Amundi Dow Jones Industrial Average UCITS ETF: Daily NAV Updates And Their Significance

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated?

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, per share. For the Amundi Dow Jones Industrial Average UCITS ETF, which tracks the Dow Jones Industrial Average, the NAV calculation reflects the collective value of the underlying 30 stocks. Understanding this calculation is fundamental to interpreting daily price movements.

- Market value of underlying assets: This is the primary component, representing the total market value of the 30 stocks comprising the Dow Jones Industrial Average, held by the ETF.

- Liabilities: This includes expenses such as management fees, administrative costs, and any other outstanding liabilities associated with the ETF.

- Number of outstanding ETF shares: The total number of shares of the Amundi Dow Jones Industrial Average UCITS ETF currently in circulation.

- NAV Calculation (Simplified): (Total Market Value of Assets - Liabilities) / Number of Outstanding Shares = NAV per share

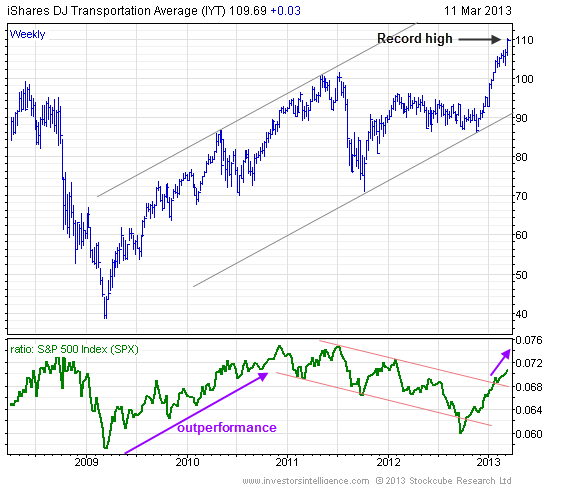

The Daily Fluctuation of the NAV

The daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF fluctuates based on several factors, primarily mirroring the performance of the Dow Jones Industrial Average. However, other elements also contribute to these changes.

- Changes in the prices of the underlying 30 stocks: Individual stock price movements within the Dow Jones Industrial Average directly impact the ETF's NAV. A positive day for the index generally translates to a higher NAV, and vice-versa.

- Currency fluctuations: While the Dow Jones Industrial Average is a US dollar-denominated index, currency exchange rates can influence the NAV if the ETF holds assets in other currencies.

- Dividend payments from underlying stocks: When underlying companies pay dividends, the ETF receives these payments, which can slightly increase the NAV.

- ETF trading volume: High trading volume can sometimes lead to slight discrepancies between the ETF's market price and its NAV.

Why are Daily NAV Updates Important for Investors?

Daily NAV updates provide crucial insights into your investment performance and are essential tools for effective investment management.

- Tracking investment performance: By monitoring the daily NAV, you can easily assess your gains or losses on your investment in the Amundi Dow Jones Industrial Average UCITS ETF.

- Making informed investment decisions: Daily NAV changes, when considered alongside broader market trends and your own risk tolerance, can inform your decision to buy, hold, or sell shares.

- Risk management: Regularly observing NAV fluctuations helps you identify potential risks and adjust your investment strategy accordingly. For example, consistent negative trends may warrant a review of your portfolio.

- Portfolio rebalancing: Monitoring NAV allows you to maintain your desired asset allocation by rebalancing your portfolio periodically.

Accessing Daily NAV Updates

Accessing the daily NAV for the Amundi Dow Jones Industrial Average UCITS ETF is straightforward through various channels:

- The official Amundi website: The Amundi website usually provides up-to-date information on the ETF's NAV.

- Financial news websites and apps: Many reputable financial news sources offer real-time or delayed NAV data for various ETFs, including this one.

- Online brokerage platforms: If you hold the ETF through a brokerage account, the platform usually displays the current NAV alongside other investment details.

- Dedicated ETF data providers: Several specialized data providers offer comprehensive ETF data, including daily NAV updates.

Interpreting NAV Changes and Making Investment Decisions

Analyzing NAV changes requires a balanced approach. While daily fluctuations can be informative, avoid making rash decisions based solely on short-term movements.

- Investment Analysis: Consider the NAV in the context of broader market trends, economic indicators, and news affecting the Dow Jones Industrial Average.

- Trend Analysis: Focus on longer-term trends rather than daily ups and downs. Consistent upward trends generally indicate a healthy investment, while prolonged downward trends may warrant closer examination.

- Long-term vs. Short-term: Daily NAV changes should be viewed within a longer-term investment strategy. Short-term fluctuations are normal and often irrelevant to long-term investment goals.

- Market Timing: Avoid trying to "time the market" based solely on daily NAV movements. This is risky and often ineffective.

- Risk Tolerance: Your risk tolerance and investment goals should guide your decision-making process, not just short-term NAV changes.

Conclusion

Understanding the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF is crucial for effective investment management. By grasping how NAV is calculated, accessing daily updates, and interpreting changes thoughtfully, you can make informed decisions that align with your investment objectives. Stay informed about your Amundi Dow Jones Industrial Average UCITS ETF investments by checking the daily NAV regularly and consider consulting with a financial advisor for personalized guidance. Remember, consistent monitoring and a well-defined investment strategy are key to successful long-term investing.

Featured Posts

-

How To Secure Bbc Radio 1 Big Weekend 2025 Tickets Confirmed Lineup

May 25, 2025

How To Secure Bbc Radio 1 Big Weekend 2025 Tickets Confirmed Lineup

May 25, 2025 -

16 Nisan 2025 Avrupa Piyasalari Stoxx Europe 600 Ve Dax 40 Ta Duesues

May 25, 2025

16 Nisan 2025 Avrupa Piyasalari Stoxx Europe 600 Ve Dax 40 Ta Duesues

May 25, 2025 -

Euronext Amsterdam Stock Market 8 Surge After Trumps Tariff Plan Suspension

May 25, 2025

Euronext Amsterdam Stock Market 8 Surge After Trumps Tariff Plan Suspension

May 25, 2025 -

Astonishing Footage Pair Refuels Car At 90mph During Police Chase

May 25, 2025

Astonishing Footage Pair Refuels Car At 90mph During Police Chase

May 25, 2025 -

Brbs Banco Master Acquisition A Challenge To Brazilian Banking Giants

May 25, 2025

Brbs Banco Master Acquisition A Challenge To Brazilian Banking Giants

May 25, 2025

Latest Posts

-

England Airpark And Alexandria International Airport Promoting Local And International Travel With Ae Xplore

May 25, 2025

England Airpark And Alexandria International Airport Promoting Local And International Travel With Ae Xplore

May 25, 2025 -

Housing Finance And Family Fun Everything You Need At The Iam Expat Fair

May 25, 2025

Housing Finance And Family Fun Everything You Need At The Iam Expat Fair

May 25, 2025 -

Philips Shareholders Full Agenda And Updates For The 2025 Agm

May 25, 2025

Philips Shareholders Full Agenda And Updates For The 2025 Agm

May 25, 2025 -

Reporting On Philips Annual General Meeting Of Shareholders

May 25, 2025

Reporting On Philips Annual General Meeting Of Shareholders

May 25, 2025 -

Discover England Airpark And Alexandria International Airport The Ae Xplore Campaign For Local And Global Travel

May 25, 2025

Discover England Airpark And Alexandria International Airport The Ae Xplore Campaign For Local And Global Travel

May 25, 2025