Factors Contributing To D-Wave Quantum's (QBTS) Stock Gain On Monday

Table of Contents

Positive News and Announcements

Several factors point to positive news impacting D-Wave Quantum's stock performance on Monday. These positive developments likely boosted investor confidence and fueled the stock's rise.

New Partnerships and Collaborations

Strategic partnerships are crucial for growth in the quantum computing sector, and recent collaborations may have played a significant role in QBTS's stock gain. For example:

- New customer acquisitions: Securing contracts with major corporations needing advanced computing solutions can signal market validation and potential for increased revenue streams. The addition of large enterprise customers would significantly impact D-Wave's future financial outlook.

- Joint ventures: Collaborating with established technology companies to develop and market quantum computing solutions can lead to increased market reach and brand recognition. This expansion into new markets could lead to further QBTS stock appreciation.

- Research agreements: Collaborations with leading research institutions can accelerate technological advancements, paving the way for innovative products and services, leading to stronger investor confidence. A partnership with a prestigious university, for instance, could enhance QBTS’s credibility and long-term prospects.

For example, a hypothetical "Partnership with Lockheed Martin boosts QBTS stock" headline might indicate a significant development driving investor enthusiasm.

Technological Advancements and Product Launches

Improvements in D-Wave's quantum annealing technology and new product releases are significant catalysts for investor interest.

- Enhanced performance: Announcements highlighting improvements in qubit count, processing speed, or solution quality would be attractive to investors. Faster and more powerful quantum computers directly translate into increased value for potential clients.

- Increased scalability: Improved scalability indicates D-Wave's ability to handle more complex problems, attracting clients with larger-scale computational needs. Scalability is a critical factor in the adoption of quantum computing technology.

- Improved accessibility: Making quantum computing more accessible through cloud-based platforms or simplified user interfaces could broaden the potential user base, attracting both enterprise and research clients. Ease of access is a key driver of wider market penetration.

Press releases showcasing such advancements can significantly impact investor sentiment, directly contributing to a QBTS stock price increase.

Improved Financial Outlook

Positive financial news can also significantly boost a company's stock price. For D-Wave Quantum, this could include:

- Stronger-than-expected quarterly earnings: Exceeding market expectations in terms of revenue and profitability can drive investor confidence.

- Increased revenue projections: Upward revisions to future revenue projections based on secured contracts or new market opportunities create positive investor sentiment.

- Positive investor sentiment reports from analysts: Positive ratings and target price increases from reputable financial analysts can influence investor decisions.

Analyzing these financial metrics in comparison to previous periods will highlight the positive impact on the QBTS stock price.

Broader Market Trends and Investor Sentiment

The overall market context also plays a critical role in stock performance.

Overall Positive Sentiment in the Quantum Computing Sector

Positive market sentiment toward quantum computing as a whole can elevate individual company stocks like QBTS.

- Industry-wide positive news: Positive news and breakthroughs in the broader quantum computing industry can create a ripple effect, boosting investor confidence in related companies.

- Competitor performance: Positive performance by other quantum computing companies can signal increased investor interest in the sector as a whole. A rising tide lifts all boats, to an extent.

- Industry reports: Positive industry reports highlighting the growth potential of quantum computing can contribute to this optimistic sentiment.

Short Squeeze or Increased Trading Volume

Market mechanics can also contribute to stock price surges.

- Short squeeze: If a significant number of investors were short-selling QBTS (betting on its price decline), a sudden shift in positive sentiment could trigger a short squeeze, forcing these investors to buy back shares to limit losses. This increased buying pressure would artificially inflate the price.

- Increased trading volume: Unusually high trading volume can itself signal heightened investor interest and speculation, pushing the price upwards. High volume, coupled with positive news, creates a powerful upward pressure.

Speculative Factors and Future Outlook

Investment in QBTS also involves speculation on future potential.

Potential for Future Growth and Innovation

The long-term potential of D-Wave's technology is a significant driver of investor interest.

- Market leadership: The potential for D-Wave to establish itself as a market leader in a rapidly growing industry is a strong incentive for investors.

- High returns on investment: The possibility of substantial future returns on investment (ROI) is a key factor attracting investors seeking high-growth opportunities.

- Competitive advantages: D-Wave's technological advantages and unique approach to quantum computing could give it a significant edge in the market.

Risks and Uncertainties

Investing in QBTS, like any investment in a young technology company, carries inherent risks.

- Technological challenges: The technology is still developing, and unforeseen technical hurdles could impact progress.

- Competition: The quantum computing field is highly competitive, and D-Wave faces challenges from established tech giants and startups.

- Market adoption: The rate of market adoption of quantum computing technology remains uncertain and could affect D-Wave's financial performance.

Conclusion

D-Wave Quantum's (QBTS) Monday stock gain resulted from a combination of factors, including positive news about partnerships, technological advancements, and potentially improved financial prospects. The broader positive market sentiment towards quantum computing and possible market mechanics like short squeezes also played a role. While the future potential for D-Wave is significant, investors should remember the inherent risks associated with this emerging technology sector.

While investing in D-Wave Quantum (QBTS) or any stock carries inherent risks, understanding the factors influencing its price fluctuations can inform investment decisions. Further research into D-Wave Quantum's technology, market position, and financial performance is crucial before making any investment choices in QBTS or other quantum computing stocks. Conduct thorough due diligence and consider consulting a financial advisor before investing in QBTS.

Featured Posts

-

Druhe Dieta Jennifer Lawrence Prekvapiva Novinka

May 20, 2025

Druhe Dieta Jennifer Lawrence Prekvapiva Novinka

May 20, 2025 -

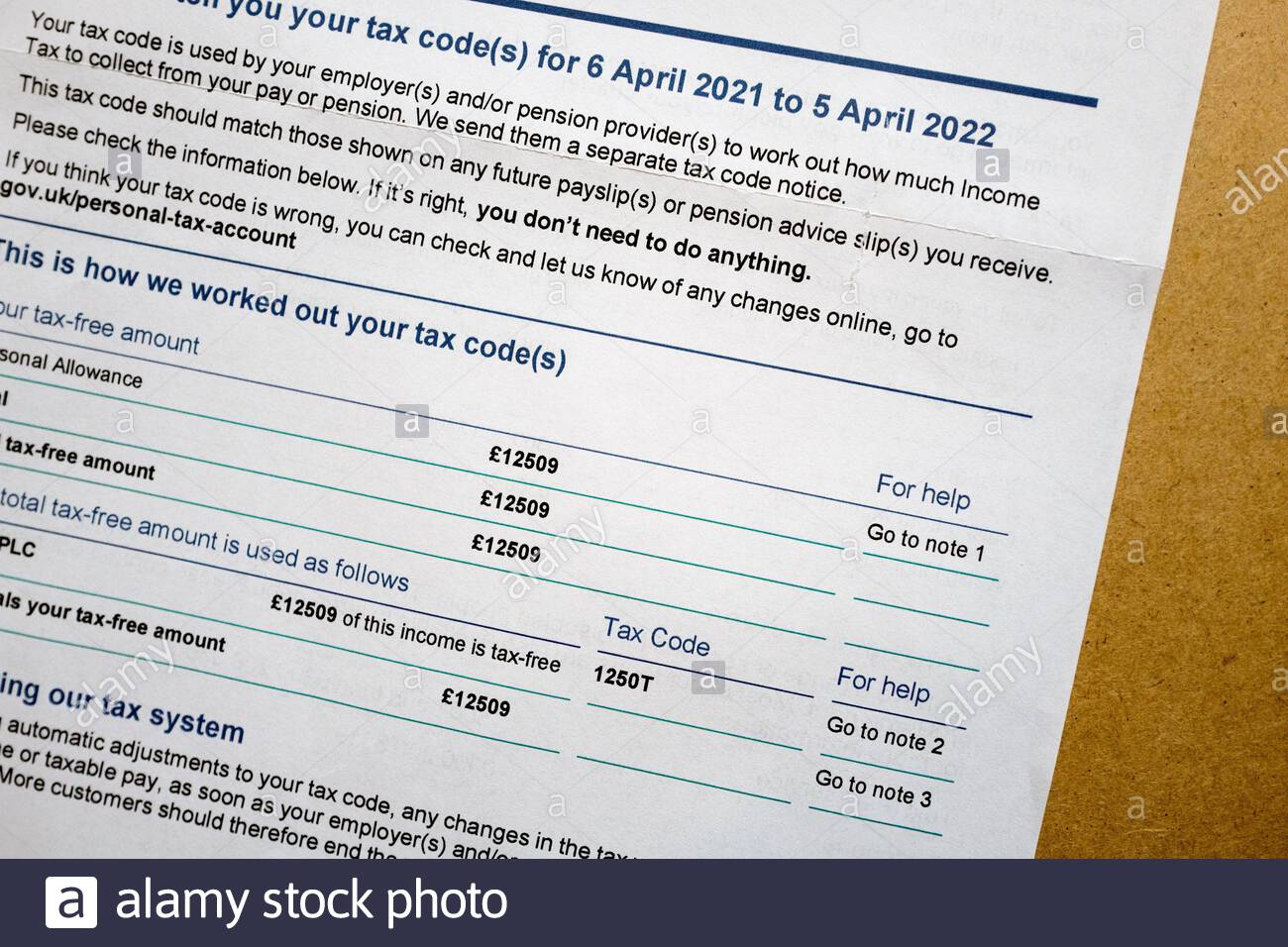

Changes To Hmrc Tax Codes And Their Impact On Savings

May 20, 2025

Changes To Hmrc Tax Codes And Their Impact On Savings

May 20, 2025 -

Hmrcs New Side Hustle Tax Rules A Us Style Snooping Scheme

May 20, 2025

Hmrcs New Side Hustle Tax Rules A Us Style Snooping Scheme

May 20, 2025 -

Bundesliga Mainz 05 Vs Leverkusen Matchday 34 Full Match Report

May 20, 2025

Bundesliga Mainz 05 Vs Leverkusen Matchday 34 Full Match Report

May 20, 2025 -

Wwe Money In The Bank Ripley And Perez Punch Their Tickets

May 20, 2025

Wwe Money In The Bank Ripley And Perez Punch Their Tickets

May 20, 2025

Latest Posts

-

Prokrisi Ston Teliko Champions League I Kroyz Azoyl Toy Giakoymaki

May 20, 2025

Prokrisi Ston Teliko Champions League I Kroyz Azoyl Toy Giakoymaki

May 20, 2025 -

Eksereynontas To Oropedio Evdomos Tin Protomagia

May 20, 2025

Eksereynontas To Oropedio Evdomos Tin Protomagia

May 20, 2025 -

Champions League I Kroyz Azoyl Kai O Giakoymakis Diekdikoyn Tin Prokrisi Ston Teliko

May 20, 2025

Champions League I Kroyz Azoyl Kai O Giakoymakis Diekdikoyn Tin Prokrisi Ston Teliko

May 20, 2025 -

Protomagia Oropedio Evdomos Idaniki Eksormisi Gia Tin Anoiksi

May 20, 2025

Protomagia Oropedio Evdomos Idaniki Eksormisi Gia Tin Anoiksi

May 20, 2025 -

Giakoymakis Odigei Tin Kroyz Azoyl Ston Teliko Toy Champions League

May 20, 2025

Giakoymakis Odigei Tin Kroyz Azoyl Ston Teliko Toy Champions League

May 20, 2025