Amundi MSCI World Catholic Principles UCITS ETF Acc: Daily NAV Updates And Analysis

Table of Contents

This article aims to provide daily NAV (Net Asset Value) updates and a comprehensive analysis of the Amundi MSCI World Catholic Principles UCITS ETF Acc. We'll explore its investment strategy, fees, risks, and historical performance to help you understand if this ETF aligns with your investment goals. We'll also cover key concepts such as ETFs, NAVs, and the importance of responsible investing within a Catholic framework.

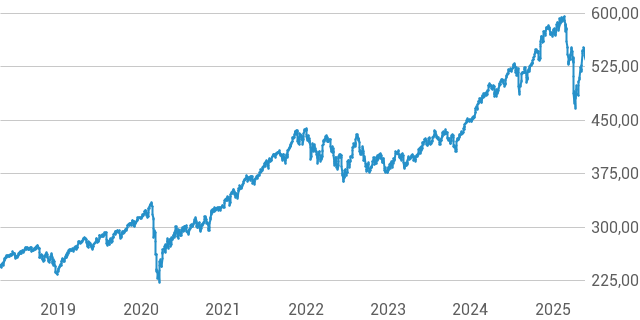

Daily NAV Updates and Historical Performance

Understanding the Net Asset Value (NAV) is crucial for any ETF investor. The NAV represents the market value of all the assets held within the ETF, divided by the total number of outstanding shares. This figure fluctuates daily, reflecting changes in the underlying assets' prices.

Below is a table showing the recent daily NAV updates for the Amundi MSCI World Catholic Principles UCITS ETF Acc. (Note: Replace this with actual data. Include at least the last week's data, clearly labeled with dates.)

| Date | Daily NAV (USD) |

|---|---|

| October 26, 2023 | XXX |

| October 25, 2023 | XXX |

| October 24, 2023 | XXX |

| October 23, 2023 | XXX |

| October 20, 2023 | XXX |

| October 19, 2023 | XXX |

| October 18, 2023 | XXX |

(Note: Insert a chart here visually representing the historical NAV performance over a longer period – 1 year, 3 years, 5 years if available. Clearly label axes and include a legend.)

Analyzing the chart and the daily NAV data helps understand the ETF's historical performance. Key Performance Indicators (KPIs) like returns (both absolute and relative to benchmarks) and volatility (a measure of price fluctuations) are important metrics to consider. Higher volatility indicates greater risk.

Understanding the Investment Strategy and Catholic Principles

The Amundi MSCI World Catholic Principles UCITS ETF Acc employs a unique investment strategy aligned with Catholic values. This means the fund actively screens companies to exclude those involved in activities deemed incompatible with these principles.

-

Key Exclusion Criteria: This ETF typically excludes companies involved in:

- Weapons manufacturing

- Alcohol production

- Gambling

- Pornography

- Abortion services

- Stem cell research (depending on specific methodologies)

-

MSCI World Index Role: The ETF tracks the MSCI World Index, but applies a rigorous screening process to ensure alignment with Catholic values. This means only companies meeting the specific criteria are included in the portfolio. This ensures broad market exposure while maintaining ethical integrity.

-

Ethical Considerations and Sustainability: Investing in this ETF allows investors to support companies that operate ethically and sustainably, aligning their investments with their faith and commitment to responsible business practices. The fund considers ESG (Environmental, Social, and Governance) factors, but the primary focus remains on aligning with Catholic principles.

Amundi MSCI World Catholic Principles UCITS ETF Acc: Fees and Expenses

Understanding the fees associated with any investment is crucial for maximizing long-term returns. The Amundi MSCI World Catholic Principles UCITS ETF Acc has an expense ratio (TER – Total Expense Ratio) that reflects the annual cost of managing the fund. (Note: Replace XXX with the actual TER).

- Expense Ratio (TER): XXX%

This TER is competitive when compared to similar ETFs in the market offering ethical or socially responsible investments. However, it's essential to compare across various options before making a final decision. Remember, even small expense ratios can significantly impact returns over the long term. Therefore, a thorough cost analysis is important.

Risk Factors and Suitability

Like any investment, the Amundi MSCI World Catholic Principles UCITS ETF Acc carries inherent risks.

- Market Risk: The value of the ETF can fluctuate due to market conditions.

- Currency Risk: As the ETF holds assets in various currencies, fluctuations in exchange rates can affect its value.

The ETF's risk profile can be considered medium to moderate. It's generally suitable for long-term investors with a moderate risk tolerance. However, it's essential to consider your personal risk profile and investment timeline before investing.

Disclaimer: This article is for informational purposes only and does not constitute financial advice.

Conclusion: Investing in the Amundi MSCI World Catholic Principles UCITS ETF Acc

The Amundi MSCI World Catholic Principles UCITS ETF Acc offers a unique opportunity to align your investments with your Catholic values and principles of responsible investing. We've explored its daily NAV updates, investment strategy, fee structure, and associated risks. This ETF provides a pathway to participate in the global market while upholding your ethical commitments. By carefully considering your risk tolerance and investment goals, you can determine if this ETF is suitable for you. Learn more and see if it aligns with your investment strategy by visiting (insert link to fund fact sheet here). Consider investing responsibly with the Amundi MSCI World Catholic Principles UCITS ETF Acc and discover the impact of aligning your investments with your values.

Featured Posts

-

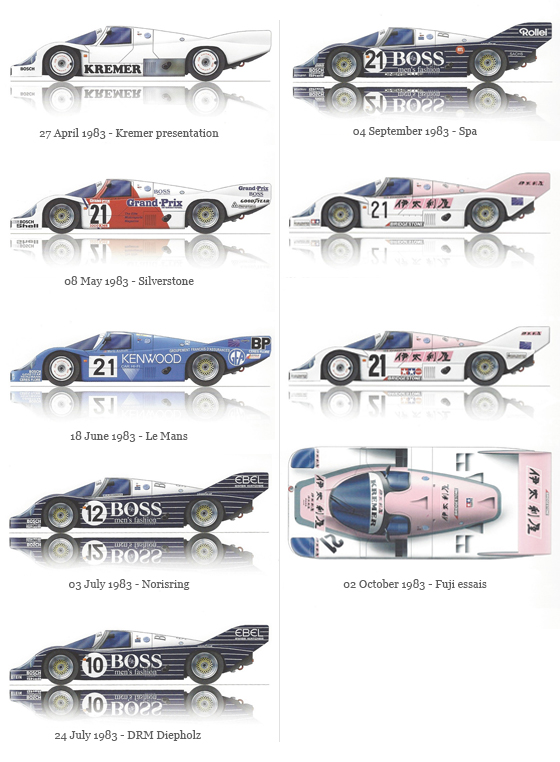

Neden Porsche 956 Araclari Tavanlardan Asili

May 25, 2025

Neden Porsche 956 Araclari Tavanlardan Asili

May 25, 2025 -

Intimacy And Growth Matt Malteses Her In Deep And The Journey Of A Sixth Album

May 25, 2025

Intimacy And Growth Matt Malteses Her In Deep And The Journey Of A Sixth Album

May 25, 2025 -

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist Key Factors

May 25, 2025

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist Key Factors

May 25, 2025 -

A Practical Guide To Escaping To The Country

May 25, 2025

A Practical Guide To Escaping To The Country

May 25, 2025 -

M6 Crash Live Updates And Traffic Delays

May 25, 2025

M6 Crash Live Updates And Traffic Delays

May 25, 2025

Latest Posts

-

She Waits By The Phone A Tale Of Anticipation

May 25, 2025

She Waits By The Phone A Tale Of Anticipation

May 25, 2025 -

Waiting For The Call A Personal Narrative

May 25, 2025

Waiting For The Call A Personal Narrative

May 25, 2025 -

The Phone Rings A Story Of Waiting

May 25, 2025

The Phone Rings A Story Of Waiting

May 25, 2025 -

Investigating Burys Missing M62 Link Road

May 25, 2025

Investigating Burys Missing M62 Link Road

May 25, 2025 -

Astonishing Footage Pair Refuels Car At 90mph During Police Chase

May 25, 2025

Astonishing Footage Pair Refuels Car At 90mph During Police Chase

May 25, 2025