Analysis Of Westpac (WBC) Earnings: Margin Compression And Future Outlook

Table of Contents

2.1. Westpac (WBC) Q[Quarter] Earnings Report: A Deep Dive

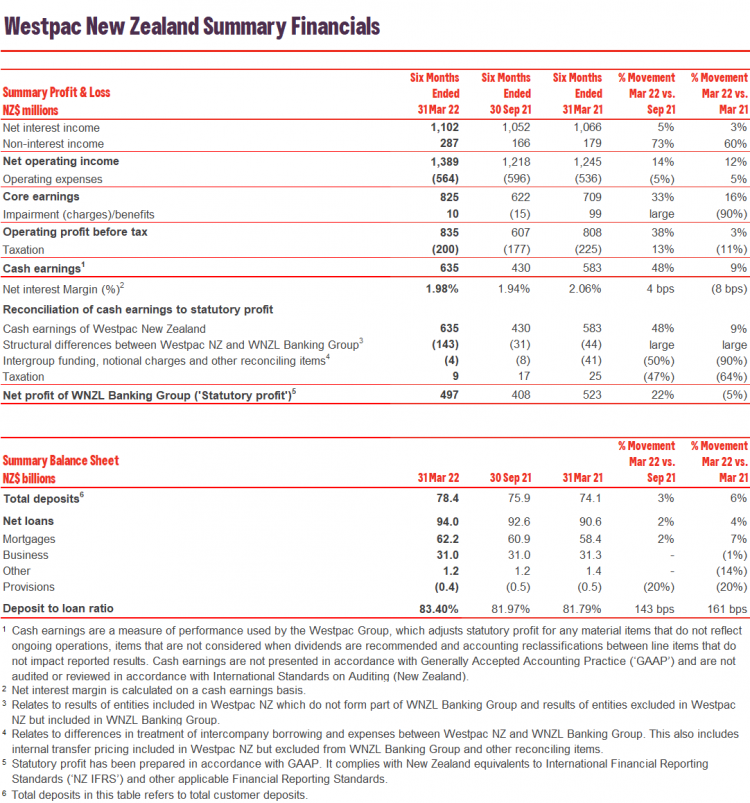

The most recent Westpac (WBC) earnings report painted a mixed picture. Let's assume, for the sake of this example, that we are analyzing Q3 2024 results. While the bank reported a [Insert actual or hypothetical number] billion in cash earnings, this figure fell short of analyst expectations and represented a [percentage]% decrease compared to Q3 2023. This decline is primarily attributable to the significant compression of the Net Interest Margin (NIM). The reported NIM stood at [Insert actual or hypothetical number]%, a notable decrease from [previous quarter]% in Q2 2024 and [previous year]% in Q3 2023. The Return on Equity (ROE) also showed a dip, settling at [Insert actual or hypothetical number]%, reflecting the overall pressure on profitability.

- Cash Earnings: [Insert actual or hypothetical number] billion (down [percentage]% YoY)

- Net Interest Margin (NIM): [Insert actual or hypothetical number]% (down [percentage]% QoQ and [percentage]% YoY)

- Return on Equity (ROE): [Insert actual or hypothetical number]% (down [percentage]% YoY)

2.2. Margin Compression: Unpacking the Cause

The significant margin compression experienced by Westpac (WBC) is a multifaceted issue. Several factors contribute to this challenging financial environment:

-

Increased Competition: The Australian banking sector is highly competitive. New entrants and established players are vying for market share, leading to intense pressure on pricing and margins. This fierce competition forces banks to lower interest rates offered to customers, impacting Net Interest Income (NII).

-

Interest Rate Changes: The Reserve Bank of Australia (RBA)'s monetary policy significantly impacts bank profitability. While rate hikes initially boost margins, the lag effect and the subsequent pressure on borrowers can lead to increased loan defaults and a decrease in demand for new loans, thus impacting the NII and overall profitability.

-

Rising Operational Costs: Inflationary pressures have increased operational costs for Westpac (WBC), including staffing, technology, and regulatory compliance. These rising expenses further erode profitability and contribute to margin compression.

-

Changes in Lending Practices: Increased regulatory scrutiny and a more cautious lending environment following the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry have impacted lending volumes and profitability.

2.3. Impact on Westpac (WBC) Stock Performance

The release of the Q3 2024 earnings report and the revelation of margin compression immediately impacted Westpac's (WBC) share price. The stock experienced a [percentage]% drop on the day of the announcement. Investor sentiment turned negative, reflecting concerns about the bank's future profitability and growth prospects. Many analysts downgraded their ratings for Westpac (WBC) stock, further contributing to the negative market reaction. The initial shock was followed by a period of volatility, with the share price fluctuating depending on market sentiment and further analysis of the results.

- Share Price Fluctuation: [Insert actual or hypothetical data on share price changes]

- Analyst Ratings: [Summarize changes in analyst recommendations, e.g., downgrade from 'buy' to 'hold']

- Investor Sentiment: Negative, reflecting concerns about future profitability.

2.4. Future Outlook and Predictions for Westpac (WBC)

Predicting Westpac's (WBC) future performance requires careful consideration of several factors. The bank will likely focus on several strategic initiatives to improve its margins and boost profitability. This might include:

- Cost-cutting measures: Streamlining operations, improving efficiency, and potentially reducing staff numbers.

- New product development: Introducing innovative financial products and services to attract new customers and increase revenue streams.

- Improved risk management: Implementing robust risk management strategies to minimize loan defaults and enhance overall financial health.

However, the ongoing impact of macroeconomic factors, such as inflation and interest rate fluctuations, remains a significant uncertainty. The future outlook for Westpac (WBC) is cautiously optimistic, contingent on the bank’s success in implementing its strategic initiatives and navigating the challenges of the broader economic environment. Further analysis and monitoring of key performance indicators are essential for a clearer and more accurate prediction.

3. Conclusion: The Westpac (WBC) Earnings Analysis: Key Takeaways and Next Steps

This analysis of Westpac (WBC) earnings highlights significant margin compression, primarily driven by increased competition, interest rate changes, rising operational costs, and evolving lending practices. This compression has negatively impacted the bank's profitability and share price. While the future outlook is cautiously optimistic, dependent on the bank's strategic response and macroeconomic conditions, understanding these factors is critical for investors. Stay informed about Westpac (WBC) earnings and their impact on your investment strategy. Conduct your own detailed analysis of Westpac (WBC) before making any investment decisions. Remember that this is an example and actual data should be used for a complete and accurate analysis.

Featured Posts

-

Patrick Schwarzeneggers White Lotus Role Dedication And Dismissal Of Nepotism Allegations

May 06, 2025

Patrick Schwarzeneggers White Lotus Role Dedication And Dismissal Of Nepotism Allegations

May 06, 2025 -

Analysis Of Westpac Wbc Earnings Margin Compression And Future Outlook

May 06, 2025

Analysis Of Westpac Wbc Earnings Margin Compression And Future Outlook

May 06, 2025 -

Analysis Romanias Election Runoff Far Right Vs Centrist

May 06, 2025

Analysis Romanias Election Runoff Far Right Vs Centrist

May 06, 2025 -

Resistance To Ev Mandates Intensifies Car Dealers Push Back

May 06, 2025

Resistance To Ev Mandates Intensifies Car Dealers Push Back

May 06, 2025 -

Recession Indicators On Social Media From Lady Gaga To Converse

May 06, 2025

Recession Indicators On Social Media From Lady Gaga To Converse

May 06, 2025

Latest Posts

-

Patrick Schwarzeneggers Nude Scenes Father Arnolds View

May 06, 2025

Patrick Schwarzeneggers Nude Scenes Father Arnolds View

May 06, 2025 -

Arnold Schwarzeneggers Opinion Patricks Public Nudity

May 06, 2025

Arnold Schwarzeneggers Opinion Patricks Public Nudity

May 06, 2025 -

Joseph Baena A Fitneszvilag Feltoerekvo Csillaga Arnold Schwarzenegger Fia

May 06, 2025

Joseph Baena A Fitneszvilag Feltoerekvo Csillaga Arnold Schwarzenegger Fia

May 06, 2025 -

Schwarzenegger Family Arnolds Take On Patricks Nude Photos

May 06, 2025

Schwarzenegger Family Arnolds Take On Patricks Nude Photos

May 06, 2025 -

Arnold Schwarzenegger Bueszke Lehet Joseph Baenara

May 06, 2025

Arnold Schwarzenegger Bueszke Lehet Joseph Baenara

May 06, 2025