Analysis Of CoreWeave (CRWV) Stock Performance: Explaining The Recent Increase

Table of Contents

CoreWeave's Competitive Advantage in the AI Boom

CoreWeave's impressive stock performance is significantly linked to its strategic positioning within the booming AI sector. The company's success hinges on several key factors:

-

Specialized Infrastructure for AI Workloads: CoreWeave boasts a massive, purpose-built infrastructure optimized for AI workloads. This includes an extensive GPU cluster, providing the immense computational power needed for training complex machine learning and deep learning models. This specialized infrastructure gives them a significant advantage over general-purpose cloud providers.

-

Strategic Partnerships Fueling Demand: CoreWeave has forged strategic partnerships with leading AI companies, securing significant contracts and driving substantial demand for its services. These partnerships ensure a steady stream of revenue and reinforce the company’s credibility within the industry.

-

Cost-Effective and Scalable Solutions: CoreWeave focuses on providing cost-effective and scalable solutions for AI development and deployment. This is crucial for AI companies, many of which require significant computational resources but operate under tight budgets. The scalability ensures they can adapt to fluctuating demands without sacrificing performance.

-

The Growing Reliance on GPUs: The increasing reliance on powerful GPUs for AI training and inference models is a major catalyst for CoreWeave's growth. As AI applications become more sophisticated and data sets grow exponentially, the demand for GPU-accelerated computing continues to skyrocket. CoreWeave is perfectly positioned to capitalize on this trend.

CoreWeave's unique approach—providing specialized, scalable, and cost-effective GPU-powered cloud computing—is resonating strongly within the AI industry, translating directly into increased demand and a rising stock price.

Strong Financial Performance and Growth Prospects

Beyond its strategic advantage, CoreWeave's impressive stock performance is also backed by strong financial results and promising growth projections.

-

Positive Revenue Growth and Profitability: Recent financial reports showcase significant revenue growth and increasing profitability, demonstrating the company's ability to translate its market position into financial success. These numbers speak volumes to investors.

-

Expansion Plans and Market Share Growth: CoreWeave is aggressively expanding its infrastructure and pursuing new market opportunities. This expansion strategy aims to capture a larger share of the rapidly expanding AI cloud computing market.

-

Favorable Valuation Compared to Competitors: Compared to its competitors, CoreWeave’s valuation may appear attractive to investors, potentially indicating further growth potential. A detailed comparative analysis is necessary for a complete understanding.

-

Future Financial Performance Projections: Based on current market trends and forecasts, analysts project continued strong financial performance for CoreWeave, further solidifying investor confidence and driving the stock price upward.

Analyzing CoreWeave's financial data reveals a clear picture of a company experiencing significant growth and demonstrating strong financial health, which directly impacts its stock valuation.

Market Sentiment and Investor Confidence

Positive market sentiment and growing investor confidence are vital contributors to the recent increase in CRWV's stock price.

-

Positive Analyst Ratings and Recommendations: Many analysts have issued positive ratings and buy recommendations for CRWV stock, bolstering investor confidence.

-

Positive News and Media Coverage: Favorable news and media coverage have helped shape a positive narrative around CoreWeave, attracting further investor interest.

-

Positive Sentiment Towards Cloud Computing and AI: The overall positive sentiment towards the cloud computing and AI sectors also positively influences investor perception of CoreWeave.

-

Market Trends and Overall Economic Conditions: Positive overall market trends and favorable macroeconomic conditions have generally benefited technology stocks, including CoreWeave.

The confluence of positive analyst opinions, favorable media coverage, and broader market trends has created a strong wave of positive sentiment surrounding CRWV, leading to increased investment and a rising stock price.

Risks and Challenges Facing CoreWeave

While the outlook for CoreWeave is positive, it's crucial to acknowledge potential risks and challenges:

-

Intense Competition: The cloud computing and AI markets are highly competitive, with established giants and emerging players vying for market share.

-

Technological Disruption: Rapid technological advancements could render current technologies obsolete, requiring CoreWeave to continuously adapt and innovate.

-

Financial Risks: While currently showing strong performance, CoreWeave faces typical financial risks associated with rapid growth, including potential debt burdens and the possibility of future losses.

-

Regulatory and Compliance Challenges: Navigating the complex regulatory landscape of data privacy and security is a continuing challenge for companies in the cloud computing sector.

Understanding these risks is crucial for a balanced assessment of CoreWeave's investment prospects.

Conclusion

The recent surge in CoreWeave (CRWV) stock price is a result of several interconnected factors: its strategic positioning within the booming AI market, demonstrably strong financial performance, positive investor sentiment, and favorable market conditions. While substantial growth potential exists, investors should also carefully consider the inherent risks and challenges in this competitive and rapidly evolving sector.

Understanding the drivers behind CoreWeave's (CRWV) stock performance is crucial for informed investment decisions. Conduct thorough due diligence before investing and continue to monitor CoreWeave’s (CRWV) progress in the evolving landscape of cloud computing and AI. Stay updated on the latest CoreWeave (CRWV) stock analysis and news to make informed investment decisions.

Featured Posts

-

Columbus Gas Prices 2 83 To 3 31 Per Gallon

May 22, 2025

Columbus Gas Prices 2 83 To 3 31 Per Gallon

May 22, 2025 -

Barry Ward Why Hes Often Cast As A Police Officer

May 22, 2025

Barry Ward Why Hes Often Cast As A Police Officer

May 22, 2025 -

This Week In Gbr Grocery Shopping Guide 2 000 Quarter Found And Doge Poll Update

May 22, 2025

This Week In Gbr Grocery Shopping Guide 2 000 Quarter Found And Doge Poll Update

May 22, 2025 -

Washington D C Terror Attack Remembering Yaron And Sara

May 22, 2025

Washington D C Terror Attack Remembering Yaron And Sara

May 22, 2025 -

Succession Planning Among The Super Wealthy A Rising Trend

May 22, 2025

Succession Planning Among The Super Wealthy A Rising Trend

May 22, 2025

Latest Posts

-

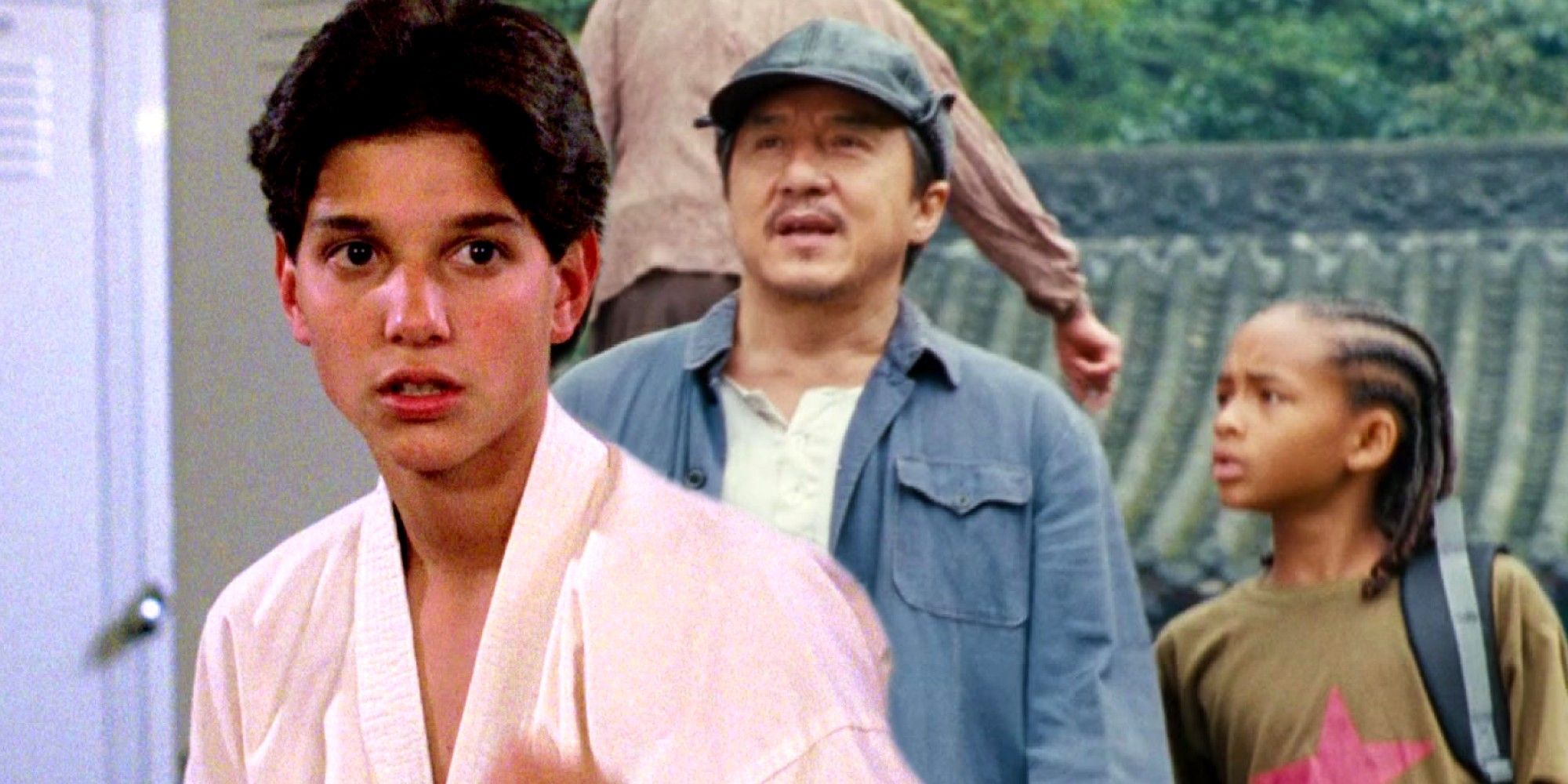

Cobra Kais Hurwitz Shares His Initial Series Pitch Trailer

May 23, 2025

Cobra Kais Hurwitz Shares His Initial Series Pitch Trailer

May 23, 2025 -

Cobra Kai Ep Hurwitz Reveals Original Series Pitch Trailer

May 23, 2025

Cobra Kai Ep Hurwitz Reveals Original Series Pitch Trailer

May 23, 2025 -

Is Ralph Macchio Reviving Another Famous Film After Karate Kid 6

May 23, 2025

Is Ralph Macchio Reviving Another Famous Film After Karate Kid 6

May 23, 2025 -

The Karate Kid Franchise A Comprehensive Look At Legend Of Miyagis Role

May 23, 2025

The Karate Kid Franchise A Comprehensive Look At Legend Of Miyagis Role

May 23, 2025 -

Karate Kid 6 And Beyond Ralph Macchios Film Choices

May 23, 2025

Karate Kid 6 And Beyond Ralph Macchios Film Choices

May 23, 2025