Amundi Dow Jones Industrial Average UCITS ETF: NAV Calculation And Implications

Table of Contents

Understanding the Amundi Dow Jones Industrial Average UCITS ETF

The Amundi Dow Jones Industrial Average UCITS ETF (often identified by its ticker symbol, which may vary depending on the exchange – check your broker for the specific ticker) provides investors with diversified exposure to the 30 large-cap, blue-chip companies that comprise the Dow Jones Industrial Average. Its investment objective is to track the performance of this benchmark index as closely as possible. This makes it a suitable investment for a broad range of investors, from beginners seeking broad market exposure to experienced investors looking for a core holding in their portfolio.

A UCITS (Undertakings for Collective Investment in Transferable Securities) ETF is a type of exchange-traded fund that complies with EU regulations, providing investors with a high degree of regulatory protection and cross-border portability.

Investing in this specific ETF offers several key advantages:

-

Diversification: Instant diversification across 30 major US companies, mitigating the risk associated with investing in individual stocks.

-

Low Cost: UCITS ETFs generally have low expense ratios compared to actively managed funds, making them a cost-effective way to gain market exposure.

-

Transparency: The holdings and NAV are publicly available, providing investors with clarity and accountability.

-

Investment Strategy and Asset Allocation: The ETF employs a full replication strategy, aiming to hold all 30 components of the Dow Jones Industrial Average in the same proportions as the index.

-

Expense Ratio and Management Fees: The expense ratio is typically low, representing the annual cost of managing the fund. Check the fund's prospectus for the most up-to-date information.

-

Minimum Investment Amount: Generally, there is no minimum investment amount for purchasing shares of the ETF through a brokerage account.

-

Trading Platform Availability: The ETF is usually traded on major stock exchanges, offering investors convenient access and liquidity.

Deconstructing the NAV Calculation Process

The NAV (Net Asset Value) of the Amundi Dow Jones Industrial Average UCITS ETF represents the total value of the ETF's underlying assets divided by the number of outstanding shares. The calculation involves several key components:

-

Market Value of Underlying Assets: This is the primary driver of the NAV. It's determined by the current market price of each of the 30 Dow Jones Industrial Average constituent stocks held by the ETF, multiplied by the number of shares of each stock held.

-

Currency Exchange Rates: Since the underlying assets are primarily US dollar-denominated, currency exchange rates play a crucial role for investors outside the US. Fluctuations in exchange rates will directly impact the NAV for non-USD investors.

-

Dividends and Other Income: Dividends received from the underlying stocks are reinvested or distributed to shareholders, impacting the NAV. Other income, such as interest, is also taken into account.

-

Frequency of NAV Calculation: The NAV is typically calculated daily, reflecting the closing market prices of the underlying assets.

-

Formula for NAV Calculation (Simplified): NAV = (Total Market Value of Assets - Liabilities) / Number of Outstanding Shares

-

Sources of Data Used in the Calculation: Data is primarily sourced from reputable market data providers, ensuring accuracy and reliability.

-

Impact of Market Fluctuations on NAV: The NAV will fluctuate in line with the performance of the Dow Jones Industrial Average. A rising market will generally lead to a higher NAV, while a falling market will lead to a lower NAV.

-

Transparency of the NAV Calculation Process: The calculation process is generally transparent, with details usually available in the ETF's prospectus and on the fund manager's website.

Factors Affecting the Amundi Dow Jones Industrial Average UCITS ETF NAV

Several factors significantly impact the NAV of the Amundi Dow Jones Industrial Average UCITS ETF:

-

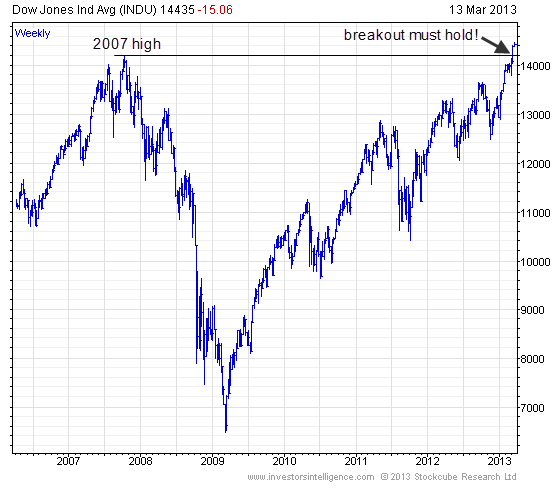

Market Performance of the Dow Jones Industrial Average: The most significant factor is the overall performance of the Dow Jones Industrial Average. Positive market sentiment and strong economic data generally lead to higher NAVs, while negative sentiment and economic weakness will negatively impact the NAV.

-

Influence of Individual Stock Performance: The performance of individual stocks within the Dow Jones Industrial Average also affects the NAV. Strong performance by a large-cap component will positively impact the overall NAV.

-

Macroeconomic Factors: Broader macroeconomic factors, such as interest rates, inflation, and economic growth, influence the overall market and, consequently, the ETF's NAV.

-

Currency Fluctuations: For international investors, currency fluctuations between the USD and their local currency will significantly impact the NAV in their local currency.

-

Examples of Events That Significantly Impact NAV: Market crashes (e.g., 2008 financial crisis), economic recessions, geopolitical events (e.g., wars, trade disputes), and significant changes in monetary policy can all have a substantial effect on the NAV.

-

Correlation between Dow Jones Industrial Average Performance and ETF NAV: There's a high correlation; the ETF NAV should closely track the Dow Jones Industrial Average's performance.

-

Impact of Geopolitical Events on the NAV: Geopolitical uncertainty often leads to market volatility, influencing the NAV.

Implications of NAV for Investors

Understanding the NAV of the Amundi Dow Jones Industrial Average UCITS ETF is crucial for several reasons:

-

Investment Timing Decisions: Monitoring NAV changes can inform investment timing strategies. For example, investors might consider buying when the NAV is relatively low and selling when it's relatively high.

-

Calculating Returns: The NAV is essential for calculating the return on investment. Comparing the purchase NAV to the current NAV, and factoring in any distributions, provides a clear picture of investment performance.

-

Portfolio Valuation: The NAV plays a vital role in determining the overall value of a portfolio holding this ETF.

-

Relationship Between NAV and ETF Market Price: While the ETF's market price often closely tracks the NAV, there can be small discrepancies due to supply and demand. Large differences should be investigated.

-

Strategies for Monitoring NAV Changes: Regularly check the fund manager's website or your brokerage account for daily NAV updates.

-

Importance of Comparing NAV to ETF Market Price: Significant deviations between NAV and market price may signal arbitrage opportunities or market inefficiencies.

-

Relationship Between NAV and Investor Sentiment: Investor sentiment can impact the market price, even if the NAV remains stable.

-

Impact of NAV on Tax Implications: Changes in NAV will affect the capital gains or losses realized when selling the ETF shares.

Conclusion

Understanding the Amundi Dow Jones Industrial Average UCITS ETF NAV calculation is crucial for making informed investment decisions. The NAV reflects the underlying value of the ETF's assets and is a key indicator of its performance. Its fluctuations are influenced by the performance of the Dow Jones Industrial Average, individual stock movements, macroeconomic factors, and currency exchange rates. By carefully monitoring the NAV and comparing it to the market price, investors can make more strategic decisions and better manage their portfolios. Understanding the Amundi Dow Jones Industrial Average UCITS ETF NAV is crucial for successful investing. Learn more about this ETF and its underlying calculations to make informed decisions about your portfolio. Consult the fund's prospectus and your financial advisor for further details.

Featured Posts

-

Apple Stock Slumps On 900 Million Tariff Projection

May 24, 2025

Apple Stock Slumps On 900 Million Tariff Projection

May 24, 2025 -

Aex Stijgt Terwijl Amerikaanse Beurs Daalt Analyse En Vooruitzichten

May 24, 2025

Aex Stijgt Terwijl Amerikaanse Beurs Daalt Analyse En Vooruitzichten

May 24, 2025 -

The Case For News Corp Undervalued And Ready For Growth

May 24, 2025

The Case For News Corp Undervalued And Ready For Growth

May 24, 2025 -

Glastonbury 2024 Unannounced Us Band Teases Festival Slot

May 24, 2025

Glastonbury 2024 Unannounced Us Band Teases Festival Slot

May 24, 2025 -

Hawaii Keikis Memorial Day Lei Making Poster Contest Showcasing Artistic Talent

May 24, 2025

Hawaii Keikis Memorial Day Lei Making Poster Contest Showcasing Artistic Talent

May 24, 2025

Latest Posts

-

The Woody Allen Controversy Sean Penns Support And The Reemergence Of Past Allegations

May 24, 2025

The Woody Allen Controversy Sean Penns Support And The Reemergence Of Past Allegations

May 24, 2025 -

Sean Penns Recent Public Appearance A Detailed Look At The Controversy

May 24, 2025

Sean Penns Recent Public Appearance A Detailed Look At The Controversy

May 24, 2025 -

Woody Allen And The Resurfacing Sexual Abuse Claims A Look At Sean Penns Involvement

May 24, 2025

Woody Allen And The Resurfacing Sexual Abuse Claims A Look At Sean Penns Involvement

May 24, 2025 -

Hollywood Star Sean Penn Makes Bombshell Claims Leaving Fans Horrified

May 24, 2025

Hollywood Star Sean Penn Makes Bombshell Claims Leaving Fans Horrified

May 24, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy A Closer Look

May 24, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy A Closer Look

May 24, 2025