Amsterdam Stock Market: 7% Drop Reflects Growing Trade War Concerns

Table of Contents

The Impact of Trade Wars on the Amsterdam Stock Market

The Amsterdam Stock Market, while geographically situated in a relatively stable region, is deeply intertwined with the global economy. Trade wars create uncertainty, impacting businesses and investors alike. This interconnectedness means that even seemingly isolated markets are affected by international trade tensions. The recent 7% drop in the Amsterdam Stock Market serves as a stark reminder of this reality.

- Increased uncertainty among investors leading to sell-offs: The unpredictable nature of trade wars leads to investor anxiety, triggering widespread sell-offs as they seek to protect their portfolios.

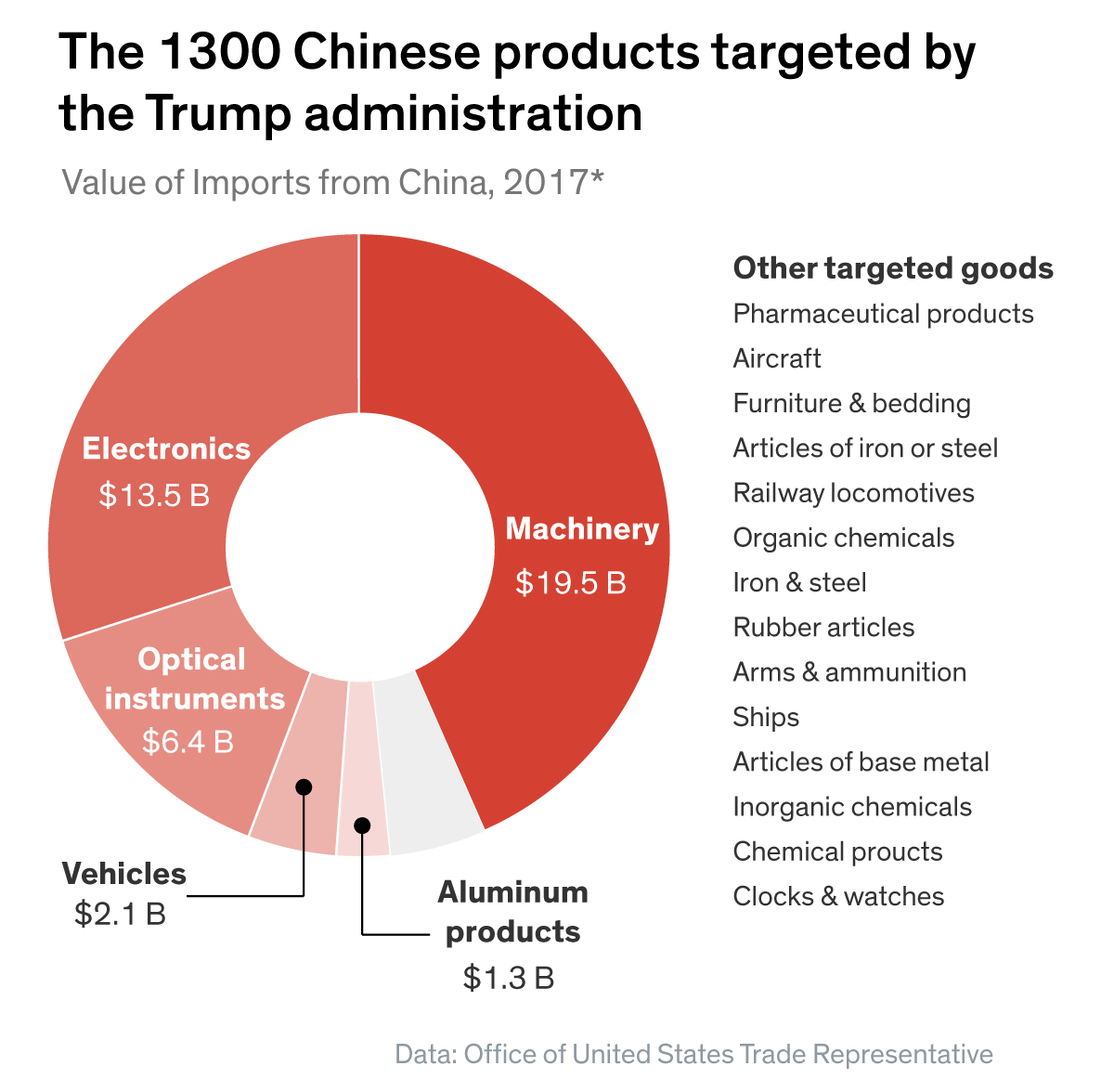

- Impact on specific sectors heavily reliant on international trade: Sectors like technology and logistics, which rely heavily on global supply chains, are particularly vulnerable to trade disruptions. Increased tariffs and trade restrictions directly impact their profitability and growth potential.

- Decreased consumer confidence affecting domestic demand: Trade war anxieties often translate into decreased consumer confidence, leading to reduced spending and dampening domestic demand. This creates a ripple effect throughout the Dutch economy.

- Potential for ripple effects impacting other European markets: The Amsterdam Stock Market's performance is closely linked to other European markets. A significant downturn in Amsterdam can easily trigger negative sentiment and further instability across the continent.

Analyzing the 7% Drop: Key Contributing Factors

While escalating trade war concerns are a major contributing factor to the 7% drop in the Amsterdam Stock Market, a deeper analysis reveals other significant elements.

- Specific policy changes impacting Dutch businesses: New regulations or changes in government policies can directly impact the profitability and competitiveness of Dutch companies listed on the Amsterdam Stock Exchange.

- Performance of key Amsterdam-listed companies: The poor performance of several large, influential companies listed on the Amsterdam Stock Exchange can significantly influence the overall market index.

- Impact of global economic slowdown: A global economic slowdown, often exacerbated by trade wars, can depress market sentiment and lead to decreased investment.

- Investor sentiment analysis: Negative news and uncertainty contribute significantly to overall investor sentiment. A shift towards pessimism can trigger rapid sell-offs, like the recent 7% drop.

Experts like Dr. Anya Sharma, a leading economist at the University of Amsterdam, comment that "The recent decline reflects not only global trade concerns but also a confluence of factors unique to the Dutch economy, demanding a nuanced analysis beyond simple trade war narratives.”

The Amsterdam Stock Market and Global Trade Tensions

The Amsterdam Stock Market's recent volatility is inseparable from the broader context of escalating global trade tensions. The ongoing trade disputes significantly influence investor confidence and market stability.

- Comparison with other European stock markets' responses to trade war anxieties: Comparing the Amsterdam Stock Market's performance with other European markets reveals the extent to which specific national factors influence market reactions to global trade anxieties.

- Potential long-term consequences for the Dutch economy: Prolonged trade tensions could have serious and lasting negative effects on Dutch economic growth, employment, and overall prosperity.

- The role of international organizations in mitigating the impact of trade wars: International organizations like the WTO play a crucial role in mediating trade disputes and attempting to mitigate the negative consequences of trade wars.

- Analysis of government responses and their effectiveness: The Dutch government's response to the market downturn, including potential policy interventions, will significantly impact the market's recovery and future stability. (Insert chart showing comparison of Amsterdam Stock Market performance against other European indices here)

Strategies for Investors During Times of Uncertainty

Navigating the volatile market conditions created by trade war concerns requires careful planning and a strategic approach.

- Diversification strategies: Diversifying investment portfolios across different asset classes and geographical regions reduces risk exposure.

- Risk management techniques: Implementing robust risk management strategies, including stop-loss orders, helps limit potential losses during market downturns.

- Importance of long-term investment perspectives: Maintaining a long-term investment horizon helps mitigate the impact of short-term market fluctuations.

- Seeking professional financial advice: Consulting with a qualified financial advisor provides personalized guidance tailored to individual investment goals and risk tolerance.

Future Outlook for the Amsterdam Stock Market

Predicting the future of the Amsterdam Stock Market amidst ongoing trade war uncertainties remains challenging. However, based on current trends and analysis:

- Projected growth or contraction of key sectors: Different sectors within the Dutch economy will experience varied impacts depending on their exposure to international trade and global demand.

- Potential policy changes affecting the market: Government policies aimed at stimulating economic growth and mitigating the effects of trade wars will significantly influence market performance.

- Predictions based on various economic models: Employing various economic models and projections can offer a range of potential scenarios for the future of the Amsterdam Stock Market.

- Scenarios based on different trade war resolutions: The outcome of ongoing trade negotiations will be a significant determinant of the Amsterdam Stock Market's future trajectory.

Conclusion: Understanding the Amsterdam Stock Market’s Volatility Amidst Trade War Concerns

The 7% drop in the Amsterdam Stock Market serves as a stark reminder of the significant impact of global trade tensions on even seemingly stable markets. This substantial decline stems from a combination of factors, including escalating trade war anxieties, specific policy changes, and the general global economic slowdown. Understanding the Amsterdam Stock Market's vulnerability to these global economic fluctuations is crucial for investors and policymakers alike. To navigate this turbulent landscape effectively, stay updated on the Amsterdam Stock Market, monitor the Amsterdam Stock Market for future trends, and learn more about the impact of trade wars on the Amsterdam Stock Market. Proactive monitoring and a well-informed investment strategy are paramount during times of such uncertainty.

Featured Posts

-

Analyse Snelle Marktdraai Europese Aandelen Een Voorbode Van Meer

May 25, 2025

Analyse Snelle Marktdraai Europese Aandelen Een Voorbode Van Meer

May 25, 2025 -

Your Escape To The Country Awaits Choosing The Right Property

May 25, 2025

Your Escape To The Country Awaits Choosing The Right Property

May 25, 2025 -

Amsterdam Exchange Plunges 7 At Opening Bell Trade War Impact

May 25, 2025

Amsterdam Exchange Plunges 7 At Opening Bell Trade War Impact

May 25, 2025 -

Aex Stijgt Na Trump Uitstel Analyse Van De Winnende Fondsen

May 25, 2025

Aex Stijgt Na Trump Uitstel Analyse Van De Winnende Fondsen

May 25, 2025 -

Used Porsche Macan Buyers Guide Tips For Finding A Great Deal

May 25, 2025

Used Porsche Macan Buyers Guide Tips For Finding A Great Deal

May 25, 2025

Latest Posts

-

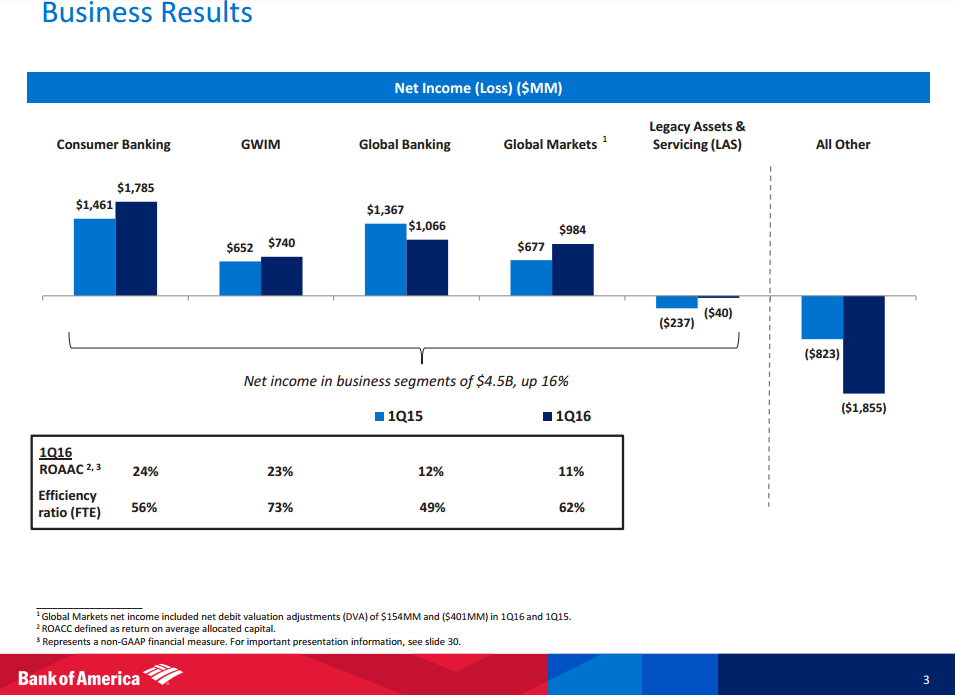

Stock Market Valuation Concerns Bof A Offers A Reassuring Perspective

May 25, 2025

Stock Market Valuation Concerns Bof A Offers A Reassuring Perspective

May 25, 2025 -

Public Reaction To Thames Waters Executive Bonus Payments

May 25, 2025

Public Reaction To Thames Waters Executive Bonus Payments

May 25, 2025 -

Thames Waters Executive Bonuses A Case Study In Corporate Governance

May 25, 2025

Thames Waters Executive Bonuses A Case Study In Corporate Governance

May 25, 2025 -

High Stock Valuations Bof As Reason For Investor Calm

May 25, 2025

High Stock Valuations Bof As Reason For Investor Calm

May 25, 2025 -

Malaysias Najib Razak Faces New Accusations In French Submarine Bribery Case

May 25, 2025

Malaysias Najib Razak Faces New Accusations In French Submarine Bribery Case

May 25, 2025