Amsterdam Stock Exchange Plunges 2% After Trump's Tariff Hike

Table of Contents

The Immediate Impact of Trump's Tariff Hike on the AEX

The immediate impact of Trump's tariff hike on the AEX was swift and substantial. The announcement sent shockwaves through various sectors, leading to a significant decline in share prices across the board.

Sector-Specific Impacts

The technology and manufacturing sectors were particularly hard hit by the Amsterdam Stock Exchange plunge. Companies heavily reliant on international trade, particularly with the US, experienced the most dramatic drops. This is because increased tariffs directly increase the cost of imported goods, impacting profitability and potentially reducing consumer demand.

- ASML Holding N.V.: This semiconductor equipment giant saw a notable decrease in its share price, reflecting concerns about reduced demand from US-based chip manufacturers.

- Philips: The healthcare technology company, with significant US operations, also experienced a substantial drop, reflecting anxieties surrounding increased import costs and potential reduced competitiveness in the US market.

- Unilever: This consumer goods multinational, while diversified, still felt the impact, showing a decrease in value, indicating market uncertainty and investor apprehension regarding future profitability.

Quantitative data illustrating the magnitude of the losses across these and other sectors is still being collated but early estimates suggest losses exceeding hundreds of millions of Euros in market capitalization. Financial analysts have directly linked this decline to the tariff hike, citing investor uncertainty and a decreased outlook for future earnings.

Analyzing the Underlying Causes Beyond the Immediate Reaction

While Trump's tariff hike was the immediate trigger for the Amsterdam Stock Exchange plunge, deeper underlying factors contributed to the market's negative reaction.

Global Market Uncertainty

The tariff hike exacerbated existing global economic uncertainties, further eroding investor confidence. The already fragile global economic climate, impacted by factors like Brexit, escalating trade wars, and rising global inflation, created a perfect storm for a market downturn.

- Brexit Uncertainty: The ongoing uncertainty surrounding Brexit continues to negatively impact investor sentiment, creating a climate of apprehension and risk aversion.

- Trade Wars: Escalating trade tensions between major economic powers fuel market instability and increase uncertainty for businesses and investors alike.

- Global Inflation: Rising inflation rates in many countries further contribute to economic uncertainty, prompting investors to seek safer havens for their investments.

The psychological impact of Trump's protectionist policies cannot be understated. Investors reacted negatively to the perceived increase in trade barriers and the resulting uncertainty regarding future market access. Investor sentiment indices dropped significantly following the announcement, reflecting a widespread loss of confidence.

Potential Long-Term Consequences for the Dutch Economy

The Amsterdam Stock Exchange plunge carries significant potential long-term consequences for the Dutch economy. The immediate impact on businesses could lead to a domino effect with broader economic repercussions.

Impact on Dutch Businesses

The decline in share prices and the increased uncertainty could lead to:

- Job Losses: Companies facing reduced profitability due to tariffs may resort to cost-cutting measures, potentially leading to job losses across various sectors.

- Economic Slowdown: A prolonged period of economic uncertainty could result in decreased investment, reduced consumer spending, and a slowdown in overall economic growth.

- Reduced Foreign Investment: The negative market sentiment could deter foreign investment in the Netherlands, hindering future economic expansion.

The Dutch government will likely need to implement measures to mitigate the economic fallout, potentially including fiscal stimulus packages or measures to support affected industries.

Strategies for Investors in the Wake of the Amsterdam Stock Exchange Plunge

The volatility witnessed in the Amsterdam Stock Exchange highlights the importance of robust investment strategies.

Risk Mitigation and Portfolio Diversification

In the wake of this significant market event, investors should focus on:

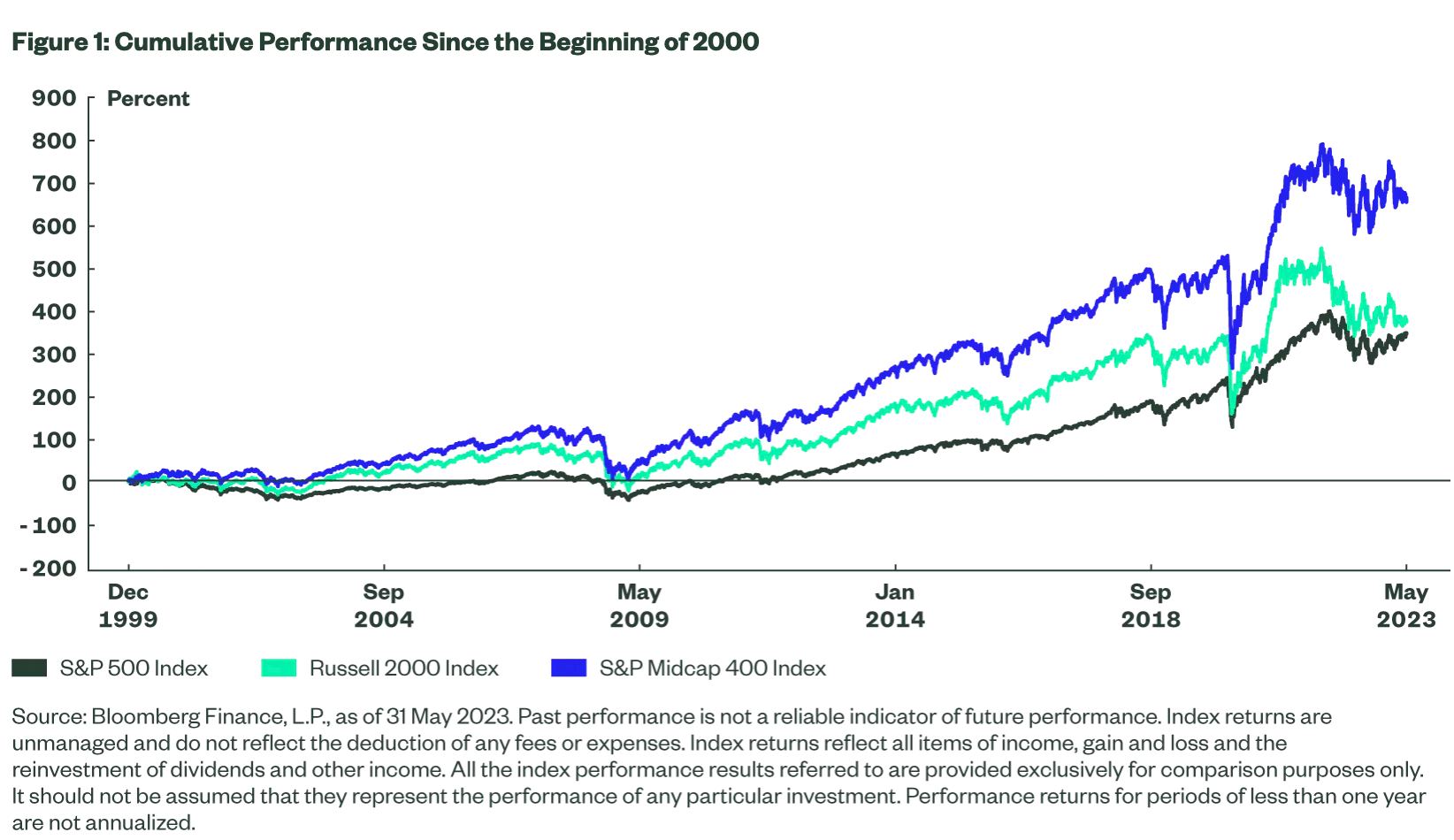

- Portfolio Diversification: Diversifying investments across different asset classes (stocks, bonds, real estate, etc.) can help mitigate risk and reduce exposure to market downturns.

- Risk Management: Implementing effective risk management strategies, including stop-loss orders and hedging techniques, can help protect portfolios during periods of market volatility.

- Staying Informed: Staying informed about market trends and global economic developments is crucial for making informed investment decisions. Monitoring news related to the AEX and global market indices is vital for timely adjustments.

Conclusion

The 2% plunge in the Amsterdam Stock Exchange following Trump's tariff hike is a stark reminder of the interconnectedness of global markets and the significant impact of protectionist trade policies. The immediate impact on various sectors, coupled with underlying global uncertainties, points towards potentially long-term consequences for the Dutch economy. Understanding the factors contributing to this Amsterdam Stock Exchange plunge is crucial for navigating the current market volatility. Investors must prioritize risk management and portfolio diversification to protect their assets during this period of uncertainty. Stay informed about further developments in the Amsterdam Stock Exchange and global markets to make well-informed investment decisions. Regularly check reputable financial news sources to remain updated on any further "Amsterdam Stock Exchange plunges" and related market events.

Featured Posts

-

Borse In Caduta Libera La Nuova Minaccia Dei Dazi Ue

May 24, 2025

Borse In Caduta Libera La Nuova Minaccia Dei Dazi Ue

May 24, 2025 -

Zapreschenniy Garazh Istoriya Protivostoyaniya Ryazanova I Tsenzury Pri Brezhneve

May 24, 2025

Zapreschenniy Garazh Istoriya Protivostoyaniya Ryazanova I Tsenzury Pri Brezhneve

May 24, 2025 -

Is De Snelle Marktdraai Van Europese Aandelen Ten Opzichte Van Wall Street Blijvend

May 24, 2025

Is De Snelle Marktdraai Van Europese Aandelen Ten Opzichte Van Wall Street Blijvend

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Nav Calculation And Analysis

May 24, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Nav Calculation And Analysis

May 24, 2025 -

Ftc Appeals Activision Blizzard Acquisition Decision Whats Next

May 24, 2025

Ftc Appeals Activision Blizzard Acquisition Decision Whats Next

May 24, 2025

Latest Posts

-

Repetitive Documents An Ai Solution For Creating A Poop Podcast

May 24, 2025

Repetitive Documents An Ai Solution For Creating A Poop Podcast

May 24, 2025 -

Ai Digest Transforming Repetitive Documents Into Informative Poop Podcasts

May 24, 2025

Ai Digest Transforming Repetitive Documents Into Informative Poop Podcasts

May 24, 2025 -

Lab Owners Guilty Plea Faking Covid 19 Test Results During Pandemic

May 24, 2025

Lab Owners Guilty Plea Faking Covid 19 Test Results During Pandemic

May 24, 2025 -

Utilizing Orbital Space Crystals For Superior Drug Production

May 24, 2025

Utilizing Orbital Space Crystals For Superior Drug Production

May 24, 2025 -

Space Crystals And Pharmaceutical Advancement Exploring New Frontiers In Drug Research

May 24, 2025

Space Crystals And Pharmaceutical Advancement Exploring New Frontiers In Drug Research

May 24, 2025