Emerging Market Stock Rally: A Contrast To The US Market Downturn

Table of Contents

Factors Driving the Emerging Market Stock Rally

Several key factors are fueling the current emerging market stock rally, creating a compelling alternative to the subdued performance of developed markets.

Strong Economic Growth in Emerging Markets

Many emerging economies are exhibiting robust economic growth, outpacing their developed counterparts. This is particularly evident in regions like Asia and Latin America, with several sectors experiencing significant expansion.

- Asia: Countries like India and Vietnam are experiencing rapid GDP growth driven by technological advancements, a young and growing workforce, and significant infrastructure investments. The technology sector, in particular, is booming, with numerous tech startups attracting substantial foreign investment.

- Latin America: Countries such as Brazil and Mexico are benefiting from increased commodity prices and domestic reforms, leading to stronger economic activity and improved investor sentiment. The infrastructure sector in these regions is seeing a significant boost from government spending and private sector participation.

- Data Points: (Insert specific data points here – e.g., "India's GDP growth is projected at X% in 2024, while Vietnam's is expected to reach Y%. Brazil's industrial production increased by Z% in the last quarter.") These statistics highlight the dynamism of these emerging markets.

Government policies focused on economic diversification and infrastructure development further contribute to this positive trend. Targeted investments in renewable energy, digital infrastructure, and education are also laying the groundwork for sustained long-term growth.

Attractive Valuations Compared to Developed Markets

Emerging market stocks often offer significantly more attractive valuations than their developed market counterparts. This is reflected in lower price-to-earnings (P/E) ratios and other valuation metrics.

- Undervalued Assets: Many companies in emerging markets are trading at significantly lower multiples than comparable companies in the US or Europe. This presents a potential opportunity for higher returns, even if growth rates are similar.

- Sectoral Opportunities: Specific sectors, like technology in India or infrastructure in Latin America, often present particularly compelling valuation opportunities.

- Return Potential: The combination of strong growth potential and relatively low valuations suggests a higher potential for capital appreciation in emerging markets.

Analyzing price-to-book ratios, dividend yields, and other valuation metrics can reveal specific investment opportunities within the emerging market stock rally.

Increased Foreign Investment

A significant influx of foreign capital is flowing into emerging markets, further driving up stock prices. This increased investment is motivated by several factors:

- Diversification: Investors are increasingly seeking diversification away from the relatively volatile US market. Emerging markets offer a unique opportunity to reduce overall portfolio risk.

- Higher Potential Returns: The attractive valuations and strong growth prospects make emerging markets a compelling investment proposition for higher potential returns.

- Investment Flows: Data on foreign direct investment (FDI) and portfolio investment flows into emerging markets can quantify this trend. (Insert specific data points here, citing sources).

- Macroeconomic Factors: Global macroeconomic factors, such as low interest rates in developed countries, can also incentivize investment in higher-yielding emerging markets.

Divergence from the US Market Downturn

The strength of the emerging market stock rally is even more striking when contrasted against the current downturn in the US market. This divergence is attributable to several key differences.

Different Economic Fundamentals

The US and emerging markets have vastly different economic fundamentals, leading to contrasting market performances.

- Inflation: Emerging markets often experience higher inflation, but this is sometimes coupled with strong economic growth. The US, on the other hand, is grappling with persistent inflationary pressures alongside slowing growth.

- Interest Rates: Interest rate policies also differ significantly. While the US Federal Reserve is aggressively raising interest rates to combat inflation, some emerging market central banks have more flexibility in their monetary policy.

- Geopolitical Risks: The impact of geopolitical risks also varies. While the US is heavily involved in global conflicts, certain emerging markets may be less directly affected, benefiting from regional stability.

Sectoral Differences

The sectoral compositions of US and emerging market indices are significantly different, contributing to the diverging performance.

- Technology: While the US tech sector has experienced significant declines, some emerging markets have seen their tech sectors thrive due to domestic growth and government support.

- Commodities: Emerging markets often have a higher weighting in commodity-related sectors. Fluctuations in commodity prices can therefore have a greater impact on their market performance.

- Consumer Discretionary: The consumer discretionary sector might perform better in emerging markets with growing middle classes.

Impact of Geopolitical Events

Geopolitical events impact the US and emerging markets differently.

- Regional Conflicts: Emerging markets may be less affected by certain global conflicts than the US, and some may even benefit from shifts in global supply chains.

- Trade Wars: Trade wars and protectionist policies can impact both markets differently depending on their trade relationships.

Risks and Opportunities in the Emerging Market Stock Rally

While the emerging market stock rally presents exciting opportunities, investors should also be aware of potential risks.

Potential Risks

- Currency Fluctuations: Significant currency fluctuations can negatively impact returns for foreign investors.

- Political Instability: Political risks and instability can disrupt economic growth and market performance.

- Economic Volatility: Emerging markets are often subject to greater economic volatility than developed markets.

Investment Opportunities

Despite these risks, the emerging market stock rally offers significant long-term growth potential and diversification benefits. Careful research and due diligence are crucial for identifying promising investment opportunities.

Conclusion

The emerging market stock rally stands in stark contrast to the US market downturn, driven by strong economic growth, attractive valuations, and increased foreign investment. While the potential for higher returns is significant, investors should carefully consider the associated risks, including currency fluctuations and political instability. Don't miss out on the potential of the emerging market stock rally. Start researching today to understand how you can diversify your portfolio and capitalize on this exciting opportunity by exploring specific markets and sectors or consulting with a financial advisor. Understanding the nuances of emerging market investing is key to successfully navigating this dynamic landscape and profiting from the emerging market stock rally.

Featured Posts

-

Pete Hegseth Delivering Trumps Agenda Amidst Signal App Controversy

Apr 24, 2025

Pete Hegseth Delivering Trumps Agenda Amidst Signal App Controversy

Apr 24, 2025 -

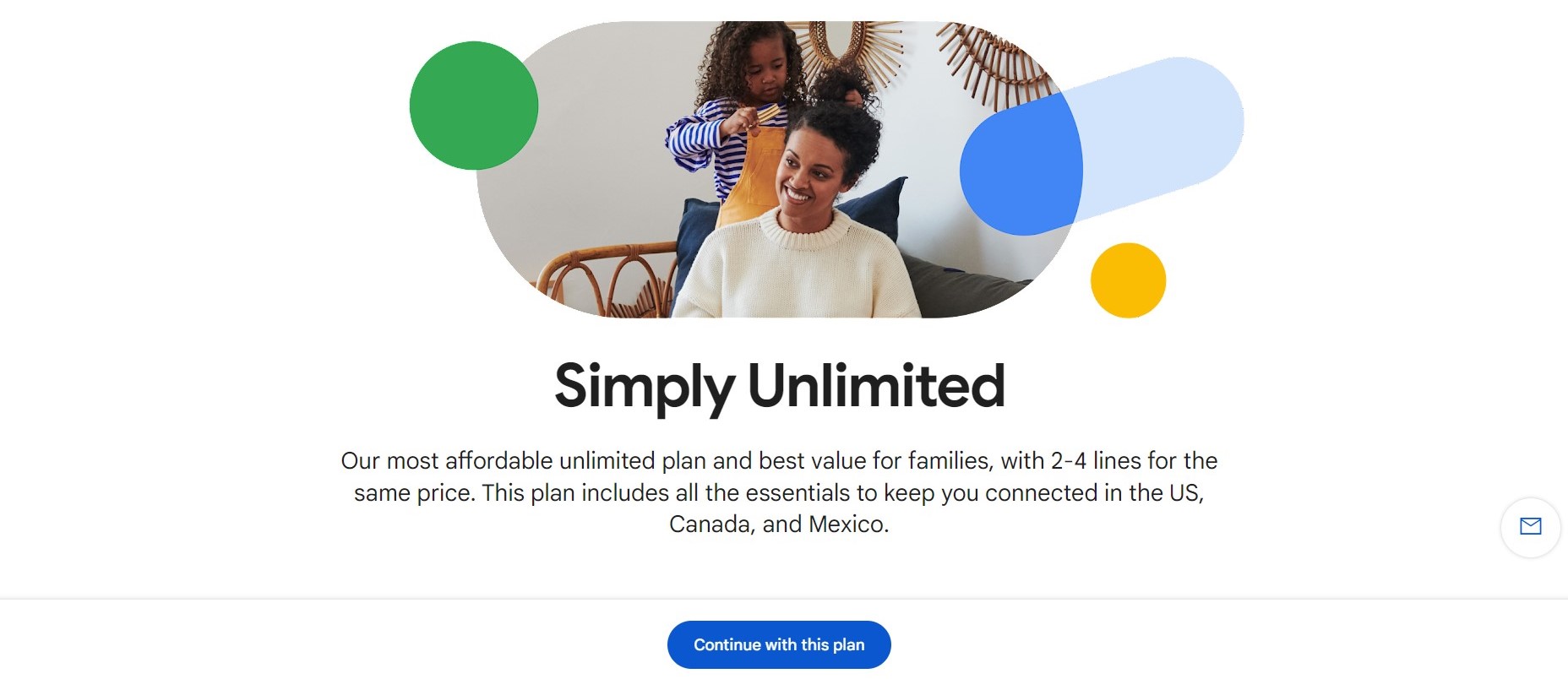

35 Unlimited Google Fis Latest Mobile Plan Explained

Apr 24, 2025

35 Unlimited Google Fis Latest Mobile Plan Explained

Apr 24, 2025 -

Canadian Dollar A Complex Currency Picture

Apr 24, 2025

Canadian Dollar A Complex Currency Picture

Apr 24, 2025 -

World Economic Forum New Investigation Into Klaus Schwabs Leadership

Apr 24, 2025

World Economic Forum New Investigation Into Klaus Schwabs Leadership

Apr 24, 2025 -

Are Bmw And Porsche Losing Ground In China An Industry Analysis

Apr 24, 2025

Are Bmw And Porsche Losing Ground In China An Industry Analysis

Apr 24, 2025

Latest Posts

-

Qui Se Cache Derriere L Autruche Le Choc De Mask Singer 2025 Et Les Reactions De Chantal Ladesou Et Laurent Ruquier

May 12, 2025

Qui Se Cache Derriere L Autruche Le Choc De Mask Singer 2025 Et Les Reactions De Chantal Ladesou Et Laurent Ruquier

May 12, 2025 -

Ines Reg Et Natasha St Pier Comparaison Des Prestations Dans Dals Et Reactions Du Jury

May 12, 2025

Ines Reg Et Natasha St Pier Comparaison Des Prestations Dans Dals Et Reactions Du Jury

May 12, 2025 -

Nba Award Boston Celtics Guard Declines Campaign

May 12, 2025

Nba Award Boston Celtics Guard Declines Campaign

May 12, 2025 -

Chantal Ladesou Et Laurent Ruquier Face A La Verite L Autruche De Mask Singer 2025 Devoilee

May 12, 2025

Chantal Ladesou Et Laurent Ruquier Face A La Verite L Autruche De Mask Singer 2025 Devoilee

May 12, 2025 -

Dals La Prestation D Ines Reg Jugee Trop Ouverte Natasha St Pier Epargnee

May 12, 2025

Dals La Prestation D Ines Reg Jugee Trop Ouverte Natasha St Pier Epargnee

May 12, 2025