Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF USD Hedged Dist: Key Factors

Table of Contents

Factors Affecting the Amundi MSCI World II UCITS ETF NAV

Several intertwined factors contribute to the daily fluctuations of the Amundi MSCI World II UCITS ETF USD Hedged Dist's NAV. Understanding these elements is critical for investors seeking to maximize their returns and manage risk effectively.

Underlying Asset Performance

The Amundi MSCI World II UCITS ETF USD Hedged Dist tracks the MSCI World Index, a broad market-capitalization weighted index representing large and mid-cap equities across developed markets globally. Therefore, the performance of this index directly and significantly impacts the ETF's NAV.

- Market Fluctuations: Bull markets generally lead to an increase in the NAV, while bear markets cause a decrease. Global economic sentiment plays a crucial role here.

- Sector Performance: The relative performance of different sectors within the MSCI World Index (e.g., technology, healthcare, financials) also affects the overall NAV. Strong performance in specific sectors will positively impact the NAV, and vice-versa.

- Individual Company Stock Prices: The price movements of individual companies within the index, weighted by their market capitalization, cumulatively influence the index's overall performance and subsequently, the ETF's NAV.

- Global Economic Events: Macroeconomic events such as interest rate changes, geopolitical instability, and unexpected economic data releases can all significantly impact the MSCI World Index and therefore the ETF's NAV.

Currency Hedging Impact

A key feature of the Amundi MSCI World II UCITS ETF USD Hedged Dist is its USD currency hedging strategy. This aims to mitigate the risk associated with fluctuations in exchange rates between the USD and other currencies represented in the underlying index.

- How the Hedge Works: The ETF utilizes financial instruments like forwards or swaps to offset potential losses from currency fluctuations. Essentially, it aims to maintain the value of the underlying assets in USD terms.

- Impact of Exchange Rate Fluctuations: While the hedge aims to neutralize currency risk, it's not always perfectly effective. Significant and unexpected movements in exchange rates can still slightly affect the NAV.

- Potential Hedging Costs: Implementing the currency hedge involves costs, which can slightly reduce the ETF's overall returns and thus influence the NAV. These costs are factored into the overall expense ratio.

Expense Ratio and Management Fees

The expense ratio, encompassing management fees and other operational costs, directly impacts the ETF's NAV. These fees are deducted from the fund's assets, reducing the overall growth of the NAV.

- How Fees are Deducted: Fees are usually deducted on a daily basis, proportionally reducing the NAV over time.

- Impact on Long-Term Returns: Even a small expense ratio can significantly reduce long-term returns. Comparing the expense ratios of similar ETFs is crucial for informed investment decisions.

- Affecting Overall NAV Growth: Higher expense ratios lead to slower NAV growth compared to ETFs with lower fees.

Inflows and Outflows

Investor demand, reflected in inflows (purchases) and outflows (sales), also affects the ETF's NAV. High demand tends to increase the NAV, while low demand can decrease it.

- High Demand Increasing NAV: Increased buying pressure increases the price of the ETF shares, leading to a rise in the NAV.

- Low Demand Decreasing NAV: Conversely, increased selling pressure puts downward pressure on the price, potentially lowering the NAV.

- Relationship Between Trading Volume and NAV Fluctuations: High trading volume often correlates with larger NAV fluctuations, reflecting stronger investor sentiment and trading activity. Large institutional investments or withdrawals can have a particularly pronounced effect.

Dividend Distributions

The Amundi MSCI World II UCITS ETF USD Hedged Dist distributes dividends earned from the underlying holdings. These distributions impact the NAV.

- How Dividends are Calculated and Distributed: Dividends are typically calculated based on the underlying companies' dividend payouts and then distributed to ETF shareholders.

- Ex-Dividend Date and its Effect on NAV: The ex-dividend date is when the share price typically reflects the deduction of the dividend. The NAV will decrease on this date, reflecting the payout.

- Reinvested Dividends: Many investors choose to reinvest dividends, which can lead to compounding returns and indirectly increase the NAV over time. The NAV will show a reduction due to the distribution, but the subsequent reinvestment will eventually impact future NAV growth.

Conclusion

The Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF USD Hedged Dist is influenced by a complex interplay of factors: the performance of the underlying MSCI World Index, the effectiveness of the USD currency hedge, the expense ratio, investor inflows and outflows, and dividend distributions. Understanding these interconnected factors is essential for making informed investment decisions. Regularly monitoring the NAV, combined with a thorough understanding of the ETF's prospectus, will help investors track the performance of their investment and manage their risk effectively. To stay informed about the Amundi MSCI World II UCITS ETF USD Hedged Dist and similar ETFs, monitor its NAV regularly and conduct thorough research.

Featured Posts

-

Net Asset Value Nav Explained Amundi Msci World Ii Ucits Etf Dist

May 25, 2025

Net Asset Value Nav Explained Amundi Msci World Ii Ucits Etf Dist

May 25, 2025 -

Porsche Cayenne Gts Coupe Moje Doswiadczenia I Opinia

May 25, 2025

Porsche Cayenne Gts Coupe Moje Doswiadczenia I Opinia

May 25, 2025 -

Escape To The Country Finding Your Dream Home For Under 1m

May 25, 2025

Escape To The Country Finding Your Dream Home For Under 1m

May 25, 2025 -

Is A Us Band Playing Glastonbury Unconfirmed Reports Fuel Excitement

May 25, 2025

Is A Us Band Playing Glastonbury Unconfirmed Reports Fuel Excitement

May 25, 2025 -

Jejak Sejarah Porsche 356 Di Pabrik Zuffenhausen Jerman

May 25, 2025

Jejak Sejarah Porsche 356 Di Pabrik Zuffenhausen Jerman

May 25, 2025

Latest Posts

-

Serious Car Crash Leads To Road Closure And Hospitalization

May 25, 2025

Serious Car Crash Leads To Road Closure And Hospitalization

May 25, 2025 -

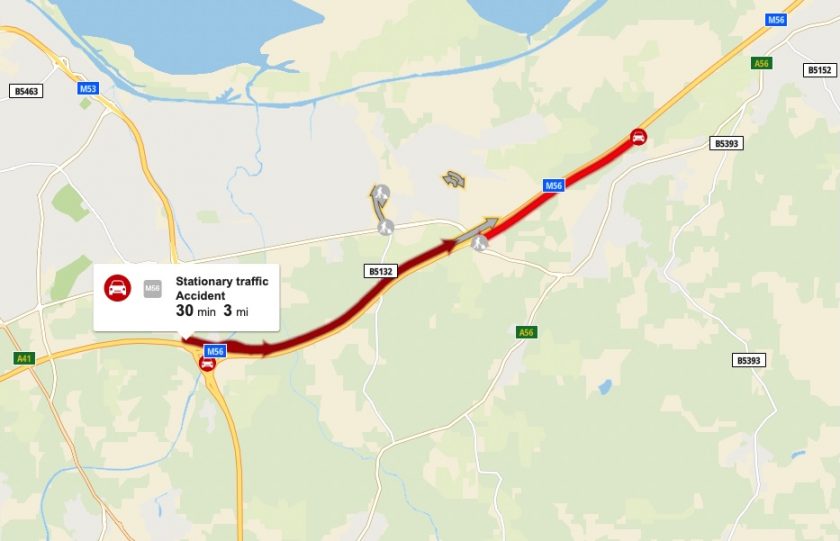

Serious M56 Crash Car Overturn Results In Motorway Casualty

May 25, 2025

Serious M56 Crash Car Overturn Results In Motorway Casualty

May 25, 2025 -

Major Road Closed After Serious Accident Person Hospitalized

May 25, 2025

Major Road Closed After Serious Accident Person Hospitalized

May 25, 2025 -

Severe Delays On M56 Collision Impacts Cheshire And Deeside Drivers

May 25, 2025

Severe Delays On M56 Collision Impacts Cheshire And Deeside Drivers

May 25, 2025 -

M62 Westbound Resurfacing Manchester To Warrington Road Closure

May 25, 2025

M62 Westbound Resurfacing Manchester To Warrington Road Closure

May 25, 2025