Analysis: Public Opinion On The Latest Spring Budget Proposals

Table of Contents

Key Provisions of the Spring Budget Proposals and Initial Public Reaction

The Spring Budget Proposals unveiled a range of measures impacting various sectors of the economy. Key provisions included significant tax changes, adjustments to public spending, and several new government initiatives. Specifically, the proposals focused on:

- Tax Cuts: Reductions in income tax for lower earners and adjustments to corporation tax rates for small and medium-sized enterprises (SMEs).

- Spending Increases: Increased investment in infrastructure projects, particularly renewable energy initiatives and improvements to public transportation.

- Environmental Initiatives: Substantial funding allocated to environmental protection programs and incentives for green technologies.

Initial reactions, as reflected in social media sentiment and early polling data, were mixed. While some welcomed the tax cuts and increased spending on essential services like healthcare, others expressed concern over the potential impact on national debt and the long-term sustainability of the proposed spending plans. The changes to corporation tax generated particularly intense debate, with disagreements over their potential effect on business investment and economic growth. Keywords associated with this initial reaction included tax cuts, spending increases, fiscal policy, economic growth, public spending, and government initiatives.

Public Opinion on Tax Changes within the Spring Budget Proposals

Public reaction to the specific tax changes within the Spring Budget Proposals was highly stratified, reflecting existing income inequalities. Analysis of available polls and surveys reveals:

- Income Tax: The proposed income tax reductions were generally well-received by lower and middle-income earners, while higher-income individuals expressed mixed reactions, with some arguing the cuts were insufficient.

- Corporation Tax: The changes to corporation tax rates elicited strong responses from businesses, with large corporations expressing concerns about competitiveness, while SMEs generally welcomed the adjustments.

- VAT: No changes to VAT were proposed in this budget, significantly reducing public discourse on this aspect of fiscal policy.

These varying perspectives highlight the complex relationship between tax policy, income levels, and public perception. Keywords crucial to understanding this section include income tax, corporation tax, VAT, tax burden, tax relief, and fiscal responsibility.

Public Perception of Government Spending Plans in the Spring Budget Proposals

Public sentiment toward government spending varied significantly depending on the sector. Analysis suggests:

- Healthcare: Increased funding for healthcare received widespread public support, reflecting a long-standing concern about the sustainability of the National Health Service.

- Education: Investment in education also garnered substantial public approval, particularly regarding initiatives focused on improving teacher training and reducing class sizes.

- Infrastructure: Public opinion on infrastructure projects was more divided, with some expressing enthusiasm for green initiatives, while others raised concerns regarding the potential for cost overruns and delays.

The sustainability of these spending plans remains a key concern for many, with questions raised about the government's ability to manage public debt while meeting its ambitious spending targets. Relevant keywords for this section are public spending, healthcare funding, education investment, infrastructure projects, and government debt.

The Impact of the Spring Budget Proposals on Different Demographic Groups

The Spring Budget Proposals are expected to have a disparate impact across various demographic groups:

- Young People: The proposals' impact on young people is largely tied to the job market and access to affordable housing, areas where significant investment was proposed.

- Families: Families with children will likely benefit from increased investment in education and childcare, although the impact will vary based on income levels.

- Retirees: Retirees’ opinions are mainly shaped by the proposals’ impact on pensions and healthcare access.

- Low-income Earners: Low-income earners are the demographic most likely to benefit from the proposed income tax cuts and increased social support programs.

Understanding these disparities is critical for assessing the overall fairness and effectiveness of the proposals. Key terms that capture this nuanced perspective include income inequality, social impact, economic disparity, and demographic analysis.

Long-Term Economic Outlook and Public Confidence in the Spring Budget Proposals

Expert opinions on the long-term economic consequences of the Spring Budget Proposals are divided. Some forecast robust economic growth, fueled by increased investment and consumer spending, while others express concerns about the potential for inflationary pressures and increased national debt.

Public confidence in the government's economic management will be significantly influenced by the success of these proposals in delivering on their promises. The potential for both significant gains and substantial risks associated with the proposals highlights the need for ongoing monitoring and evaluation. Keywords for this section include economic forecast, economic stability, investor confidence, and long-term growth.

Conclusion

Public opinion on the Spring Budget Proposals is mixed, with significant variations across different aspects of the proposals and different demographic groups. While tax cuts and increased spending in key areas like healthcare and education have generally been well-received, concerns remain about the long-term fiscal sustainability and potential impact on income inequality. Further research and analysis are needed to fully understand the long-term impact of these Spring Budget Proposals. Continue to monitor public opinion and engage in the ongoing debate surrounding these crucial economic policies. Stay informed on the evolving situation regarding the Spring Budget Proposals and their effects on the economy.

Featured Posts

-

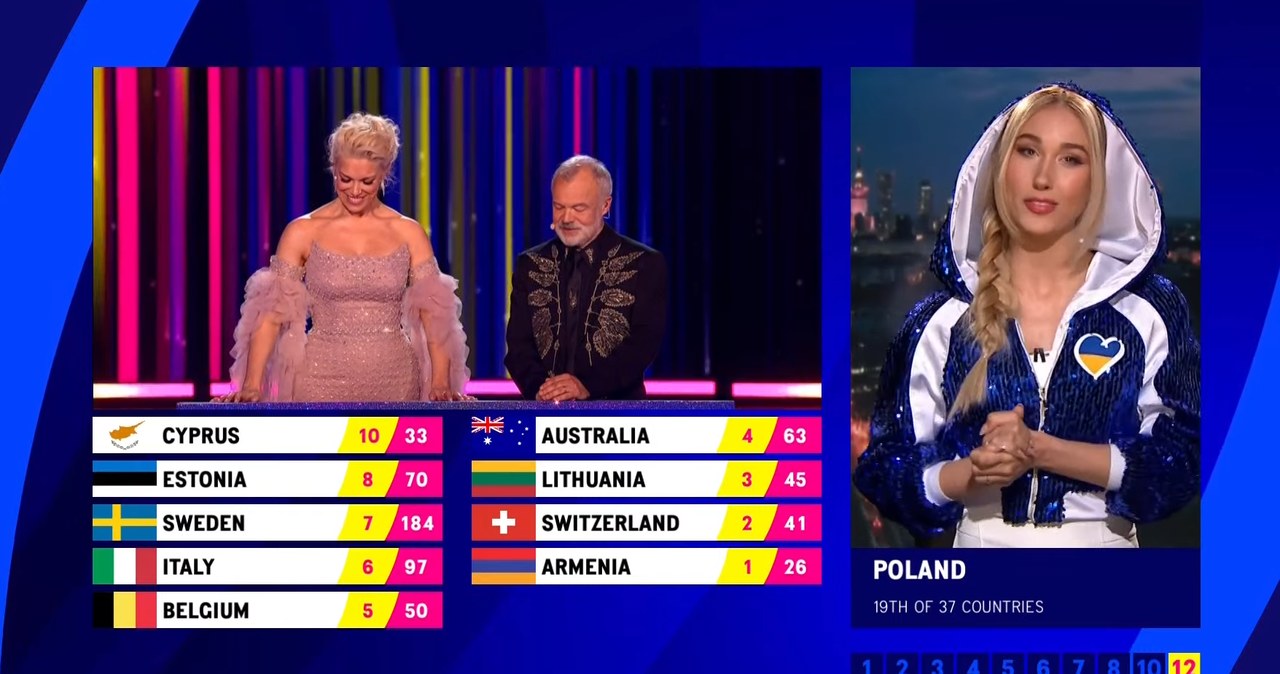

Eurowizja Wyniki Glosowania Fanow Jak Wypadla Steczkowska

May 19, 2025

Eurowizja Wyniki Glosowania Fanow Jak Wypadla Steczkowska

May 19, 2025 -

Gazze Balikcilik Sektoerue Gecmis Guenuemuez Ve Gelecege Dair Bir Degerlendirme

May 19, 2025

Gazze Balikcilik Sektoerue Gecmis Guenuemuez Ve Gelecege Dair Bir Degerlendirme

May 19, 2025 -

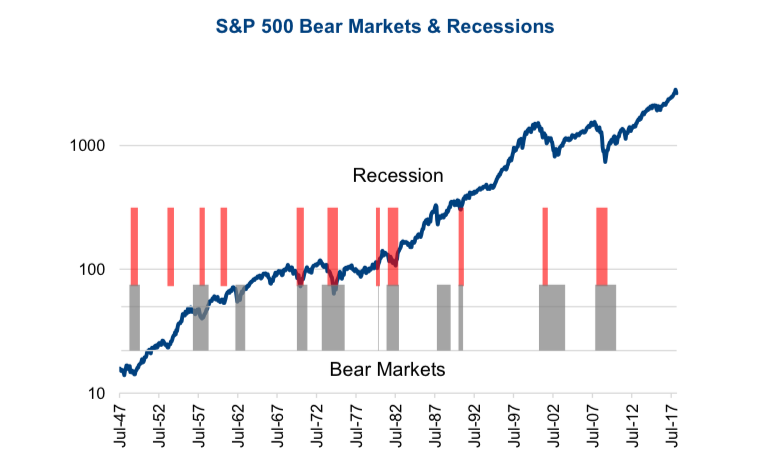

Uber Stock And Recessions A Look At Historical Performance And Future Predictions

May 19, 2025

Uber Stock And Recessions A Look At Historical Performance And Future Predictions

May 19, 2025 -

Kktc Gastronomisi Itb Berlin De Goez Kamastirdi

May 19, 2025

Kktc Gastronomisi Itb Berlin De Goez Kamastirdi

May 19, 2025 -

Mtabet Mbashrt Lqdas Alqyamt Fy Dyr Sydt Allwyzt Ebr Alwkalt Alwtnyt Llielam

May 19, 2025

Mtabet Mbashrt Lqdas Alqyamt Fy Dyr Sydt Allwyzt Ebr Alwkalt Alwtnyt Llielam

May 19, 2025

Latest Posts

-

Kiprskiy Vopros Gensek Oon Provedet Neformalnye Peregovory V Zheneve

May 19, 2025

Kiprskiy Vopros Gensek Oon Provedet Neformalnye Peregovory V Zheneve

May 19, 2025 -

Zheneva Gotovitsya K Peregovoram Gensek Oon Sozyvaet Vstrechu Po Kipru

May 19, 2025

Zheneva Gotovitsya K Peregovoram Gensek Oon Sozyvaet Vstrechu Po Kipru

May 19, 2025 -

Vstrecha Genseka Oon Po Kipru V Zheneve Podrobnosti I Ozhidaniya

May 19, 2025

Vstrecha Genseka Oon Po Kipru V Zheneve Podrobnosti I Ozhidaniya

May 19, 2025 -

Gensek Oon Neformalnaya Vstrecha Po Kipru V Zheneve

May 19, 2025

Gensek Oon Neformalnaya Vstrecha Po Kipru V Zheneve

May 19, 2025 -

O Kateynasmos Os Lysi Sto Kypriako Eksetasi Ton Epixeirimaton

May 19, 2025

O Kateynasmos Os Lysi Sto Kypriako Eksetasi Ton Epixeirimaton

May 19, 2025