Acquisition Battle Looms: Toronto Firm Eyes Hudson's Bay's Assets

Table of Contents

The Toronto Firm's Interest and its Potential Strategies

While the specific Toronto firm remains unnamed at this time, its interest in HBC's assets suggests a strategic play for expansion or diversification. This unnamed entity likely sees significant value in HBC's portfolio, potentially targeting specific elements for acquisition. Their motivations could include:

- Market Domination: Acquiring key retail chains or real estate holdings would significantly increase their market share and influence.

- Synergy and Cost Savings: Integrating HBC's assets into their existing operations could lead to economies of scale and improved profitability.

- Brand Acquisition: Certain HBC brands might be attractive for their established customer base and brand recognition.

Their potential strategies include:

- Targeted Acquisition: Focusing on specific high-value assets within HBC's portfolio, such as the flagship Hudson's Bay stores in prime real estate locations or select retail chains.

- Financing Mix: Utilizing a combination of debt financing, equity investment, and potentially seeking private investment to fund the acquisition.

- Leveraging Existing Expertise: Drawing on past acquisition experiences to smooth the integration process and maximize returns from the acquired assets.

Hudson's Bay Company's Current Situation and Potential Responses

HBC is currently navigating a challenging retail landscape. Facing pressure to reduce debt and refocus its strategy, the sale of assets may be seen as a necessary step to ensure its long-term viability. This could be driven by:

- Debt Reduction: Selling non-core assets could free up capital to pay down debt and improve the company's financial stability.

- Strategic Refocusing: HBC may be divesting from less profitable segments to concentrate on its core business and improve operational efficiency.

- Market Pressures: Increased competition and changing consumer preferences may have influenced HBC's decision to explore asset sales.

HBC's potential responses to the acquisition bid include:

- Counter-Offers: Negotiating a higher price for its assets or seeking more favorable terms.

- Strategic Partnerships: Exploring alternative options like joint ventures or strategic alliances instead of a full sale.

- Defensive Tactics: Employing legal strategies or other tactics to protect its assets and influence the outcome of the acquisition process.

Potential Competitors and the Acquisition Landscape

The potential for a bidding war is high. Several other companies may be interested in acquiring parts of HBC's portfolio. These could include:

- Private Equity Firms: Actively seeking opportunities in the retail and real estate sectors.

- Large Retail Competitors: Looking to expand their market presence and brand portfolio.

- Real Estate Investment Trusts (REITs): Interested primarily in the valuable real estate holdings of HBC.

The acquisition landscape is further complicated by:

- Regulatory Scrutiny: Antitrust regulations and competition laws will be carefully examined to prevent monopolies or unfair market practices.

- Valuation Disputes: Discrepancies in the valuation of HBC's assets could lead to lengthy negotiations and potential legal challenges.

- Impact on Canadian Retail: The outcome of this acquisition battle will significantly impact the overall competitive landscape of the Canadian retail sector.

Market Reaction and Financial Implications

The news of the potential acquisition has already sent ripples through the financial markets. The impact is multifaceted:

- HBC Stock Price Volatility: Investor reactions to the news are likely to cause fluctuations in HBC's stock price.

- Job Security Concerns: Employees of HBC may face uncertainty regarding their jobs following the potential acquisition.

- Consumer Impacts: The changes in ownership could influence pricing strategies and the availability of products, impacting consumers.

This Hudson's Bay's assets acquisition could potentially lead to:

- Increased Consolidation: Further mergers and acquisitions in the Canadian retail sector.

- Shifting Market Dynamics: Changes in competition and pricing strategies within the retail industry.

- Long-term Economic Impacts: Consequences for employment, investment, and the overall health of the Canadian economy.

Conclusion: The Future of Hudson's Bay's Assets and the Looming Acquisition Battle

The potential acquisition of Hudson's Bay's assets represents a significant event for the Canadian retail industry. The outcome of this acquisition battle will reshape the competitive landscape and impact numerous stakeholders. While the identity of the Toronto firm and the final outcome remain uncertain, the stakes are undeniably high. The intense interest highlights the considerable value and strategic importance of HBC's portfolio.

Stay tuned for updates on this unfolding acquisition battle and the future of Hudson's Bay's valuable assets. This Hudson's Bay's assets acquisition story is far from over, and the coming weeks and months will likely reveal significant developments.

Featured Posts

-

Diner Houleux Sardou Critique Macron

May 03, 2025

Diner Houleux Sardou Critique Macron

May 03, 2025 -

Npps 2024 Election Loss Abu Jinapors Perspective On The Unexpected Outcome

May 03, 2025

Npps 2024 Election Loss Abu Jinapors Perspective On The Unexpected Outcome

May 03, 2025 -

Le Role Suppose De Macron Dans Le Choix Du Futur Pape

May 03, 2025

Le Role Suppose De Macron Dans Le Choix Du Futur Pape

May 03, 2025 -

Check Your Tickets Latest Lotto Lotto Plus 1 And Lotto Plus 2 Numbers

May 03, 2025

Check Your Tickets Latest Lotto Lotto Plus 1 And Lotto Plus 2 Numbers

May 03, 2025 -

Securing A Place In The Sun Navigating The International Property Market

May 03, 2025

Securing A Place In The Sun Navigating The International Property Market

May 03, 2025

Latest Posts

-

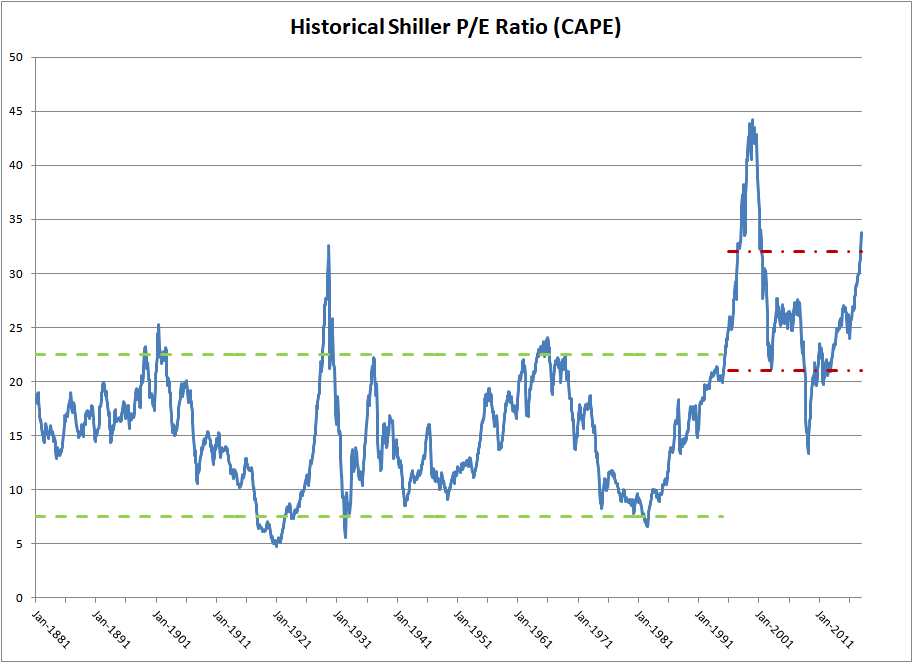

Addressing Investor Concerns Bof As View On High Stock Market Valuations

May 04, 2025

Addressing Investor Concerns Bof As View On High Stock Market Valuations

May 04, 2025 -

Effective Middle Management Key To A Thriving Company Culture

May 04, 2025

Effective Middle Management Key To A Thriving Company Culture

May 04, 2025 -

The Untapped Potential Of Middle Management Fostering Growth And Productivity

May 04, 2025

The Untapped Potential Of Middle Management Fostering Growth And Productivity

May 04, 2025 -

The Impact Of Opt Outs On Googles Search Ai Training With Web Content

May 04, 2025

The Impact Of Opt Outs On Googles Search Ai Training With Web Content

May 04, 2025 -

Los Angeles Wildfires A New Frontier For Disaster Betting

May 04, 2025

Los Angeles Wildfires A New Frontier For Disaster Betting

May 04, 2025