Addressing Investor Concerns: BofA's View On High Stock Market Valuations

Table of Contents

BofA's Stance on Current High Valuations

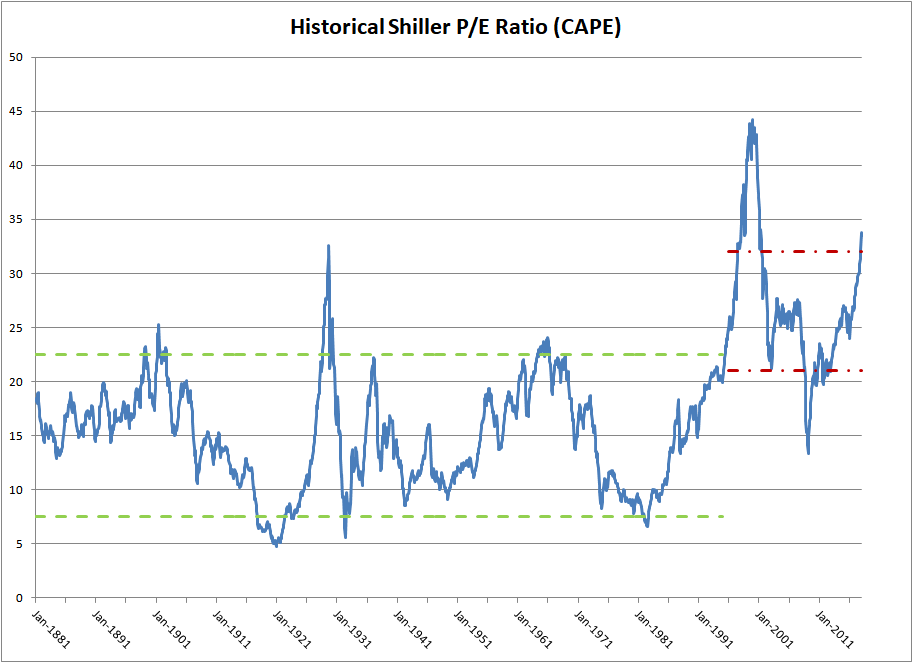

BofA's official position on current market valuations has been cautious, reflecting concerns about the potential for a market correction. While they haven't explicitly declared a market crash is imminent, their analysts have consistently highlighted the elevated price-to-earnings (P/E) ratios across various sectors as a key risk factor. (Note: Specific reports and dates would need to be cited here with links to BofA's official publications for complete accuracy).

- Key Factors Driving BofA's Assessment:

- Persistent Inflation: High inflation erodes corporate earnings and reduces the present value of future cash flows, impacting equity valuations negatively.

- Aggressive Interest Rate Hikes: The Federal Reserve's interest rate increases aim to curb inflation, but this can also slow economic growth and reduce corporate profitability, affecting stock prices.

- Corporate Earnings Growth: BofA analysts closely monitor corporate earnings reports to assess the sustainability of current valuations. Slower-than-expected earnings growth can trigger a market correction.

- Geopolitical Uncertainty: Global events like the war in Ukraine and ongoing supply chain disruptions contribute to market volatility and uncertainty, impacting investor sentiment and stock valuations.

- Overvalued and Undervalued Sectors (according to BofA's analysis - needs specific citations): BofA's research often identifies specific sectors they deem overvalued (e.g., technology, potentially due to high growth expectations) and undervalued (e.g., energy, potentially due to supply constraints). (Note: This requires insertion of specific sector analysis from BofA reports).

- Warnings and Cautions: BofA typically issues warnings about the risks associated with high valuations, emphasizing the need for diversification and careful risk management. They might stress the importance of monitoring economic indicators and adjusting investment strategies accordingly.

Key Economic Factors Influencing BofA's Analysis

BofA's valuation analysis incorporates various macroeconomic factors crucial for understanding the market's overall health.

- Impact of Inflation on Stock Valuations: High inflation reduces purchasing power and increases borrowing costs, making future earnings less valuable and potentially leading to lower stock prices. BofA's analysis likely incorporates inflation forecasts into their valuation models.

- Role of Interest Rate Hikes: Higher interest rates increase borrowing costs for businesses, impacting their profitability and potentially leading to lower investment. BofA analyzes the Fed's monetary policy and its potential impact on market sentiment and valuations.

- Analysis of Recessionary Risks: BofA's economists assess the probability of a recession and its potential severity, which significantly influences their market outlook and investment recommendations.

- Global Economic Conditions and Their Influence: BofA's analysis considers global economic factors, including growth rates in major economies, currency fluctuations, and geopolitical risks, as these influence investor sentiment and market performance.

BofA's Predicted Market Scenarios and Implications

BofA typically outlines various market scenarios, ranging from bullish to bearish, with assigned probabilities. (Note: This section requires specific data from BofA's reports, including their predicted probabilities for each scenario.)

-

Bullish Scenario: This scenario might involve continued moderate economic growth, controlled inflation, and sustained corporate earnings growth, leading to further market gains, though potentially at a slower pace.

-

Bearish Scenario: This scenario might involve a recession, higher-than-expected inflation, and significant drops in corporate earnings, resulting in a significant market correction or even a bear market.

-

Neutral Scenario: This scenario might involve a period of sideways trading with moderate growth and inflation, and stable corporate earnings.

-

Implications for Investors: Each scenario has distinct implications for investors, affecting portfolio strategies and risk management approaches. BofA likely provides specific recommendations for each scenario.

Strategies for Investors Based on BofA's Analysis

Based on BofA's analysis, investors should consider the following strategies:

- Diversification: Diversifying across asset classes (stocks, bonds, real estate) and sectors can help mitigate risk and reduce the impact of a potential market downturn.

- Sector-Specific Recommendations: BofA's analysis might highlight specific sectors offering better risk-adjusted returns, given their assessment of overvalued and undervalued sectors. (Note: Insert sector-specific recommendations from BofA reports here).

- Risk Management and Tolerance: Investors should carefully assess their risk tolerance and adjust their portfolios accordingly. A conservative investor might favor lower-risk investments, while a more aggressive investor might accept higher risk for potentially higher returns.

- Alternative Investment Options: BofA might suggest exploring alternative investment options, such as commodities or precious metals, as hedges against inflation or market volatility.

Comparing BofA's View with Other Market Analyses

It's crucial to compare BofA's analysis with perspectives from other prominent financial institutions like Goldman Sachs, Morgan Stanley, or JP Morgan. (Note: This section needs specific comparisons and citations to other financial institutions' analyses. Highlight areas of consensus and divergence on key issues like valuation metrics and future market predictions.)

Conclusion

BofA's analysis highlights significant concerns regarding high stock market valuations, emphasizing the need for cautious optimism and robust risk management. Their assessment considers key economic factors like inflation, interest rates, and corporate earnings growth, outlining potential market scenarios with varying probabilities. By carefully considering their analysis and incorporating diversification and risk management strategies, investors can better navigate the current market environment. Understanding BofA's perspective on high stock market valuations is crucial for making informed investment decisions. By carefully considering their analysis and incorporating risk management strategies, investors can better navigate the current market environment and potentially mitigate potential losses. Continue your research on addressing investor concerns regarding high stock market valuations and adapt your investment strategy accordingly. Remember to always consult with a financial advisor before making any major investment decisions.

Featured Posts

-

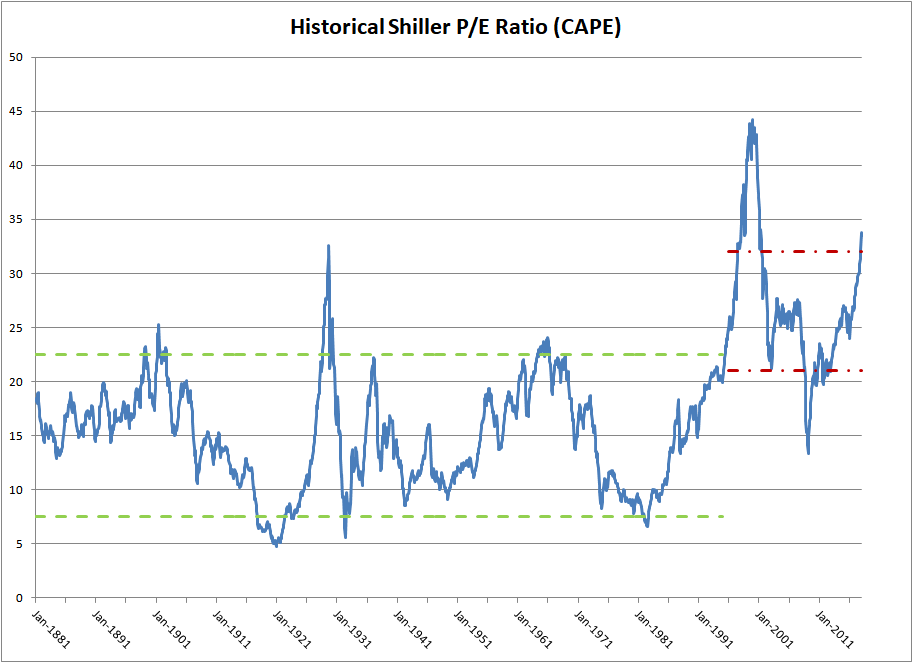

Extreme Price Increase Projected For V Mware Following Broadcom Acquisition

May 04, 2025

Extreme Price Increase Projected For V Mware Following Broadcom Acquisition

May 04, 2025 -

Australia Election Anti Trump Sentiment Takes Center Stage

May 04, 2025

Australia Election Anti Trump Sentiment Takes Center Stage

May 04, 2025 -

Unlocking Canadas Potential Gary Mar On The Importance Of Western Development

May 04, 2025

Unlocking Canadas Potential Gary Mar On The Importance Of Western Development

May 04, 2025 -

Bob Baffert And The Kentucky Derby A Look At His Legacy And Future

May 04, 2025

Bob Baffert And The Kentucky Derby A Look At His Legacy And Future

May 04, 2025 -

Zuckerbergs New Chapter Navigating A Trump Presidency

May 04, 2025

Zuckerbergs New Chapter Navigating A Trump Presidency

May 04, 2025

Latest Posts

-

Gold Market Update Potential For Double Digit Weekly Losses In 2025

May 04, 2025

Gold Market Update Potential For Double Digit Weekly Losses In 2025

May 04, 2025 -

Shopifys New Lifetime Revenue Share Impact On Developer Earnings

May 04, 2025

Shopifys New Lifetime Revenue Share Impact On Developer Earnings

May 04, 2025 -

2025 Gold Market Consecutive Weekly Losses Predicted

May 04, 2025

2025 Gold Market Consecutive Weekly Losses Predicted

May 04, 2025 -

The Cusma Deal Hanging In The Balance After Carney Trump Meeting

May 04, 2025

The Cusma Deal Hanging In The Balance After Carney Trump Meeting

May 04, 2025 -

Gold Slumps Facing Back To Back Weekly Declines In 2025

May 04, 2025

Gold Slumps Facing Back To Back Weekly Declines In 2025

May 04, 2025