Analysis Of Japan's Economic Contraction: Before Trump Tariffs Hit

Table of Contents

Domestic Factors Contributing to Japan's Economic Contraction

Several significant domestic factors contributed to the Japanese economic contraction before the Trump tariffs. These internal pressures created a weakened foundation, making the economy more susceptible to external shocks.

Stagnant Wages and Consumption

Despite increased productivity, low wage growth in Japan led to decreased consumer spending. This was exacerbated by several factors:

- Aging population and declining birth rate: A shrinking consumer base limited overall demand. The aging population also shifted spending patterns towards healthcare and away from discretionary goods.

- High household debt: High levels of Japanese household debt reduced consumer confidence and spending power, leaving less disposable income for purchases. Many households were focused on debt repayment rather than consumption.

- Income inequality: The widening gap between rich and poor further dampened consumer spending, as a larger portion of the population experienced stagnant or declining real incomes.

These factors combined to create a vicious cycle: low wages led to low consumption, which in turn discouraged businesses from raising wages or investing.

Deflationary Pressures

Persistent deflation in Japan discouraged investment and spending. The expectation of lower prices in the future led consumers and businesses to delay purchases, hoping for even better deals later.

- Weak consumer demand: Companies struggled to raise prices due to weak consumer demand, further reinforcing the deflationary spiral. Price cuts became a competitive necessity, hindering profitability.

- Limited impact of monetary policy: The Bank of Japan's monetary policies, including quantitative easing, had limited success in stimulating inflation. The deflationary mindset proved difficult to overcome.

- Impact on business investment: Deflation eroded corporate profits and discouraged investment in expansion and new technologies, slowing overall economic growth.

This deflationary environment created a significant headwind for the Japanese economy.

Government Debt and Fiscal Policy

Japan's high levels of government debt significantly constrained the government's ability to implement effective fiscal stimulus measures.

- Sustainability concerns: Concerns about the long-term sustainability of public finances limited the government's willingness to increase spending. The large debt burden reduced fiscal flexibility.

- Ineffective structural reforms: Despite efforts at structural reforms, progress remained slow and insufficient to significantly boost economic growth. These reforms often faced political opposition and implementation challenges.

- Crowding out effect: High government debt could have a crowding-out effect, reducing private investment as the government competes for limited funds.

The limitations on fiscal policy further hampered efforts to stimulate economic growth.

Global Economic Headwinds Impacting Japan

Beyond domestic challenges, Japan faced several significant global economic headwinds. These external factors amplified the impact of the internal weaknesses.

Slowing Global Growth

Reduced demand for Japanese exports from key trading partners significantly impacted the Japanese economy.

- Weakening global economy: The global economic slowdown decreased demand for Japanese manufactured goods, particularly in sectors like automobiles and electronics.

- Impact on manufacturing: Japanese manufacturing, a key driver of the economy, suffered from reduced global demand, impacting production and employment.

- Ripple effect: The slowdown in exports had a ripple effect throughout the Japanese economy, impacting related industries and employment.

The interconnected nature of the global economy made Japan particularly vulnerable to external slowdowns.

Currency Fluctuations

Yen appreciation made Japanese exports less competitive in global markets.

- Impact on export competitiveness: A stronger yen increased the price of Japanese goods for foreign buyers, reducing demand and impacting profitability.

- Profitability of international companies: Japanese companies operating internationally saw reduced profits due to the stronger yen, further impacting investment and economic growth.

- Trade balance implications: The yen appreciation worsened Japan's trade balance, contributing to the overall economic slowdown.

Currency fluctuations added another layer of complexity to the challenges faced by the Japanese economy.

Pre-existing Structural Issues

Underlying structural issues within the Japanese economy further contributed to the slowdown. These long-term challenges hindered adaptability and innovation.

Technological Stagnation in Certain Sectors

Slow adoption of new technologies in some key industries hampered productivity growth and competitiveness.

- Lack of innovation: Insufficient investment in research and development (R&D) contributed to a lack of innovation in certain sectors.

- Resistance to change: Established industries sometimes showed resistance to adopting new technologies, hindering efficiency gains.

- Impact on long-term growth: This lack of technological advancement limited Japan's long-term growth potential.

Labor Market Rigidities

Challenges in adapting to a changing labor market created further obstacles to economic dynamism.

- Rigid employment practices: Traditional Japanese employment practices, while offering job security, sometimes hindered flexibility and adaptability.

- Limited labor mobility: Restrictions on labor mobility limited the efficient allocation of resources and hampered economic restructuring.

- Need for labor market reform: The Japanese labor market required reforms to improve flexibility and facilitate a smoother transition to a more dynamic economy.

Conclusion

Japan's economic contraction before the implementation of Trump tariffs was a complex issue rooted in a combination of domestic and international factors. Stagnant wages, deflationary pressures, high government debt, slowing global growth, currency fluctuations, and pre-existing structural issues all contributed to the economic slowdown. Understanding these underlying vulnerabilities is crucial to effectively address future economic challenges. Further research into the interplay of these factors is needed for a comprehensive understanding of Japan's economic performance. To delve deeper into the intricacies of this period, further exploration of the Japanese economic contraction before the Trump tariffs is highly recommended. Analyzing these pre-existing conditions provides valuable insights into the resilience and vulnerability of the Japanese economy in the face of both internal and external pressures.

Featured Posts

-

Yankees Vs Mariners Game Prediction Expert Picks And Betting Odds

May 17, 2025

Yankees Vs Mariners Game Prediction Expert Picks And Betting Odds

May 17, 2025 -

16 Million Penalty For T Mobile Three Years Of Data Security Lapses

May 17, 2025

16 Million Penalty For T Mobile Three Years Of Data Security Lapses

May 17, 2025 -

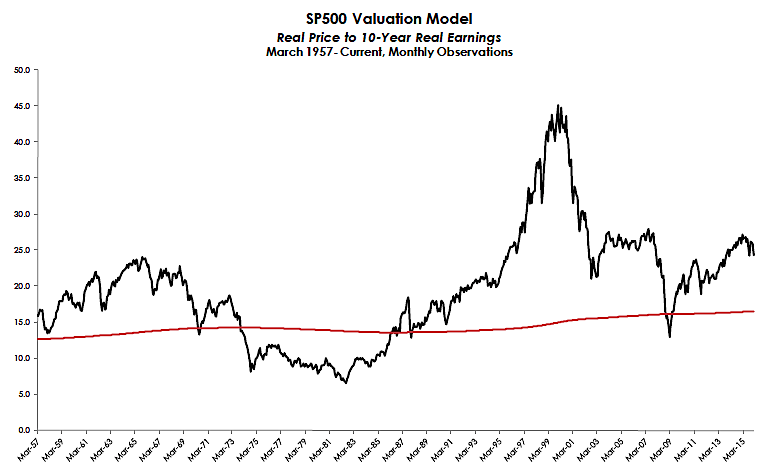

Bof As Reassurance Are Stretched Stock Market Valuations A Concern

May 17, 2025

Bof As Reassurance Are Stretched Stock Market Valuations A Concern

May 17, 2025 -

Planning Your Trip To The New Orleans Jazz And Heritage Festival

May 17, 2025

Planning Your Trip To The New Orleans Jazz And Heritage Festival

May 17, 2025 -

127 Years Of Brewing History Ends Anchor Brewing Company To Shutter

May 17, 2025

127 Years Of Brewing History Ends Anchor Brewing Company To Shutter

May 17, 2025

Latest Posts

-

Investitsii Rossii V Uzbekistane Novye Rekordy

May 17, 2025

Investitsii Rossii V Uzbekistane Novye Rekordy

May 17, 2025 -

Elaekeyhtioeiden Osakesijoitusten Heikko Alkuvuosi

May 17, 2025

Elaekeyhtioeiden Osakesijoitusten Heikko Alkuvuosi

May 17, 2025 -

Alkuvuoden Osakesijoitukset Painoivat Elaekeyhtioeitae

May 17, 2025

Alkuvuoden Osakesijoitukset Painoivat Elaekeyhtioeitae

May 17, 2025 -

Elaekeyhtioeiden Osakesijoitukset Alkuvuosi Toi Tappioita

May 17, 2025

Elaekeyhtioeiden Osakesijoitukset Alkuvuosi Toi Tappioita

May 17, 2025 -

Investigacion Sobre El Esquema Ponzi De Koriun Inversiones

May 17, 2025

Investigacion Sobre El Esquema Ponzi De Koriun Inversiones

May 17, 2025