto Winning Numbers For Friday 18th April 2025

May 03, 2025 -

Sydney Harbour Surveillance Heightened Amidst Reports Of Chinese Ship Activity

May 03, 2025

Sydney Harbour Surveillance Heightened Amidst Reports Of Chinese Ship Activity

May 03, 2025 -

Exclusive Details Emerge On Teslas Post Musk Ceo Search

May 03, 2025

Exclusive Details Emerge On Teslas Post Musk Ceo Search

May 03, 2025

Latest Posts

-

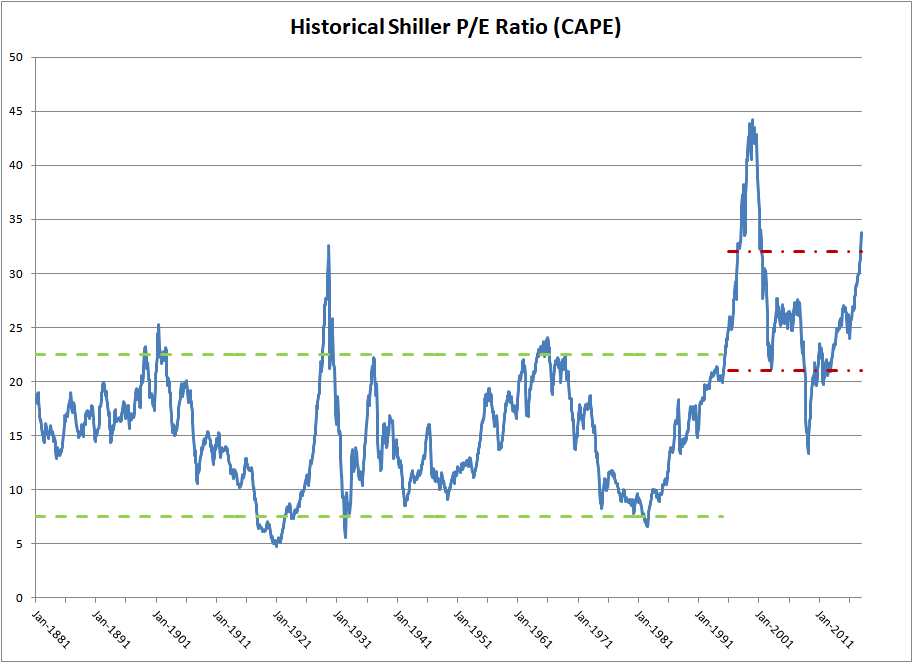

Addressing Investor Concerns Bof As View On High Stock Market Valuations

May 04, 2025

Addressing Investor Concerns Bof As View On High Stock Market Valuations

May 04, 2025 -

Effective Middle Management Key To A Thriving Company Culture

May 04, 2025

Effective Middle Management Key To A Thriving Company Culture

May 04, 2025 -

The Untapped Potential Of Middle Management Fostering Growth And Productivity

May 04, 2025

The Untapped Potential Of Middle Management Fostering Growth And Productivity

May 04, 2025 -

The Impact Of Opt Outs On Googles Search Ai Training With Web Content

May 04, 2025

The Impact Of Opt Outs On Googles Search Ai Training With Web Content

May 04, 2025 -

Los Angeles Wildfires A New Frontier For Disaster Betting

May 04, 2025

Los Angeles Wildfires A New Frontier For Disaster Betting

May 04, 2025