Analysis: Brexit's Impact On UK Luxury Exports To The EU

Table of Contents

Increased Tariffs and Non-Tariff Barriers

The shift from frictionless trade within the EU single market to a more distanced relationship has introduced significant hurdles for UK luxury exporters. These hurdles manifest primarily as increased tariffs and complex non-tariff barriers (NTBs).

Tariff Impact on Profit Margins

The imposition of tariffs on various luxury goods has directly impacted the profitability of UK exporters. Specific examples highlight this impact:

- Scotch Whisky: Tariffs imposed on Scotch whisky entering the EU have increased its price, reducing competitiveness against other spirits and impacting sales volumes. Estimates suggest a price increase of X% per bottle, significantly eroding profit margins for distilleries and exporters.

- High-End Cars: Luxury car manufacturers face increased tariffs on vehicles exported to the EU, leading to a higher price point for consumers and a potential decrease in demand. This affects not only the manufacturers but also the entire supply chain involved in producing and exporting these vehicles.

- Designer Clothing: The added tariffs on high-fashion garments have reduced price competitiveness, making British brands less attractive compared to those from within the EU or other regions with preferential trade deals.

These tariff increases have forced many luxury brands to absorb some of the cost, reducing profit margins, or pass the extra expense on to consumers, potentially impacting demand. Careful analysis of these price changes and their effects on consumer behavior is crucial for understanding the full impact of these new tariffs.

Non-Tariff Barriers (NTBs)

Beyond tariffs, Brexit has introduced a significant number of NTBs, creating additional complexities and costs for UK luxury exporters. These include:

- Delays at Borders: Increased customs checks and paperwork have resulted in significant delays at EU borders, disrupting supply chains and leading to spoilage of perishable goods (though less applicable to most luxury goods, the principle still applies to time-sensitive deliveries).

- Increased Administrative Burdens: The new customs procedures require extensive paperwork, certifications, and compliance with differing EU regulations, adding significantly to administrative costs. This administrative burden disproportionately impacts smaller luxury exporters who lack the resources of larger corporations.

- Increased Logistics Costs: Navigating the new regulatory landscape necessitates increased investment in logistics and supply chain management, further impacting profitability. This includes increased reliance on specialist freight forwarders and the need for meticulous documentation. The cost of these added logistical processes is directly impacting the bottom line for UK luxury exporters.

Changes in Consumer Demand and Market Access

Brexit's impact extends beyond the purely logistical, influencing consumer perceptions and market access for UK luxury goods.

Impact on Brand Perception and Consumer Confidence

Brexit has undeniably affected the perception of British luxury brands within the EU. This is evident in:

- Surveys and Data on Consumer Sentiment: Post-Brexit surveys have indicated a decline in consumer confidence towards British luxury goods in some sectors, suggesting potential shifts in consumer preference. More research is needed to ascertain the extent and longevity of this shift.

- Potential Brand Image Damage: The uncertainty surrounding Brexit and its implications for trade initially created negative press and could have negatively impacted the perception of British luxury brands as reliable and high-quality suppliers. This could be further exacerbated by any disruptions to supply chains or delays in deliveries.

- Shifts in Consumer Preferences: Consumers may have shifted their preferences towards brands originating from within the EU or other regions perceived as more reliable and less susceptible to trade disruptions.

Reduced Market Access and Competition

Brexit has undoubtedly created challenges to market access for UK luxury exporters, leading to increased competition.

- Competitors Gaining Market Share: EU-based competitors and brands from other regions have capitalized on the increased hurdles for UK exporters, potentially gaining market share. A detailed analysis of market share data across various luxury goods sectors is needed to accurately quantify this shift.

- Market Share Changes for Specific Brands: Specific brands have reported a decline in sales within the EU market, directly attributable to the challenges posed by Brexit. These case studies provide valuable insights into the sector-specific implications of these changes.

- Strategies to Regain Market Access: UK luxury exporters are actively implementing strategies to regain market access, such as diversification, improved logistics, and focused marketing campaigns within the EU.

Adaptation and Mitigation Strategies

Despite the challenges, UK luxury exporters are demonstrating resilience and implementing various strategies to adapt to the post-Brexit environment.

Strategies Employed by Luxury Exporters

Many companies are investing in:

- Investment in Logistics and Supply Chain Optimization: Significant investment in new technologies and improved supply chain management is crucial to mitigate the impact of border delays and increased administrative burdens. This includes enhanced tracking systems, improved communication with customs authorities, and strategically located warehouses.

- Diversification of Markets: To reduce reliance on the EU market, many luxury exporters are actively expanding into other global markets to diversify their customer base and reduce risk. This diversification strategy is crucial for mitigating future disruptions.

- Strategic Partnerships: Collaboration with logistics providers, customs brokers, and other stakeholders within the EU is essential to navigate the complex post-Brexit landscape. Strategic partnerships help to reduce costs and streamline processes.

- Government Support and Initiatives: UK government initiatives designed to support exporters through grants, advice, and export promotion programs are proving crucial in helping businesses adapt.

Future Outlook and Potential for Growth

While Brexit presents challenges, the future for UK luxury exports isn't solely bleak. Opportunities remain:

- Long-Term Projections of the Luxury Goods Market: The global luxury goods market is expected to continue its growth trajectory, presenting opportunities for UK brands to capture new market share.

- Predictions of Market Share Changes: Strategic adaptation and market diversification could lead to a stabilization or even a recovery of market share in the long term.

- Identification of Potential New Market Niches: The complexities of Brexit could create new niche opportunities for specialized luxury goods and services where adaptability and bespoke solutions are valued.

Conclusion

Brexit has undeniably impacted UK luxury exports to the EU, introducing significant challenges related to increased tariffs, non-tariff barriers, and shifts in consumer demand. However, UK luxury brands have demonstrated adaptability, implementing various strategies to mitigate these challenges. Understanding the complexities of Brexit's impact is crucial for businesses to navigate the new trading landscape and maintain competitiveness. Continued analysis of Brexit's impact on UK luxury exports, including the effects of Brexit on UK luxury goods and the implications of post-Brexit trade for UK luxury brands, is essential to inform strategic decision-making and ensure the future success of this vital sector. For detailed insights and proactive strategies to navigate these complexities, further research into the evolving regulations and market dynamics is strongly recommended.

Featured Posts

-

Chinas Orbital Supercomputer Progress And Challenges

May 20, 2025

Chinas Orbital Supercomputer Progress And Challenges

May 20, 2025 -

Todays Nyt Mini Crossword Solution April 2nd

May 20, 2025

Todays Nyt Mini Crossword Solution April 2nd

May 20, 2025 -

Tadic Posljedice Ignoriranja Daytonskog Sporazuma U Sarajevu

May 20, 2025

Tadic Posljedice Ignoriranja Daytonskog Sporazuma U Sarajevu

May 20, 2025 -

Finding Freedom Planning The Perfect Solo Vacation

May 20, 2025

Finding Freedom Planning The Perfect Solo Vacation

May 20, 2025 -

Talisca Nin Saha Icinde Tartismasi Ve Fenerbahce Nin Tadic Transferi Icin Yaptigi Hareket

May 20, 2025

Talisca Nin Saha Icinde Tartismasi Ve Fenerbahce Nin Tadic Transferi Icin Yaptigi Hareket

May 20, 2025

Latest Posts

-

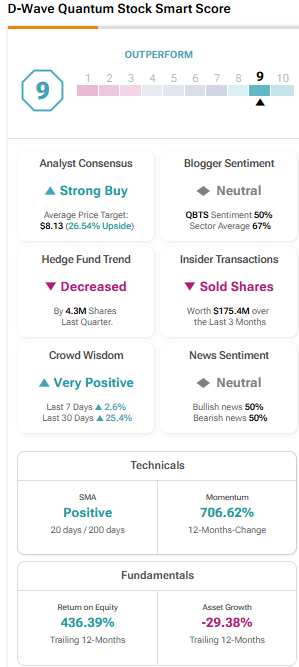

D Wave Quantum Qbts Stock Explaining The Thursday Price Drop

May 20, 2025

D Wave Quantum Qbts Stock Explaining The Thursday Price Drop

May 20, 2025 -

Understanding The Market Reaction D Wave Quantum Qbts Stock On Thursday

May 20, 2025

Understanding The Market Reaction D Wave Quantum Qbts Stock On Thursday

May 20, 2025 -

D Wave Quantum Qbts Stock Performance On Monday Causes And Implications

May 20, 2025

D Wave Quantum Qbts Stock Performance On Monday Causes And Implications

May 20, 2025 -

D Wave Quantum Qbts Stock Performance Thursday Factors Contributing To The Decline

May 20, 2025

D Wave Quantum Qbts Stock Performance Thursday Factors Contributing To The Decline

May 20, 2025 -

Factors Contributing To D Wave Quantums Qbts Stock Gain On Monday

May 20, 2025

Factors Contributing To D Wave Quantums Qbts Stock Gain On Monday

May 20, 2025