Analysis Of Oil Prices And Market News - April 23

Table of Contents

Geopolitical Influences on Oil Prices (April 23)

Geopolitical instability is a major driver of oil price volatility. On April 23rd, several events contributed to the market's fluctuations. Tensions in the Middle East, specifically [mention a specific region or event if applicable on April 23rd, e.g., escalating conflict in a particular country], significantly impacted global oil supply concerns. Increased uncertainty about oil production from this region led to a surge in prices as traders anticipated potential disruptions. This uncertainty also affected the insurance costs for oil tankers transiting through the region, indirectly increasing the final cost of oil.

- Specific country or region's impact on global oil production: [Specify the country/region and its production levels, citing sources]. The potential for reduced output from this key oil-producing area directly influenced the global supply and subsequently affected prices.

- International relations and their influence on oil trade routes: [Discuss any geopolitical tensions affecting oil transportation routes, e.g., sanctions, trade disputes]. These factors create uncertainty and can lead to price increases as transportation costs rise or routes are rerouted.

- Sanctions or embargoes and their effects on market stability: [Mention any sanctions imposed around April 23rd and their impact on oil supply]. These actions can severely restrict the flow of oil, leading to price spikes.

OPEC+ Decisions and Their Impact

OPEC+ (the Organization of the Petroleum Exporting Countries and its allies) plays a significant role in shaping global oil production and prices. Any announcements or decisions made by this group directly affect market supply and demand. On April 23rd, [mention any relevant OPEC+ news, e.g., a decision to maintain or adjust production quotas].

- Production levels agreed upon: [State the production levels decided by OPEC+ on or around April 23rd, citing the source].

- Changes in production targets compared to previous periods: [Analyze whether the decision represents an increase, decrease, or maintenance of production targets].

- Market reaction to OPEC+ decisions: [Describe the market's response to the OPEC+ decision – did prices rise, fall, or remain relatively stable?]. The market's reaction often reflects investor sentiment and expectations about future supply.

Economic Indicators and Market Sentiment

Economic indicators provide valuable insights into future oil demand. On April 23rd, [mention specific economic indicators, e.g., inflation rates, GDP growth forecasts for major economies]. High inflation, for instance, can reduce consumer spending on fuel, impacting demand. Simultaneously, strong GDP growth in major economies usually translates to increased oil consumption, thus boosting prices.

- Impact of inflation on fuel demand: High inflation often leads to reduced consumer spending, lowering demand for oil and potentially causing prices to fall.

- Economic growth forecasts and their relation to oil consumption: Strong economic growth forecasts in major oil-consuming countries usually result in higher oil demand and prices.

- Investor confidence and its effect on oil futures: Positive investor sentiment can drive up oil futures prices, reflecting expectations of future price increases. Conversely, negative sentiment may lead to price drops.

Supply Chain Disruptions and Their Role

Supply chain disruptions can significantly impact the availability and price of oil. On April 23rd, [mention any disruptions, such as pipeline issues, refinery outages, or logistical bottlenecks]. These disruptions create bottlenecks, limiting the flow of oil to consumers and influencing prices.

- Specific incidents causing disruptions: [Detail specific events impacting oil supply on April 23rd, e.g., weather events, accidents, or maintenance issues].

- Impact on transportation and delivery of oil: [Explain how these incidents affected oil transportation, leading to delays or shortages].

- Consequences for refineries and overall supply: [Discuss how these disruptions affected refinery operations and overall market supply].

Conclusion: Key Takeaways and Call to Action

The analysis of oil prices and market news on April 23rd reveals the intricate relationship between geopolitical events, OPEC+ decisions, economic indicators, and supply chain disruptions. Understanding these factors is critical for predicting future price movements. Monitoring global events and key economic indicators provides a better understanding of the complexities influencing the oil market. For informed decision-making, regularly check for updated analyses of oil prices and market news. Subscribe to our newsletter or follow our social media channels for timely updates and in-depth analyses. The oil market is dynamic; continuous monitoring of oil price analysis and market news is essential for navigating its complexities.

Featured Posts

-

The La Wildfires A Reflection Of Our Times Through Disaster Betting

Apr 24, 2025

The La Wildfires A Reflection Of Our Times Through Disaster Betting

Apr 24, 2025 -

Emerging Market Stock Rally A Contrast To The Us Market Downturn

Apr 24, 2025

Emerging Market Stock Rally A Contrast To The Us Market Downturn

Apr 24, 2025 -

The Epa Vs Elon Musk Doges Unexpected Role In The Tesla And Space X Controversy

Apr 24, 2025

The Epa Vs Elon Musk Doges Unexpected Role In The Tesla And Space X Controversy

Apr 24, 2025 -

Why Pope Francis Signet Ring Will Be Destroyed After His Death

Apr 24, 2025

Why Pope Francis Signet Ring Will Be Destroyed After His Death

Apr 24, 2025 -

How Middle Management Drives Employee Engagement And Business Results

Apr 24, 2025

How Middle Management Drives Employee Engagement And Business Results

Apr 24, 2025

Latest Posts

-

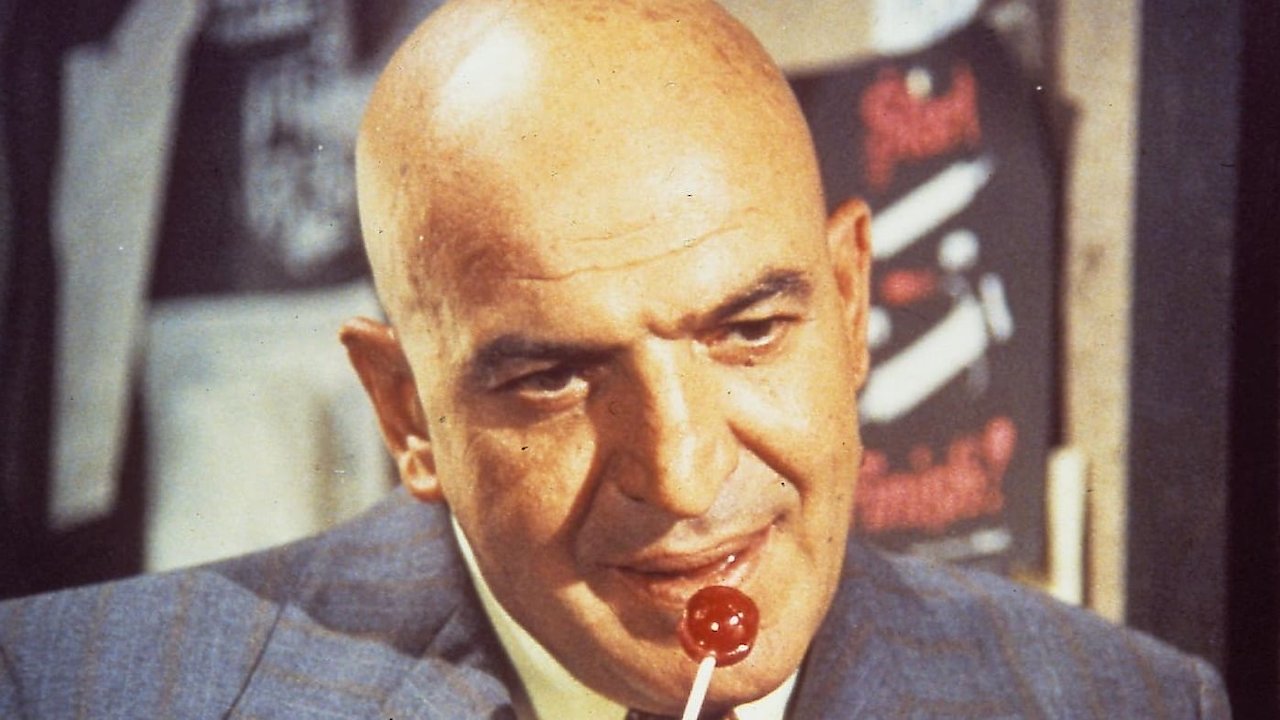

Find Kojak On Itv 4 A Comprehensive Guide To Episodes And Showtimes

May 12, 2025

Find Kojak On Itv 4 A Comprehensive Guide To Episodes And Showtimes

May 12, 2025 -

Kojak Full Episode Listings And Air Times On Itv 4

May 12, 2025

Kojak Full Episode Listings And Air Times On Itv 4

May 12, 2025 -

De Schoonheid Van Sylvester Stallones Dochter Foto Gaat Viraal

May 12, 2025

De Schoonheid Van Sylvester Stallones Dochter Foto Gaat Viraal

May 12, 2025 -

Itv 4 Kojak Schedule When And Where To Watch

May 12, 2025

Itv 4 Kojak Schedule When And Where To Watch

May 12, 2025 -

Atelier D Artiste Rencontre Exceptionnelle Avec Sylvester Stallone

May 12, 2025

Atelier D Artiste Rencontre Exceptionnelle Avec Sylvester Stallone

May 12, 2025