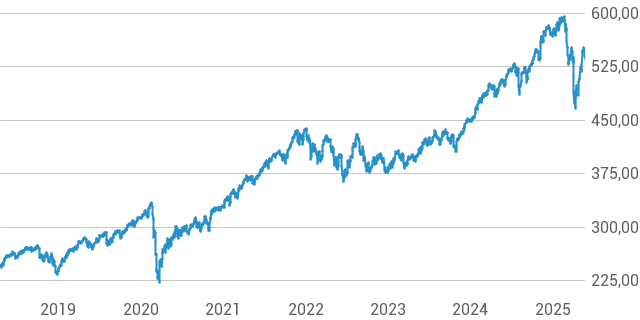

Amsterdam Exchange Plunges 11% Since Wednesday: Three Days Of Decline

Table of Contents

Analyzing the Causes of the Amsterdam Exchange Plunge

Several intertwined factors likely contributed to this sharp Amsterdam Exchange decline. Understanding these causes is crucial for navigating the current market volatility.

-

Macroeconomic Headwinds: The global economic landscape is currently fraught with challenges.

- Global Economic Slowdown: Concerns about a potential recession in major economies are weighing heavily on investor sentiment, impacting the Amsterdam Exchange.

- Rising Inflation: Persistent inflation and subsequent aggressive interest rate hikes by central banks globally are dampening economic growth and increasing uncertainty.

- Geopolitical Instability: Ongoing geopolitical tensions, particularly the war in Ukraine and its impact on energy prices and supply chains, further contribute to market instability.

-

Company-Specific and Sectoral Issues: The overall decline isn't solely attributed to macroeconomic factors. Specific company performances and sector-specific issues played a significant role.

- Underperforming Sectors: The energy and technology sectors, particularly sensitive to interest rate changes and global uncertainty, witnessed significant drops.

- Major Company Drops: Several key companies listed on the Amsterdam Exchange experienced substantial share price reductions, amplifying the overall market decline. A detailed analysis of these individual company performances is necessary to fully understand the scope of the plunge.

-

Investor Sentiment and Market Volatility: The sharp drop reflects a significant shift in investor sentiment.

- Increased Sell-Offs: A wave of sell-offs triggered by fear and uncertainty exacerbated the decline, creating a downward spiral.

- Loss of Confidence: Decreased investor confidence in the market's short-term outlook contributed significantly to the Amsterdam Exchange plunge. This loss of confidence is reflected in other major European market indices as well.

Impact of the Amsterdam Exchange Plunge on Investors

The consequences of this sudden Amsterdam Exchange plunge are far-reaching and affect various investor types differently.

-

Impact on Investor Types:

- Retail Investors: Smaller investors with significant portions of their portfolios invested in the Amsterdam Exchange experienced substantial losses. Many are now reevaluating their investment strategies.

- Institutional Investors: Large institutional investors, while better equipped to manage risk, also suffered losses. However, their diversified portfolios may help mitigate the impact compared to retail investors.

-

Long-Term Investment Implications: The plunge raises crucial questions about long-term investment strategies.

- Holding vs. Selling: Whether to "buy the dip" or sell off depends greatly on individual risk tolerance and investment horizon. Diversification is crucial during periods of heightened volatility.

- Re-evaluation of Strategies: Many investors are now reviewing their portfolio allocations and risk management strategies in light of the recent events.

-

Psychological Impact and Market Confidence: The significant drop has undeniably shaken market confidence.

- Ripple Effects: The Amsterdam Exchange plunge may have ripple effects on other European and global markets, increasing overall investor anxiety.

- Uncertainty and Fear: The combination of uncertainty and fear is creating a challenging environment for investors, making informed decision-making more critical than ever.

Predicting the Future of the Amsterdam Exchange

Predicting the future of the Amsterdam Exchange with certainty is impossible, but several scenarios are plausible.

-

Potential Scenarios:

- Optimistic Scenario: A swift recovery driven by positive economic news, easing geopolitical tensions, and improved investor sentiment.

- Pessimistic Scenario: A prolonged period of stagnation or further declines, driven by persistent economic headwinds and a lack of confidence.

-

Expert Opinions and Market Predictions: Financial analysts are closely monitoring the situation, offering diverse opinions on the market’s trajectory. Some anticipate a rebound, while others suggest a prolonged correction. Their predictions should be considered alongside other indicators.

-

Potential Recovery Strategies and Market Stabilization:

- Government Intervention: Government policies aimed at stimulating the economy and boosting investor confidence might play a significant role.

- Central Bank Actions: Central bank actions to manage interest rates and inflation will also heavily influence the market recovery.

- Market Rebounds: Market rebounds often follow periods of sharp declines, driven by bargain hunting and a return of investor confidence.

Conclusion: Understanding and Navigating the Amsterdam Exchange Plunge

The 11% drop in the Amsterdam Exchange represents a significant event with potential long-term consequences. The causes are multifaceted, encompassing macroeconomic headwinds, company-specific issues, and volatile investor sentiment. The impact on investors is substantial, requiring careful analysis and strategic adjustments. While predicting the future is uncertain, staying informed about developments and adopting a well-diversified investment strategy is paramount. Stay updated on the latest developments in the Amsterdam Exchange plunge and make informed decisions about your investments. For further analysis and market updates, consult reputable financial news sources and professional investment advisors.

Featured Posts

-

Planning Your Memorial Day Trip The Busiest Flight Days Of 2025

May 25, 2025

Planning Your Memorial Day Trip The Busiest Flight Days Of 2025

May 25, 2025 -

Net Asset Value Nav Explained Amundi Msci All Country World Ucits Etf Usd Acc

May 25, 2025

Net Asset Value Nav Explained Amundi Msci All Country World Ucits Etf Usd Acc

May 25, 2025 -

Tik Tok Tourism Backlash Amsterdam Residents File Lawsuit Over Snack Bar Chaos

May 25, 2025

Tik Tok Tourism Backlash Amsterdam Residents File Lawsuit Over Snack Bar Chaos

May 25, 2025 -

Amundi Msci World Catholic Principles Ucits Etf Acc Daily Nav Updates And Analysis

May 25, 2025

Amundi Msci World Catholic Principles Ucits Etf Acc Daily Nav Updates And Analysis

May 25, 2025 -

Kharkovschina 40 Svadeb Za Odin Den Kakaya Data Stala Samoy Populyarnoy Foto

May 25, 2025

Kharkovschina 40 Svadeb Za Odin Den Kakaya Data Stala Samoy Populyarnoy Foto

May 25, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025 -

Actress Mia Farrow Demands Trumps Arrest For Venezuelan Deportation Policy

May 25, 2025

Actress Mia Farrow Demands Trumps Arrest For Venezuelan Deportation Policy

May 25, 2025 -

Actress Mia Farrow Seeks Trumps Imprisonment Regarding Venezuelan Deportations

May 25, 2025

Actress Mia Farrow Seeks Trumps Imprisonment Regarding Venezuelan Deportations

May 25, 2025 -

From Fame To Shame 17 Celebrities Who Lost It All

May 25, 2025

From Fame To Shame 17 Celebrities Who Lost It All

May 25, 2025 -

The Downfall 17 Celebrities Whose Careers Imploded

May 25, 2025

The Downfall 17 Celebrities Whose Careers Imploded

May 25, 2025