Addressing Investor Concerns: BofA On High Stock Market Valuations

Table of Contents

BofA's Stance on High Stock Market Valuations

BofA generally adopts a cautious stance regarding current high stock market valuations. While acknowledging the positive aspects of strong corporate earnings in certain sectors, they highlight the elevated risk associated with historically high price-to-earnings (P/E) ratios. Their assessment isn't purely pessimistic; it's more nuanced, recognizing both the potential for continued growth and the significant downside risk.

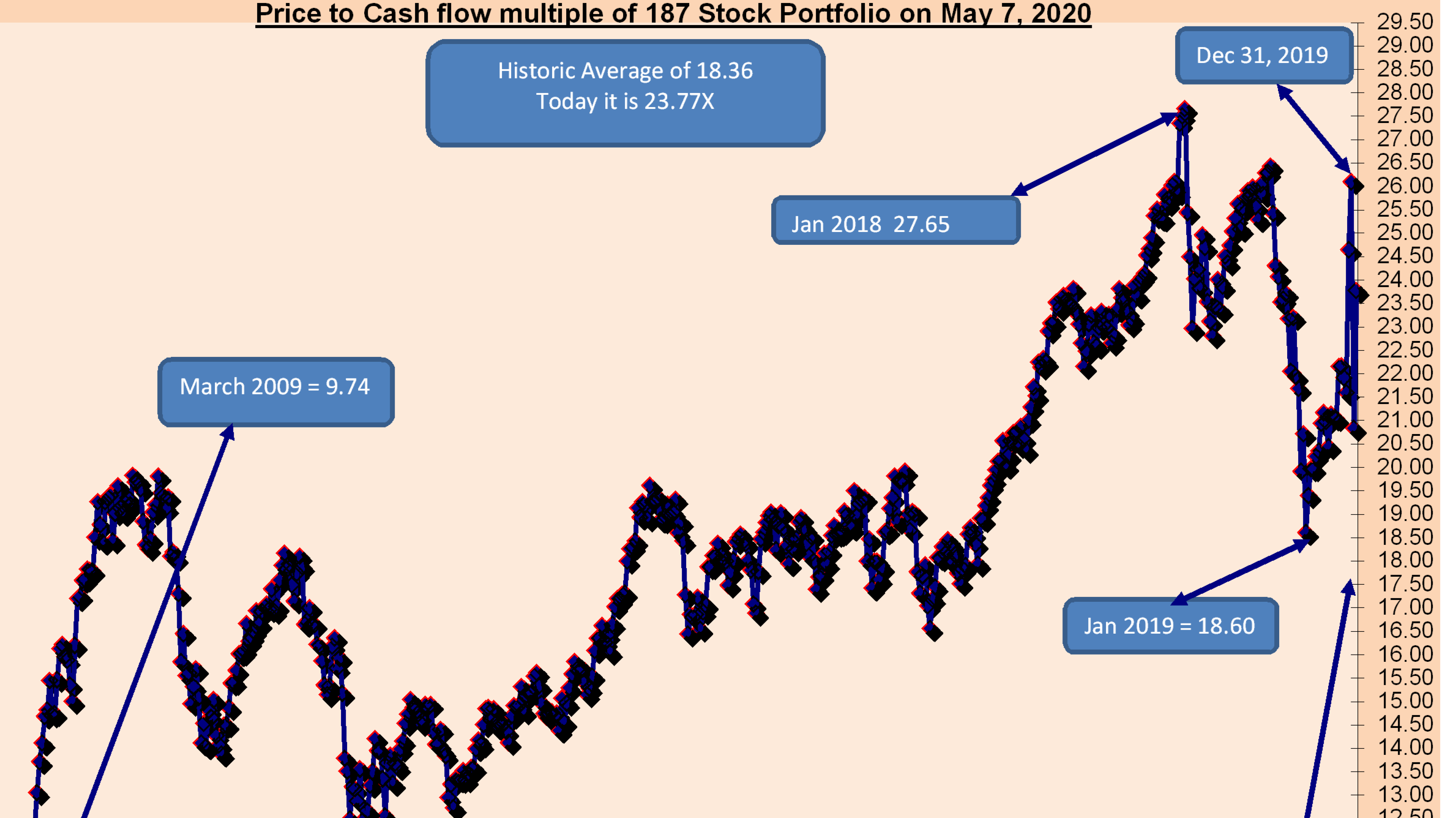

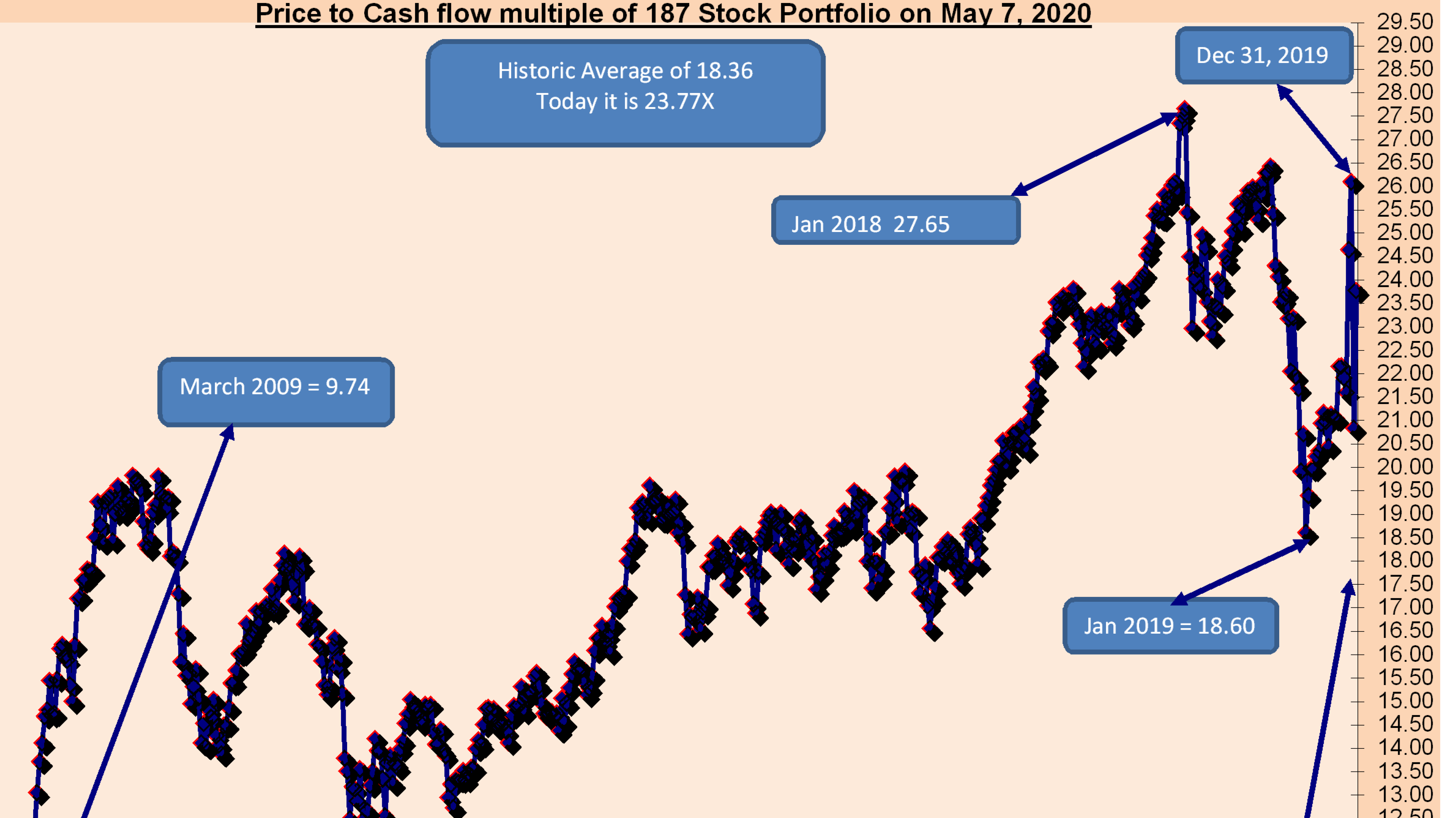

- Metrics Used: BofA utilizes various metrics to evaluate valuations, including traditional P/E ratios, the cyclically adjusted price-to-earnings ratio (Shiller PE), and various sector-specific valuation benchmarks. They analyze these metrics across different market segments and compare them to historical averages.

- Overvalued and Undervalued Sectors: BofA's analysis often identifies specific sectors as being particularly overvalued (e.g., certain technology sub-sectors during periods of rapid growth) while highlighting others as potentially undervalued (e.g., value stocks during market corrections). Specific sectors mentioned frequently vary based on the report's release date, so consulting the most recent BofA reports is advised.

- BofA Quote: "While current earnings growth is supporting elevated valuations, we believe that the risks associated with these valuations are significant, and investors should proceed with caution." (This is a hypothetical quote, replace with an actual quote from a relevant BofA report)

Underlying Factors Contributing to High Valuations

Several macroeconomic factors contribute to the current high stock market valuations. These factors are interconnected and influence investor behavior and market sentiment.

- Low Interest Rates: Historically low interest rates have made investing in bonds less attractive, pushing investors towards higher-yielding assets like stocks. This increased demand fuels stock prices.

- Quantitative Easing (QE): Monetary policies such as QE, implemented by central banks to stimulate economic growth, have injected significant liquidity into the market, further driving up asset prices.

- Strong Corporate Earnings (in certain sectors): While not uniform across all sectors, strong corporate earnings in specific industries, particularly technology and some consumer staples, have contributed to the elevated valuations of their stocks.

- Technological Advancements: Breakthroughs in technology, particularly in areas like artificial intelligence and cloud computing, have created immense growth potential for associated companies, boosting their valuations.

Potential Risks Associated with High Valuations

Investing in a highly valued market inherently carries significant risks. Understanding these risks is crucial for developing a robust investment strategy.

- Increased Market Volatility: High valuations often lead to increased market volatility. Small negative news or shifts in investor sentiment can trigger sharp corrections.

- Inflated Asset Bubbles: When asset prices are driven primarily by speculation rather than fundamentals, the risk of asset bubbles forming increases dramatically. These bubbles are prone to sudden and dramatic collapses.

- Rising Inflation: Rising inflation erodes the purchasing power of future earnings, putting downward pressure on stock valuations, especially if interest rates rise to combat inflation.

- Geopolitical Risks: Geopolitical events, such as international conflicts or trade wars, can significantly impact market sentiment and trigger sharp declines in stock prices.

Mitigating Investment Risks in a High-Valuation Market

Even in a high-valuation market, investors can mitigate risks by employing prudent strategies:

- Diversification: Diversifying across different asset classes (stocks, bonds, real estate, etc.) reduces the impact of any single asset's underperformance.

- Long-Term Investment Horizon: A long-term investment strategy allows investors to ride out short-term market corrections and benefit from the long-term growth potential of the market.

- Value Investing: Focusing on undervalued companies with strong fundamentals can offer better risk-adjusted returns compared to investing in overvalued growth stocks.

- Regular Portfolio Rebalancing: Regularly rebalancing your portfolio ensures that your asset allocation remains aligned with your risk tolerance and investment goals.

BofA's Recommendations and Future Outlook

BofA's recommendations often emphasize a cautious approach. They typically advise investors to carefully assess their risk tolerance before making investment decisions and diversify their portfolios across various asset classes.

- Recommended Sectors/Asset Classes: BofA's specific recommendations vary depending on market conditions. Their reports often highlight sectors they deem less susceptible to market downturns or offering superior risk-adjusted returns.

- Market Performance Predictions: BofA publishes forecasts for future market performance, acknowledging the inherent uncertainty involved. These predictions are often conditional on various economic and geopolitical factors.

- Warnings/Cautions: BofA frequently cautions investors about the risks associated with high valuations and the potential for market corrections. They stress the importance of a well-defined investment strategy tailored to individual risk profiles.

Conclusion

BofA's analysis of high stock market valuations highlights a cautious but not entirely pessimistic outlook. While strong corporate earnings in some sectors support current valuations, the elevated price-to-earnings ratios and other valuation metrics point to significant risks. Factors like low interest rates, quantitative easing, and technological advancements contribute to the high valuations, yet increased market volatility, inflated asset bubbles, rising inflation, and geopolitical uncertainties pose considerable threats. Mitigating these risks involves diversification, a long-term investment horizon, value investing strategies, and regular portfolio rebalancing. While BofA's insights offer valuable perspectives on addressing investor concerns regarding high stock market valuations, individual investment decisions should always be guided by a thorough understanding of your personal risk tolerance and financial goals. Consult a financial advisor to develop a tailored investment strategy that aligns with your circumstances and objectives. Remember, carefully analyzing high stock market valuations is crucial for making informed investment decisions.

Featured Posts

-

Ripple Vs Sec Understanding The 50 M Settlement And Its Impact On Xrp

May 01, 2025

Ripple Vs Sec Understanding The 50 M Settlement And Its Impact On Xrp

May 01, 2025 -

The Long Road To Recovery The 2012 Louisville Tornados Lasting Effects

May 01, 2025

The Long Road To Recovery The 2012 Louisville Tornados Lasting Effects

May 01, 2025 -

Fourth Firm Agrees To Pro Bono Work For Trump Avoiding Sanctions

May 01, 2025

Fourth Firm Agrees To Pro Bono Work For Trump Avoiding Sanctions

May 01, 2025 -

Chris Kaba Panorama Police Watchdog Challenges Bbcs Coverage

May 01, 2025

Chris Kaba Panorama Police Watchdog Challenges Bbcs Coverage

May 01, 2025 -

Gaslek Roden Vals Alarm

May 01, 2025

Gaslek Roden Vals Alarm

May 01, 2025